Home>Finance>How To Run A Profit And Loss Statement In Quickbooks

Finance

How To Run A Profit And Loss Statement In Quickbooks

Published: January 22, 2024

Learn how to run a profit and loss statement in Quickbooks with our comprehensive guide. Manage your finances effectively and gain valuable insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Running a Profit and Loss (P&L) statement is an essential task for any business, as it provides a comprehensive overview of the company's financial performance over a specific period. In QuickBooks, a popular accounting software, generating a P&L statement is a straightforward process that offers valuable insights into the company's revenues, costs, and expenses. This article will guide you through the steps of setting up QuickBooks and running a P&L statement, as well as reviewing and analyzing the results.

Understanding the financial health of your business is crucial for making informed decisions and planning for the future. A P&L statement, also known as an income statement, is a key financial document that summarizes the company's revenues and expenses, resulting in either a profit or a loss for the specified period. By leveraging the capabilities of QuickBooks, you can streamline the process of creating and analyzing P&L statements, enabling you to gain a deeper understanding of your business's financial performance.

Whether you are a small business owner, an entrepreneur, or a finance professional, mastering the art of running a P&L statement in QuickBooks can provide valuable insights that drive strategic decision-making. With this in mind, let's delve into the essential steps of setting up QuickBooks, generating a P&L statement, reviewing the results, and making informed adjustments to optimize your business's financial performance.

Setting up Quickbooks

Before delving into the process of running a Profit and Loss (P&L) statement in QuickBooks, it is crucial to ensure that your QuickBooks account is set up accurately to reflect your business’s financial data. The following steps will guide you through the essential setup process:

- Create a QuickBooks Account: If you haven’t already, sign up for a QuickBooks account and select the appropriate subscription plan based on the size and needs of your business.

- Set Up Company Information: Enter your company’s name, address, industry, and other relevant details to personalize your QuickBooks account.

