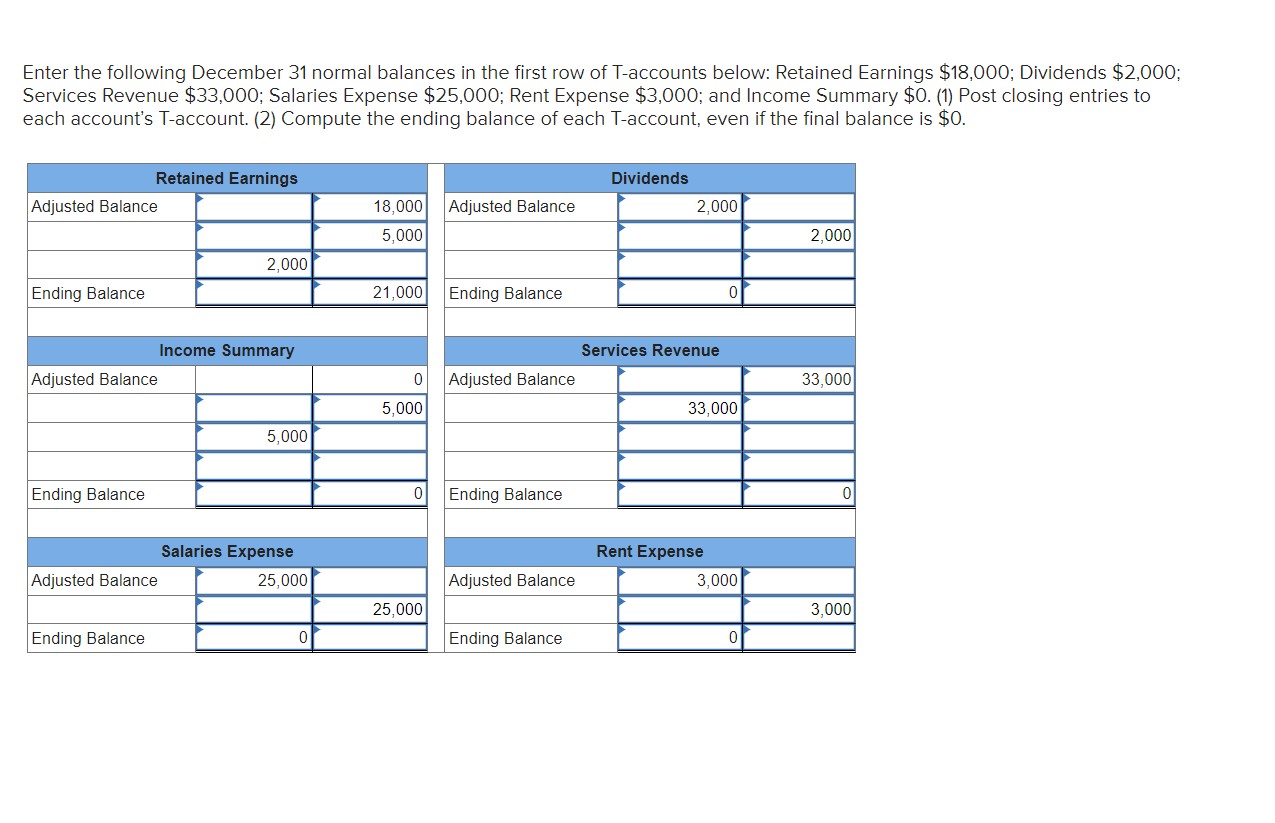

Home>Finance>Equity-Linked Note (ELN) Definition And Features

Finance

Equity-Linked Note (ELN) Definition And Features

Published: November 19, 2023

Learn more about Equity-Linked Notes (ELNs), a popular financial instrument in the world of finance. Explore their definition, features, and benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Basics of Equity-Linked Notes (ELNs)

Are you looking for an investment product that offers the potential for higher returns while also providing an element of downside protection? If so, you may want to consider Equity-Linked Notes (ELNs). In this blog post, we will provide an in-depth look into the definition and features of ELNs, and how they can benefit investors like you.

Key Takeaways:

- Equity-Linked Notes (ELNs) are derivative securities with characteristics of both bonds and equities.

- ELNs offer the potential for higher returns based on the performance of an underlying equity or equity index.

What are Equity-Linked Notes (ELNs)?

Equity-Linked Notes, commonly known as ELNs, are financial instruments that combine the features of both bonds and equities. They are derivative securities that offer investors exposure to the performance of an underlying equity or equity index while providing an element of downside protection.

ELNs are structured products that function as bonds with a fixed maturity date and face value. Their performance, however, is linked to an underlying equity or equity index. This means that the returns on ELNs are typically tied to the price movement of the underlying asset. If the underlying asset performs well, the investor may receive a higher return. On the other hand, if the underlying asset performs poorly, the investor’s returns may be lower, but they are often still protected from the full downside risk.

Features of Equity-Linked Notes

Here are some key features of ELNs:

- Principal Protection: ELNs often provide a level of principal protection, meaning that even if the underlying equity or equity index declines in value, the investor is guaranteed to receive at least the face value of their investment at maturity.

- Upside Potential: ELNs offer the potential for higher returns based on the performance of the underlying equity or equity index. If the underlying asset performs well, the investor has the opportunity to earn a higher return than they would with a traditional bond.

- Enhanced Yield: ELNs sometimes offer enhanced yield compared to traditional fixed-income investments. This is because the potential for higher returns from the equity component of the ELN can offset the lower fixed coupon payments often associated with these products.

- Flexibility: ELNs come in various structures and can be customized to suit different risk appetites and investment objectives. Investors can choose different underlying equities or equity indices, coupon structures, and maturity dates to create a product that aligns with their specific needs.

- Risk Considerations: While ELNs provide an element of downside protection, it’s important to note that they still carry certain risks. The performance of the underlying asset can have a significant impact on the returns. Additionally, ELNs are typically not as liquid as traditional bonds, meaning that their marketability may be limited.

Conclusion

Equity-Linked Notes (ELNs) combine the characteristics of both bonds and equities, offering investors the potential for higher returns while providing an element of downside protection. These structured products allow investors to participate in the performance of an underlying equity or equity index, while often guaranteeing the return of at least the face value of the investment at maturity. However, it’s important to carefully consider the risks and features associated with ELNs before making any investment decisions.

Ultimately, Equity-Linked Notes can be an attractive option for individuals seeking to diversify their investment portfolio or those looking for potentially higher returns while managing downside risk. As with any investment product, seeking advice from a qualified financial professional is always recommended to ensure it aligns with your specific goals and risk tolerance.