Finance

How To Buy Commercial Property For Investment

Published: October 16, 2023

Learn how to finance your commercial property investment and make smart financial decisions to maximize your returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Researching the Commercial Property Market

- Determining Your Investment Goals and Budget

- Identifying Suitable Commercial Properties

- Assessing the Potential Return on Investment

- Conducting Due Diligence on the Property

- Financing Your Commercial Property Investment

- Negotiating the Purchase Agreement

- Closing the Deal and Transferring Ownership

- Managing and Maintaining Your Commercial Property

- Conclusion

Introduction

Investing in commercial property can be a lucrative venture, providing a steady stream of income and the potential for long-term appreciation. Whether you’re an experienced investor or just starting out, understanding the ins and outs of buying commercial property is crucial for success. In this article, we will guide you through the process of buying commercial property for investment, offering valuable insights and tips to help you navigate the complex world of commercial real estate.

Commercial properties include office buildings, retail spaces, industrial warehouses, and multifamily apartment complexes. They offer a variety of opportunities for generating income, such as leasing the space to businesses or collecting rent from residential tenants. However, investing in commercial property requires careful planning, research, and analysis to make informed decisions and maximize returns.

Before diving into the world of commercial real estate, it’s important to understand your investment objectives. Are you looking for regular rental income, long-term capital appreciation, or a combination of both? Identifying your goals will help guide you in selecting the right property and developing an investment strategy.

Another crucial aspect to consider is your budget. Determine how much capital you’re willing to invest and how much you can afford in terms of down payments, financing costs, and ongoing expenses. It’s essential to have a solid understanding of your financial capabilities to ensure a successful and sustainable investment.

In this comprehensive guide, we will walk you through the key steps involved in buying commercial property for investment. From researching the market to financing the purchase and managing the property, we will provide valuable insights and expert advice to help you make informed decisions and achieve your investment goals.

Researching the Commercial Property Market

Before embarking on your commercial property investment journey, it’s crucial to thoroughly research the market to gain a deep understanding of current trends, property values, and potential opportunities. Here are some key steps to consider:

- Identify target locations: Start by identifying specific target locations where you would like to invest. Consider factors such as economic growth, population demographics, and the presence of industries that contribute to the demand for commercial properties.

- Study market trends: Analyze market data, reports, and forecasts to understand the overall performance of the commercial real estate market in your selected locations. Look for trends in rental rates, vacancy rates, and property values to determine the attractiveness of the market.

- Network with professionals: Reach out to real estate agents, brokers, and industry professionals who specialize in commercial properties. Their expertise and insights can provide valuable information about market conditions, upcoming developments, and investment opportunities.

- Attend industry events: Attend seminars, conferences, and industry events related to commercial real estate. These events offer valuable networking opportunities and allow you to stay updated on the latest trends, regulations, and investment strategies.

- Utilize online resources: Take advantage of online platforms and commercial real estate websites that provide market data, property listings, and investment analysis tools. These resources can help you gather information, compare properties, and make more informed investment decisions.

- Consider the competition: Analyze the competition in your target market. Identify the types of businesses and industries that are thriving, as well as potential gaps in the market that you can capitalize on. Understanding the competitive landscape will help you position your investment for success.

By thoroughly researching the commercial property market, you will gain invaluable insights that will guide your investment decisions. This research will enable you to identify lucrative opportunities, understand market risks, and set realistic expectations for your investment returns.

Determining Your Investment Goals and Budget

Before diving into the process of buying commercial property, it’s essential to determine your investment goals and establish a budget. Identifying your objectives and financial limitations will guide your decision-making process and ensure that you make informed choices. Here are some steps to consider:

- Define your investment objectives: Determine what you hope to achieve with your commercial property investment. Are you looking for a steady stream of rental income or long-term capital appreciation? Clarifying your goals will help you focus your efforts and make informed investment decisions.