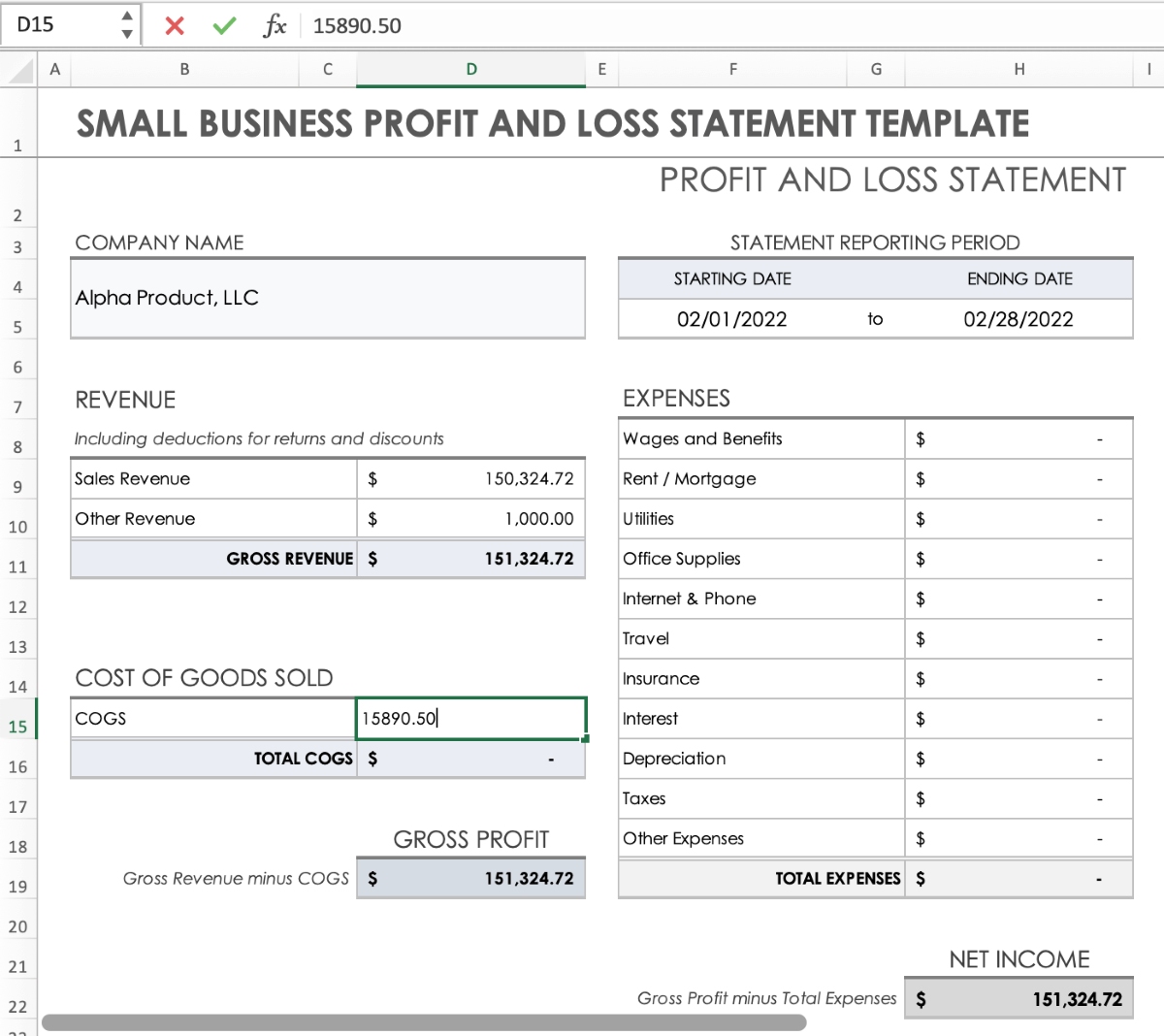

- Chart of Accounts: Customize your Chart of Accounts to align with your business’s specific financial structure. This includes setting up income and expense accounts that will be reflected in the P&L statement.

- Connect Bank and Credit Card Accounts: Link your business’s bank and credit card accounts to QuickBooks to seamlessly track financial transactions and reconcile accounts.

- Configure Tax Settings: Ensure that your tax settings are accurately configured to reflect the applicable tax rates and obligations for your business.

By meticulously setting up QuickBooks and tailoring it to your business’s financial framework, you lay a solid foundation for generating accurate and insightful P&L statements. This meticulous setup ensures that the financial data reflected in the P&L statement is aligned with your business’s actual performance, enabling you to make informed decisions based on reliable financial insights.

