Finance

Fraud Protection When Your ID Is Stolen

Published: February 18, 2024

Protect your finances with our fraud protection services when your identity is stolen. Safeguard your financial security with expert assistance and proactive measures.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Identity theft is a pervasive and distressing crime that can wreak havoc on your financial well-being and personal life. When your identity is stolen, fraudsters can exploit your personal information for their gain, leading to unauthorized transactions, damaged credit, and emotional distress. In this comprehensive guide, we'll delve into the critical aspects of fraud protection when your identity is stolen. Understanding the nuances of identity theft and the necessary steps to mitigate its impact is crucial in safeguarding your financial security.

Navigating the aftermath of identity theft can be overwhelming, but with the right knowledge and proactive measures, you can protect yourself from further harm. From recognizing the signs of identity theft to implementing fraud protection measures, this guide aims to equip you with the essential tools to mitigate the repercussions of this invasive crime.

In the subsequent sections, we'll explore the intricacies of identity theft, including the common signs that indicate your identity may have been compromised. Moreover, we'll delve into the actionable steps you should take if your identity is stolen, empowering you to reclaim control over your personal information and financial security. Additionally, we'll discuss fraud protection measures and the significance of monitoring your credit to detect any suspicious activity promptly.

By arming yourself with the knowledge and strategies outlined in this guide, you can fortify your defenses against identity theft and minimize its detrimental impact. Let's embark on this insightful journey to bolster your fraud protection measures and safeguard your financial well-being.

Understanding Identity Theft

Identity theft is a pernicious crime wherein an individual’s personal information is illicitly obtained and exploited for fraudulent purposes. This nefarious act can encompass various forms, such as financial identity theft, criminal identity theft, and identity cloning, each posing unique threats to the victim’s financial stability and reputation.

Financial identity theft involves the unauthorized use of a victim’s financial information to make purchases, access funds, or open lines of credit. On the other hand, criminal identity theft occurs when a perpetrator assumes the victim’s identity to evade law enforcement or perpetrate criminal activities, tarnishing the victim’s record and integrity. Identity cloning involves creating a new identity using the victim’s personal details, which can lead to extensive financial liabilities and legal entanglements.

Perpetrators of identity theft employ various means to acquire sensitive information, including phishing scams, data breaches, and physical theft of documents or cards. Once in possession of this data, they can wreak havoc by making unauthorized transactions, applying for loans or credit cards, or committing crimes under the victim’s name. The repercussions of identity theft extend beyond financial losses, often inflicting emotional distress and tarnishing the victim’s credit history.

Understanding the multifaceted nature of identity theft is crucial in fortifying your defenses against this insidious crime. By familiarizing yourself with the tactics employed by fraudsters and the potential ramifications of identity theft, you can adopt a proactive stance in safeguarding your personal information and financial assets.

As we delve deeper into this guide, we’ll explore the telltale signs that your identity may have been stolen and the pivotal steps to take if you fall victim to this pervasive crime. Equipped with this knowledge, you can navigate the complexities of identity theft with resilience and fortitude, mitigating its impact on your financial well-being.

Signs Your Identity Has Been Stolen

Recognizing the signs of identity theft is paramount in mitigating its detrimental effects. While the manifestations of identity theft can vary, several red flags may indicate that your personal information has been compromised by malicious actors.

Unexplained Financial Activity: One of the primary indicators of identity theft is unexplained financial activity, such as unfamiliar charges on your credit card or bank statements. These unauthorized transactions may encompass retail purchases, cash withdrawals, or online transactions that you did not initiate.

Receiving Bills for Unfamiliar Accounts: If you start receiving statements or bills for accounts that you did not open, it could signify that your identity has been utilized to establish fraudulent accounts. These could range from credit cards and loans to utility services or medical bills.

Notices of Suspicious Activity from Financial Institutions: Your bank or credit card issuer may alert you to suspicious activity on your accounts, such as attempts to access funds from unfamiliar locations or unusual spending patterns that deviate from your typical behavior.

