Home>Finance>Disruptive Technology: Definition, Example, And How To Invest

Finance

Disruptive Technology: Definition, Example, And How To Invest

Published: November 12, 2023

Learn about disruptive technology in finance, its definition, example, and how to invest. Stay ahead of the curve and capitalize on industry-changing innovations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Disruptive Technology: Definition, Example, and How to Invest

Welcome to our Finance blog! In today’s article, we’ll be diving into the world of disruptive technology – what it means, providing an example, and discussing how you can potentially invest in this exciting field. But first, let’s answer the burning question: what exactly is disruptive technology?

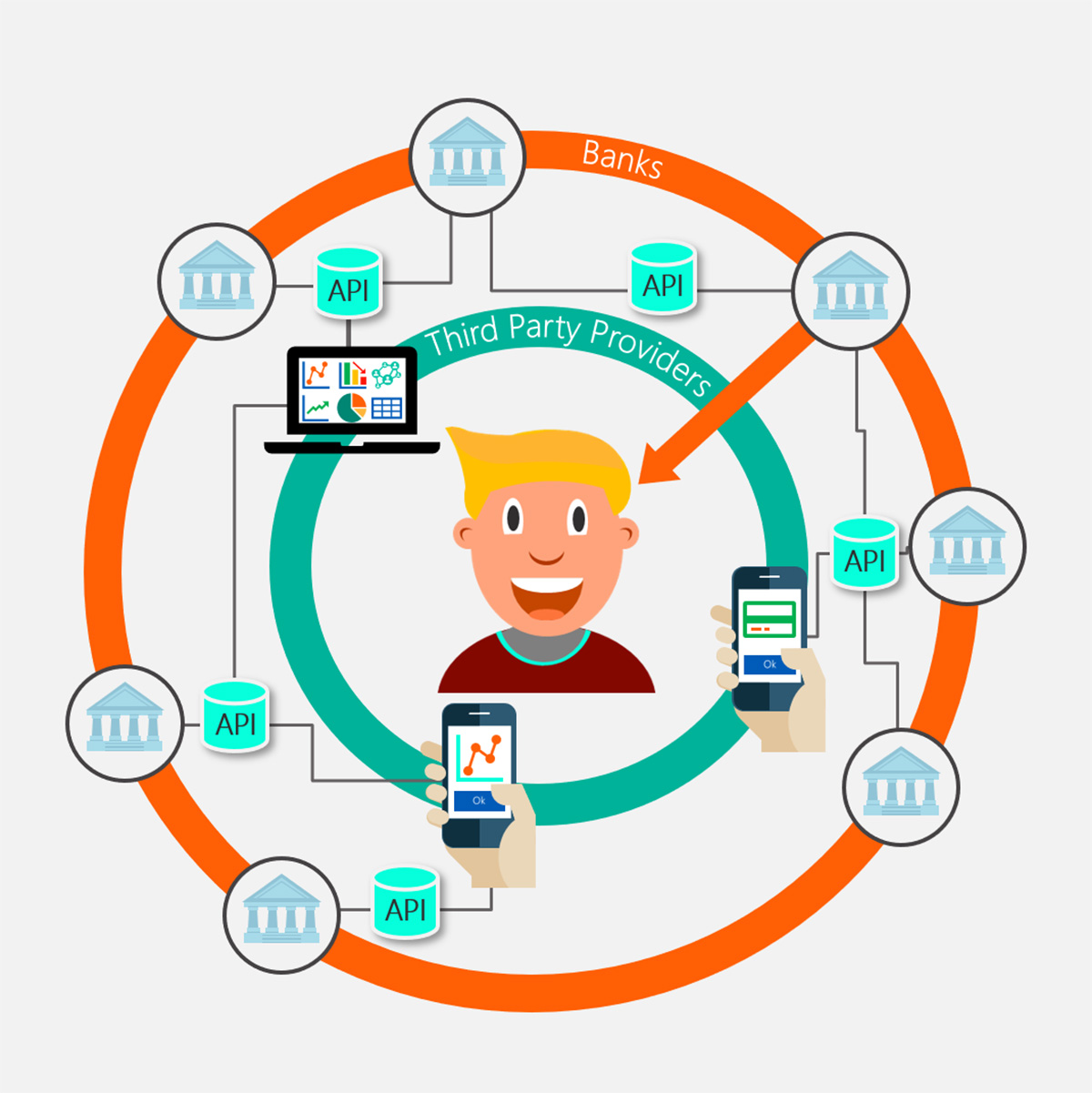

Definition

Disruptive technology refers to innovations that significantly alter established industries or create entirely new markets by displacing existing technologies or practices. These groundbreaking advancements disrupt the status quo, often challenging traditional ways of doing things and forcing businesses to adapt or risk becoming obsolete.

Example

An excellent example of disruptive technology is the advent of ride-hailing services like Uber and Lyft. These companies revolutionized the transportation industry by introducing a new model that allows anyone with a car to become a taxi driver. By leveraging the power of mobile technology and real-time data, these platforms disrupted the traditional taxi industry, offering consumers a more convenient, affordable, and flexible alternative.

How to Invest in Disruptive Technology

If you’re interested in investing in disruptive technology, it’s essential to approach it with a clear understanding of the risks and potential rewards involved. Here are a few steps to get you started:

- Educate Yourself: Begin by learning about the different types of disruptive technology and the industries they target. Stay up to date with the latest trends, research, and news in the field. This knowledge will help you make informed investment decisions.

- Diversify Your Portfolio: Investing in disruptive technology can be risky, as not all innovations will succeed. It’s crucial to diversify your portfolio by investing in a range of disruptive companies across various industries. This strategy helps mitigate risk and increases your chances of capitalizing on successful technology transformations.

- Seek Professional Advice: Consider consulting with a financial advisor or investment professional who specializes in technology and disruptive industries. They can provide valuable insights and guidance tailored to your specific financial goals and risk tolerance.

- Invest Long-Term: Disruptive technologies often take time to mature and gain widespread adoption. Investing with a long-term mindset can help you weather short-term market fluctuations and potentially benefit from the growth of these transformative technologies as they become more mainstream.

Key Takeaways:

- Disruptive technology refers to innovations that disrupt established industries and create new markets.

- An example of disruptive technology is the rise of ride-hailing services like Uber and Lyft.

Investing in disruptive technology can be an exciting and potentially profitable venture. By continuously educating yourself, diversifying your portfolio, seeking professional advice, and adopting a long-term investment approach, you can position yourself to benefit from the transformative power of disruptive technology. With the right strategy, you may find yourself at the forefront of technological advancements and reaping the rewards of your forward-thinking investments.