Finance

Denationalization Definition And Examples

Published: November 10, 2023

Learn the meaning of denationalization in finance and explore real-world examples. Discover how this concept affects the global economy and investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Denationalization: Definition and Examples

Welcome to another informative blog post in our FINANCE category! Today, we will be discussing a concept that may seem complex at first glance but is actually quite fascinating: denationalization. If you’ve ever wondered what denationalization means and how it works, you’ve come to the right place. In this article, we will define denationalization and provide you with some real-life examples to help you grasp the concept better.

Key Takeaways:

- Denationalization refers to the process of transferring ownership or control of a company or industry from the public sector (government) to the private sector.

- This process aims to improve efficiency, increase competition, and reduce government intervention in the economy.

What is Denationalization?

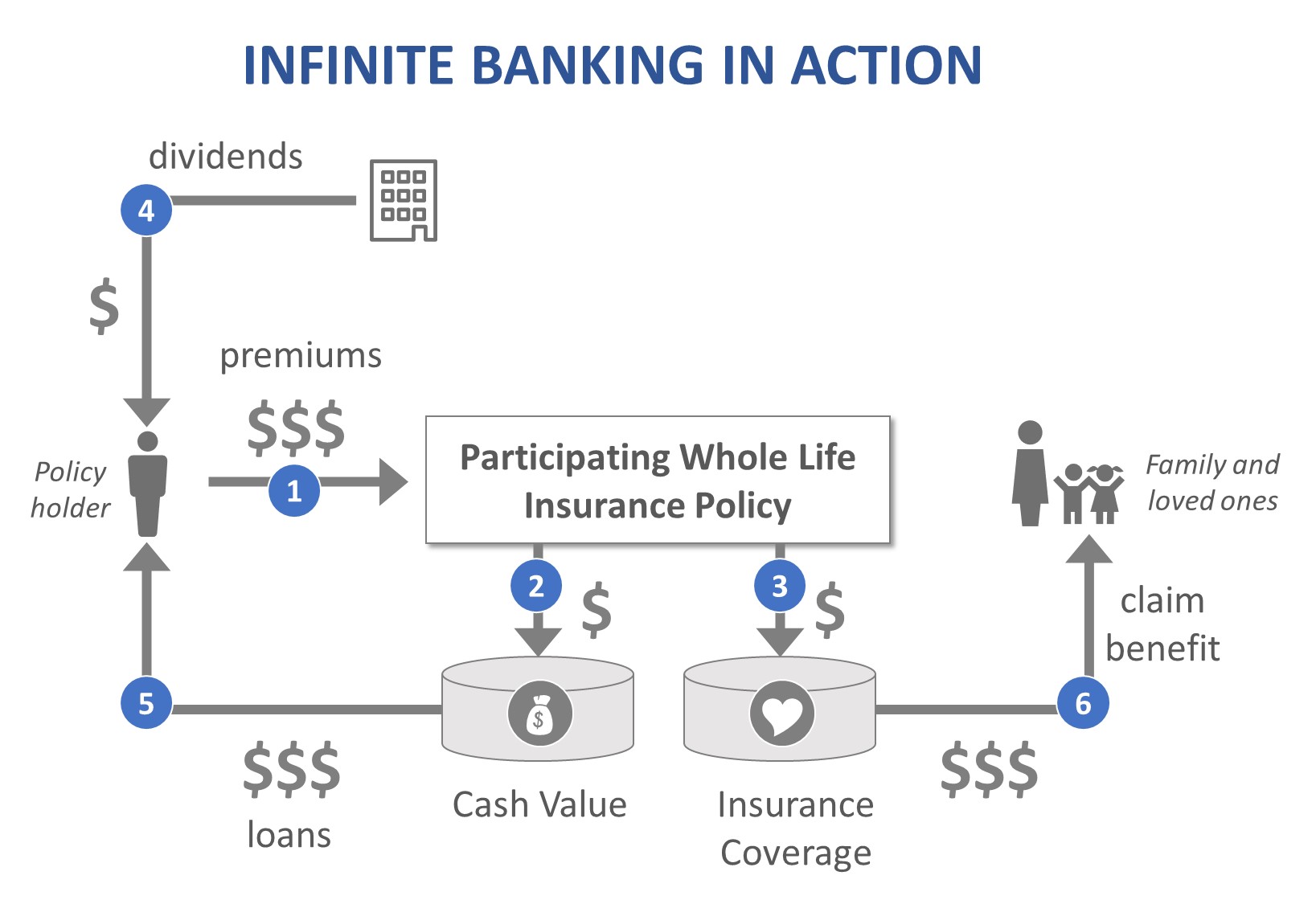

Denationalization, also known as privatization, is the process of transferring ownership or control of a company or industry from the public sector (government) to the private sector. It involves selling state-owned assets, such as businesses, utilities, or infrastructure, to private individuals or entities. The main goal of denationalization is to improve efficiency, promote competition, and reduce government intervention in the economy.

Denationalization typically occurs when a government considers that the private sector can better manage a particular industry or enterprise. By allowing private ownership, the government aims to increase productivity, encourage innovation, and stimulate economic growth. This process is particularly common in industries like telecommunications, energy, transportation, and banking.

Examples of Denationalization

- British Telecom (BT): One of the prominent examples of denationalization is the privatization of British Telecom. In 1984, the British government sold off the majority of its shares in BT, making it a private company. This move aimed to introduce competition and improve the efficiency of the telecommunications sector in the United Kingdom.

- Japan Post: Another noteworthy example is the denationalization of Japan Post. Until 2007, Japan Post was a state-owned postal and financial services company. However, the government decided to privatize it in order to increase competition and modernize the postal and banking sectors.

- Qantas Airways: Qantas Airways, the largest airline in Australia, was also denationalized. The Australian government sold its remaining stake in Qantas in 2015, making it a fully private company. This move aimed to allow Qantas to operate more flexibly and compete globally.

In Conclusion

Denationalization or privatization is a process that plays a crucial role in modern economies. It allows for greater efficiency, increased competition, and reduced government control. Through real-life examples like British Telecom, Japan Post, and Qantas Airways, we can see how denationalization has successfully transformed various industries, leading to positive outcomes for both the companies involved and the overall economy.

We hope this article has provided you with a clear understanding of what denationalization means and how it works. If you have any further questions or would like to explore more topics in the world of finance, feel free to browse our blog or reach out to us.

Stay tuned for more informative content in our FINANCE category!