Home>Finance>8 Ways to Generate Passive Income with Cryptocurrency

Finance

8 Ways to Generate Passive Income with Cryptocurrency

Published: March 19, 2024

Explore innovative strategies to earn passive income through cryptocurrencies, leveraging blockchain technology for financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Passive income through crypto has become increasingly popular among investors who want to diversify their portfolios or to grow their wealth quickly. You can earn passively via liquidity mining, staking, airdrops, and playing crypto games, among many others. It is best to understand how to withstand the volatility and minimize risk to increase your earning potential. Here are the top eight strategies to put your crypto to work to get extra money:

1. Yield Farming

Also called liquidity mining, this income generation strategy has gained dominance within the DeFi (decentralized finance). You must provide necessary DeFi protocols by keeping cryptocurrency in liquidity pools. You will get some gains through participation as additional tokens or fees. Exploring different approaches and platforms that can help you optimize your reward preferences depending on your financial goals is wise. Popular yield farming platforms include:

- Uniswap

- SushiSwap

- Yearn Finance

- Coinbase

Thorough research and risk management are essential whether you are a seasoned or new investor, as yield farming involves risks such as impermanent liss and smart contract vulnerabilities. Research also helps you learn how to spread funds to maximize returns while keeping risks low.

2. Running Lightning Crypto Nodes

The LN (Lightning Network) nodes play a massive role in facilitating low-cost and quick transactions by utilizing the off-chain payment route. Running a lighting node can contribute to LN’s efficiency and scalability and earn you rewards, such as routing fees. You will get these fees every time a transaction happens through the node to its destination.

You can also choose the fee rate, which is usually a small percentage of the transaction. If you have the skills and resources, running a Lightning Network node can be an effective way to earn passive income as it requires:

