Home>Finance>FDIC Insured Account Definition, Requirements, Pros/Cons

Finance

FDIC Insured Account Definition, Requirements, Pros/Cons

Published: November 22, 2023

Looking to open an FDIC insured account? Learn about the definition, requirements, and pros/cons of these finance options. Make an informed decision about your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding FDIC Insured Accounts: Definition, Requirements, Pros/Cons

When it comes to managing our finances, it’s crucial to explore different options and learn about the available tools that can help us protect and grow our hard-earned money. One such tool is a FDIC insured account. In this blog post, we’ll break down what exactly a FDIC insured account is, the requirements to open one, and the pros and cons of utilizing this type of account. By the end of this article, you’ll have a comprehensive understanding of FDIC insured accounts and whether it’s the right choice for you.

Key Takeaways:

- FDIC insured accounts provide protection to depositors by guaranteeing their funds, up to a certain limit, in case the financial institution fails.

- To open a FDIC insured account, you need to ensure the financial institution you choose is FDIC-insured, provide the required personal identification information, and meet any minimum deposit requirements.

What is a FDIC Insured Account?

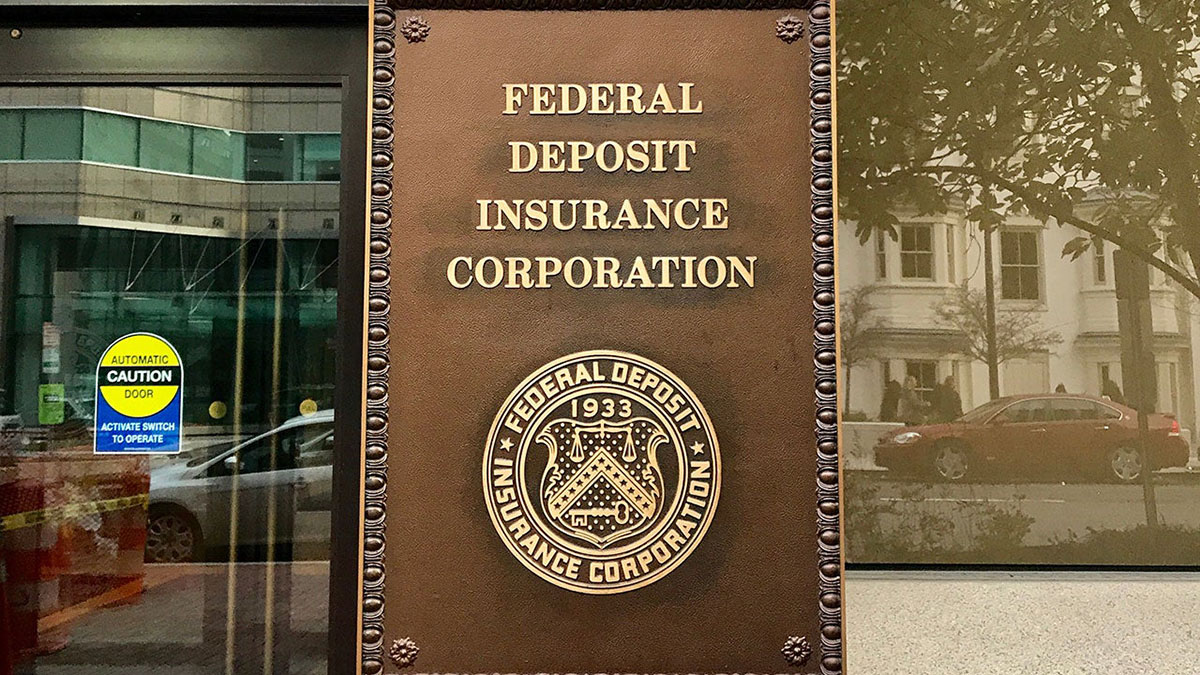

FDIC stands for the Federal Deposit Insurance Corporation, an independent agency of the United States government. The FDIC was established in 1933 to provide stability and public confidence in the nation’s financial system. A FDIC insured account is a bank or credit union account that is insured by the FDIC, protecting depositors from potential financial losses in the unfortunate event that the financial institution fails.

In simpler terms, a FDIC insured account is like a safety net for your money, providing peace of mind knowing that your funds are protected.

Requirements to Open a FDIC Insured Account

Opening a FDIC insured account is a straightforward process, but there are a few requirements to keep in mind:

- Choose a FDIC-insured financial institution: Before opening an account, ensure that the bank or credit union you select is FDIC-insured. The FDIC will provide a list of member institutions on their official website, making it easy for you to verify the institution’s status.

- Personal identification information: To open any bank account, you’ll typically need to provide personal identification information such as your full name, address, social security number, and a valid form of identification, such as a driver’s license or passport.

- Minimum deposit requirements: Some financial institutions may require a minimum deposit to open a FDIC insured account. Make sure to check the specific requirements of the institution you choose.

Pros of FDIC Insured Accounts

FDIC insured accounts offer several benefits to depositors:

- Protection and peace of mind: The primary advantage of a FDIC insured account is the protection it provides. Knowing that your funds are insured up to the specified limit (currently $250,000 per depositor, per institution) can offer peace of mind, especially during uncertain times.

- Accessibility and convenience: FDIC insured accounts are offered by numerous financial institutions, giving depositors a wide range of choices. Additionally, these accounts often come with online and mobile banking options, making it convenient to manage your money from anywhere.

- Stability and reliability: FDIC insured accounts are backed by the U.S. government, providing a sense of stability and reliability. This can be particularly important for individuals who want to ensure the safety of their funds.

Cons of FDIC Insured Accounts

While FDIC insured accounts have numerous advantages, it’s also important to consider their limitations:

- Lower potential returns: Compared to other investment options, the interest rates offered by FDIC insured accounts may be comparatively lower. This is because the primary focus of these accounts is safety rather than maximizing returns.

- Limits on insurance coverage: The FDIC insurance coverage limit of $250,000 per depositor, per institution means that if you have more than that amount, the excess funds may not be fully protected. If you require additional coverage, you may need to open accounts at multiple financial institutions.

- Inflation risk: Over time, the purchasing power of your money may be eroded by inflation. While FDIC insured accounts are safe from bank failures, they may not provide the same level of protection against the effects of inflation as other investment options.

Now that you have a comprehensive understanding of FDIC insured accounts, you can make an informed decision about whether it’s the right choice for your financial goals and needs. Remember to always conduct thorough research and consult with a financial advisor before making any decisions regarding your money.