Home>Finance>Frequency-Severity Method: Definition And How Insurers Use It

Finance

Frequency-Severity Method: Definition And How Insurers Use It

Published: November 28, 2023

Learn about the Frequency-Severity method in finance and how insurers utilize it to assess risk and determine insurance premiums.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Frequency-Severity Method: Understanding its Definition and How Insurers Utilize It

When it comes to the world of finance, insurance plays an essential role. We rely on insurance companies to protect us from financial risks, such as accidents, natural disasters, and unforeseen events. But have you ever wondered how insurance companies calculate the premiums they charge? One of the methods they use is known as the frequency-severity method. In this article, we’ll delve deeper into the frequency-severity method, its definition, and how insurers utilize it to determine insurance premiums. So, let’s get started!

Key Takeaways:

- The frequency-severity method is a technique used by insurance companies to assess and calculate the premiums they charge.

- This method involves analyzing two main factors: the frequency of claims and the average severity of those claims.

What is the Frequency-Severity Method?

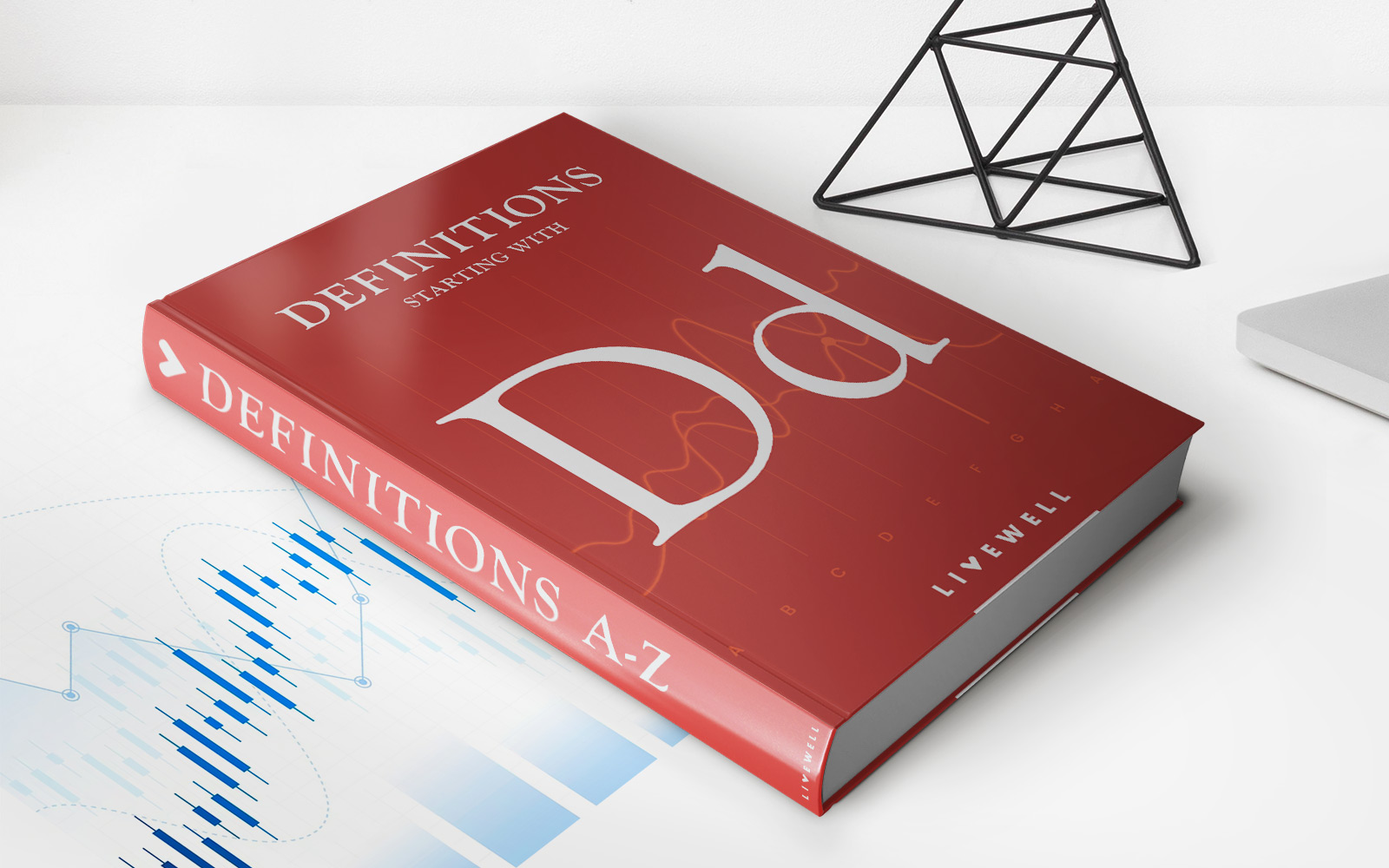

The frequency-severity method is a statistical approach used by insurance companies to evaluate risks and determine the premiums they charge. It involves analyzing two key elements: the frequency of claims and the average severity of those claims. By understanding these factors, insurers can accurately assess the expected losses and establish appropriate premiums for policyholders.

Frequency refers to the number of claims filed within a given period. Insurers analyze historical data to determine the frequency of claims in a specific line of insurance. For instance, they examine data from auto insurance policies to understand how often accidents occur. This helps them estimate the likelihood of policyholders filing a claim.

Severity, on the other hand, refers to the financial impact of each claim. Insurance companies evaluate the average amount paid out for each claim in a particular line of business. They examine historical data to understand the severity of claims and the potential financial risk associated with them.

Once insurance companies have calculated the frequency and severity, they multiply these two factors to estimate the expected losses. The result helps them determine the premiums they need to charge for coverage.

How Do Insurers Use the Frequency-Severity Method?

The frequency-severity method plays a crucial role in insurers’ decision-making processes. By utilizing this method, insurers can:

- Assess Risk: Insurance companies rely on the frequency-severity method to assess the level of risk involved in providing coverage. This analysis helps them understand the likelihood and financial implications of policyholders filing claims.

- Set Premiums: Based on the calculated expected losses, insurers can determine the appropriate premiums to charge. High-frequency and high-severity lines of business often require higher premiums to cover the potential losses.

- Design Insurance Products: The frequency-severity method also guides insurance companies in designing new insurance products. By understanding the risk factors associated with different lines of business, insurers can create tailored policies to meet specific customer needs.

In summary, the frequency-severity method is a fundamental tool used by insurers to evaluate risks and calculate insurance premiums. By analyzing the frequency and severity of claims, insurers can accurately assess potential losses and establish appropriate premiums. Whether you’re seeking auto insurance, home insurance, or any other form of coverage, understanding this method can help you navigate the complex world of insurance more confidently.

Hopefully, this article has shed light on the frequency-severity method, its definition, and how insurers utilize it in their decision-making processes. If you have any questions or would like further information, feel free to reach out to us!