Finance

What Is The Normal Balance Of Dividends

Published: January 2, 2024

Learn about the normal balance of dividends in finance. Discover how dividends affect balance sheets and financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding the nuances of various accounting concepts is essential. One such concept is dividends, which play a crucial role in the financial landscape. Dividends are the returns that a company distributes to its shareholders as a reward for their investment.

In the world of accounting, it is important to have a clear understanding of the normal balance of dividends. The normal balance refers to the side of the general ledger account where increases are recorded. This concept is fundamental in maintaining accurate financial records and ensuring the integrity of financial statements.

In this article, we will delve into the meaning of dividends, explore the concept of normal balance, discuss the factors that affect the normal balance of dividends, provide examples for better comprehension, highlight the importance of understanding the normal balance, and ultimately demonstrate how a solid knowledge of this concept can contribute to a sound financial strategy.

So, whether you are a seasoned investor, an aspiring accountant, or simply someone looking to gain a better understanding of finance, read on to unlock the secrets of the normal balance of dividends and how it impacts the financial world at large.

Definition of Dividends

Dividends are a distribution of a portion of a company’s earnings to its shareholders. It is a way for the company to share its profits with those who have invested in the company’s stocks. Dividends are typically paid out in cash, but they can also be distributed as additional shares of stock or other assets.

When a company generates profit, it has a few options on what to do with that money. One option is to reinvest the profits back into the company for research, development, or expansion. Another option is to pay off debts or save the money for future investments. However, many companies choose to distribute some of the profits as dividends to reward their shareholders.

Dividends are usually paid on a regular basis, such as quarterly, semi-annually, or annually. The amount of the dividend can vary depending on the profitability of the company and its financial situation. The decision to pay dividends is made by the company’s board of directors and is subject to approval by the shareholders.

Dividends can be an attractive feature for investors, especially those who are looking for a steady stream of income. They can provide a predictable and regular cash flow, which is particularly appealing to retirees and income-focused investors. Dividends can also be an indication of a company’s financial health and stability. If a company consistently pays dividends or increases the amount of dividends over time, it may be a sign of a strong and well-managed company.

It’s worth noting that not all companies pay dividends. Some companies, especially those in the growth phase, may reinvest all their profits back into the business to fuel expansion and innovation. These companies may choose to forgo paying dividends in favor of reinvesting the profits for future growth, with the expectation that the value of the stock will increase over time.

In summary, dividends are a distribution of a portion of a company’s earnings to its shareholders. They can be paid in cash, additional shares of stock, or other assets. Dividends can provide investors with a regular income stream and are indicative of a company’s financial health. However, not all companies pay dividends, as some may choose to reinvest all their profits back into the business for future growth.

Meaning of Normal Balance

In the world of accounting, the concept of normal balance refers to the side of the general ledger account where increases are recorded. Each account in the financial records has a normal balance, which is determined by its nature and function. Understanding the normal balance of an account is crucial for accurately recording and summarizing financial transactions.

When it comes to dividends, the normal balance is typically on the debit side of the ledger. This means that dividends are considered an expense or a reduction in the company’s retained earnings. When a company distributes dividends to shareholders, it reduces its profits, which ultimately affects the overall financial health of the company.

It’s important to note that the normal balance of an account is not set in stone and can vary depending on the specific circumstances or accounting practices of a company. However, in general, dividends are considered a reduction in equity and are therefore recorded as a debit entry.

The concept of normal balance is essential for maintaining the accuracy and integrity of financial records. By ensuring that the correct side of the ledger is debited or credited for dividends, accountants can provide reliable and meaningful financial statements.

Accounting software often has built-in controls that prevent errors when recording transactions. For example, if an accountant mistakenly tries to credit the dividends account instead of debiting it, the software may generate an error message, prompting the user to correct the entry. These controls help maintain the accuracy of the financial records and prevent potential misstatements.

