Finance

How To Get Line Of Credit For Small Business

Modified: February 21, 2024

Looking for finance options to get a line of credit for your small business? Discover how to secure the funding you need and boost your financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Line of Credit?

- Benefits of Line of Credit for Small Business

- Qualification Requirements for Line of Credit

- Steps to Get a Line of Credit for Small Business

- Research and Prepare Documentation

- Choose the Right Lender

- Complete the Application

- Wait for Approval and Review the Offer

- Accept the Line of Credit and Start Using It

- Conclusion

Introduction

In today’s competitive business landscape, having access to adequate funding is crucial for the success and growth of small businesses. While traditional loans have been a popular financing option, they may not always be the most flexible or convenient solution for small businesses. This is where a line of credit can prove to be a valuable financial resource.

A line of credit is a flexible form of financing that allows small businesses to access a predetermined amount of funds, typically ranging from a few thousand to several hundred thousand dollars. It provides businesses with the flexibility to draw funds as needed, making it an ideal solution for managing cash flow, taking advantage of growth opportunities, or addressing unexpected expenses.

Unlike a traditional loan where the borrower receives a lump sum payment, a line of credit operates more like a credit card. Small business owners can utilize the available credit limit whenever they need it, and they only have to pay interest on the amount borrowed instead of the entire credit limit. This makes it a cost-effective and convenient financing option for small businesses.

Whether you are a startup looking for working capital or an established business looking to expand, having a line of credit can provide you with the financial flexibility and stability you need. In this article, we will explore the benefits of a line of credit for small businesses, the qualification requirements, and the steps to obtain one.

What is a Line of Credit?

A line of credit is a type of revolving credit that allows borrowers to have access to a predetermined amount of funds that they can draw from as needed. Think of it as a financial safety net that gives businesses the flexibility to borrow money when necessary without having to go through the process of applying for a new loan each time.

Unlike a traditional loan where you receive a lump sum of money and pay it back in installments, a line of credit works more like a credit card. You are given a limit, or maximum amount you can borrow, and you can draw funds up to that limit at any time. As you repay the borrowed amount, the credit becomes available again.

One of the key advantages of a line of credit is that you only pay interest on the amount you borrow, not the entire credit limit. This makes it a cost-effective financing option for small businesses that may not need to access the full amount immediately.

Lines of credit can be either secured or unsecured. Secured lines of credit require collateral, such as inventory, equipment, or property, which serves as a guarantee for the lender. Unsecured lines of credit, on the other hand, do not require collateral but may have stricter qualification requirements and higher interest rates.

Lines of credit can be used for various purposes, such as managing cash flow, purchasing inventory or equipment, covering operational expenses, or taking advantage of time-sensitive business opportunities. It offers businesses the flexibility to use the funds as needed and repay them according to their cash flow.

It’s important to note that a line of credit is not a one-time loan. Instead, it is an ongoing financial arrangement that can be accessed as long as the borrower remains in good standing with the lender and does not exceed the credit limit.

Benefits of Line of Credit for Small Business

A line of credit offers several advantages for small businesses, making it a preferred financing option for many entrepreneurs. Here are some key benefits of having a line of credit:

- Flexibility: One of the main advantages of a line of credit is its flexibility. Unlike a traditional loan with a fixed repayment schedule, a line of credit allows small business owners to access funds as needed, giving them the flexibility to manage their cash flow. This can be especially useful for businesses that experience fluctuating revenue or seasonal sales.

- Cost-effective: With a line of credit, you only pay interest on the amount you borrow, not the entire credit limit. This can result in significant cost savings compared to a traditional loan where interest is charged on the entire loan amount. By utilizing only the funds you need, you can minimize the interest expense and keep your borrowing costs under control.

- Quick access to funds: In times of unexpected expenses or immediate investment opportunities, having quick access to funds is essential for small businesses. With a line of credit, you can access funds almost instantly, providing you with the liquidity you need to seize opportunities or address emergencies without delay.