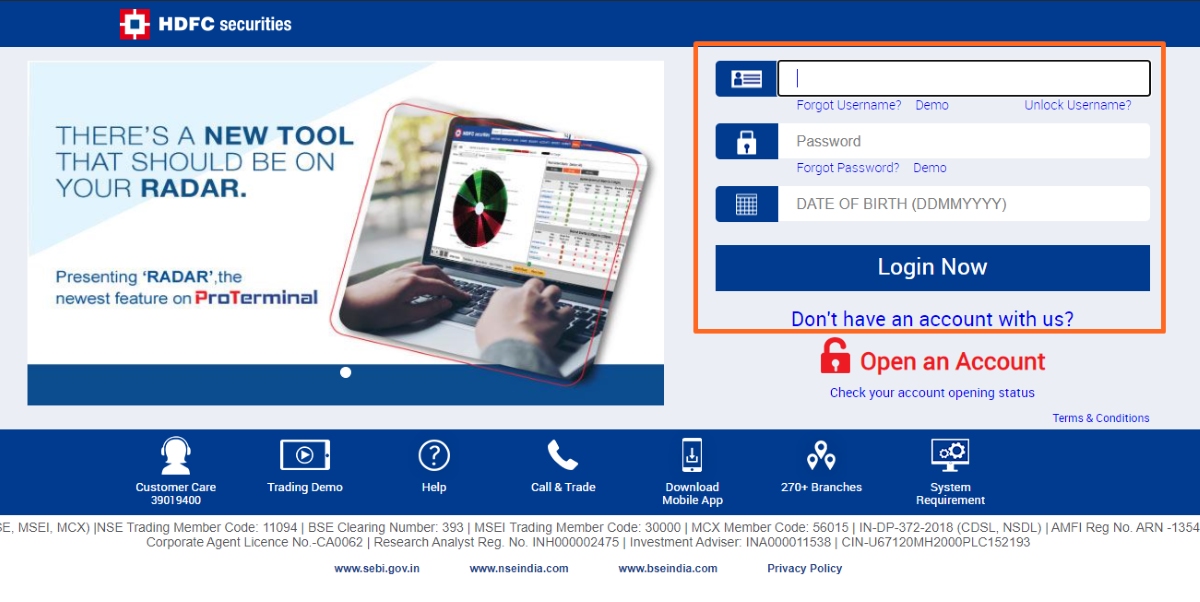

Generating a Profit and Loss Statement

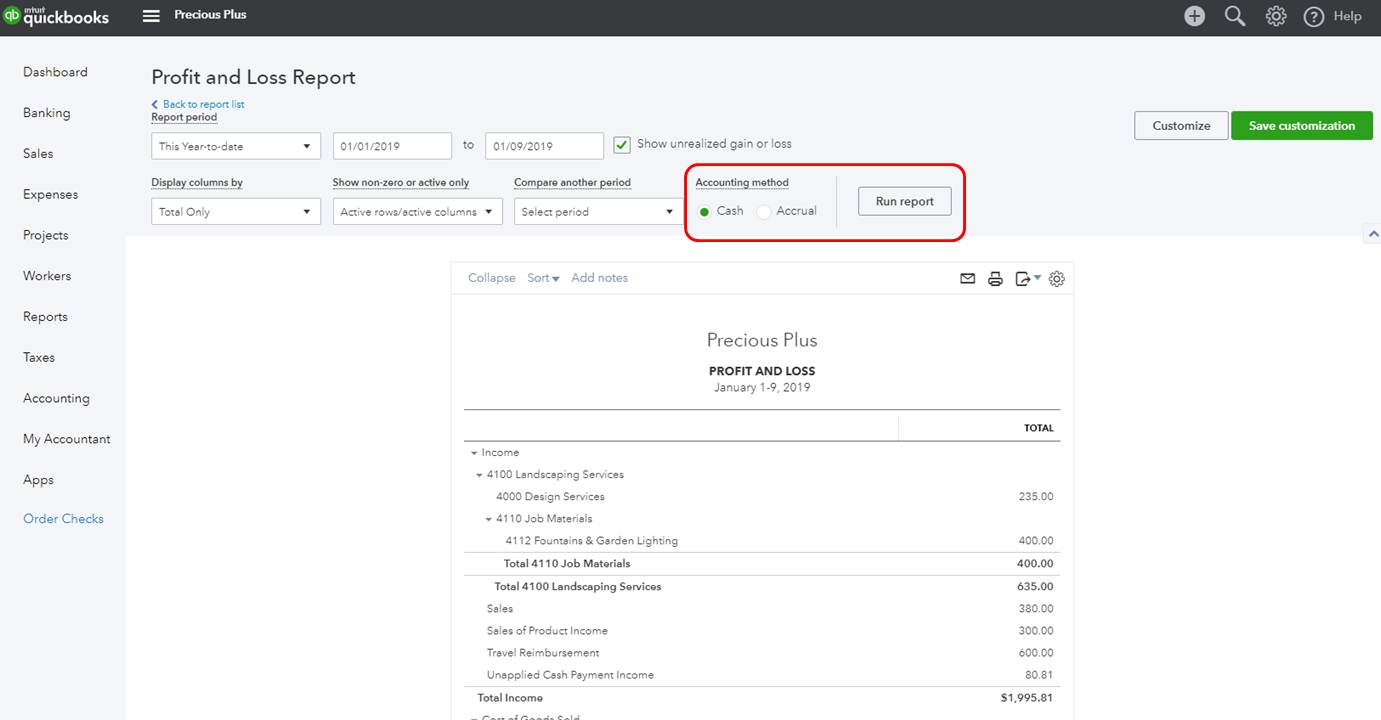

Once your QuickBooks account is meticulously set up to accurately reflect your business’s financial data, you can proceed with generating a comprehensive Profit and Loss (P&L) statement. QuickBooks simplifies this process, allowing you to obtain a clear overview of your business’s financial performance for a specified period. Here’s how you can generate a P&L statement in QuickBooks:

- Navigate to the Reports Section: Log in to your QuickBooks account and navigate to the “Reports” section, where you will find a wide array of financial reports, including the P&L statement.

- Select the Profit and Loss Report: Within the Reports section, locate and select the “Profit and Loss” report to initiate the process of generating your P&L statement.

- Set the Reporting Period: Specify the reporting period for the P&L statement, such as a specific month, quarter, or year, to analyze your business’s financial performance within the chosen timeframe.

- Customize the Report (Optional): QuickBooks offers customization options that allow you to tailor the P&L statement based on your unique preferences. You can modify the report to include specific accounts, departments, or classes to gain a more granular view of your business’s financial performance.

- Generate and Review the Report: After setting the reporting parameters and any desired customizations, generate the P&L statement and carefully review the results to gain insights into your business’s revenues, expenses, and overall profitability.

By following these steps, you can effortlessly generate a detailed P&L statement in QuickBooks, providing you with a comprehensive snapshot of your business’s financial performance within the specified reporting period. This foundational financial document serves as a valuable tool for assessing your business’s profitability, identifying areas of strength and opportunity, and making informed strategic decisions.