In summary, the normal balance of dividends is typically on the debit side of the ledger. Understanding the normal balance of an account is crucial for accurate financial record-keeping. By ensuring that the correct side of the ledger is debited or credited for dividends, accountants can provide reliable financial statements that reflect the company’s financial health. Accounting software often includes controls to prevent errors when recording transactions, further safeguarding the integrity of financial records.

Factors Affecting the Normal Balance of Dividends

While the normal balance of dividends is typically on the debit side of the ledger, there are several factors that can influence this balance. Understanding these factors is crucial for accurately recording dividend transactions and analyzing their impact on the company’s financial health. Here are some key factors that can affect the normal balance of dividends:

- Company Structure: The legal structure of a company can influence how dividends are treated. For example, in a sole proprietorship or partnership, the withdrawals by the owner(s) are considered as drawings and are not recorded as dividends. However, in a corporation, dividends are formal distributions of profits to shareholders.

- Profitability: The financial performance of a company is a significant factor in determining the normal balance of dividends. If a company is consistently generating profits, it may be more inclined to declare and distribute dividends to its shareholders. Conversely, if a company is experiencing losses or financial difficulties, it may choose to cut or eliminate its dividend payments.

- Legal and Regulatory Requirements: Dividends are subject to legal and regulatory requirements imposed by government bodies or stock exchanges. These requirements may include limitations on the amount of dividends that can be distributed, maintenance of a certain level of capital reserves, or compliance with specific dividend payment timelines. Companies must adhere to these requirements when determining the normal balance of dividends.

- Investor Expectations: Investor expectations and preferences can also influence the normal balance of dividends. Some investors prioritize dividend payments as a key factor in their investment decisions. If a company has a large number of income-focused investors, it may place more emphasis on maintaining consistent dividend payments, resulting in a higher normal balance of dividends.

- Business Strategy: The strategic goals and priorities of a company can impact its dividend policy. If a company is in a growth phase and is focused on reinvesting profits for expansion or research and development, it may have a lower normal balance of dividends. On the other hand, if a company has reached a mature stage and has fewer growth opportunities, it may choose to distribute a higher portion of its profits as dividends.

It’s important for companies to consider these factors when determining the normal balance of dividends. By taking into account the company’s structure, profitability, legal requirements, investor expectations, and business strategy, companies can make informed decisions on dividend payments that align with the company’s financial goals and objectives.

In summary, the factors affecting the normal balance of dividends include the company’s structure, profitability, legal and regulatory requirements, investor expectations, and business strategy. By considering these factors, companies can determine the appropriate normal balance for dividend transactions, enabling them to effectively manage their financial obligations and meet the expectations of their shareholders.

