Home>Finance>Distributed Ledgers: Definition, How They’re Used, And Potential

Finance

Distributed Ledgers: Definition, How They’re Used, And Potential

Published: November 12, 2023

Learn the definition of distributed ledgers, how they're used in finance, and their potential impact. Gain insights into this innovative technology.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Distributed Ledgers: Definition, How They’re Used, and Potential

Welcome to our “Finance” category blog post, where we explore different topics related to the world of finance. Today, we delve into the fascinating realm of distributed ledgers, also known as blockchain technology. In this article, we will define distributed ledgers, discuss their various use cases, and explore their potential for revolutionizing industries. So, buckle up and let’s dive into this exciting topic!

Key Takeaways:

- Distributed ledgers are decentralized digital databases that enable multiple stakeholders to maintain a synchronized record of transactions without the need for a central authority.

- Blockchain is a specific type of distributed ledger that utilizes cryptographic algorithms to ensure security and immutability.

Understanding Distributed Ledgers

Before we delve into the specifics, let’s start with the definition: what exactly are distributed ledgers? At its core, a distributed ledger is a decentralized digital database that allows multiple participants to maintain a synchronized record of transactions. Unlike traditional ledgers, which are typically managed by a central authority, distributed ledgers facilitate peer-to-peer transactions without the need for intermediaries.

One of the most well-known forms of distributed ledgers is blockchain technology. Blockchain achieves immutability and security through cryptographic algorithms, making it virtually tamper-proof and transparent. The distributed nature of the ledger ensures that no single entity has complete control, enhancing trust and reducing the risk of fraud.

How are Distributed Ledgers Used?

The potential applications of distributed ledgers are vast and extend beyond the realm of finance. Let’s explore some of the most prominent use cases:

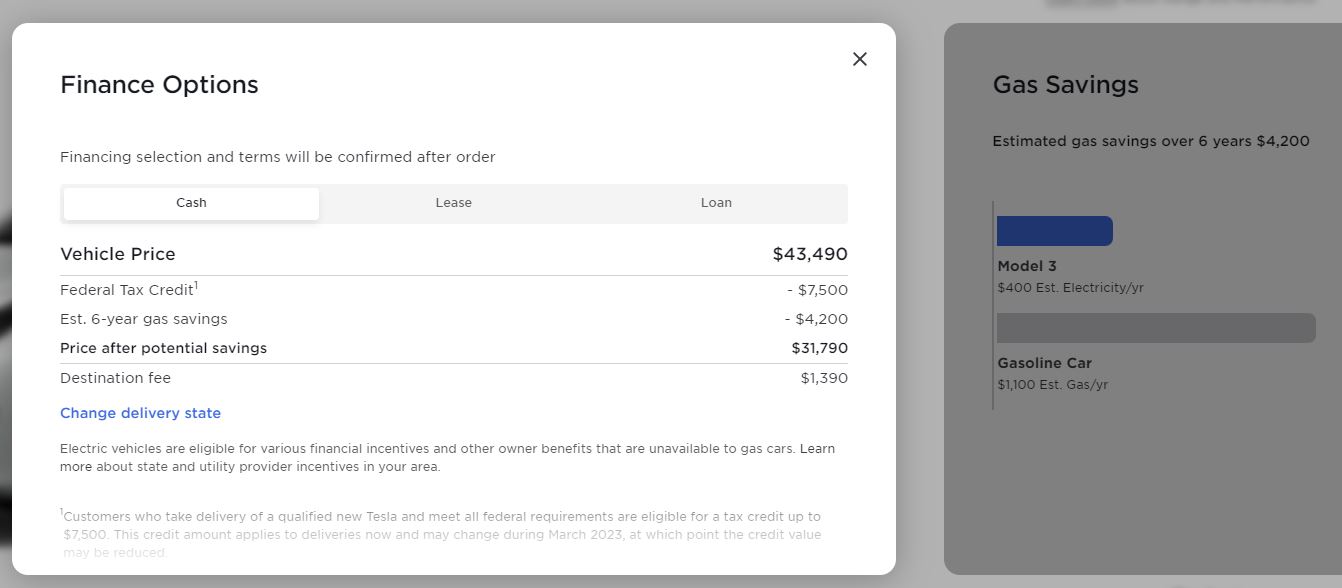

- Financial Services: Distributed ledgers have the potential to revolutionize the financial industry by streamlining processes and reducing costs. They can enable faster cross-border transactions, enhance transparency, and improve fraud detection.

- Supply Chain Management: By utilizing distributed ledgers, supply chain networks can enhance traceability, reduce counterfeiting, and improve efficiency. Smart contracts can automate and enforce agreements, ensuring compliance throughout the entire supply chain.

- Healthcare: Distributed ledgers can improve the security and privacy of patient health records. They can provide a secure platform for sharing sensitive medical information between healthcare providers, enabling seamless collaboration and improving patient care outcomes.

- Voting Systems: Distributed ledgers can enhance the integrity of voting systems by ensuring transparency, immutability, and tamper-resistance. Every vote would be recorded on the ledger, reducing the risk of fraud or manipulation.

The Potential of Distributed Ledgers

The potential impact of distributed ledgers is immense. Here are a few ways this technology can shape the future:

- Increased Efficiency: Distributed ledgers have the potential to streamline complex processes, eliminating intermediaries and reducing costs. This increased efficiency benefits various industries, from finance to supply chain management.

- Enhanced Security: Through cryptographic algorithms and distributed consensus mechanisms, distributed ledgers offer a heightened level of security. This can protect sensitive data and prevent unauthorized modifications, promoting trust between participants.

- Disintermediation: With distributed ledgers, intermediaries such as banks or clearinghouses may no longer be necessary. Peer-to-peer transactions can occur directly between participants, reducing reliance on intermediaries and potentially leveling the playing field for smaller players.

In conclusion, distributed ledgers represent a transformative technology with the potential to reshape industries across the globe. Whether it’s revolutionizing finance, improving supply chains, or enhancing healthcare systems, the applications are vast. As we continue to explore this burgeoning technology, we look forward to witnessing its impact on our increasingly interconnected world.