Finance

Credit Inquiry When Using Card

Published: March 4, 2024

Learn how credit inquiries affect your finances when using your card. Understand the impact of inquiries on your credit score and financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit inquiries and their impact on your financial well-being. Understanding credit inquiries is crucial for managing your credit health, especially when using credit cards. This comprehensive guide will delve into the intricacies of credit inquiries, shedding light on their types, effects on credit scores, and their relevance in the realm of credit card usage. By the end of this article, you'll have a deeper understanding of how credit inquiries can influence your financial journey and the steps you can take to manage them effectively.

Credit inquiries play a pivotal role in the evaluation of an individual's creditworthiness. Whether you're applying for a loan, a credit card, or a mortgage, potential lenders often initiate a credit inquiry to assess your credit history and determine the level of risk associated with extending credit to you. While credit inquiries are a standard part of the lending process, it's essential to comprehend their implications and how they can impact your financial standing.

Join us as we embark on a journey through the world of credit inquiries, equipping you with the knowledge to navigate the intricacies of credit management with confidence and clarity. Let's explore the nuances of credit inquiries and their correlation with credit card usage, empowering you to make informed decisions and take control of your financial future.

What is a Credit Inquiry?

A credit inquiry, also known as a credit pull or credit check, occurs when a third party requests to view your credit report from one of the major credit bureaus. This request is typically made by lenders, creditors, or service providers to assess your creditworthiness when you apply for credit, such as a loan or a credit card. Essentially, a credit inquiry allows the requesting party to review your credit history and determine the level of risk associated with extending credit to you.

