Home>Finance>Bottom-Up Investing: Definition, Example, Vs. Top-Down

Finance

Bottom-Up Investing: Definition, Example, Vs. Top-Down

Published: October 18, 2023

Learn about bottom-up investing in finance, including its definition and an example, as well as how it compares to top-down investing. Enhance your understanding of investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of Bottom-Up Investing: A Comprehensive Guide

Are you interested in maximizing your returns in the financial markets? If so, understanding different investment strategies is key. One strategy that has gained significant attention is bottom-up investing. In this article, we will delve into the concept of bottom-up investing, provide examples, and compare it to its counterpart, top-down investing. So, let’s dive in!

Key Takeaways:

- Bottom-up investing focuses on analyzing individual companies rather than macroeconomic factors.

- This investment strategy emphasizes fundamental analysis, such as studying a company’s financials, competitive advantage, and management team.

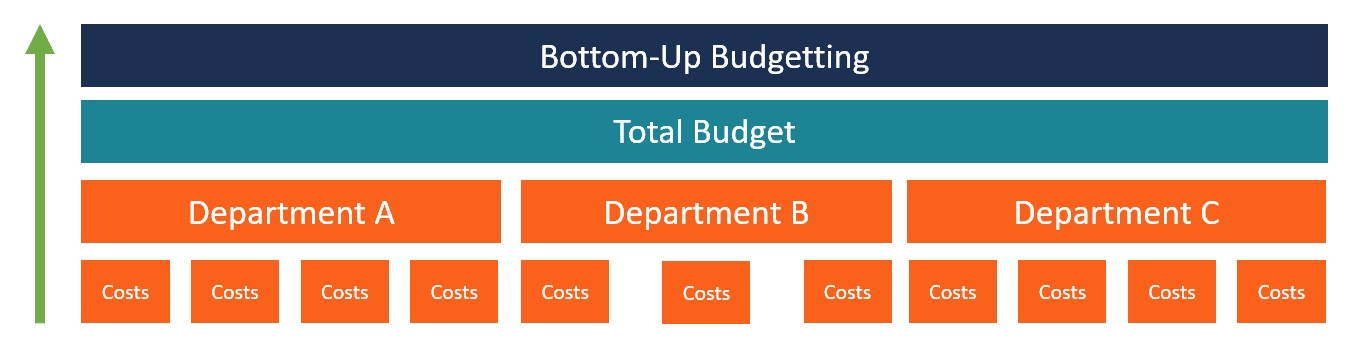

Bottom-up investing is a powerful approach that aims to identify promising individual investment opportunities by thoroughly analyzing the fundamental aspects of a company. It stands in contrast to top-down investing, which prioritizes macroeconomic factors and market trends when making investment decisions.

In a bottom-up investing approach, investors start by studying the specific characteristics of a company. They look at the company’s financial statements, scrutinize its competitive advantage, evaluate the management team, and assess the growth prospects. By conducting in-depth research on individual companies, bottom-up investors believe that they can uncover undervalued stocks that have the potential for significant growth.

Let’s understand this with an example. Imagine a bottom-up investor interested in investing in the technology sector. Instead of taking a broad view of the sector’s performance as a whole, the investor would focus on analyzing individual tech companies to identify the most promising investments. They would evaluate each company’s financial health, technological innovation, market position, and revenue growth potential. Based on this analysis, the bottom-up investor would select individual stocks that are expected to outperform the market.

Now, how does bottom-up investing compare with top-down investing? While bottom-up investing analyzes individual companies in detail, top-down investing looks at the broader economic picture and market trends before making investment decisions. Top-down investors consider factors like interest rates, GDP growth, inflation rates, and industry trends to gauge where the market is heading. They then adjust their investments accordingly, investing in sectors or industries that align with their macroeconomic outlook.

Key Takeaways:

- Bottom-up investing focuses on analyzing individual companies rather than macroeconomic factors.

- This investment strategy emphasizes fundamental analysis, such as studying a company’s financials, competitive advantage, and management team.

Both bottom-up and top-down investing strategies have their merits, and successful investors may choose one over the other based on their investment goals, risk appetite, and preferred level of involvement.

In conclusion, bottom-up investing is an empowering strategy for investors who prefer to focus on individual companies rather than macroeconomic factors when making investment decisions. By conducting thorough fundamental analysis, these investors aim to identify undervalued stocks with the potential for significant growth. So, whether you are a seasoned investor or a beginner looking to maximize your returns, bottom-up investing is a strategy worth considering.

Thank you for reading. Happy investing!