- Flexible repayment terms: A line of credit typically offers more flexibility in repayment terms compared to traditional loans. While some lines of credit require minimum monthly payments, others allow you to repay the borrowed amount in full or make interest-only payments. This flexibility can be beneficial for managing cash flow and tailoring your repayment schedule to align with your business needs.

- Building credit history: A line of credit provides an opportunity to build and strengthen your business credit history. By making timely payments and managing your credit utilization, you can demonstrate your business’s creditworthiness and improve your chances of securing larger lines of credit or loans in the future.

- Growth opportunities: Having a line of credit can empower small businesses to seize growth opportunities. Whether it’s expanding your operations, launching a new product or service, or pursuing a strategic partnership, having readily available funds can be a game-changer. A line of credit can provide the financial support needed to fuel your business’s growth and propel it to the next level.

Overall, a line of credit can provide small businesses with the financial flexibility and stability they need to navigate through various stages of growth and manage their financial obligations effectively.

Qualification Requirements for Line of Credit

While a line of credit can be a valuable financial resource for small businesses, it’s important to note that there are certain qualification requirements that need to be met in order to be eligible. While these requirements can vary depending on the lender and the specific line of credit program, here are some common factors that lenders consider:

- Credit Score: Lenders typically assess the creditworthiness of the borrower by looking at their personal and business credit scores. A higher credit score increases the chances of approval and may even result in more favorable terms and interest rates. It’s important to maintain a good credit history and address any issues or discrepancies on your credit report.

- Business History: Lenders may consider the length of time your business has been operating. Generally, they prefer to work with more established businesses that have a proven track record of generating revenue and managing finances responsibly. However, some lenders may also offer lines of credit to startups or newer businesses, although the eligibility criteria may be more stringent.

- Revenue and Financial Statements: Lenders will typically request financial statements, such as profit and loss statements and balance sheets, to assess the financial health of your business. They want to ensure that your business has enough revenue and cash flow to support the repayment of the line of credit. It’s important to have accurate and up-to-date financial records to present to potential lenders.

- Collateral: Depending on the type of line of credit and the lender’s requirements, you may be asked to provide collateral to secure the line of credit. This can be in the form of business assets, such as real estate, equipment, inventory, or accounts receivable. Collateral provides the lender with a form of security in case the borrower defaults on the line of credit.

- Business Plan: Some lenders may ask for a detailed business plan that outlines your objectives, growth strategies, and financial projections. This helps lenders assess the viability of your business and its ability to generate sufficient cash flow to repay the line of credit.

- Legal and Regulatory Compliance: Lenders may conduct background checks to ensure that your business operates in compliance with all applicable laws and regulations. This includes verifying licenses, permits, and any necessary certifications.

It’s important to keep in mind that these are general qualification requirements, and each lender may have their own specific criteria. It’s recommended to research and reach out to different lenders to understand their eligibility requirements and find the one that best suits your business’s needs.

Steps to Get a Line of Credit for Small Business

Obtaining a line of credit for your small business involves a series of steps to ensure a smooth application process. Here are the typical steps you can follow to secure a line of credit:

- Research and Prepare Documentation: Begin by researching different lenders and line of credit programs. Compare their eligibility requirements, interest rates, and terms to find the most suitable option for your business. Additionally, gather all the necessary documentation, such as financial statements, tax returns, legal documentation, and business plans, to support your loan application.

- Choose the Right Lender: Once you have an understanding of different lenders and their offerings, select the one that best aligns with your business’s needs. Consider factors such as interest rates, credit requirements, repayment terms, and customer reviews. It’s helpful to reach out to lender representatives and ask any questions or concerns you may have before proceeding.

- Complete the Application: Fill out the line of credit application form provided by the lender. This typically includes personal and business information, financial information, and details about how you plan to use the line of credit. Ensure that all the information provided is accurate and up-to-date.