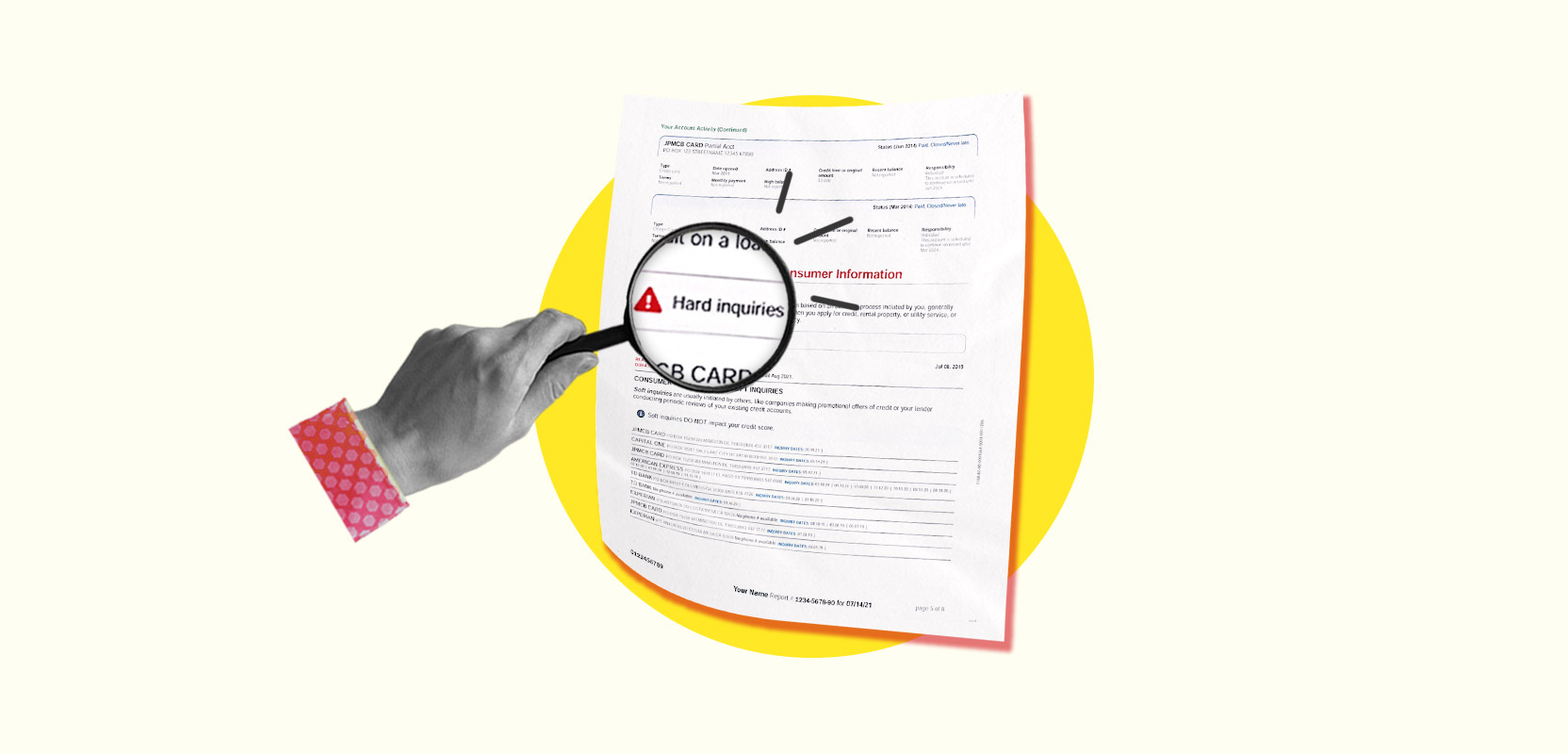

There are two primary types of credit inquiries: hard inquiries and soft inquiries. A hard inquiry occurs when you apply for new credit, such as a credit card, auto loan, or mortgage. These inquiries are initiated with your consent and can impact your credit score. On the other hand, soft inquiries are typically made for non-lending purposes, such as pre-approved credit offers, background checks, or when you check your own credit report. Soft inquiries do not affect your credit score and are not visible to potential lenders.

It’s important to note that each credit inquiry is documented on your credit report, indicating which party accessed your credit information and when the inquiry took place. Understanding the distinction between hard and soft inquiries is crucial for managing your credit health, as it enables you to discern the potential impact on your credit score and overall financial standing.

By grasping the fundamental concept of credit inquiries, you can navigate the credit application process with confidence and make informed decisions regarding your financial endeavors. As we delve deeper into the realm of credit inquiries, you’ll gain valuable insights into their significance and the factors that influence their impact on your credit profile.

Types of Credit Inquiries

When it comes to credit inquiries, it’s essential to distinguish between the two primary types: hard inquiries and soft inquiries. Understanding the nature of each inquiry is crucial for managing your credit health and making informed financial decisions.

- Hard Inquiries: Hard inquiries occur when you apply for new credit, such as a credit card, mortgage, auto loan, or personal loan. These inquiries typically result from your proactive pursuit of credit and are initiated with your consent. When a potential lender or creditor conducts a hard inquiry, it signifies that you are actively seeking to take on additional debt. Hard inquiries are documented on your credit report and may impact your credit score, albeit to varying degrees. While a single hard inquiry may have a minimal effect on your credit score, multiple inquiries within a short timeframe can raise concerns among lenders and potentially lower your score.

- Soft Inquiries: Soft inquiries, also known as soft pulls, occur in situations where your credit report is accessed for non-lending purposes. These inquiries may result from background checks, pre-approved credit offers, or when you check your own credit report. Importantly, soft inquiries do not impact your credit score and are not visible to potential lenders. They serve informational or promotional purposes and are not associated with an active pursuit of new credit. Checking your own credit report, for instance, constitutes a soft inquiry and allows you to review your credit history without affecting your credit score.

By recognizing the distinction between hard and soft inquiries, you can navigate the credit application process with a clear understanding of how each type of inquiry may influence your credit score and overall creditworthiness. As we delve deeper into the impact of credit inquiries on your financial standing, you’ll gain valuable insights into managing and mitigating the effects of these inquiries on your credit profile.

How Credit Inquiries Affect Your Credit Score

Credit inquiries play a significant role in shaping your credit score, which is a numerical representation of your creditworthiness. Understanding how credit inquiries impact your credit score is essential for managing your financial reputation and making informed credit-related decisions.

When a hard inquiry is made on your credit report as a result of applying for new credit, it can affect your credit score. The impact of a single hard inquiry is typically minimal, often resulting in a temporary decrease of a few points in your credit score. However, multiple hard inquiries within a short timeframe can raise concerns among potential lenders, as they may interpret this pattern as a sign of financial distress or overextension. Consequently, an excessive number of hard inquiries can lead to a more significant drop in your credit score and may hinder your ability to secure new credit.

On the other hand, soft inquiries have no impact on your credit score. Whether it’s a background check, a pre-approved credit offer, or checking your own credit report, these inquiries are not factored into the calculation of your credit score. This distinction underscores the importance of being mindful of the type of credit inquiries you encounter and their potential implications for your credit standing.

It’s important to note that credit scoring models take into account the timing of credit inquiries. For instance, inquiries made within a short timeframe for a specific purpose, such as rate shopping for a mortgage or auto loan, are typically treated as a single inquiry and have a limited impact on your credit score. This allows consumers to compare loan offers without being excessively penalized for seeking the best terms.

By understanding the dynamics of credit inquiries and their influence on your credit score, you can adopt proactive strategies to manage your credit health effectively. As we explore the correlation between credit inquiries and credit card usage, you’ll gain valuable insights into optimizing your credit management practices and maintaining a healthy credit profile.

Credit Inquiries When Using a Credit Card

When it comes to using a credit card, understanding the potential impact of credit inquiries is essential for maintaining a healthy credit profile. While credit card usage itself may not directly result in a credit inquiry, certain actions related to credit cards can lead to inquiries that affect your credit score.