Denial of Credit or Increased Interest Rates: If you are unexpectedly denied credit or encounter exorbitant interest rates when applying for loans or credit cards, it may stem from negative marks on your credit report due to fraudulent activity.

Erroneous Information on Your Credit Report: Regularly monitoring your credit report is crucial, as discrepancies such as unfamiliar accounts, inquiries, or delinquent payments can serve as early indicators of identity theft.

Collection Calls for Debts You Don’t Owe: Receiving calls from debt collectors for obligations you do not recognize can be a clear indication of identity theft, especially if the debts are associated with unfamiliar accounts or services.

Should you encounter any of these warning signs, it is imperative to take prompt action to address the potential theft of your identity. By remaining vigilant and attuned to these indicators, you can thwart the adverse effects of identity theft and safeguard your financial well-being.

Steps to Take If Your Identity Is Stolen

Discovering that your identity has been stolen can evoke feelings of vulnerability and apprehension. However, taking immediate and decisive action is crucial in mitigating the repercussions of this distressing event. If you suspect that your identity has been compromised, it is imperative to follow these essential steps:

- Initiate a Fraud Alert or Credit Freeze: Contact one of the major credit bureaus—Equifax, Experian, or TransUnion—to place a fraud alert on your credit report. This alert notifies potential creditors to verify your identity before extending credit in your name. Alternatively, you can opt for a credit freeze, which restricts access to your credit report, making it challenging for fraudsters to open new accounts.

- File a Report with the Federal Trade Commission (FTC): Visit the FTC’s website or call their identity theft hotline to report the theft of your identity. This step is crucial in creating an official record of the incident and accessing resources to guide you through the recovery process.

- Notify Financial Institutions and Credit Card Companies: Contact your bank, credit card issuers, and any relevant financial institutions to report the identity theft. Request to freeze or close compromised accounts and open new ones with enhanced security measures to prevent further unauthorized activity.

- File a Police Report: Visit your local law enforcement agency to file a report documenting the identity theft. Obtain a copy of the report, as it may be required by creditors or other entities to substantiate the crime.

- Document All Communications and Transactions: Maintain meticulous records of all communications with financial institutions, law enforcement, and credit bureaus regarding the identity theft. Additionally, keep a comprehensive log of any fraudulent transactions and unauthorized accounts.

- Utilize Identity Theft Protection Services: Consider enlisting the services of reputable identity theft protection providers to safeguard your personal information and receive ongoing monitoring for any suspicious activity.

By diligently adhering to these steps, you can initiate the process of reclaiming your identity and mitigating the adverse effects of identity theft. While the road to recovery may be arduous, swift and resolute action is pivotal in restoring your financial security and peace of mind.

Fraud Protection Measures

Implementing robust fraud protection measures is instrumental in fortifying your defenses against identity theft and financial fraud. By integrating proactive strategies and leveraging available resources, you can mitigate the risk of falling victim to malicious actors seeking to exploit your personal information. Here are essential fraud protection measures to safeguard your financial well-being:

- Secure Your Personal Information: Safeguard sensitive documents, such as social security cards, passports, and financial statements, in a secure location. Shred outdated documents containing personal details before discarding them to prevent unauthorized access.

- Exercise Caution Online: Be vigilant when sharing personal information online and refrain from divulging sensitive details on unsecured websites or unfamiliar platforms. Verify the legitimacy of websites before entering confidential data and utilize secure, encrypted connections for online transactions.