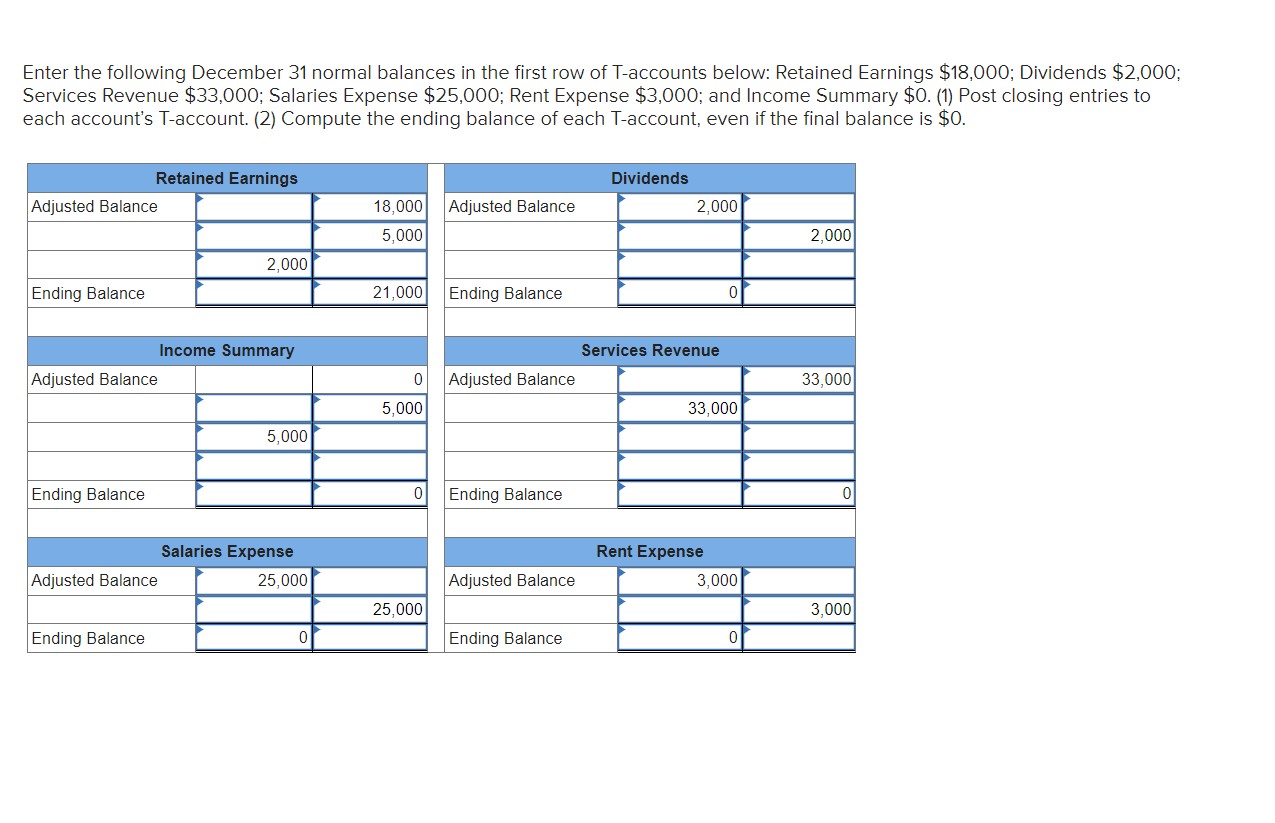

Examples of Normal Balance in Dividends

To provide a clearer understanding of the normal balance in dividends, let’s explore a few examples of how dividends are recorded in the general ledger:

Example 1: Company ABC, a publicly traded corporation, declares a cash dividend of $0.50 per share to its shareholders. The company has 10,000 shares outstanding. To record this dividend payment, the entry would be as follows:

- Debit: Dividends Payable – $5,000 (10,000 shares x $0.50)

- Credit: Cash – $5,000

Example 2: Company XYZ, a privately held corporation, declares a stock dividend at a ratio of 10%. The company has 1,000 outstanding shares. To record this stock dividend, the entry would be as follows:

- Debit: Retained Earnings – $100 (10% of 1,000 shares)

- Credit: Common Stock – $100

Example 3: Company DEF, a partnership, decides to distribute a portion of its profits as a withdrawal to the partners. This withdrawal is not classified as a dividend but rather as a withdrawal account. To record the withdrawal in the books, the entry would be as follows:

- Debit: Partner Withdrawal – $2,000

- Credit: Cash – $2,000

In each of these examples, the normal balance of dividends varies based on the specific circumstances. In Example 1, where a cash dividend is paid, the debit entry is recorded under Dividends Payable, reflecting the reduction in the company’s retained earnings. In Example 2, where a stock dividend is issued, the debit entry is recorded under Retained Earnings, representing the transfer of equity from retained earnings to common stock. Example 3 illustrates that in partnerships, withdrawals by partners are not classified as dividends but are recorded separately.