- Wait for Approval and Review the Offer: After submitting your application, the lender will review your information and assess your creditworthiness. This can take some time, so be patient. Once a decision is made, the lender will communicate their offer, including the approved line of credit amount, interest rate, repayment terms, and any other conditions or fees. Take the time to review the offer thoroughly before accepting it.

- Accept the Line of Credit and Start Using It: If you’re satisfied with the terms and conditions, formally accept the line of credit offer. The lender will provide further instructions on how to access and utilize the funds. Keep in mind that you are only responsible for repaying the funds that you actually borrow, not the entire credit limit.

It’s important to maintain regular communication with your lender throughout the application and approval process. Ask any questions you may have and provide any additional documentation or information requested. By being proactive and responsive, you can help expedite the loan approval process and secure the line of credit for your small business.

Research and Prepare Documentation

Before applying for a line of credit for your small business, it’s essential to conduct thorough research and gather the necessary documentation. This step will help you understand the requirements of different lenders and ensure that you have all the relevant information in order to complete the loan application process smoothly. Here are the key aspects to consider:

- Research Different Lenders: Start by researching and comparing various lenders that offer lines of credit to small businesses. Look for lenders with a solid reputation, competitive interest rates, favorable repayment terms, and good customer reviews. Consider both traditional financial institutions and online lenders to find the best fit for your business.

- Understand Eligibility Requirements: Each lender may have specific eligibility criteria for their line of credit programs. It’s important to review and understand these requirements to ensure that your business qualifies. Common eligibility factors include credit score, business history, revenue, and collateral. Knowing these requirements beforehand will save you time and effort in the application process.

- Gather Financial Statements: Lenders typically require financial statements to assess your business’s financial health. Gather documents such as profit and loss statements, balance sheets, and cash flow statements for the past few years. These statements should accurately reflect your business’s revenue, expenses, and cash flow. Organize and update them as needed to present a clear financial picture to potential lenders.

- Prepare Tax Returns: Lenders often request personal and business tax returns to verify your income and ensure compliance with tax obligations. Have your recent personal and business tax returns readily available to provide to the lender. This will help establish your credibility and financial stability.

- Compile Legal Documentation: Depending on your business’s legal structure, you may need to gather additional documentation. For example, if your business is a corporation or limited liability company (LLC), you may need to provide articles of incorporation or organization, operating agreements, or other legal documents that establish your business’s existence and structure.

- Create a Business Plan: Some lenders may require a comprehensive business plan outlining your company’s goals, marketing strategies, financial projections, and growth plans. Even if not required, having a well-crafted business plan can demonstrate your commitment and vision to potential lenders. It shows that you have a clear roadmap for your business’s success.

By conducting thorough research and preparing all the necessary documentation, you will be well-equipped to complete the line of credit application accurately and efficiently. This will increase your chances of approval and make the entire process smoother for both you and the lender.

Choose the Right Lender

Choosing the right lender is a critical step in securing a line of credit for your small business. The lender you select should align with your business’s needs, offer favorable terms, and provide reliable customer service. Here are some factors to consider when choosing a lender:

- Interest Rates: One of the key factors to consider is the interest rate offered by the lender. Compare the rates of different lenders to ensure you’re getting a competitive rate that aligns with your business’s financial capabilities. A lower interest rate can save you money over the repayment term of the line of credit.

- Repayment Terms: Examine the repayment terms offered by each lender. Pay attention to factors such as the duration of the repayment period, frequency of payments, and any flexibility in modifying the repayment schedule. Look for repayment terms that match your business’s cash flow and ensure that the repayment schedule is feasible for your financial stability.

- Fees and Charges: Inquire about any fees or charges associated with the line of credit. Some lenders may charge application fees, annual fees, or other transactional fees. Be sure to understand the full cost structure of the line of credit to avoid any surprises later on.

- Customer Support: Assess the customer support services provided by the lender. Consider factors such as responsiveness, accessibility, and the availability of knowledgeable representatives to address your concerns or queries. Prompt and reliable customer support can be invaluable when you need assistance throughout the application, approval, and repayment processes.