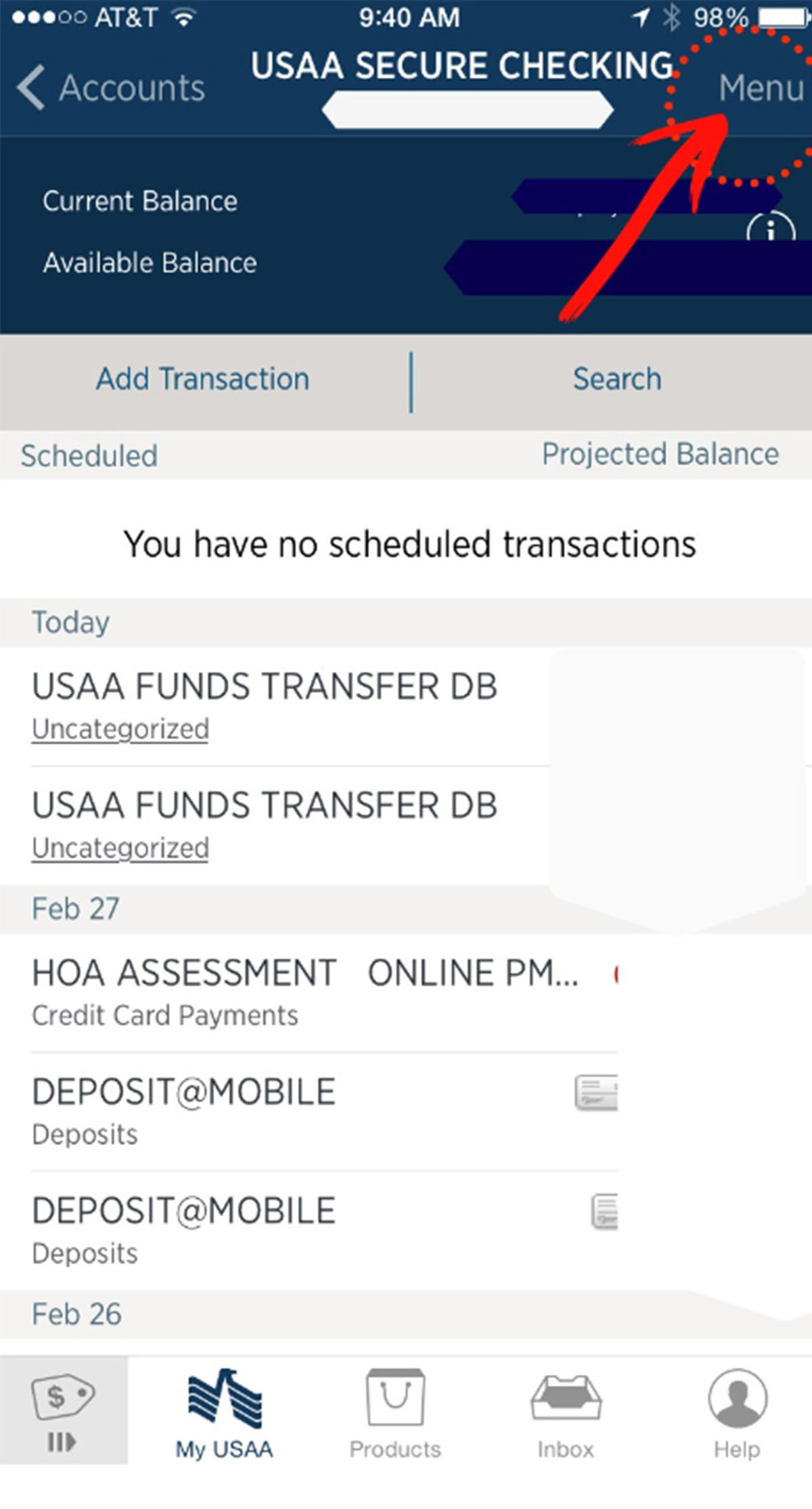

- Monitor Your Accounts Regularly: Routinely review your bank statements, credit card transactions, and financial accounts for any unauthorized activity. Promptly report any discrepancies or suspicious charges to your financial institutions.

- Utilize Strong, Unique Passwords: Employ complex, distinct passwords for each online account and consider utilizing a reputable password manager to securely store and manage your login credentials.

- Enable Two-Factor Authentication: Enhance the security of your online accounts by enabling two-factor authentication, which requires an additional verification step beyond entering a password, such as a unique code sent to your mobile device.