- Evaluate your risk tolerance: Assess your risk tolerance level, as commercial property investment comes with its own set of risks. Understand that property values can fluctuate, vacancies may occur, and economic conditions can impact the market. Consider your comfort level with these risks and adjust your investment strategy accordingly.

- Set a realistic budget: Establish a budget for your commercial property purchase. Consider factors such as down payment, financing costs, closing costs, and ongoing expenses such as property taxes, insurance, and maintenance. Ensure that your budget aligns with your financial capabilities to avoid overextending yourself.

- Explore financing options: Research and explore different financing options for your commercial property investment. Evaluate mortgage rates, loan terms, and repayment options offered by various lenders. Consider working with a financial advisor to help you select the most suitable financing option for your investment.

- Consider your investment timeline: Determine your investment timeline, whether you’re looking for a short-term investment or a long-term commitment. This will influence the type of commercial property you target and the strategies you employ to maximize returns.

- Consult with professionals: Seek advice from professionals such as financial advisors, accountants, and real estate agents. They can provide guidance on setting realistic investment goals and establishing a budget that aligns with your financial situation.

By determining your investment goals and budget upfront, you can streamline your commercial property search and focus on properties that fit within your criteria. Additionally, having a clear understanding of your goals and financial limitations will help you negotiate effectively and make sound investment decisions throughout the buying process.

Identifying Suitable Commercial Properties

Once you have established your investment goals and budget, the next step is to identify suitable commercial properties that align with your criteria. Here are some key considerations to help you in the process:

- Location: Consider the location of the commercial property. Look for areas with strong economic growth, high demand for commercial space, and a supportive business environment. The location should also be easily accessible for potential tenants and customers.

- Type of property: Determine the type of commercial property that suits your investment goals. This could range from office buildings and retail spaces to industrial warehouses and multifamily apartment complexes. Each property type has its own set of pros and cons, so choose one that aligns with your investment strategy.

- Condition and potential for improvement: Assess the current condition of the property and evaluate its potential for improvement. Consider factors such as required renovations, maintenance costs, and any potential value-add opportunities that could increase its marketability and value.

- Rental income potential: Evaluate the potential rental income that the commercial property can generate. Research rental rates in the area and determine if they align with your financial goals. Additionally, consider the demand for commercial space in the area and the potential for lease renewals and tenant retention.

- Market trends and growth potential: Stay informed about market trends and growth potential in the area. Look for indicators of economic stability, population growth, and infrastructure improvements that can positively impact the value and demand for commercial properties.

- Property management: Consider the management aspect of owning a commercial property. Determine if you will manage the property yourself or hire a professional property management company. Factor in the associated costs and responsibilities when assessing the feasibility of the investment.

- Future development and zoning regulations: Research future development plans and zoning regulations in the area. Understanding potential changes can help you assess whether the property’s value and suitability for your investment goals may be affected in the future.

It’s important to conduct a thorough due diligence process when identifying suitable commercial properties. Take the time to visit properties, conduct inspections, review financial statements, and analyze potential risks and returns. Additionally, enlisting the help of a real estate professional can provide valuable insights and access to a wider range of investment opportunities.

By carefully evaluating these factors, you can identify commercial properties that have the potential to meet your investment objectives and provide a solid return on investment.

Assessing the Potential Return on Investment

One of the key aspects of buying commercial property for investment is assessing the potential return on your investment. By thoroughly evaluating the financial aspects of a property, you can make informed decisions and ensure that your investment aligns with your goals. Here are the key steps to assess the potential return on investment:

- Calculate Net Operating Income (NOI): NOI is calculated by subtracting operating expenses from the property’s total income. It is a crucial metric to determine the property’s profitability and cash flow potential. The higher the NOI, the better the potential return on investment.

- Analyze Cash-on-Cash Return: Cash-on-Cash return measures the annual cash flow from the property as a percentage of the initial cash investment. This metric helps determine the income generated from the property relative to the amount invested, providing insights into the return on your capital.

