Home>Finance>In What Order Would The Items On The Balance Sheet Appear?

Finance

In What Order Would The Items On The Balance Sheet Appear?

Modified: February 23, 2024

Learn the order in which items appear on the balance sheet in finance. Understand how assets, liabilities, and equity are presented for financial analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the order in which items appear on the balance sheet. A balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position at a specific point in time. It highlights the company’s assets, liabilities, and equity, giving investors and stakeholders valuable insights into its financial health.

Understanding the order in which the items are presented on the balance sheet is essential for investors, analysts, and anyone interested in evaluating a company’s financial standing. The arrangement of these items follows a predetermined structure that adheres to accounting principles and regulatory guidelines.

In this article, we will delve into the order in which the items on the balance sheet appear, exploring the different categories and how they contribute to the overall financial outlook of a company. So, whether you’re a finance professional, an aspiring investor, or simply someone curious about financial statements, let’s dive into the details and unravel the mysteries of the balance sheet.

Overview of a Balance Sheet

Before we discuss the order of items on a balance sheet, let’s first establish a basic understanding of what a balance sheet represents. As mentioned earlier, a balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is one of the three main financial statements used by companies to communicate their financial information to investors, lenders, and other stakeholders.

The balance sheet follows the fundamental accounting equation that states: Assets = Liabilities + Equity. This equation highlights the idea that a company’s assets are financed by a combination of its liabilities (debt obligations) and equity (ownership interests).

