Home>Finance>Economic Profit (or Loss): Definition, Formula, And Example

Finance

Economic Profit (or Loss): Definition, Formula, And Example

Published: November 16, 2023

Discover the definition, formula, and example of economic profit (or loss) in finance. Enhance your understanding of this crucial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Economic Profit (or Loss): Definition, Formula, and Example

Welcome to our finance category, where we dive deep into the world of economic concepts that can help you navigate the complex world of money management. In this blog post, we’ll unravel the concept of economic profit (or loss), its formula, and provide you with a real-life example to better understand how it works.

Key Takeaways:

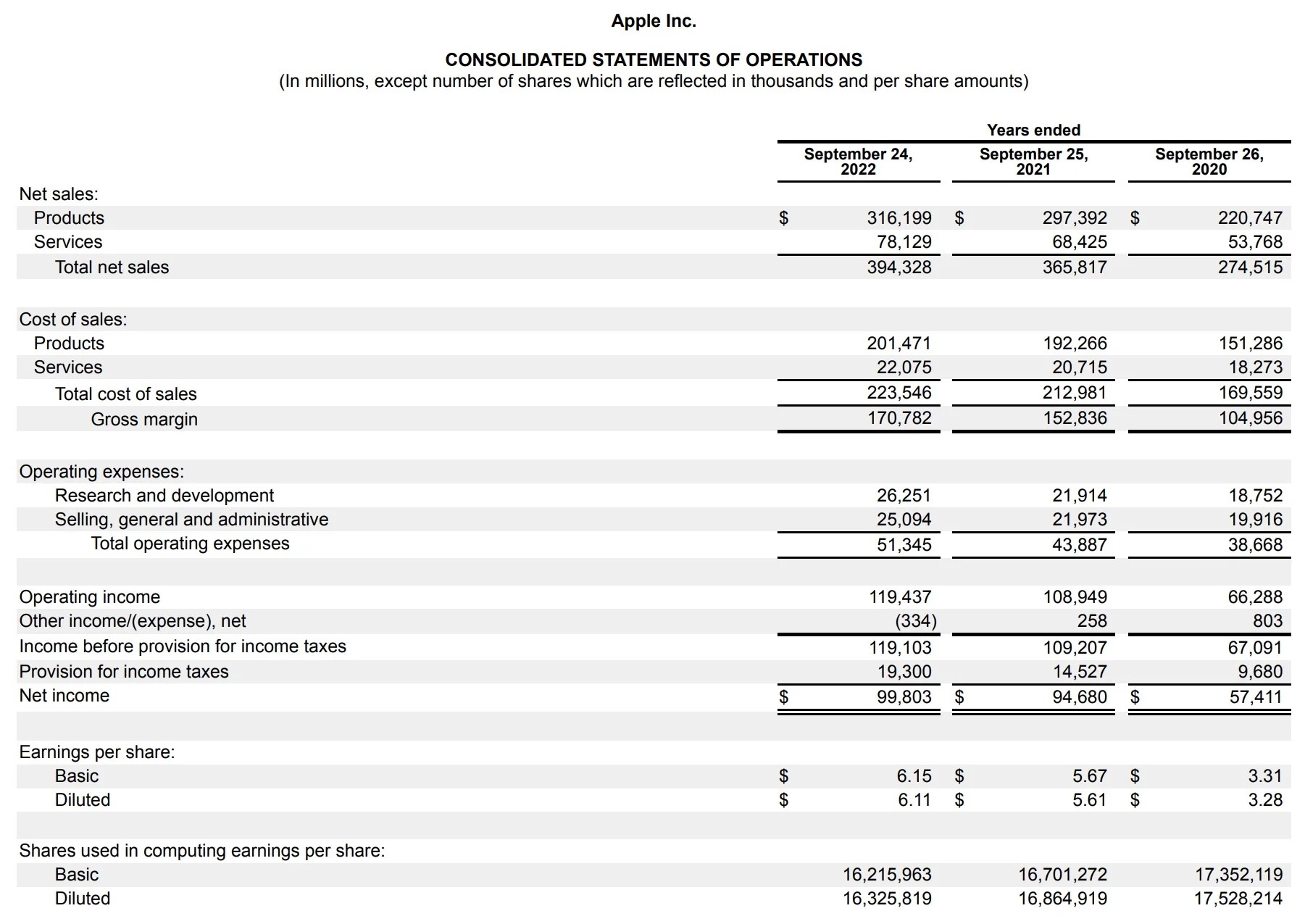

- Economic profit is a measure of the overall financial performance of a business, taking into account both explicit and implicit costs.

- The formula to calculate economic profit is: Economic Profit = Total Revenue – Total Cost (including explicit and implicit costs).

So, what exactly is economic profit or loss? It’s essential to differentiate between economic profit and accounting profit. While accounting profit only considers explicit costs (such as wages, rent, and materials), economic profit takes into account both explicit and implicit costs. Implicit costs refer to the opportunity costs of utilizing resources in one way instead of their next best alternative use.

To calculate economic profit, you need to subtract total cost (including implicit costs) from total revenue. The resulting figure will tell you whether your business is making a profit or experiencing a loss.

Let’s break it down using a hypothetical example:

Imagine you decide to start your own bakery, Sweet Delights. You invest $50,000 to purchase equipment, lease a space, and buy baking supplies. In your first year, your total revenue amounts to $200,000, and you incurred explicit costs of $150,000 (including wages, rent, and supplies).

At first glance, one might assume that your accounting profit is $50,000 ($200,000 – $150,000). However, to calculate your economic profit, we need to consider the implicit costs.

Let’s say you left your previous job, where you earned $60,000 a year. In this case, your implicit cost is $60,000, as you are forgoing the opportunity to earn that income while running your bakery.

Now, let’s calculate your economic profit:

Economic Profit = Total Revenue – Total Cost

Economic Profit = $200,000 – ($150,000 + $60,000)

Economic Profit = $200,000 – $210,000

Economic Profit = -$10,000

In this example, Sweet Delights incurred an economic loss of $10,000. Even though the accounting profit seemed positive, the inclusion of implicit costs paints a different picture. It highlights the fact that the bakery could have made more money if the owner had chosen to stay at their previous job.

Key Takeaways:

- Economic profit considers both explicit and implicit costs, while accounting profit only considers explicit costs.

- Calculation of economic profit involves subtracting total cost (including implicit costs) from total revenue.

Understanding economic profit (or loss) is crucial for evaluating the true financial performance of a business. By taking into account all costs, both explicit and implicit, you can make more informed decisions about resource allocation and overall strategy. Remember, economic profit provides a comprehensive perspective on your business’s profitability, enabling you to navigate the financial landscape with greater clarity.