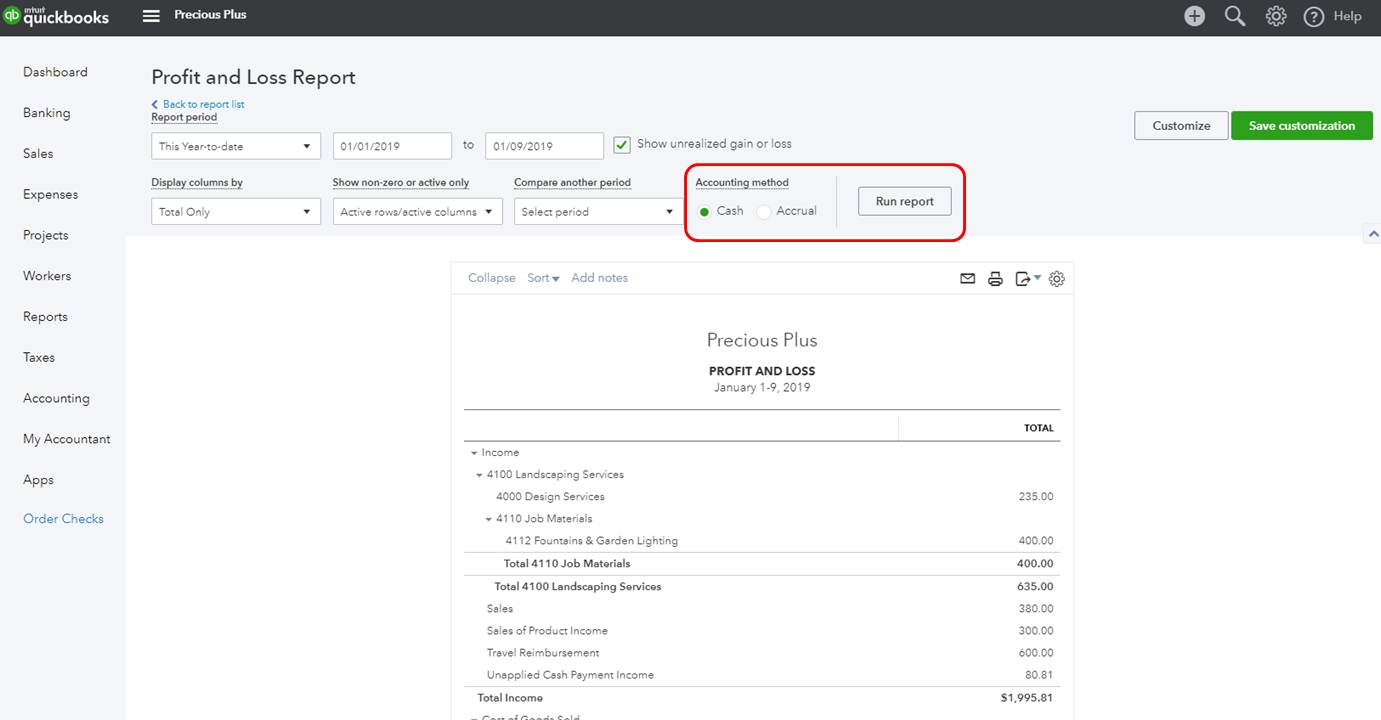

Reviewing the Profit and Loss Statement

Once you have generated the Profit and Loss (P&L) statement in QuickBooks, the next crucial step is to thoroughly review and analyze the financial insights it provides. The P&L statement offers a comprehensive overview of your business’s revenues, costs, and expenses, allowing you to assess its overall financial performance. Here are essential aspects to consider when reviewing the P&L statement:

