Home>Finance>Electronic Bill Payment & Presentment (EBPP): Definition, Types

Finance

Electronic Bill Payment & Presentment (EBPP): Definition, Types

Published: November 17, 2023

Discover the definition and types of Electronic Bill Payment & Presentment (EBPP) in the world of finance. Enhance your financial management with this essential tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Electronic Bill Payment & Presentment (EBPP): Definition, Types

In today’s digital age, the convenience and speed of electronic transactions have revolutionized the way we handle our finances. One such innovation is Electronic Bill Payment & Presentment (EBPP), a service that allows individuals and businesses to pay bills and receive bills electronically. In this blog post, we will explore what EBPP is, its types, and how it can benefit both consumers and businesses.

Key Takeaways:

- Electronic Bill Payment & Presentment (EBPP) is a service that enables individuals and businesses to pay and receive bills electronically.

- There are two main types of EBPP: “Biller Direct” and “Consolidator Model.” Each has its advantages and disadvantages, catering to different needs and preferences.

What is Electronic Bill Payment & Presentment (EBPP)?

EBPP, also known as electronic billing, is a digital alternative to traditional paper-based billing methods. It allows consumers and businesses to pay bills, view their billing statements, and receive bills through electronic channels such as online banking platforms, mobile apps, or email. By embracing EBPP, individuals can save time, reduce paperwork, and streamline their bill payment process. For businesses, EBPP offers cost savings, improved cash flow, and enhanced customer satisfaction.

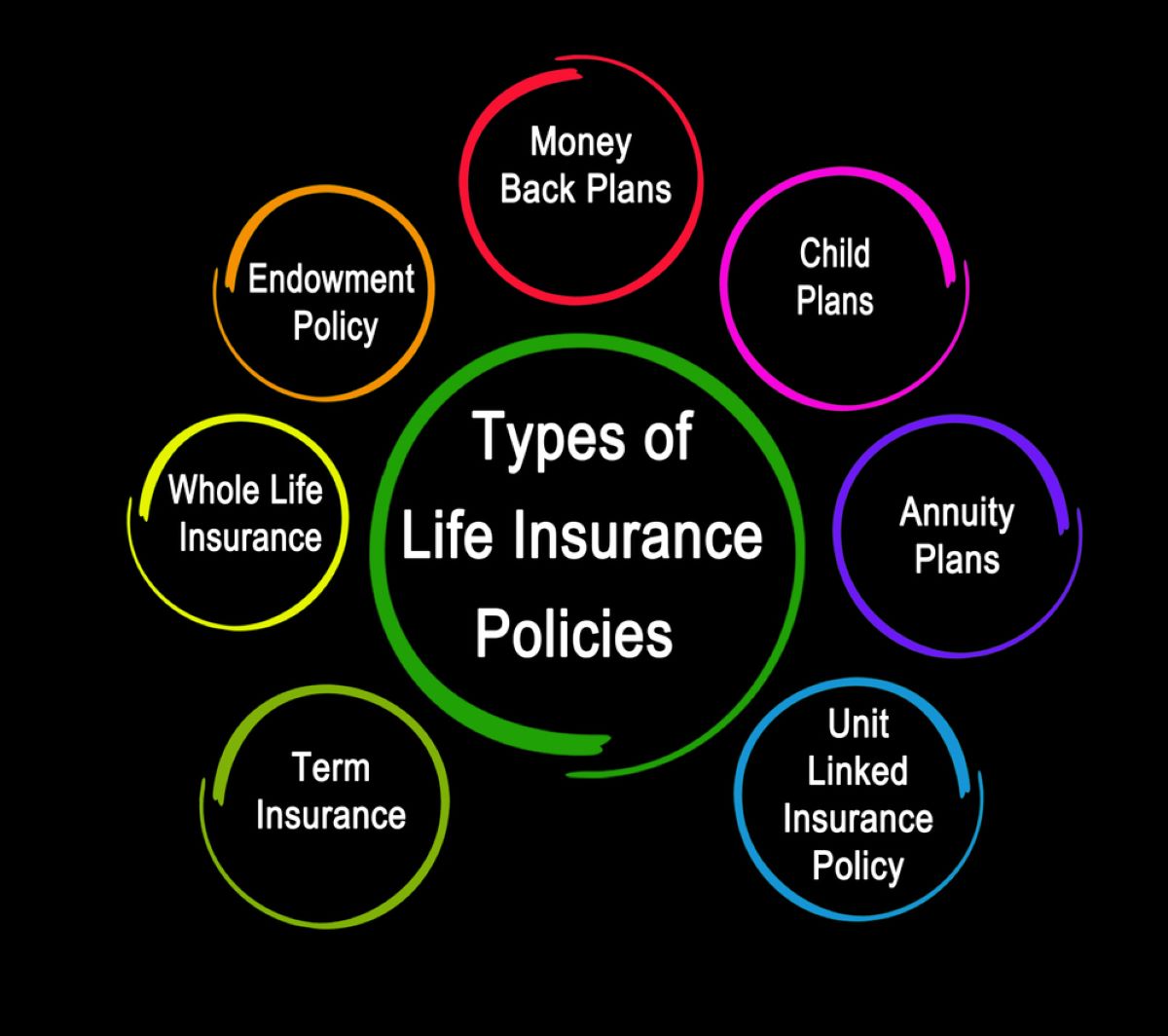

Types of Electronic Bill Payment & Presentment (EBPP)

1. Biller Direct: In the Biller Direct model, the biller (e.g., utility companies, telecom providers) manages the entire billing and payment process. Customers typically visit the biller’s website or use their mobile app to access, view, and pay their bills. This model offers a personalized experience, as customers interact directly with the biller’s interface. However, it requires customers to have multiple accounts with different billers.

2. Consolidator Model: In the Consolidator Model, third-party service providers (known as consolidators) act as intermediaries between customers and billers. These consolidators aggregate bills from various billers into a single platform, allowing customers to view and pay all their bills in one place. This model provides convenience by centralizing bill management but might not offer the same level of personalization as Biller Direct.

Benefits of Electronic Bill Payment & Presentment (EBPP)

1. Convenience: EBPP eliminates the need for paper bills, manual check writing, and postage stamps. With just a few clicks, customers can pay their bills anytime and anywhere using their preferred digital devices.

2. Time and Cost Savings: By automating bill payment processes, EBPP saves time and reduces administrative expenses for both consumers and businesses. It eliminates the need for manual data entry and reduces the risk of late or missed payments.

3. Improved Security: Compared to traditional paper bills, EBPP offers enhanced security measures to protect sensitive financial information. Encryption and authentication methods ensure that customer data remains secure during online transactions.

4. Real-time Access: With EBPP, customers can access their billing statements and payment history in real-time. This allows for better financial planning and budgeting, giving individuals greater control over their finances.

5. Environmentally Friendly: By reducing the use of paper and the need for physical mail, EBPP contributes to a more sustainable environment. It helps conserve natural resources and reduces carbon emissions associated with transportation and waste disposal.

In conclusion, Electronic Bill Payment & Presentment (EBPP) streamlines bill payment processes and offers numerous benefits for both consumers and businesses. Whether you prefer the personalized approach of Biller Direct or the convenience of the Consolidator Model, embracing EBPP can save time, reduce costs, and improve financial management. So why not make the switch to electronic bills and payments today?