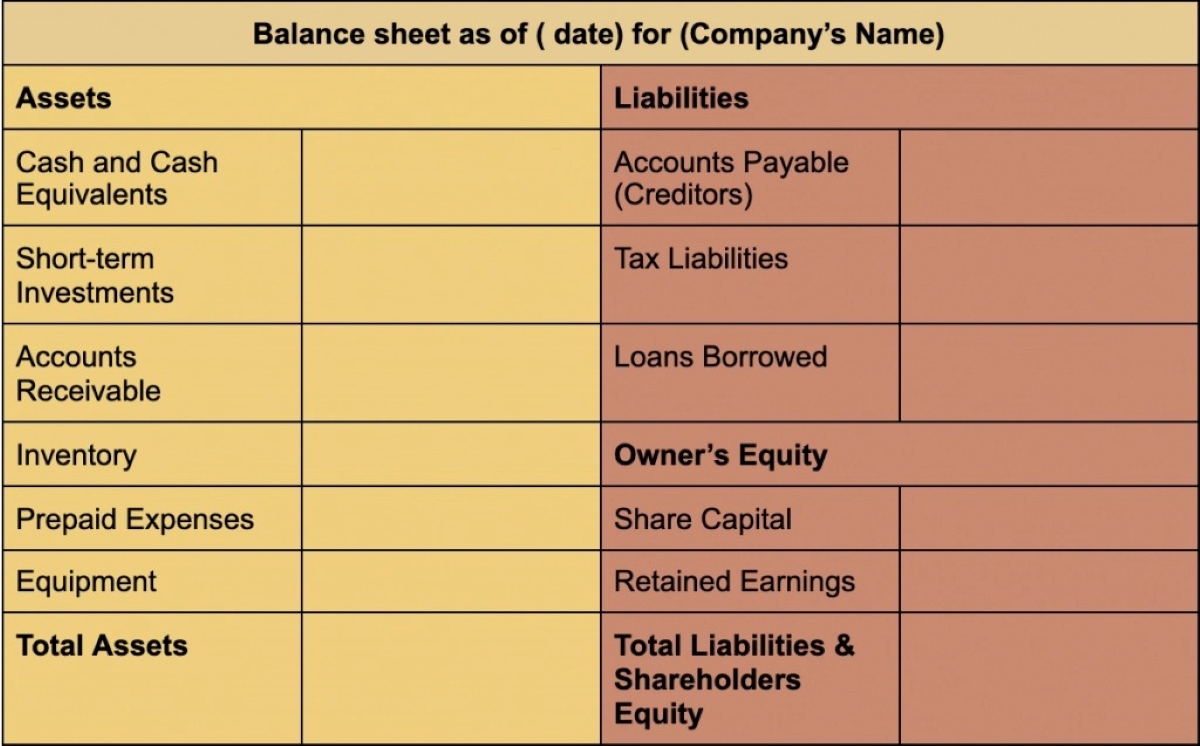

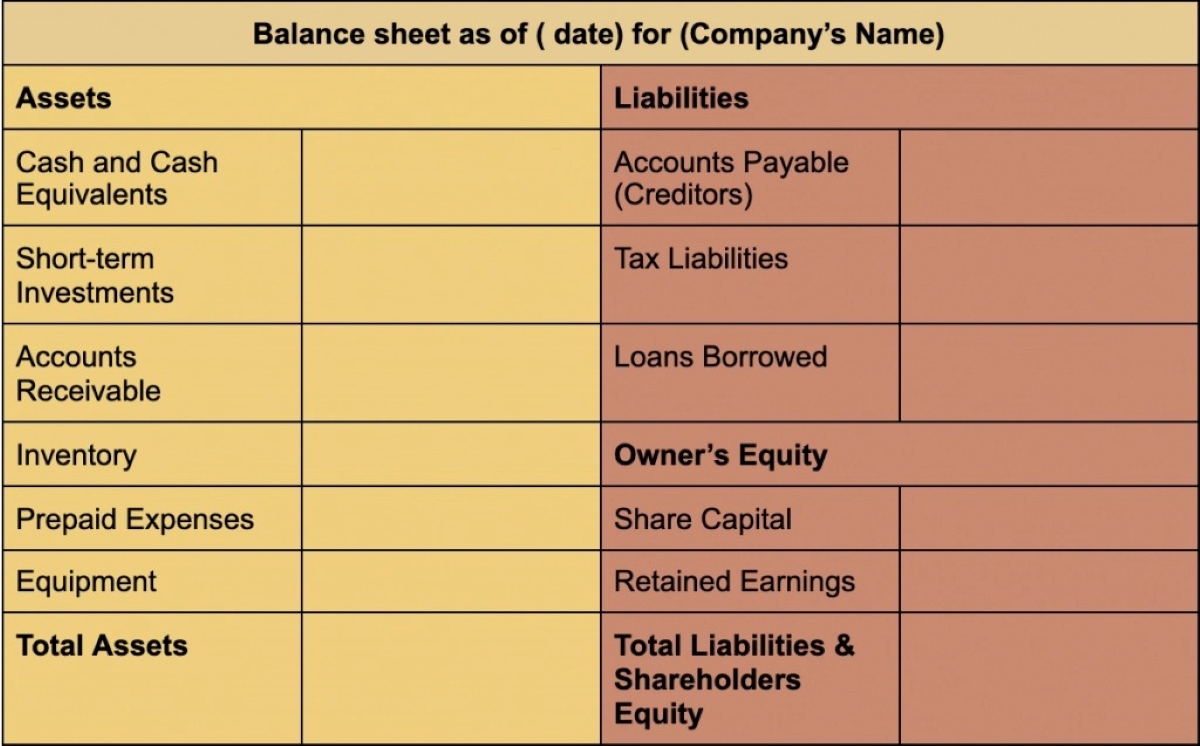

The balance sheet is divided into three main sections: assets, liabilities, and equity. These sections help to categorize and organize the various items that make up a company’s financial position.

Assets represent what the company owns, including cash, investments, inventory, property, and equipment. Liabilities represent the company’s obligations and debts, such as loans, accounts payable, and accrued expenses. Equity represents the residual interest in the assets of the company, after deducting liabilities.

By presenting these items in a specific order, the balance sheet provides a clear and systematic view of a company’s financial position. Let’s now explore the order in which these items are typically presented on a balance sheet.

Order of Items on the Balance Sheet

When it comes to the order of items on a balance sheet, there is a standardized layout that most companies follow. This helps to ensure consistency and comparability among financial statements. The items are typically presented in a sequence that reflects their liquidity and maturity.

The balance sheet begins with the presentation of assets, followed by liabilities, and ends with equity. Let’s take a closer look at each of these categories:

Assets:

Assets are the resources that a company owns or controls, which have economic value and can be used to generate future benefits. They are listed on the balance sheet in order of their liquidity, or how easily they can be converted into cash within a year. Here is a typical order in which assets appear:

- Cash and Cash Equivalents: This category includes cash on hand, bank deposits, and short-term investments that are readily convertible into cash.

- Short-term Investments: These are investments that will mature within one year, such as marketable securities.

- Accounts Receivable: This represents the money owed to the company by its customers for goods or services delivered.

- Inventory: This includes the value of the company’s products or raw materials held for production and eventual sale.

- Prepaid Expenses: These are payments made in advance for goods or services that will be received in the future.

- Long-term Investments: These are investments that will mature beyond one year, such as bonds or stocks held for strategic purposes.

- Property, Plant, and Equipment: This category includes the company’s tangible assets, such as land, buildings, machinery, and vehicles.