- Stay Informed About Scams: Stay abreast of prevalent scams and fraudulent schemes targeting individuals, particularly those involving phishing emails, fraudulent phone calls, or deceptive online tactics. Educate yourself and remain cautious to avoid falling prey to these ploys.

By diligently adhering to these fraud protection measures, you can bolster your resilience against identity theft and financial fraud, fostering a secure environment for your personal information and monetary assets. Proactive vigilance and informed decision-making are pivotal in thwarting the efforts of fraudsters and preserving your financial security.

Monitoring Your Credit

Regularly monitoring your credit is a fundamental aspect of safeguarding your financial well-being and detecting potential instances of identity theft. By staying informed about changes to your credit report and actively scrutinizing your financial activity, you can swiftly identify unauthorized transactions and address discrepancies that may indicate fraudulent behavior. Here are essential practices for effectively monitoring your credit:

- Review Your Credit Reports: Obtain and review your credit reports from the major credit bureaus—Equifax, Experian, and TransUnion—at least annually. Scrutinize the reports for inaccuracies, unfamiliar accounts, or suspicious inquiries that could signify fraudulent activity.

- Utilize Credit Monitoring Services: Consider enlisting the services of reputable credit monitoring providers that offer real-time alerts and comprehensive tracking of changes to your credit report. These services can promptly notify you of any suspicious activity, enabling swift action to address potential identity theft.

- Monitor Account Activity: Regularly review your bank statements, credit card transactions, and online account activity for any unauthorized charges, unfamiliar withdrawals, or irregularities that warrant further investigation. Promptly report any suspicious activity to your financial institutions.

- Stay Informed About Credit Scores: Monitor your credit scores and track changes over time to identify any unexplained fluctuations that could indicate fraudulent activity. Sudden drops in your credit score without a valid reason may necessitate a thorough review of your credit report for potential discrepancies.

- Act on Suspicious Findings: If you encounter any irregularities or signs of potential identity theft during your credit monitoring activities, take immediate action by contacting the relevant financial institutions, initiating fraud alerts, and reporting the incidents to the appropriate authorities.

By diligently monitoring your credit and remaining vigilant about changes to your financial accounts and credit reports, you can proactively identify and address instances of identity theft, thereby safeguarding your financial stability and personal information. This proactive approach empowers you to take swift and decisive action in the event of fraudulent activity, mitigating its impact and fortifying your defenses against future threats.

Conclusion

Identity theft poses a pervasive threat to individuals’ financial security and personal well-being, necessitating proactive measures to mitigate its detrimental impact. By understanding the nuanced manifestations of identity theft, recognizing the signs of potential compromise, and implementing robust fraud protection measures, individuals can fortify their defenses against this insidious crime.

When faced with the distressing reality of identity theft, swift and decisive action is paramount. Initiating fraud alerts, reporting the theft to relevant authorities, and diligently monitoring credit activity are pivotal steps in reclaiming control over one’s personal information and financial stability. Additionally, fostering awareness about prevalent scams and fraudulent tactics empowers individuals to exercise caution and discernment in their interactions, thereby reducing the risk of falling victim to malicious actors.

As technology continues to advance, individuals must remain vigilant and proactive in safeguarding their personal information, both in the physical realm and the digital landscape. By securing sensitive documents, leveraging secure online practices, and actively monitoring financial accounts, individuals can fortify their resilience against identity theft and financial fraud.

Ultimately, the journey toward robust fraud protection and vigilant identity theft mitigation is an ongoing endeavor, requiring continual awareness, adaptability, and informed decision-making. By arming themselves with knowledge, proactive strategies, and a resolute mindset, individuals can navigate the complexities of identity theft with resilience and fortitude, preserving their financial security and peace of mind.

Through concerted efforts to fortify fraud protection measures, monitor credit diligently, and remain informed about evolving threats, individuals can mitigate the risk of identity theft and proactively safeguard their financial well-being. By fostering a culture of vigilance and resilience, individuals can navigate the intricacies of identity theft with confidence, reclaiming control over their personal information and financial security.