Finance

How To Increase Affirm Credit Limit

Published: March 5, 2024

Learn effective strategies to increase your Affirm credit limit and manage your finances better. Discover expert tips for boosting your credit limit and gaining more financial flexibility.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Affirm Credit Limits

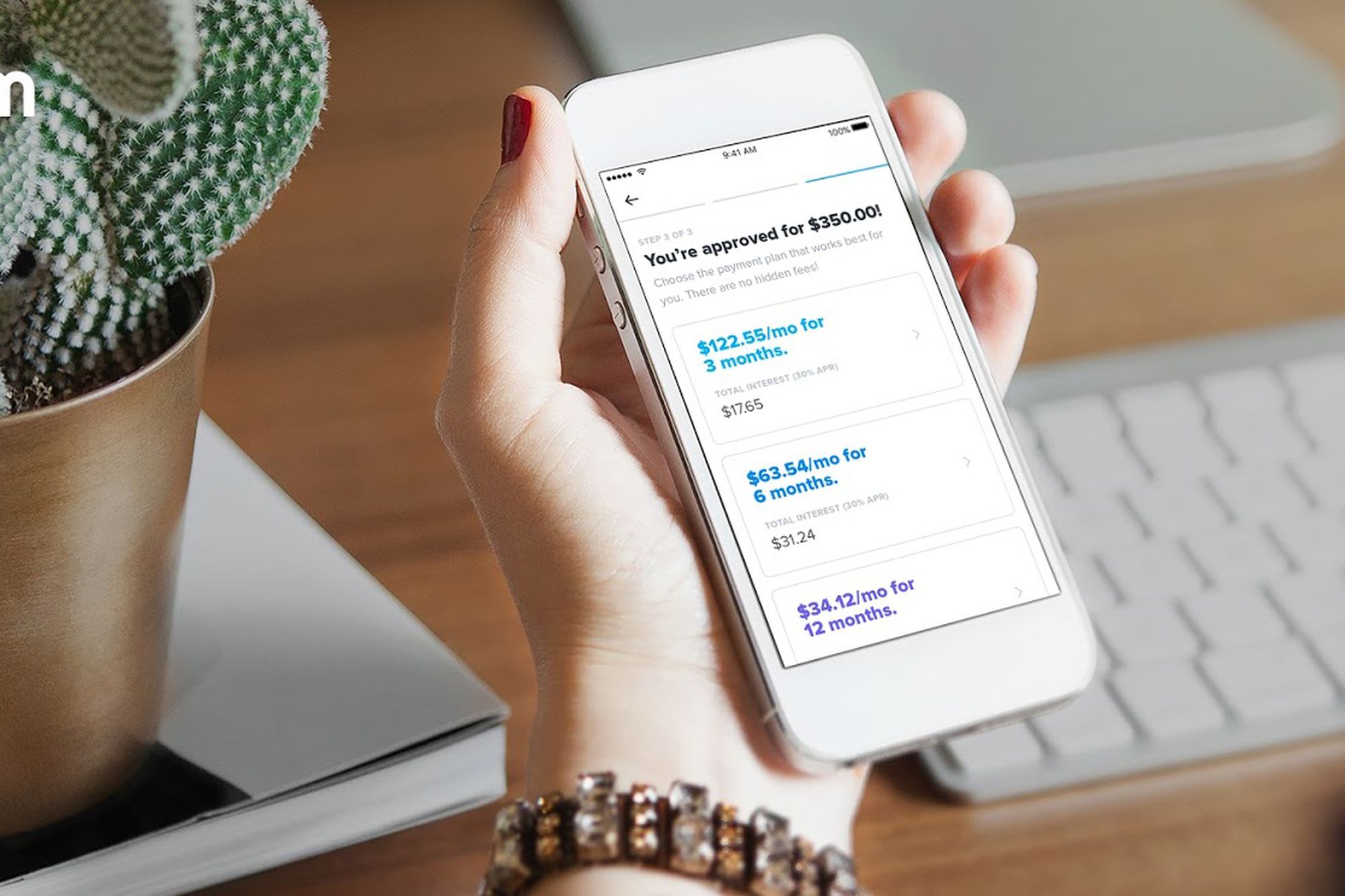

Welcome to the world of flexible and transparent financing with Affirm! Affirm offers a refreshing approach to credit, providing consumers with the ability to make purchases and pay over time with simple, clear terms. One of the key elements of using Affirm is understanding and managing your credit limit. In this article, we’ll delve into the nuances of Affirm credit limits, exploring the factors that influence them and providing actionable tips for increasing your limit.

Managing your Affirm credit limit effectively can significantly impact your purchasing power and financial flexibility. Whether you’re eyeing that new laptop, planning a vacation, or simply looking to manage unexpected expenses, a higher credit limit can make a substantial difference. By understanding how Affirm determines credit limits and implementing strategies to increase them, you can unlock greater financial freedom and take full advantage of the convenience offered by this innovative financing option.

So, let’s embark on a journey to demystify Affirm credit limits and empower you to make informed decisions that align with your financial goals. Whether you’re new to Affirm or a seasoned user looking to maximize your benefits, this guide will equip you with the knowledge and strategies to navigate the world of Affirm credit limits confidently and effectively.

Understanding Affirm Credit Limits

Before diving into the factors influencing Affirm credit limits and strategies for increasing them, it’s crucial to grasp the fundamental concept of credit limits within the context of Affirm’s financing platform.

Affirm credit limits represent the maximum amount of financing extended to an individual for making purchases through the platform. When you opt to pay with Affirm at a partner store or online retailer, your approved credit limit dictates the total value of the items you can purchase using Affirm’s flexible payment options. This limit is determined based on various financial factors and is tailored to each user’s unique financial profile.