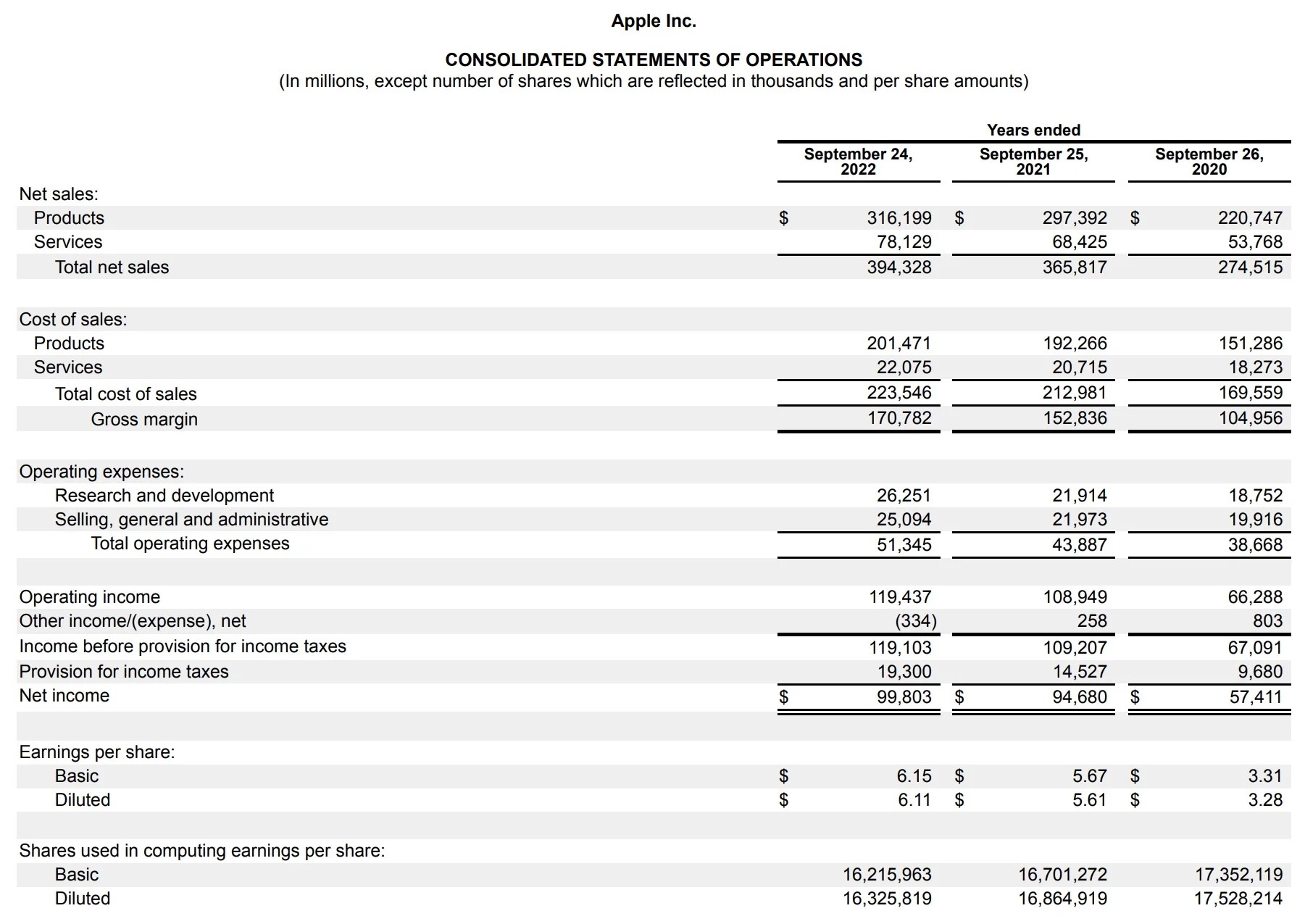

- Revenue Analysis: Evaluate the sources of revenue reflected in the P&L statement. Identify the primary revenue streams and assess their contributions to your business’s overall income.

- Cost of Goods Sold (COGS): Review the direct costs associated with producing goods or services. Analyze the COGS to understand the profitability of your core business operations.

- Operating Expenses: Examine the various operating expenses, such as rent, utilities, salaries, and marketing costs, to gauge the impact of these expenditures on your business’s financial performance.

- Gross Profit Margin: Calculate the gross profit margin by subtracting the COGS from the total revenue. This metric provides insights into the efficiency of your business’s core operations.

- Net Profit/Loss: Assess whether the business has generated a net profit or incurred a loss during the specified reporting period. Understanding the bottom-line financial outcome is crucial for strategic decision-making.

By meticulously reviewing the P&L statement, you can gain valuable insights into your business’s financial health, identify areas of strength and potential improvement, and make informed decisions to drive growth and profitability. The P&L statement serves as a powerful tool for assessing the overall performance of your business and is instrumental in shaping strategic financial plans and operational strategies.

Analyzing the Profit and Loss Statement

Once you have reviewed the Profit and Loss (P&L) statement in QuickBooks, it’s time to delve deeper into the financial insights it provides and perform a comprehensive analysis. Analyzing the P&L statement entails interpreting the data to gain a nuanced understanding of your business’s financial performance. Here are key steps to effectively analyze the P&L statement:

- Comparative Analysis: Compare the current P&L statement with previous periods to identify trends and patterns in your business’s financial performance. This comparative analysis provides valuable context for assessing growth and identifying potential areas of concern.

- Ratio Analysis: Calculate and analyze key financial ratios derived from the P&L statement, such as the gross profit margin, net profit margin, and operating expense ratio. These ratios offer insights into the efficiency, profitability, and financial health of your business.

- Variance Analysis: Identify significant variances in revenues, costs, and expenses compared to budgeted or projected figures. Understanding these variances enables you to pinpoint areas that require attention and potential areas for improvement.

