Home>Finance>Equity Co-Investment: Definition, How It Works, Benefits

Finance

Equity Co-Investment: Definition, How It Works, Benefits

Modified: December 30, 2023

Learn about equity co-investment in finance, its definition, how it works, and the benefits it provides. Explore this investment strategy to maximize your financial gains.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Equity Co-Investment: Definition, How It Works, Benefits

Finance is a crucial aspect of our lives, and it’s important to understand different investment options and strategies available to us. One such strategy that has gained popularity in recent years is equity co-investment. If you’re new to the concept or looking to expand your knowledge, you’ve come to the right place. In this blog post, we will explore what equity co-investment is, how it works, and the benefits it offers.

Key Takeaways:

- Equity co-investment involves multiple investors pooling their resources to invest in a single project or company.

- It provides investors with an opportunity to diversify their investments and potentially increase their returns.

What is Equity Co-Investment?

Equity co-investment is an investment strategy where multiple investors join forces to invest in a specific project or company. This collaborative approach allows investors to pool their resources, knowledge, and expertise to capitalize on lucrative investment opportunities. By partnering with other investors, individuals can gain access to deals they might not have been able to pursue on their own, such as large-scale real estate or private equity ventures.

How Does Equity Co-Investment Work?

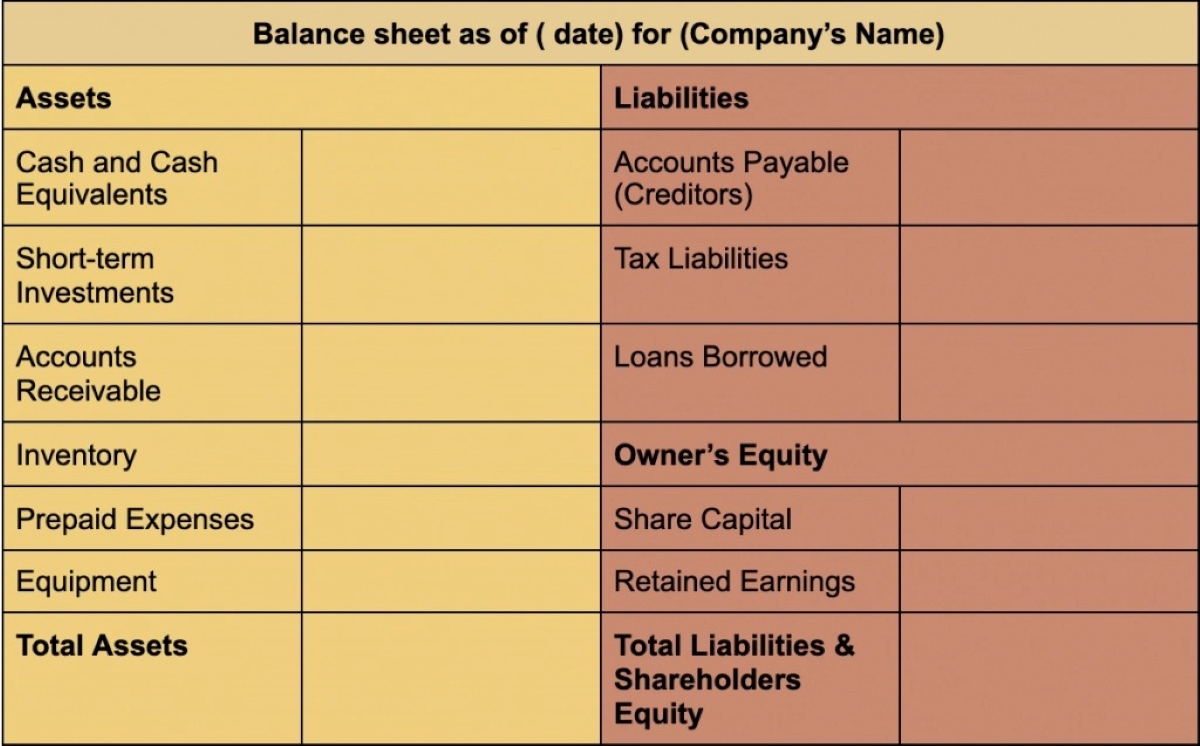

When it comes to equity co-investment, investors typically form a syndicate or a group to pool their capital. This syndicate then invests in a project or company together, sharing the risks and rewards associated with the investment. The syndicate may consist of individual investors, private equity firms, institutional investors, or venture capitalists.

Once the investment is made, investors hold a defined ownership stake in the project or company. This means they can benefit from potential capital appreciation and receive a share of the profits when the investment is profitable. The level of involvement and decision-making authority may vary depending on the syndicate’s structure and agreement.

The Benefits of Equity Co-Investment

Equity co-investment offers several benefits to investors:

- Diversification: By pooling resources with other investors, individuals can spread their investments across multiple projects or companies, reducing their exposure to any single investment.

- Access to Exclusive Deals: Co-investing provides investors with access to deals they might not have access to as individual investors, allowing them to tap into potentially high-growth industries or lucrative projects.

- Enhanced Returns: By leveraging their combined capital, co-investors can pursue larger-scale projects, which may have a higher potential for returns compared to individual investments.

- Reduced Risk: Sharing the risks and rewards of an investment among multiple investors helps to mitigate individual risk, as losses or unexpected developments are distributed across the group.

- Network Expansion: Co-investing provides an opportunity to connect and collaborate with like-minded investors, creating a network that can open doors to future investment opportunities.

Overall, equity co-investment offers a unique approach to diversifying investments, accessing exclusive deals, and potentially boosting returns while minimizing risks. It’s important to carefully evaluate each co-investment opportunity, understand the terms and conditions, and assess the potential risks before participating in any venture.

As with any investment strategy, it’s also advisable to consult with a financial advisor or investment professional to determine if equity co-investment aligns with your financial goals and risk tolerance.

Have you ever explored equity co-investment opportunities? Let us know your experiences and thoughts in the comments below!