Finance

Financial Shenanigans Definition

Published: November 24, 2023

Learn the definition of financial shenanigans and how they can impact the world of finance. Stay informed about the various tactics used in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Art of Financial Shenanigans

Welcome to our Finance category, where we delve into the intriguing world of money management, investments, and all things related to personal and corporate finances. In this blog post, we are shining a spotlight on a topic that might make you raise an eyebrow – financial shenanigans. What are they exactly, and why should you care? Let’s uncover the secrets behind this intriguing concept.

Key Takeaways:

- Financial shenanigans involve manipulations and deceptive tactics in financial reporting.

- Understanding financial shenanigans is crucial for investors, regulators, and businesses to identify potential red flags and protect their interests.

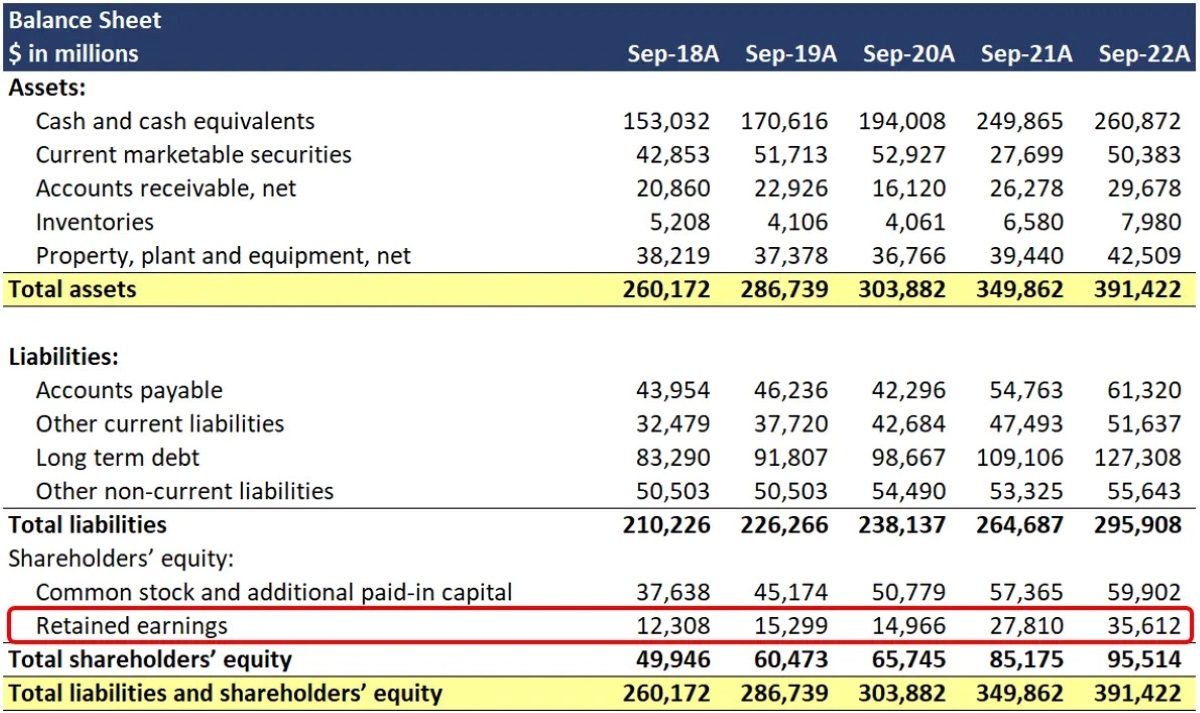

Imagine a scenario where a company’s financial statements don’t quite add up. The numbers may look perfectly legitimate at first glance, but after careful scrutiny, you realize something fishy is going on. This is where financial shenanigans come into play. Financial shenanigans refer to the actions taken by individuals or organizations to manipulate financial information, presenting a distorted picture of a company’s financial health.

Now, it’s important to note that not all financial manipulations are illegal. Some may simply be ethical gray areas, while others may be outright fraudulent. Regardless, understanding financial shenanigans is crucial, especially for investors, regulators, and businesses.

So, let’s dive in and explore some common tactics used in financial shenanigans:

1. Revenue Recognition Games

One common ploy in financial shenanigans involves manipulating the recognition of revenue. Companies may employ tactics such as premature revenue recognition or “channel stuffing” to inflate their financial results artificially.

- Premature revenue recognition: This involves recognizing revenue from a sale before the product has been delivered or services have been rendered. It gives the illusion of higher revenue, deceiving investors and stakeholders.

- Channel stuffing: Companies may use aggressive sales techniques to persuade distributors or retailers to purchase excessive amounts of products. By artificially inflating sales, they can boost reported revenue, masking the actual demand for their products.

2. Expense Manipulation

Another common tactic in financial shenanigans involves manipulating expenses. By understating expenses, a company can make its financial performance appear stronger than it really is.

- Capitalizing expenses: Rather than recognizing certain expenses in the current period, companies may capitalize them as assets, thereby spreading the costs over multiple periods. This makes the financial statements look more favorable in the short term.

- Operating vs. Non-operating expenses: Companies may categorize certain expenses as non-operating, pushing them below the operating line. This can distort the true operating performance of a company, making it appear more profitable than it actually is.

It’s important to note that uncovering financial shenanigans requires a combination of financial analysis skills, knowledge of accounting practices, and a keen eye for potential red flags. For investors, it is crucial to be able to identify and interpret such manipulations when making investment decisions.

By understanding financial shenanigans, investors and businesses can better protect themselves and make more informed decisions. Additionally, regulators can develop measures to detect and prevent deceptive practices, ensuring a fair and transparent financial marketplace.

Remember, knowledge is power, especially when it comes to your financial future. Stay tuned for more informative content in our Finance category, where we strive to empower you with the knowledge and tools to navigate the intricate world of finance.