It’s important to note that Affirm’s credit limits are not fixed and can evolve over time based on your financial behavior, payment history, and other pertinent factors. By understanding the dynamics of Affirm credit limits, you can navigate the platform more effectively and leverage its benefits to support your purchasing needs.

Whether you’re considering a major investment or seeking to manage everyday expenses, having a clear understanding of your Affirm credit limit is essential for making informed financial decisions. In the following sections, we’ll explore the specific elements that influence Affirm credit limits and provide actionable insights for maximizing your credit limit potential.

Factors Affecting Affirm Credit Limits

When it comes to determining Affirm credit limits, several key factors come into play, shaping the financial parameters that govern your purchasing power and payment flexibility. Understanding these factors can offer valuable insights into how Affirm assesses creditworthiness and empowers users to make informed financial decisions.

1. Credit History: Your credit history plays a pivotal role in influencing your Affirm credit limit. A strong credit history, characterized by timely payments, responsible credit utilization, and a demonstrated ability to manage credit effectively, can contribute to a higher credit limit. Conversely, a limited or adverse credit history may result in a lower initial credit limit.

2. Income: Affirm considers your income level when determining your credit limit. A higher income may lead to a more substantial credit limit, reflecting your capacity to manage larger purchases and credit obligations. Providing accurate income information during the application process can positively impact your credit limit assessment.

3. Debt-to-Income Ratio: Your debt-to-income ratio, which compares your monthly debt payments to your income, is another critical factor. A lower ratio indicates a healthier financial position and may lead to a higher credit limit, while a higher ratio could influence a more conservative credit limit assessment.

4. Payment History: Your track record of making timely payments on existing credit accounts and loans is a significant consideration for Affirm. A consistent history of on-time payments can enhance your creditworthiness and potentially lead to an increase in your credit limit over time.

5. Credit Utilization: Affirm evaluates your credit utilization, which reflects the percentage of your available credit that you are currently using. Maintaining a moderate credit utilization rate, ideally below 30%, can positively impact your credit limit assessment.

By comprehending the multifaceted nature of these factors, you can gain insights into the criteria that shape your Affirm credit limit. In the subsequent section, we’ll delve into actionable tips for increasing your Affirm credit limit, empowering you to optimize your financial flexibility and purchasing capabilities within the Affirm ecosystem.

Tips for Increasing Affirm Credit Limit

While Affirm determines initial credit limits based on various financial factors, there are proactive steps you can take to potentially increase your credit limit over time. By strategically managing your finances and engaging in responsible credit behavior, you can enhance your creditworthiness and demonstrate your capacity to handle larger credit limits. Here are actionable tips for increasing your Affirm credit limit:

- Make Timely Payments: Consistently making on-time payments on your Affirm-financed purchases and other credit obligations can positively influence your creditworthiness and signal responsible financial behavior to Affirm’s credit assessment system.

- Manage Existing Debt: Effectively managing your existing debts and maintaining a healthy debt-to-income ratio can bolster your financial profile and contribute to a favorable evaluation of your credit limit potential.

- Update Income Information: If your income has increased since you initially set up your Affirm account, consider updating your income information. A higher income level can reflect improved financial capacity and may lead to a reassessment of your credit limit.

- Avoid Maxing Out Your Limit: While it can be tempting to utilize your entire credit limit, maintaining a moderate credit utilization rate by using only a portion of your available credit can demonstrate prudent financial management and potentially support a credit limit increase.

- Engage in Credit Building: Actively engaging in credit-building activities, such as responsibly using and managing other credit accounts, can contribute to an enhanced credit profile, potentially resulting in a higher Affirm credit limit.

By implementing these strategies and maintaining a proactive approach to managing your finances, you can position yourself for potential increases in your Affirm credit limit. It’s important to note that credit limit adjustments are subject to Affirm’s assessment and policies, and individual outcomes may vary based on specific financial circumstances.

By leveraging these tips and adopting responsible financial practices, you can optimize your Affirm credit limit and unlock greater purchasing power, enabling you to pursue your desired purchases and manage expenses with enhanced flexibility and convenience.

Conclusion

Understanding and managing your Affirm credit limit is a fundamental aspect of leveraging Affirm’s flexible financing options to support your purchasing needs and financial goals. By gaining insights into the factors that influence credit limits and adopting proactive strategies, you can navigate the Affirm platform with confidence and optimize your credit limit potential.

Throughout this guide, we’ve explored the nuanced elements that contribute to Affirm credit limits, including credit history, income, debt-to-income ratio, payment history, and credit utilization. By comprehending these factors, you can gain clarity on how Affirm evaluates creditworthiness and makes credit limit determinations, empowering you to make informed financial decisions within the Affirm ecosystem.

Moreover, the actionable tips provided for increasing your Affirm credit limit offer a roadmap for engaging in responsible financial practices that can potentially lead to credit limit enhancements over time. By focusing on timely payments, prudent debt management, income updates, credit utilization moderation, and credit-building activities, you can position yourself for favorable credit limit assessments and expanded purchasing capabilities.

As you continue to engage with Affirm for your financing needs, remember that responsible financial management and a proactive approach to credit utilization can yield long-term benefits, potentially resulting in higher credit limits and enhanced financial flexibility. While individual credit limit adjustments are subject to Affirm’s policies and assessments, your commitment to sound financial practices can positively influence your credit limit journey.

In conclusion, managing your Affirm credit limit effectively involves a blend of financial awareness, responsible credit behavior, and strategic planning. By embracing these principles, you can harness the full potential of Affirm’s financing solutions, making informed purchases and managing expenses with greater flexibility and confidence.

Armed with a deeper understanding of Affirm credit limits and actionable strategies for credit limit optimization, you are well-equipped to navigate the dynamic landscape of consumer financing and make the most of your Affirm experience.