Finance

Gray Knight Definition

Published: December 2, 2023

Learn what a gray knight is in the finance industry and how they can impact mergers and acquisitions. Find out their strategies and role in takeover battles.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking Financial Success: A Comprehensive Guide to Personal Finance

Welcome to our Finance category! In this blog post, we will provide you with a comprehensive guide to personal finance and offer valuable insights to help you unlock financial success.

Key Takeaways:

- Understanding personal finance is essential for achieving financial stability and long-term wealth.

- By following simple yet effective strategies, you can take control of your finances and build a bright financial future.

Money plays a critical role in our daily lives, allowing us to meet our needs and pursue our goals. However, managing finances can often feel overwhelming and confusing. That’s why it’s crucial to equip yourself with the knowledge and tools necessary to make informed financial decisions. In this blog post, we will explore the fundamental principles of personal finance and provide practical tips on budgeting, saving, investing, and debt management. Whether you’re just starting your financial journey or looking to strengthen your current financial situation, this guide is for you.

Creating a Budget: Mastering the Art of Financial Planning

A budget is the foundation of effective financial planning. It empowers you to track your income, expenses, and savings, ensuring that you are in control of your financial inflows and outflows. Here’s how you can create and manage a successful budget:

- Assess your current financial situation: Start by evaluating your income, expenses, and debt. Understanding where your money is coming from and where it is going is crucial.

- Set financial goals: Define your short-term and long-term financial goals. This will help you prioritize your spending and focus on what truly matters to you.

- Create a realistic budget: Allocate your income towards essential expenses, such as housing and utilities, debt repayment, savings, and discretionary spending. Make sure to leave room for unexpected expenses and emergencies.

- Track your expenses: Regularly monitor your spending to ensure that you are sticking to your budget. Utilize online budgeting tools or apps to make tracking easier.

- Adjust as needed: Life circumstances and financial goals may change over time, so be flexible with your budget and make adjustments whenever necessary.

By following these steps, you’ll gain a clear understanding of your financial situation and be able to make informed decisions to align your spending with your long-term goals.

Saving Strategically: The Road to Financial Security

Saving money allows you to build an emergency fund, prepare for unexpected expenses, and work towards your financial goals. Here are some strategic saving tips to help you strengthen your financial security:

- Automate your savings: Set up automatic transfers from your paycheck to a separate savings account. This ensures that a portion of your income goes towards savings before you even have a chance to spend it.

- Pay yourself first: Prioritize saving a percentage of your income before paying your bills or expenses. Treat saving as an essential expense rather than an afterthought.

- Reduce unnecessary expenses: Analyze your monthly expenses and identify areas where you can cut back. For example, packing your lunch instead of eating out can save you a significant amount of money over time.

- Save for retirement: Start contributing to a retirement account as early as possible. The power of compound interest can grow your retirement savings exponentially over time.

- Stay motivated: Set short-term milestones and celebrate your saving victories along the way. This will help you stay motivated and remain committed to your saving goals.

By incorporating these saving strategies into your financial plan, you’ll be well on your way to achieving long-term financial security and peace of mind.