Liabilities:

Liabilities represent the company’s obligations to pay debts and fulfill other financial commitments. Like assets, liabilities are listed in order of their maturity or the time frame in which they are due. Here is the typical order in which liabilities appear:

- Accounts Payable: This represents the money owed by the company to its suppliers and vendors for goods or services received.

- Short-term Borrowings: These are the company’s current outstanding debts and loans that are due within one year.

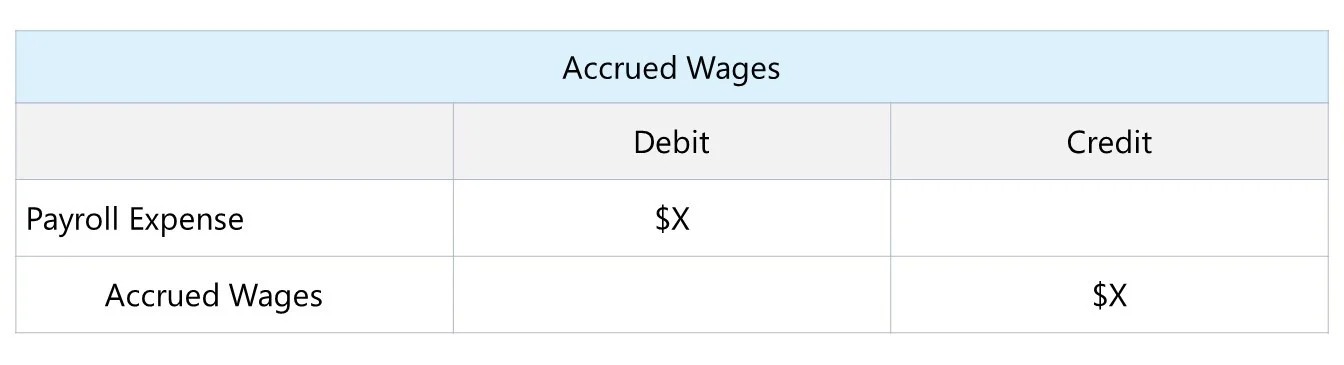

- Accrued Expenses: These are expenses that the company has incurred but has not yet paid, such as salaries, utilities, and taxes.

- Long-term Debt: This includes the company’s obligations and loans that will mature beyond one year.

- Deferred Revenues: These are payments received in advance for goods or services that will be delivered in the future.

Equity:

Equity represents the residual interest in the assets of the company after deducting liabilities. It is the ownership interest of the shareholders and reflects the company’s net worth. Equity is typically presented at the end of the balance sheet and includes the following:

- Share Capital: This represents the funds raised by the company by issuing shares to shareholders.

- Additional Paid-in Capital: This represents the amount received from shareholders for shares issued above their par value.

- Retained Earnings: This is the accumulated net income of the company that has not been distributed to shareholders as dividends.

- Other Comprehensive Income: This includes gains and losses that are not recognized in the income statement, such as foreign currency translation adjustments or changes in the value of available-for-sale securities.

By following this standardized order, the balance sheet provides a clear representation of a company’s financial position, making it easier for investors, creditors, and other stakeholders to analyze and evaluate its financial health.

Assets

Assets are an essential component of a balance sheet as they represent the resources owned or controlled by a company that have economic value. Assets are divided into different categories based on their liquidity – how easily they can be converted into cash within a year. Let’s explore the main categories of assets that typically appear on a balance sheet:

- Cash and Cash Equivalents: This category includes cash on hand, along with any highly liquid investments that are easily convertible into cash. Cash equivalents are short-term investments with a maturity period of 90 days or less, such as money market funds, treasury bills, and certificates of deposit.

- Short-term Investments: These investments have a maturity period of one year or less and are readily marketable. Examples of short-term investments include government bonds, high-quality corporate bonds, and marketable securities.

- Accounts Receivable: This represents the amount of money owed to the company by its customers for goods sold or services rendered. It is an asset that indicates the cash inflow expected from outstanding invoices.

- Inventory: Inventory includes the value of the company’s raw materials, work-in-progress, and finished goods. It represents assets that are to be sold or used in the production of goods or services.

- Prepaid Expenses: Prepaid expenses arise when a company pays in advance for goods or services that it will receive later. Common examples include prepaid rent, insurance premiums, and annual subscriptions.

- Long-term Investments: These investments are held for a period exceeding one year and are not intended for immediate sale. They can include shares of other companies, bonds, or long-term loans to other entities.

- Property, Plant, and Equipment: Often referred to as PP&E, this category represents tangible assets that are used in operations and have a useful life of more than one year. It includes land, buildings, machinery, vehicles, and furniture.