- Identifying Profit Drivers: Determine the primary drivers of your business’s profitability based on the P&L statement. This involves identifying the revenue streams and cost elements that have the most significant impact on your business’s bottom line.

- Identifying Opportunities and Challenges: Use the insights from the P&L analysis to identify opportunities for growth and expansion, as well as potential challenges that may require strategic interventions to mitigate risks.

By conducting a thorough analysis of the P&L statement, you can gain a holistic understanding of your business’s financial performance, identify trends and patterns, and uncover actionable insights that drive informed decision-making. This analysis serves as a foundational step in developing strategic financial plans, optimizing operational efficiency, and steering your business towards sustainable growth and profitability.

Making Adjustments in QuickBooks

Upon analyzing the Profit and Loss (P&L) statement in QuickBooks, you may uncover insights that necessitate adjustments to your financial records and strategies. QuickBooks provides a seamless platform for making these essential adjustments to ensure that your financial data accurately reflects your business’s performance. Here are key considerations and steps for making adjustments in QuickBooks based on your P&L analysis:

- Updating Revenue and Expense Accounts: Based on the insights from the P&L analysis, you may need to update and categorize revenue and expense accounts to align with your business’s evolving financial landscape. This ensures that your P&L statement accurately reflects the current state of your business.

- Revising Budgets and Projections: If the P&L analysis reveals significant variances from budgeted or projected figures, consider revising your budgets and financial projections in QuickBooks to reflect the new insights and align future financial planning with realistic expectations.

- Adjusting Inventory and Cost of Goods Sold: If your business involves inventory management, the P&L analysis may highlight the need to adjust inventory valuations and cost of goods sold (COGS) figures to accurately reflect the cost of producing goods or delivering services.

- Allocating Expenses and Overhead Costs: Based on the P&L analysis, consider reallocating and adjusting overhead costs and expenses to ensure that they are accurately attributed to the relevant revenue-generating activities or cost centers within your business.

- Implementing Process Improvements: Use the insights from the P&L analysis to identify areas for process improvements and operational efficiencies. This may involve streamlining expense tracking, optimizing revenue recognition processes, or enhancing cost control measures within QuickBooks.

By leveraging the flexibility and functionality of QuickBooks, you can seamlessly make these adjustments to your financial records, ensuring that your P&L statement and other financial reports provide a true and accurate reflection of your business’s financial performance. These adjustments enable you to align your financial data with strategic insights, drive informed decision-making, and optimize your business’s overall financial health.

Conclusion

Mastering the art of running a Profit and Loss (P&L) statement in QuickBooks empowers you to gain valuable insights into your business’s financial performance, make informed decisions, and drive strategic growth. By following the essential steps of setting up QuickBooks, generating a P&L statement, reviewing and analyzing the results, and making necessary adjustments, you can harness the power of financial data to steer your business towards sustained profitability and success.

QuickBooks serves as a robust platform that streamlines the process of generating and analyzing P&L statements, providing you with a comprehensive overview of your business’s revenues, costs, and overall profitability. The insights derived from the P&L analysis enable you to identify key drivers of profitability, assess the efficiency of your operations, and pinpoint opportunities for growth and improvement.

Furthermore, the ability to make seamless adjustments in QuickBooks based on the insights from the P&L analysis ensures that your financial records accurately reflect the dynamic nature of your business. Whether it involves updating revenue and expense accounts, revising budgets, or implementing process improvements, these adjustments are instrumental in aligning your financial data with strategic objectives.

Ultimately, the proficiency in running a P&L statement in QuickBooks equips you with the financial acumen necessary to navigate the complexities of business management, plan for the future, and optimize your business’s financial performance. By leveraging the tools and insights provided by QuickBooks, you can make data-driven decisions that propel your business towards sustainable growth, resilience, and success in today’s dynamic business landscape.