- Technical expertise

- Stable internet connection

- Software

- Hardware

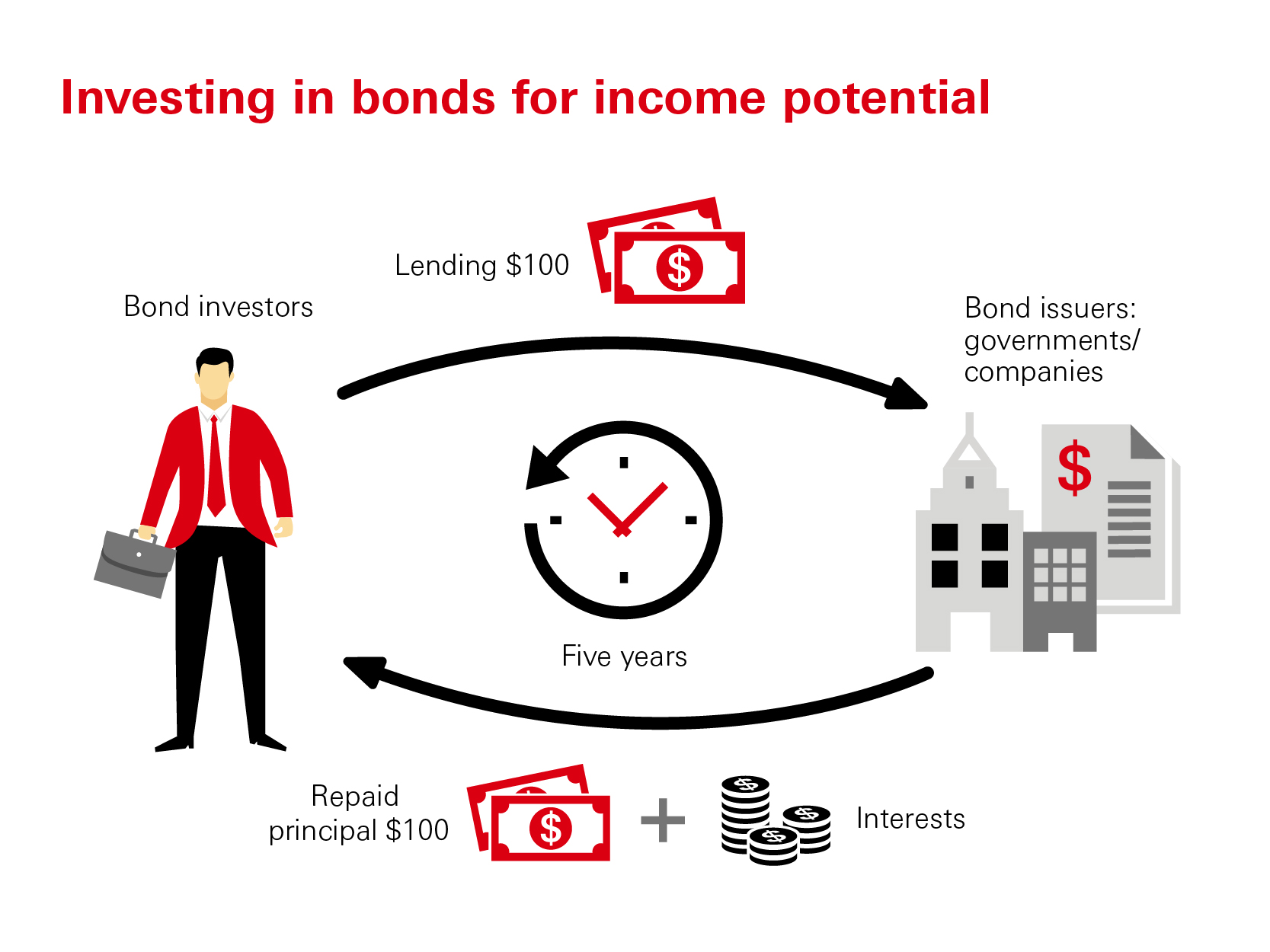

3. Crypto Lending

The cryptocurrency space operates like traditional financial settings on the element of interest through lending. There are two types of crypto lending platforms: decentralized and centralized. Both require collateral as security and offer high-interest rates.

Using decentralized lending platforms such as Aave and Compound in your lending mission is a good idea. Depending on the platform you choose, the interest rate determination will vary. Compound considers the demand and supply of the assets, while Aave uses the utilization rate of crypto assets.

Ensure your wallet is well-loaded before proceeding with the lending to get a chance to serve many borrowers, which will increase your earnings. You need to use reliable crypto exchanges to ensure secure transactions.

As you buy Bitcoin, it brings much convenience when the processing is fast and accurate. Choose exchanges that allow you to automate the buying process. This saves you from frequent, manual purchases while giving you a constantly high asset holding.

4. Staking

This method involves keeping specific amounts of cryptocurrency in a wallet, which will offer support for the normal operation of the respective blockchain network. Similar to getting some interest when on a savings account, as a staker, you’ll get rewards for helping the blockchain maintain its consensus and integrity.

Before deciding on staking, consider lock-up periods and whether there are any minimum staking requirements. A large number of cryptocurrencies, starting with Tezos, Ethereum, and Cardano, highly depend on staking to keep their network strong in validating the transactions. The reward you get will depend on several factors, like the length of the staking period, the amount you stake, and the consensus mechanism for the network.

5. Crypto Games

This is a great way to earn income while enjoying some fantastic plays. By leveraging blockchain technology, these games offer a player a chance to earn some coins. These play-to-earn games have specific requirements for players to get rewards. It could be in participating in battles, being part of in-game economies, or completing specific tasks.

They mostly feature non-fungible tokens (NFTs), unique digital identifiers that certify the authenticity and ownership of the virtual items in the game ecosystem. You have to do thorough homework on your target games to determine the perks. Some popular games are:

- CryptoKitties

- Axie Infinity

- Pegaxy

- CoinFantasy

- The Sandbox

- Ethermon

- Gods Unchained

6. Utilize Airdrops

Airdrops offer you an opportunity to get free tokens from blockchain projects. These distributions act as marketing tactics by the company behind the currency, which helps promote a new crypto. It encourages community participation by sending them some small amounts of the new coin to their wallets. This is as long as you’re an active member of the blockchain and hold the required minimum amount of crypto.

You may be asked to help circulate the message about the launch, such as by retweeting the company’s posts. The good thing with these airdropped tokens is that they will appreciate in value with time, giving you a huge potential for gains as an investor. Participating can result in earnings through referrals, holding, selling, and staking. Common types of crypto airdrops include:

- Standard Airdrop

- Exclusive Airdrop

- Hard Fork Airdrop

- Holder Airdrop

- Raffle Airdrop

- Bounty Airdrop

7. Dividend-Paying Cryptocurrencies

Target the crypto that sends dividends to every token holder. The value of these dividends will vary and will be influenced by the profits realized or fees generated by the relevant platform. The basis for the distribution will also depend on the specific policies of the crypto owners.

For instance, KuCoin Shares and NEO send amounts to token holders based on network usage and trading volume. Before investing, take time to learn more about the project’s fundamentals. Look at its resilience in the market lately and the revenue model, which can help you decide whether to make the move.

8. Cryptocurrency Mining

This is the process of validating transactions while incorporating them into the blockchain ledger. It requires using powerful computers that can help solve complex mathematical puzzles. If you are the first to find the solution, you automatically get the right to add the next block and receive a reward for the latest coins. This also includes receiving part of the transaction fees related to the block.

The mining work is not all about gaining more digital assets but also about making the blockchain networks’ security and processes run efficiently. To succeed in crypto mining, it is paramount to have the necessary technical expertise, use specialized hardware and have sufficient resources to match the resource-intensiveness of the work.

Endnote

The crypto world presents endless opportunities of increasing your income. To make the most of your earnings, it is crucial to learn the correct tactics and methods for each strategy. You should also gather information on the relevant strategy, be it staking or mining, to ensure you are well-informed.