Finance

Economic Spread Definition

Published: November 16, 2023

Discover the meaning of economic spread and its importance in finance. Learn how it affects financial performance and investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Economic Spread: Definition and Significance

Welcome to our finance blog category! In this post, we will delve into the concept of economic spread, its definition, and why it is important in the world of finance. Whether you are a seasoned investor or simply curious about economic indicators, understanding the economic spread can provide valuable insights into economic trends and developments.

Key Takeaways:

- Economic spread refers to the difference or gap between two key economic indicators, such as interest rates or bond yields.

- It is an essential measure used by economists, investors, and policymakers to gauge the health and stability of an economy.

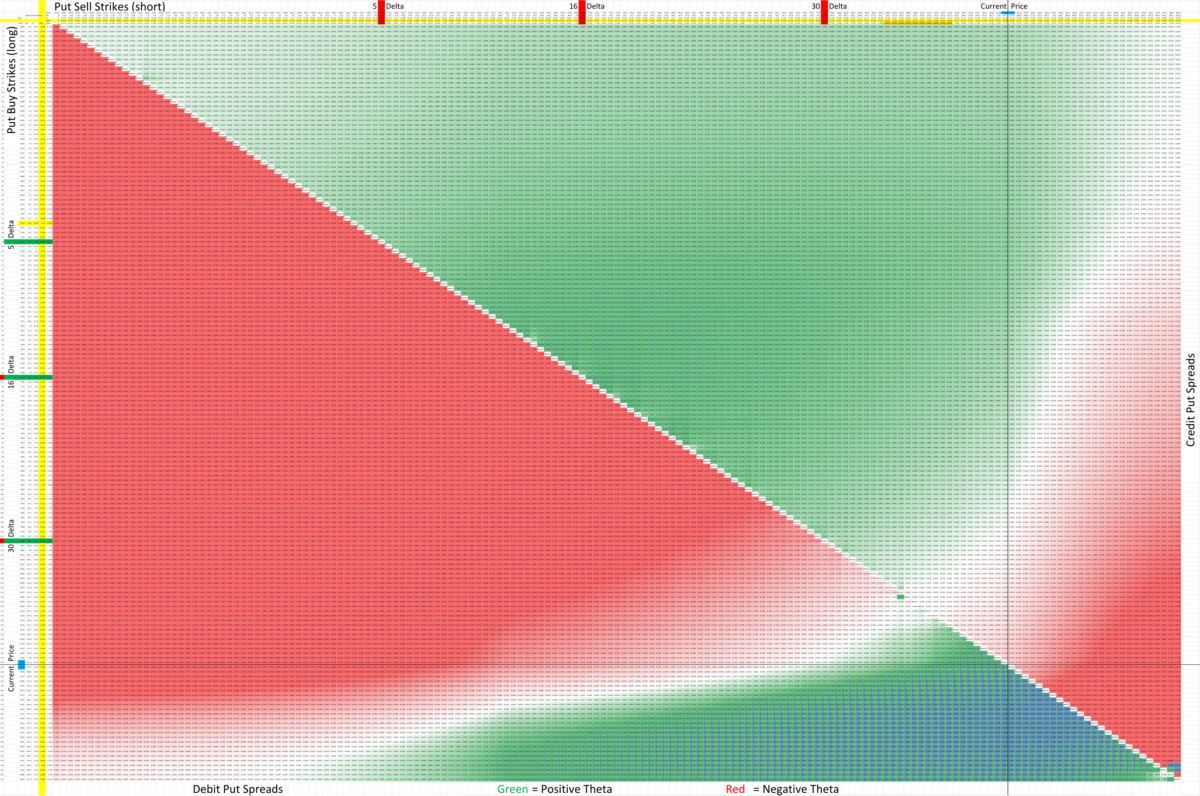

So, what exactly is economic spread? In simple terms, it is the difference between two significant economic variables, often expressed in percentage terms. This spread can be calculated across different aspects of an economy, such as interest rates, bond yields, or even stock market returns.

One of the most common examples of economic spread is the yield spread, which is the difference between the yields on two bonds with different levels of risk. This spread is essentially a measure of the compensation investors demand for taking on higher risk investments. A wider yield spread indicates greater perceived risk in the market, while a narrower spread suggests confidence and lower perceived risk.

The economic spread can provide useful insights into the overall health of an economy. Here are a few reasons why it is important:

- Indicator of economic stability: The economic spread can help identify potential vulnerabilities in the economy. For example, a widening spread in interest rates could indicate increased financial stress and the potential for a slowdown in economic growth. On the other hand, a narrowing spread may suggest a more stable and balanced economy.

- Predictive tool for investors: Investors often look at economic spreads as an indicator of future market movements. By analyzing the spread between different asset classes or interest rates, investors can make informed decisions about where to allocate their capital. A wider spread may signal the potential for higher returns, while a narrower spread may suggest less favorable investment opportunities.

In summary, economic spread is a crucial concept in finance that helps investors, economists, and policymakers assess the health and stability of an economy. By analyzing the difference between key economic indicators, such as interest rates or bond yields, we can gain valuable insights into market trends and potential opportunities. Whether you are a seasoned investor or a curious observer, understanding economic spread can enhance your financial knowledge and decision-making abilities.