It’s important to note that the normal balance of dividends may vary depending on the accounting principles and practices followed by different companies. It is always recommended to consult the specific accounting guidelines and policies applicable to the organization in question.

In summary, the examples provided highlight how dividends are recorded in the general ledger. The normal balance of dividends can vary based on the type of dividend (cash or stock), the company’s structure, and the accounting principles followed. Understanding these examples can help enhance your comprehension of the normal balance in dividends and its impact on financial records.

Importance of Understanding the Normal Balance of Dividends

Understanding the normal balance of dividends is of utmost importance in accounting and financial management. Here are several reasons why a solid grasp of this concept is crucial:

- Accurate Financial Reporting: Recording dividends with the correct normal balance ensures the accuracy of financial statements. By properly debiting or crediting the dividends account, accountants can provide reliable information about the company’s profitability, shareholder distributions, and overall financial health.

- Compliance with Accounting Standards: Various accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), require adherence to specific rules for recording dividends. Understanding the normal balance helps companies comply with these standards and maintain consistency in financial reporting.

- Investor Communication: The normal balance of dividends plays a crucial role in communicating financial information to investors. Investors rely on accurate financial statements to make informed decisions about investing in a company. By correctly recording dividends, companies are able to provide transparency and build trust with their shareholders.

- Financial Analysis: Analyzing the normal balance of dividends allows for effective financial evaluation. Comparing dividend payments over time can help assess the company’s dividend policy, profitability, and potential for growth. Investors and analysts use this information to gauge the stability and value of a company’s stock.

- Dividend Planning: Understanding the normal balance of dividends is essential for dividend planning. Companies need to consider various factors, such as available profits, legal requirements, and investor expectations, when determining the appropriate dividend policy. By correctly recording dividends, companies can plan and allocate their financial resources accordingly.

- Tax Considerations: The normal balance of dividends also impacts tax planning and reporting. Dividend payments may have different tax implications for both companies and shareholders. By accurately recording dividends, companies can ensure compliance with tax regulations and facilitate smooth tax filing procedures.

- Financial Decision-Making: The normal balance of dividends influences important financial decisions. For example, companies may choose to retain earnings instead of distributing dividends to fund future expansion or make strategic investments. Understanding the normal balance helps companies evaluate the impact of dividend payouts on their overall financial strategy.

In summary, understanding the normal balance of dividends is vital for accurate financial reporting, compliance with accounting standards, effective investor communication, and informed financial decision-making. It enables companies to provide reliable financial information, plan dividends strategically, and assess their financial performance. By recognizing the importance of the normal balance of dividends, businesses can maintain transparency, build trust with stakeholders, and make sound financial choices.

Conclusion

In the realm of finance, understanding the normal balance of dividends is essential for accurate financial reporting, compliance with accounting standards, effective investor communication, and informed financial decision-making. Dividends represent the distribution of a company’s earnings to its shareholders, and their normal balance often lies on the debit side of the ledger. By correctly recording dividends, companies can provide reliable financial information, plan dividends strategically, and assess their financial performance.

Factors such as company structure, profitability, legal requirements, investor expectations, and business strategy can influence the normal balance of dividends. Moreover, comprehending the normal balance enables businesses to accurately record dividend transactions and analyze their impact on financial statements. It allows for effective tax planning, facilitates dividend communication with investors, and guides financial analysis and decision-making processes.

By recognizing the importance of the normal balance of dividends, companies can maintain transparency, build trust with stakeholders, and make sound financial choices. Investors can rely on accurate financial statements to make informed investment decisions, while accountants can ensure compliance with accounting standards. Understanding the normal balance of dividends is a fundamental aspect of financial management and contributes to the overall success and stability of a company.

As you navigate the intricate world of finance, remember that the normal balance of dividends is just one piece of the puzzle. By continually expanding your knowledge and staying up-to-date with accounting principles and industry trends, you can become an informed investor, a skillful accountant, and a strategic decision-maker in the pursuit of financial success.