- Lender Reputation: Research the lender’s reputation in the industry. Look for reviews and feedback from other small business owners who have worked with the lender. A reputable lender with positive customer experiences and a track record of successful loan offerings is more likely to provide you with a satisfactory experience.

- Additional Services: Consider any additional services or benefits offered by the lender. Some lenders may provide resources or tools to help you manage your finances more effectively or offer other types of business support. These value-added services can be advantageous in enhancing your overall banking relationship.

Take the time to compare different lenders based on the factors mentioned above. It’s recommended to reach out directly to lenders and ask questions to clarify any doubts or concerns you may have. By selecting the right lender, you can ensure a positive borrowing experience and set your small business up for financial success.

Complete the Application

Once you have researched lenders and identified the right one for your small business line of credit, the next step is to complete the application. The application process may vary slightly between lenders, but here are the general steps involved:

- Gather Required Information: Before starting the application, gather all the necessary information and documentation that will be required. This may include personal identification documents, business financial statements, tax returns, legal documentation, and any other relevant records. Having everything prepared in advance will help streamline the application process.

- Fill Out the Application Form: The lender will provide you with an application form that needs to be completed. It will require information about your personal and business details, such as name, address, contact information, business structure, and ownership. Additionally, you may need to provide details about your business’s financial history, revenue, and expenses.

- Provide Financial Information: Along with the application form, you will need to submit your business’s financial information. This may include profit and loss statements, balance sheets, and cash flow statements for a specified period. These documents help the lender assess your business’s financial health and repayment capacity.

- Disclose Business Purpose: Clearly state the purpose for which you are seeking the line of credit. Whether it’s to fund working capital needs, purchase inventory or equipment, or support ongoing operations, provide a detailed explanation of how the line of credit will be utilized.

- Answer Additional Questions: The lender may have additional questions regarding your business, financial situation, or the line of credit itself. Be prepared to provide responses to these questions to provide the lender with a complete understanding of your business and financing needs.

- Review and Submit: Carefully review all the information you have provided to ensure its accuracy and completeness. Any errors or omissions could result in delays in the application process. Once you are satisfied, submit the application to the lender for review.

During the application process, it’s essential to be honest and transparent with the lender. If there are any aspects of your business or financial history that may raise questions, it’s better to address them upfront. By providing accurate and reliable information, you can build trust with the lender and enhance your chances of approval.

Keep in mind that the application process may also involve a credit check and evaluation of your business’s creditworthiness. The lender may conduct due diligence to verify the information provided and assess the risk associated with offering you a line of credit. Be prepared to provide any additional documentation or clarification that may be requested by the lender during this stage.

Once you have completed and submitted the application, the lender will review it and make a decision regarding the approval of your line of credit. This may take some time, so be patient and stay in touch with the lender regarding the status of your application.

Wait for Approval and Review the Offer

After submitting your line of credit application, the next step is to wait for approval from the lender. The timeframe for approval can vary depending on the lender and the complexity of your application. During this waiting period, it’s important to stay in communication with the lender and be prepared to provide any additional information or documentation they may require. Once the lender has reviewed your application, they will provide an offer for your line of credit. Here’s what you should do during this stage:

- Stay in Communication: It’s crucial to maintain open lines of communication with the lender during the approval process. Follow up regularly to check the status of your application and to provide any additional information that may be requested. Respond promptly to any inquiries from the lender to ensure a smooth and timely approval process.

- Review the Offer: Once the lender has made a decision on your line of credit application, they will provide you with an offer. Take the time to review it carefully and understand the terms and conditions. This includes the approved credit limit, interest rate, repayment terms, fees, and any other specific terms outlined in the offer. Assess whether the offer aligns with your needs and financial capabilities.

- Compare with Other Offers: If you have applied for a line of credit with multiple lenders, compare the offer you received with the offers from other lenders. Analyze the interest rates, repayment terms, fees, and overall cost structure to determine which offer is the most beneficial and suitable for your business. Consider factors such as flexibility, affordability, and any additional benefits or services provided by the lenders.

