Home>Finance>Defining The Mosaic Theory Of Financial Research

Finance

Defining The Mosaic Theory Of Financial Research

Published: November 9, 2023

Discover the Mosaic Theory of Financial Research and its vital role in the world of finance. Explore how this theory shapes investment decisions and drives market analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Mosaic Theory of Financial Research

Welcome to our finance blog! Today, we’ll be diving into the fascinating world of the mosaic theory of financial research. This concept is a fundamental pillar in the realm of investing and provides investors with valuable insights into making informed decisions about their portfolios. In this blog post, we will define the mosaic theory, explore its origins, and discuss how it can be applied in the world of finance.

Key Takeaways:

- The mosaic theory of financial research is an approach that allows investors to gather and analyze diverse pieces of information to form a complete investment thesis.

- By collecting information from various sources and combining them into a coherent mosaic, investors gain a broader perspective and can make better-informed decisions.

What is the Mosaic Theory of Financial Research?

Imagine a beautiful mosaic artwork composed of numerous colorful tiles. Each individual tile may not hold much meaning on its own, but when combined with other tiles, a complete picture emerges. The same concept applies to the mosaic theory of financial research.

At its core, the mosaic theory is an approach that allows investors to gather and analyze diverse pieces of information from a variety of sources to form a complete investment thesis. It recognizes that no single piece of information can provide a full understanding of an investment opportunity. Instead, it advocates for the careful collection and thoughtful assembly of multiple sources to gain a comprehensive view.

Now, let’s explore the origins of the mosaic theory.

The Origins of the Mosaic Theory

The mosaic theory gained prominence in the investment community during the 1960s and 1970s. During this time, the United States witnessed the emergence of landmark legal cases, including SEC v. Texas Gulf Sulphur Company and SEC v. Capital Gains, where the mosaic theory played a pivotal role.

In these cases, the courts recognized that by gathering various pieces of non-material, public information and combining them into a coherent mosaic, investors could form a reasonable belief about the value of a security. This approach allowed the courts to distinguish between trading on material, non-public information (insider trading) versus making well-informed investment decisions based on publicly available data.

Since then, the mosaic theory has become an accepted practice in the financial world, guiding investors and research analysts in their quest for valuable insights.

Applying the Mosaic Theory in Finance

The application of the mosaic theory in finance involves a systematic process of gathering, analyzing, and interpreting various sources of information. Here are the essential steps involved:

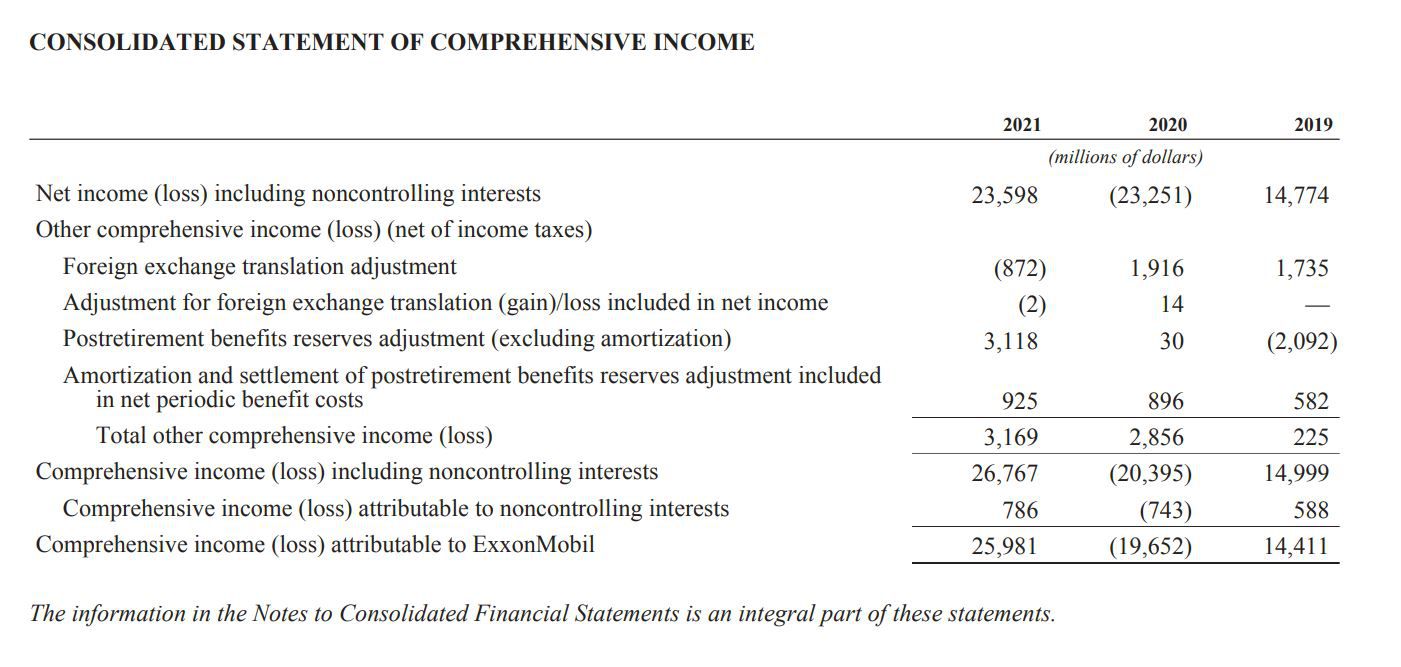

- Collecting Data: Investors need to gather information from a wide range of sources, including financial statements, news articles, industry reports, and analyst opinions. The key is to cast a wide net to collect a diverse range of data points.

- Analyzing Information: Investors should carefully analyze the collected information, looking for patterns, discrepancies, and correlations. This process requires critical thinking skills and the ability to identify relevant insights that may impact investment decisions.

- Constructing the Mosaic: After analyzing the information, investors need to assemble the various pieces into a coherent mosaic. This involves connecting the dots, identifying trends, and creating a comprehensive investment thesis that considers both the strengths and weaknesses of the opportunity.

- Making Informed Decisions: The final step involves using the mosaic to make well-informed investment decisions. By considering the collective insights from the diverse sources of information, investors can increase their chances of success in the market.

Remember, the mosaic theory is not about relying on a single source of information or making hasty judgments. It is about taking a holistic approach and using multiple data points to gain a comprehensive understanding of an investment opportunity.

Conclusion

The mosaic theory of financial research is a powerful tool that allows investors to gather and analyze information from various sources, ultimately offering a more complete perspective. By applying this approach, investors can make better-informed decisions and navigate the complex world of finance with greater confidence.

So, the next time you are exploring potential investment opportunities, remember to embrace the mosaic theory and delve into the diverse range of information available. Happy investing!