Assets listed on the balance sheet provide insights into a company’s ability to generate cash flows and its overall financial strength. They also play a significant role in determining a company’s market value and creditworthiness. Investors and analysts closely analyze the asset portion of the balance sheet to assess the company’s liquidity, solvency, and potential for future growth.

Liabilities

Liabilities are an integral part of the balance sheet, representing a company’s obligations and debts. They highlight the amounts owed to external parties and provide insight into the company’s financial obligations. Let’s explore the main categories of liabilities that typically appear on a balance sheet:

- Accounts Payable: This category includes the amount owed by the company to its suppliers and vendors for goods or services received. It represents a short-term liability that is payable within a specified timeframe.

- Short-term Borrowings: These are the company’s current outstanding debts and loans that are due within one year. Short-term borrowings can include bank loans, lines of credit, and other types of short-term financing.

- Accrued Expenses: Accrued expenses represent costs incurred by the company but not yet paid. Examples include salaries and wages, rent, utilities, and taxes. These liabilities are recorded to ensure accurate financial reporting.

- Long-term Debt: Long-term debt refers to the obligations that will mature and become due beyond one year. It includes loans, bonds, and other forms of debt that extend over an extended period and require regular interest payments.

- Deferred Revenues: Deferred revenues arise when a company receives payment from customers in advance for goods or services that have not yet been delivered. It represents a liability until the company fulfills its obligations.

Liabilities represent the financial obligations a company has to external parties and provide insight into its ability to meet those obligations. They are crucial indicators of a company’s solvency, financial stability, and leverage. Investors and creditors closely analyze the liabilities section of the balance sheet to assess a company’s ability to manage its debt, make timely payments, and maintain a healthy financial position.

Equity

Equity is a vital component of the balance sheet, representing the residual interest in a company’s assets after deducting liabilities. It reflects the ownership interest of shareholders and serves as a measure of a company’s net worth. The equity section of the balance sheet typically includes the following components:

- Share Capital: The share capital represents the amount of capital raised by the company through the issuance of shares to shareholders. It includes the par value, or nominal value, assigned to each share.

- Additional Paid-in Capital: Additional paid-in capital, also known as capital in excess of par, represents the amount above the par value that shareholders have paid for their shares. This can occur when shares are issued at a premium.

- Retained Earnings: Retained earnings represent the accumulated profits of the company that have not been distributed to shareholders as dividends. It reflects the portion of earnings that the company has retained for reinvestment or to fund future growth.

- Other Comprehensive Income: Other comprehensive income includes gains and losses that are not recognized in the income statement. This can include items such as foreign currency translation adjustments, gains or losses on hedging instruments, or changes in the market value of available-for-sale securities.

Equity is a measure of a company’s financial health, indicating the net value of the business that belongs to its shareholders. It represents the residual claim on assets after meeting all liabilities. Shareholders’ equity is closely monitored by investors and analysts as it reflects the company’s ability to generate profits and sustain growth over time.

Changes in equity can occur through various events, such as share issuances or repurchases, dividend payments, net income or losses, and changes in the fair value of certain assets. These fluctuations impact the overall equity position of the company and can provide insights into its financial performance and capital structure.

Understanding the equity section of the balance sheet helps stakeholders assess a company’s financial stability, the level of risk, and the potential returns for shareholders. It provides important information for valuation purposes and helps investors make informed decisions regarding their investment in the company.

Conclusion

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time. The order in which items appear on the balance sheet follows a standardized structure that provides consistency and comparability among financial statements.

Assets are listed first on the balance sheet, in order of their liquidity, representing the resources owned or controlled by the company. Liabilities come next, showcasing the company’s obligations and debts to external parties. Finally, equity represents the ownership interest and the residual claim on assets after deducting liabilities.

By understanding the order of items on the balance sheet, investors, creditors, and other stakeholders gain valuable insights into a company’s financial health. They can assess the company’s liquidity, solvency, and the extent of its financial obligations. This information helps stakeholders make informed decisions, evaluate investment opportunities, and assess the overall financial strength of the company.

Analyzing the balance sheet in its entirety allows for a comprehensive evaluation of a company’s financial position, enabling stakeholders to assess its ability to generate cash flows, manage debt, and sustain growth. It is important to note that while the ordered presentation of items on the balance sheet is generally followed, specific companies may have variations based on their industry, accounting practices, or regulatory requirements.

By understanding the components and order of items on a balance sheet, stakeholders can gain a deeper understanding of a company’s financial position, which is essential for making informed decisions and evaluating its potential for success.