- Seek Clarification: If any part of the offer is unclear or if you have any questions or concerns, don’t hesitate to seek clarification from the lender. It’s important to have a complete understanding of the terms and conditions before making any decisions. Ask for explanations regarding interest calculations, prepayment penalties, or any other aspects that require clarification.

- Negotiate if Possible: Depending on the lender and the specific line of credit program, there may be room for negotiation. If you feel that certain terms are not favorable or if you believe you can secure better terms, discuss this with the lender. While not all lenders may be open to negotiations, it’s worth exploring the possibility to potentially improve the terms of your line of credit.

- Make an Informed Decision: Based on your review of the offer and any negotiations, make an informed decision about whether to accept or decline the line of credit. Consider your business’s financial needs, projected cash flow, and ability to repay the line of credit. If you have obtained multiple offers, weigh the pros and cons of each before making a final decision.

Remember, accepting the offer is a commitment to the terms and conditions outlined by the lender. Ensure that you are fully comfortable and confident in your ability to meet the repayment obligations before accepting the line of credit. If you have any doubts, seek advice from financial professionals or business advisors to make the best decision for your small business.

Accept the Line of Credit and Start Using It

Once you have reviewed the offer and made the decision to accept the line of credit, you can proceed with the necessary steps to finalize the arrangement and start using the funds. Here’s what you should do:

- Notify the Lender: Contact the lender to formally accept the line of credit offer. This can usually be done by signing and returning the required documents or by following the lender’s specific instructions for acceptance. Confirm the terms of the offer and ensure that you fully understand the rights and responsibilities associated with the line of credit.

- Review the Terms and Conditions: Before starting to use the line of credit, carefully review the terms and conditions once again to ensure that you fully understand them. Take note of important details such as the interest rate, repayment schedule, any fees, and any specific provisions or restrictions outlined in the agreement. Understanding the terms will help you effectively manage and make the most of your line of credit.

- Establish a Plan: Develop a plan for utilizing the line of credit effectively. Consider your business’s financial needs and goals, as well as any specific projects or initiatives that require funding. Take a strategic approach to using the line of credit, ensuring that the borrowed funds will contribute to growth, expansion, or the improvement of your business’s financial position.

- Manage the Funds Wisely: Once you have access to the line of credit, use the funds judiciously and responsibly. Avoid unnecessary spending or using the line of credit for personal expenses. Keep detailed records of how the funds are being used to maintain transparency and facilitate accurate accounting. Regularly monitor your spending and stay within the credit limit to avoid overextending your business’s financial obligations.

- Make Timely Payments: Adhere to the repayment schedule outlined in the agreement. Make timely payments to ensure that you maintain a good relationship with the lender and preserve your creditworthiness. Missing or late payments can negatively impact your credit score and incur additional penalties or fees. Set up reminders or automatic payments to avoid any potential issues with repayment.

- Monitor Interest and Costs: Stay vigilant about the interest charges and any associated costs of the line of credit. Regularly review your statements and account activity to ensure accuracy and identify any discrepancies promptly. By monitoring the costs associated with the line of credit, you can effectively manage your finances and make informed decisions.

- Maintain Communication with the Lender: Establish and maintain open lines of communication with the lender throughout the duration of your line of credit. Notify them of any significant changes in your business, such as financial challenges or opportunities, that may impact your ability to repay the line of credit. Effective communication ensures a good working relationship and may help in resolving any issues that may arise.

By accepting the line of credit and using it strategically and responsibly, you can effectively leverage the funds to support your business’s growth and financial stability. Regularly review your business’s financial position and make adjustments to your utilization of the line of credit as needed. With proactive management and responsible use, a line of credit can be a valuable tool for small businesses.