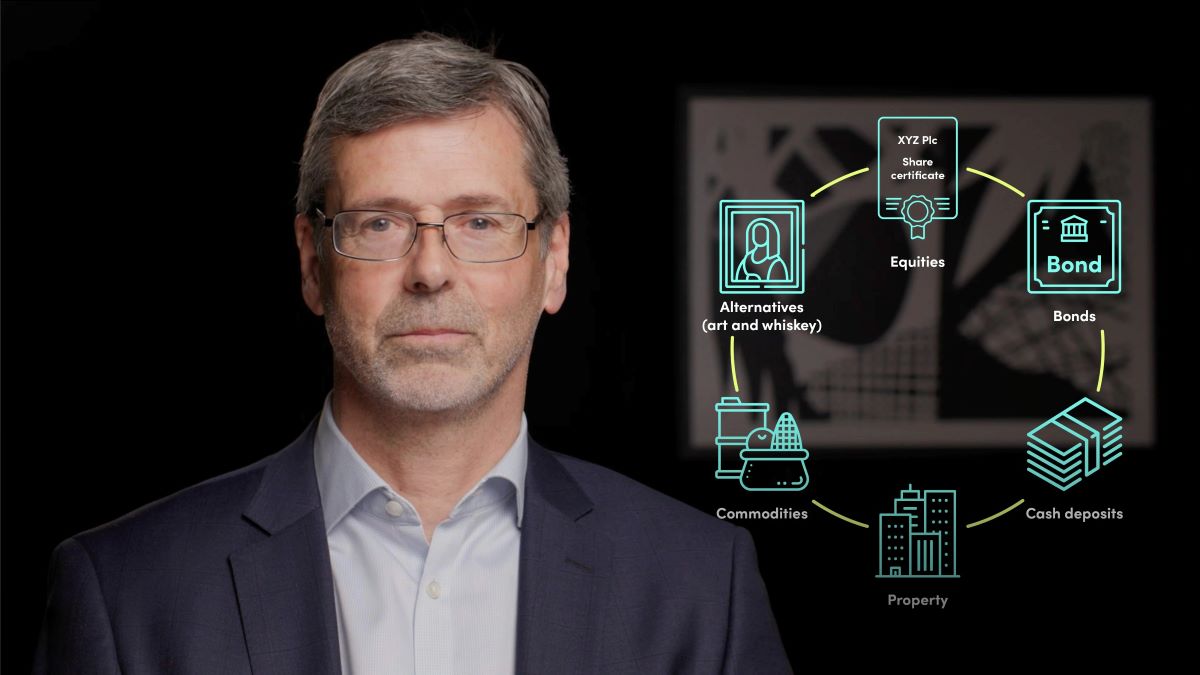

Investing Wisely: Making Your Money Work for You

Investing is a key component of building wealth and achieving financial success. Here are some essential tips to help you invest wisely:

- Define your investment goals: Determine your investment objectives, whether it’s saving for retirement, buying a home, or funding your children’s education.

- Understand risk and reward: Different investment options come with varying levels of risk and potential returns. Educate yourself about different investment vehicles and assess your risk tolerance.

- Diversify your portfolio: Spreading your investments across different asset classes can help mitigate risk and maximize potential returns. Consider investing in stocks, bonds, mutual funds, and real estate.

- Start early and be consistent: The power of compounding works best when you start investing early and contribute regularly. Time is your greatest ally in growing your investment portfolio.

- Stay informed: Stay updated on market trends and economic indicators that may impact your investments. Consider seeking professional advice when necessary.

Remember, investing is a long-term game. By approaching it with patience, discipline, and a diversified strategy, you can grow your wealth steadily and reap the rewards in the future.

Managing Debt: Breaking Free from Financial Burdens

Debt can be a significant obstacle on your journey to financial success. Here are some tips to help you effectively manage and reduce your debt:

- Create a debt repayment plan: List all your debts, including outstanding credit card balances, loans, and mortgages. Prioritize debt with higher interest rates and develop a repayment plan.

- Consolidate high-interest debt: Consider consolidating multiple debts into a single loan with a lower interest rate. This can make repayment more manageable and save you money on interest charges.

- Pay more than the minimum: Whenever possible, contribute more than the minimum required payment towards your debts. This will help you pay off your debts faster and save on interest.

- Avoid accumulating new debt: While working towards paying off existing debt, limit your use of credit cards and avoid taking on new loans unnecessarily.

- Stay committed and seek support: Paying off debt requires discipline and perseverance. Seek support from friends, family, or online communities to stay motivated and accountable.

By taking tangible steps towards managing your debt, you’ll experience a sense of relief and gain greater control over your financial future.

Conclusion: Your Path to Financial Freedom Begins Now!

Navigating the world of personal finance can be challenging, but armed with the knowledge and strategies shared in this comprehensive guide, you are well-equipped to unlock financial success. Remember, understanding personal finance, creating a budget, saving strategically, investing wisely, and managing debt are all crucial components of achieving financial stability and long-term wealth.

Start implementing these tips today and take control of your financial future. Embrace the journey, stay patient, and celebrate every milestone along the way. Financial freedom awaits!