Home>Finance>Form 2106-EZ: Unreimbursed Employee Business Expenses Definition

Finance

Form 2106-EZ: Unreimbursed Employee Business Expenses Definition

Published: November 27, 2023

Discover the definition of Form 2106-EZ and learn about unreimbursed employee business expenses in finance. Master your understanding and optimize your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Form 2106-EZ: Unreimbursed Employee Business Expenses Definition

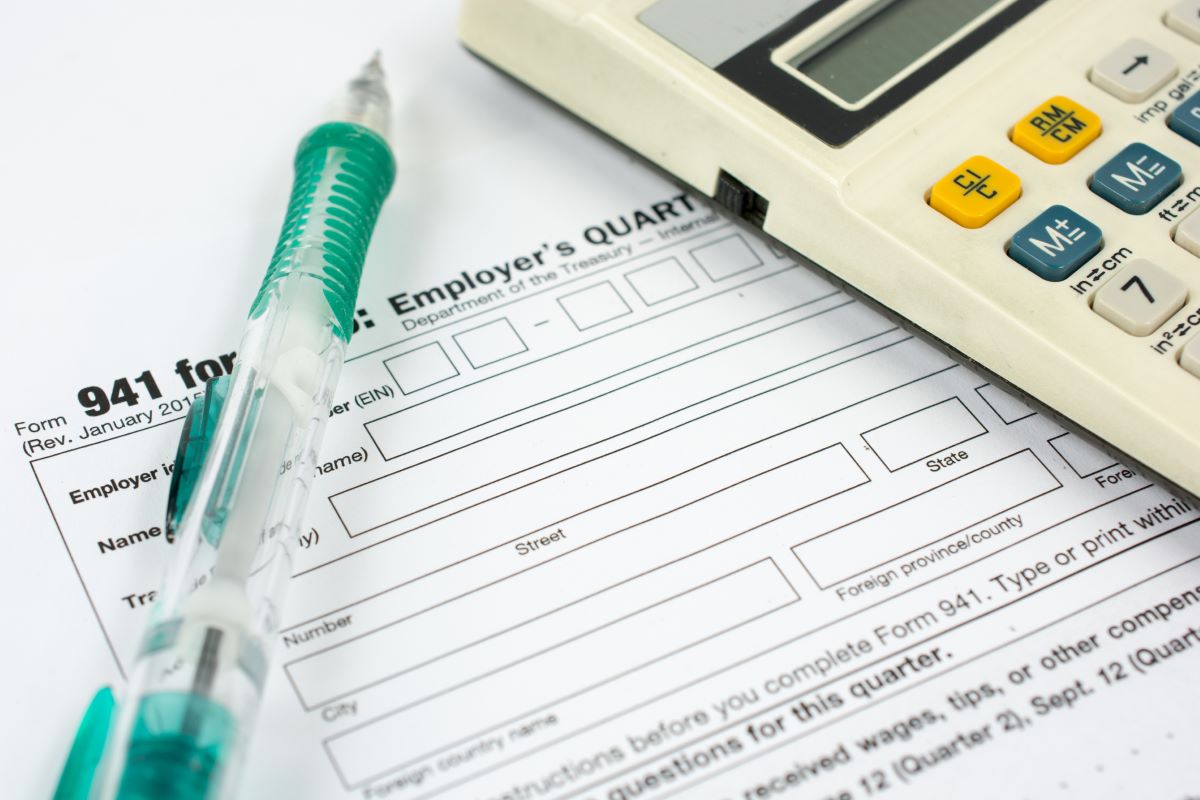

Are you an employee who incurs business-related expenses that are not reimbursed by your employer? If so, you may be eligible to claim these expenses on your tax return using Form 2106-EZ. In this article, we will provide a comprehensive overview of Form 2106-EZ, including its definition, eligibility criteria, and how to fill it out correctly. So, let’s dive into the details!

Key Takeaways:

- Form 2106-EZ is used to report unreimbursed employee business expenses on your tax return.

- Eligible expenses must meet certain criteria and be necessary for your job.

What is Form 2106-EZ?

Form 2106-EZ is an IRS tax form specifically designed for employees to report unreimbursed business expenses. These expenses are costs you incur while performing your job duties that your employer does not reimburse you for. By filling out this form, you can potentially deduct these expenses from your taxable income, reducing the amount of taxes you owe.

Before we get into the nitty-gritty details of the form, let’s take a look at some key takeaways:

- Key Takeaway 1: Form 2106-EZ is used to report unreimbursed employee business expenses on your tax return.

- Key Takeaway 2: Eligible expenses must meet certain criteria and be necessary for your job.

Who is Eligible to Use Form 2106-EZ?

Not all employees are eligible to use Form 2106-EZ; there are specific criteria you must meet. If you are a qualified employee and meet all the following conditions, then you can use this form:

- You are an employee who itemizes deductions.

- You have eligible expenses related to your job that are not reimbursed by your employer.

- You do not have any expenses for a work vehicle.

- You do not have any other employees.

If you meet these conditions, you can move forward with filling out Form 2106-EZ to claim your unreimbursed employee business expenses.

How to Fill Out Form 2106-EZ?

Now that you know what Form 2106-EZ is and who is eligible to use it, let’s discuss how to correctly fill out the form:

- Provide your personal information, including your name, social security number, and job title.

- List the total amount of your unreimbursed business expenses that you want to deduct.

- Provide a brief description of your job or occupation.

- Calculate and enter the allowable expenses for the business use of your home if applicable.

- Calculate and enter your total expenses, including any related to the business use of your home.

- Calculate and enter your total expenses that your employer did not reimburse you for.

- Transfer your total expenses to Schedule A (Itemized Deductions) of Form 1040.

Remember, it is crucial to accurately report your expenses to avoid any potential issues with the IRS. Keep detailed records of your expenses, including receipts and documentation to support your claims.

Conclusion

Form 2106-EZ is a valuable tool that allows employees to claim unreimbursed business expenses on their tax returns. By deducting these expenses, eligible individuals can potentially reduce their taxable income and, in turn, lower the amount of taxes owed. If you are an employee who incurs job-related expenses that are not reimbursed, make sure to check your eligibility and fill out Form 2106-EZ correctly to take advantage of these potential tax savings.