Conclusion

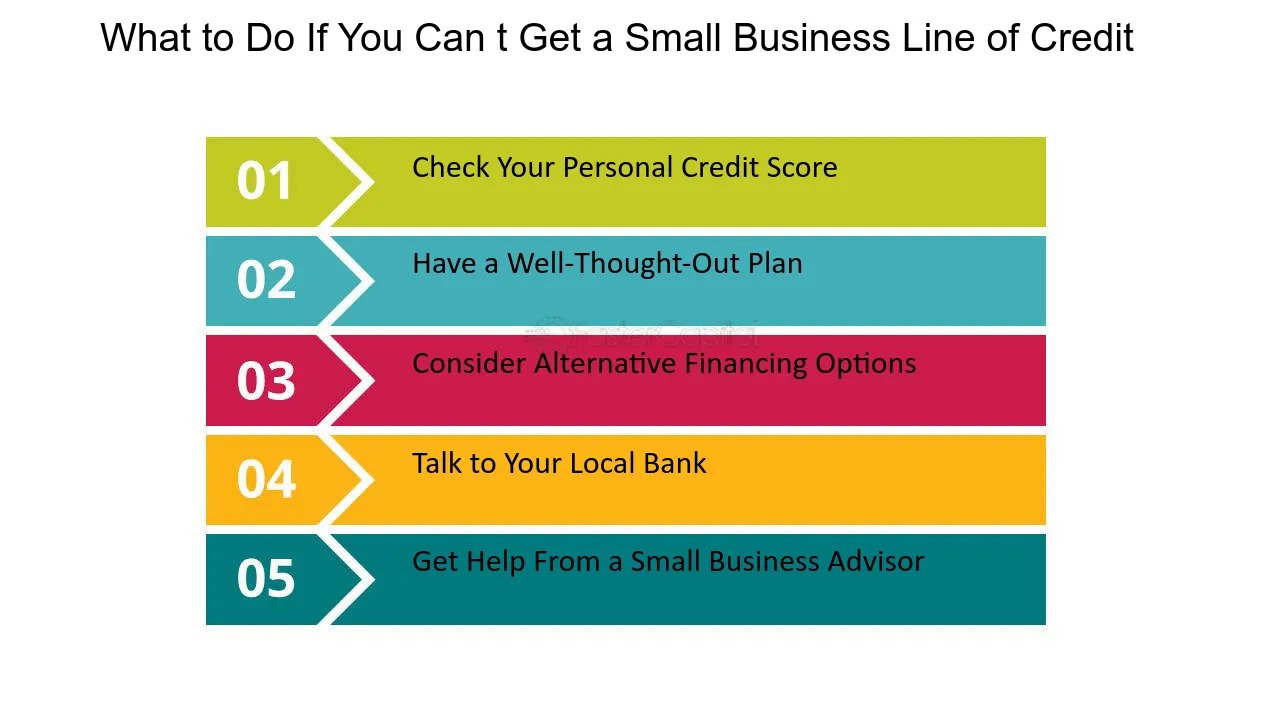

A line of credit can be a lifeline for small businesses, providing them with the financial flexibility and stability needed to navigate the ups and downs of the business world. By understanding what a line of credit is and the benefits it offers, you can make an informed decision about whether it is the right financing option for your small business.

Throughout the process of obtaining a line of credit, it’s essential to conduct thorough research, gather the necessary documentation, and choose the right lender. By following the steps to complete the application and patiently waiting for approval, you can position yourself for success in securing a line of credit.

Once you have received an offer, take the time to carefully review the terms and conditions and compare multiple offers if applicable. By accepting the line of credit and managing it responsibly, you can effectively utilize the funds to support your business’s growth and financial needs.

Remember, a line of credit is a tool that requires careful planning and management. Regularly review your financial situation, make timely repayments, and communicate with your lender to ensure a positive borrowing experience.

Obtaining a line of credit for your small business can provide you with the flexibility to handle day-to-day operations, seize growth opportunities, and manage unexpected expenses. With responsible use and effective management, a line of credit can be a valuable asset in navigating the financial landscape and fueling your business’s success.