Home>Finance>Fixed Capital: Definition, What’s Included, And Requirements

Finance

Fixed Capital: Definition, What’s Included, And Requirements

Published: November 25, 2023

Learn the definition of fixed capital in finance, including what it encompasses and the requirements involved, to enhance your understanding of this crucial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Fixed Capital: Definition, What’s Included, and Requirements

When it comes to managing your finances, having a solid understanding of different financial terms is essential. One such term is fixed capital. In this blog post, we will delve into the definition of fixed capital, what it includes, and the requirements associated with it. So, let’s get started!

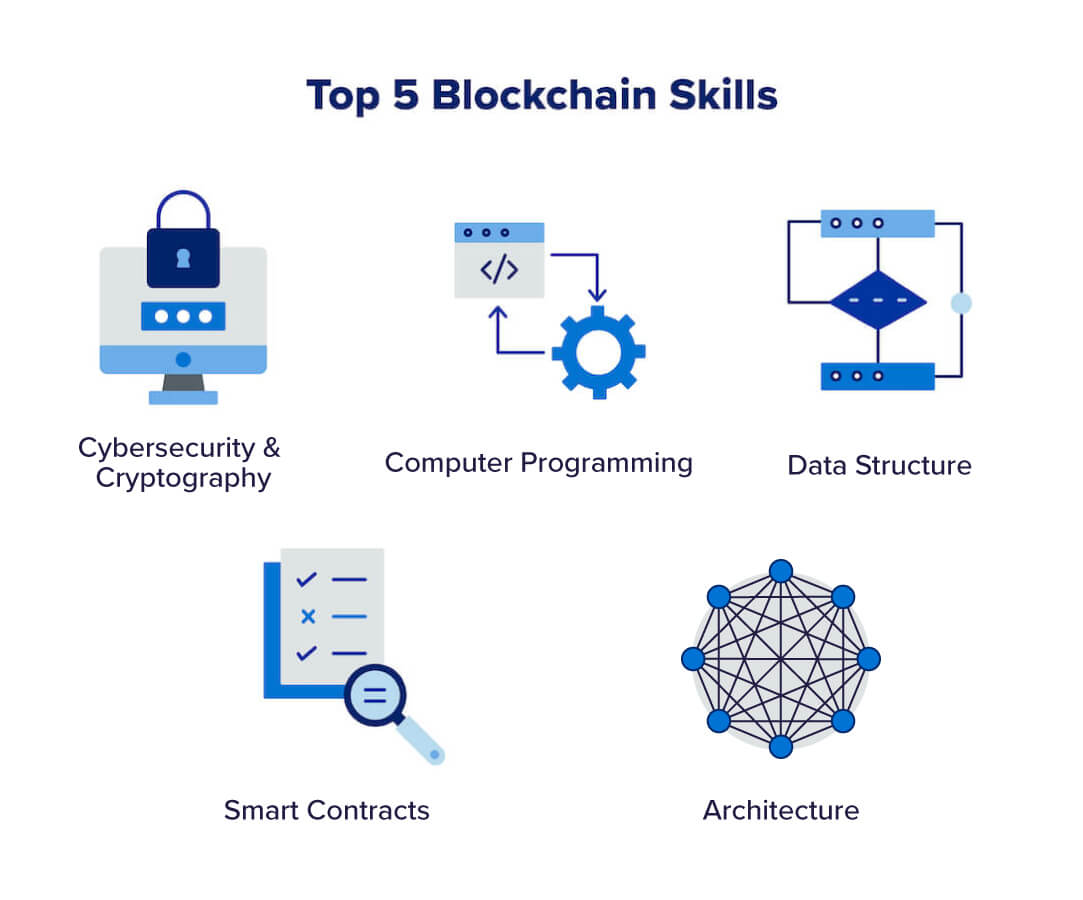

Key Takeaways:

- Fixed capital refers to the long-term assets a business invests in to facilitate its operations and generate income.

- It typically includes tangible assets such as land, buildings, machinery, equipment, and vehicles.

Defining Fixed Capital

Fixed capital can be seen as the backbone of a business, representing the long-term investments made to support its day-to-day operations. It refers to the assets that a company owns and uses to generate income over an extended period. Unlike working capital, which consists of short-term assets, fixed capital is intended to be used for the long haul.

Fixed capital assets are generally tangible in nature and can include land, buildings, machinery, equipment, and vehicles. These are the assets that play a vital role in the production process, allowing businesses to manufacture and deliver their products or services.

What’s Included in Fixed Capital?

Fixed capital assets can vary depending on the nature and scale of the business. While every company’s fixed capital will differ, here are some common examples of assets typically included:

- Land: This includes the value of any land owned by the business, where the company’s facilities or operations are situated.

- Buildings: Buildings owned by the business, whether it’s office space, factories, warehouses, or retail outlets.

- Machinery and Equipment: This includes tools, manufacturing machinery, computer systems, vehicles, and any other equipment necessary to carry out business activities.

- Infrastructure: Any infrastructure owned by the company that supports its operations, such as power stations or communication networks.

These assets form the foundation upon which businesses operate and enable them to generate steady income and profits over time.

Requirements for Fixed Capital

Acquiring fixed capital assets typically involves a significant investment for businesses. Here are some requirements associated with fixed capital:

- Financial Planning: Businesses need to carefully plan and allocate financial resources to acquire fixed capital assets. This involves assessing the cost, potential return on investment, and the company’s ability to finance the purchase.

- Long-Term Outlook: Fixed capital requires a long-term commitment since these assets are meant to be used over an extended period. Businesses should consider their future growth projections and ensure that the assets can support their evolving needs.

- Maintenance and Upkeep: Fixed capital assets need regular maintenance and periodic upgrades to ensure their optimal functionality and value. Businesses must factor in the costs associated with maintenance while planning their finances.

- Risk Assessment: Investing in fixed capital assets comes with inherent risks, such as changes in market conditions or advancements in technology that may render certain assets obsolete. Businesses need to assess these risks and develop contingency plans.

By carefully considering and fulfilling these requirements, businesses can leverage fixed capital assets to drive growth, enhance productivity, and maintain a competitive edge in the market.

Having a solid understanding of fixed capital is crucial for businesses and individuals involved in financial management. By recognizing the assets included in fixed capital and the requirements associated with it, you can make informed decisions about your financial resources and investments.

Interested in learning more about finance and other related topics? Explore our FINANCE category for more informative articles. Stay tuned for our next blog post!