One scenario where a credit inquiry may arise in the context of credit card usage is when you apply for a new credit card. Whether you’re seeking a rewards card, a cashback card, or a card with a low introductory APR, submitting an application triggers a hard inquiry as the card issuer assesses your creditworthiness. It’s important to be mindful of the potential impact of this inquiry on your credit score and consider whether the benefits of the new card outweigh any temporary decrease in your score.

Additionally, when you request a credit limit increase on an existing credit card, the card issuer may conduct a hard inquiry to evaluate your financial standing and repayment history. While this inquiry is initiated by the card issuer, it’s important to be aware of its potential impact on your credit score. However, some card issuers may offer credit limit increases without requiring a hard inquiry, so it’s advisable to inquire about their policies before submitting a request.

It’s worth noting that routine activities such as making purchases, paying your credit card bill on time, and keeping your credit utilization low do not result in credit inquiries. These actions contribute to positive credit behavior and can enhance your creditworthiness without triggering inquiries that affect your credit score.

By being mindful of the potential credit inquiries associated with credit card usage, you can make informed decisions that align with your credit management goals. As we delve deeper into strategies for managing credit inquiries, you’ll gain valuable insights into optimizing your credit card usage and maintaining a strong financial standing.

Tips for Managing Credit Inquiries

Effectively managing credit inquiries is integral to maintaining a healthy credit profile and maximizing your creditworthiness. By implementing strategic approaches and prudent financial practices, you can mitigate the impact of credit inquiries and safeguard your credit score. Here are some valuable tips for managing credit inquiries:

- Be Mindful of Credit Applications: When applying for new credit, whether it’s a credit card, auto loan, or mortgage, be mindful of the potential impact of hard inquiries on your credit score. Limiting the frequency of credit applications can help minimize the impact on your credit profile.

- Rate Shopping Strategy: If you’re in the market for a major loan, such as a mortgage or auto loan, consider conducting rate shopping within a condensed timeframe. Credit scoring models typically treat multiple inquiries for the same purpose as a single inquiry, allowing you to compare loan offers without incurring significant credit score fluctuations.

- Monitor Your Credit Report: Regularly monitoring your credit report enables you to stay informed about the inquiries made on your credit history. This proactive approach allows you to identify any unauthorized inquiries and address potential discrepancies promptly.

- Utilize Pre-Qualification Tools: Many lenders and credit card issuers offer pre-qualification tools that allow you to assess your eligibility for credit products without triggering a hard inquiry. Leveraging these tools can help you gauge your likelihood of approval without impacting your credit score.

- Understand the Impact of Credit Limit Increases: When requesting a credit limit increase on an existing credit card, inquire about the card issuer’s policies regarding hard inquiries. Some issuers may offer credit limit increases without requiring a hard inquiry, minimizing the impact on your credit score.

- Focus on Positive Credit Behavior: Emphasize responsible credit management practices, such as timely bill payments, maintaining a low credit utilization ratio, and avoiding excessive debt accumulation. These actions contribute to a positive credit history and can offset the impact of occasional credit inquiries.

By implementing these tips and adopting a proactive approach to credit management, you can navigate the landscape of credit inquiries with confidence and prudence. Understanding the nuances of credit inquiries empowers you to make informed decisions that align with your long-term financial objectives, ultimately contributing to a resilient and favorable credit profile.

Conclusion

As we conclude our exploration of credit inquiries and their relevance in the realm of credit card usage, it’s evident that understanding the intricacies of credit inquiries is vital for maintaining a healthy credit profile and making informed financial decisions. Whether you’re applying for a new credit card, seeking a credit limit increase, or navigating the broader landscape of credit management, the impact of credit inquiries on your credit score warrants careful consideration.

By distinguishing between hard and soft inquiries and recognizing their respective implications, you can navigate the credit application process with clarity and foresight. Understanding the factors that influence credit scores and the strategies for managing credit inquiries empowers you to proactively safeguard your creditworthiness and pursue your financial goals with confidence.

It’s essential to approach credit inquiries with a balanced perspective, acknowledging their role in the lending process while implementing prudent practices to mitigate their potential impact. From being mindful of credit applications to leveraging pre-qualification tools and focusing on positive credit behavior, these proactive measures contribute to a resilient credit profile and position you for long-term financial success.

As you continue your financial journey, remember that knowledge and awareness are your greatest allies in navigating the complexities of credit management. By staying informed, exercising prudence in your credit-related decisions, and prioritizing responsible financial habits, you can cultivate a robust credit profile that reflects your creditworthiness and financial discipline.

Ultimately, the insights gained from this exploration serve as a compass for navigating the realm of credit inquiries, empowering you to make informed choices that align with your unique financial aspirations. With a comprehensive understanding of credit inquiries and their impact, you are equipped to chart a course towards a resilient and prosperous financial future.