- Consider Cap Rate: Cap rate, or Capitalization rate, is calculated by dividing the NOI by the property’s purchase price. It is an important indicator of the property’s potential return and market value. Higher cap rates indicate higher potential returns, but it’s essential to compare them to market averages for proper evaluation.

- Evaluate Cash Flow and Financing: Assess the property’s cash flow potential, taking into account both income and expenses. Consider factors such as rental rates, vacancy rates, maintenance costs, property taxes, and financing expenses. Ensure that the property generates positive cash flow after accounting for all expenses.

- Project Future Growth: Evaluate the potential for future growth in terms of rental income and property appreciation. Consider factors such as market trends, location, development plans, and economic conditions that could impact the property’s value and income potential over time.

- Account for Risks: Assess the potential risks associated with the investment. Consider factors such as market volatility, tenant turnover, economic downturns, and potential maintenance or repair costs. Understanding and accounting for risks will help you make more accurate projections of the potential return on investment.

- Perform Comparative Analysis: Compare the property’s financial performance and potential returns with similar properties in the market. This will help you gauge the competitiveness of the investment and make more informed decisions.

It is important to note that assessing the potential return on investment involves a combination of financial analysis and market knowledge. Consider consulting with professionals, such as accountants, real estate agents, or investment advisors, who can provide expertise and guidance throughout the evaluation process.

By thoroughly evaluating the financial aspects and potential returns, you can make informed decisions and choose commercial properties that align with your investment goals and have the potential to generate significant returns.

Conducting Due Diligence on the Property

Before finalizing the purchase of a commercial property, it is crucial to conduct due diligence to ensure that you have a comprehensive understanding of the property’s condition, legal status, and any potential risks or liabilities. Here are the key steps to follow when conducting due diligence on a commercial property:

- Inspect the property: Hire a professional inspector to thoroughly examine the property for any structural issues, mechanical problems, or other potential concerns. This inspection will help uncover any hidden defects or maintenance issues that may affect the property’s value and future profitability.

- Review financial statements: Request and review the property’s financial statements, including income and expense reports, balance sheets, and rent rolls. This will provide a clear picture of the property’s financial performance, occupancy rates, and potential income streams.

- Assess legal and zoning compliance: Review the property’s legal documents, including leases, contracts, permits, and licenses. Ensure that the property is in compliance with zoning regulations, building codes, and any other legal requirements. Identify any potential legal issues or pending lawsuits that may impact the property’s value or operations.

- Confirm property boundaries: Hire a surveyor to verify the property boundaries and ensure that there are no encroachments or boundary disputes with neighboring properties. This will prevent potential conflicts or title issues in the future.

- Investigate environmental factors: Conduct an environmental assessment to identify any potential environmental hazards or contamination on the property. This is particularly important for properties with a history of industrial or hazardous activities.

- Research property title: Engage a title company to perform a thorough title search and ensure that the property’s title is clear of any liens, encumbrances, or other ownership disputes. Title insurance can provide added protection against any unforeseen title issues.

- Review lease agreements: If the property has existing leases, carefully review the terms and conditions of each lease agreement. Analyze the lease terms, rental rates, expiration dates, and any potential lease obligations or tenant disputes.

- Conduct market analysis: Analyze the local market conditions, including rental rates, vacancy rates, and comparable properties. This will help validate the property’s income potential and determine if the asking price is in line with market expectations.

It’s important to take your time and thoroughly review all aspects of the property during the due diligence process. Consider hiring professionals, such as attorneys, surveyors, inspectors, and environmental consultants, to assist you with the various aspects of due diligence.

By conducting thorough due diligence, you can identify any potential risks or issues associated with the property and make informed decisions before finalizing the purchase. This will help mitigate risks and ensure a smoother transition of ownership.

Financing Your Commercial Property Investment

When it comes to purchasing commercial property, financing plays a critical role in making the investment feasible and managing your cash flow. Here are some key considerations when it comes to financing your commercial property investment:

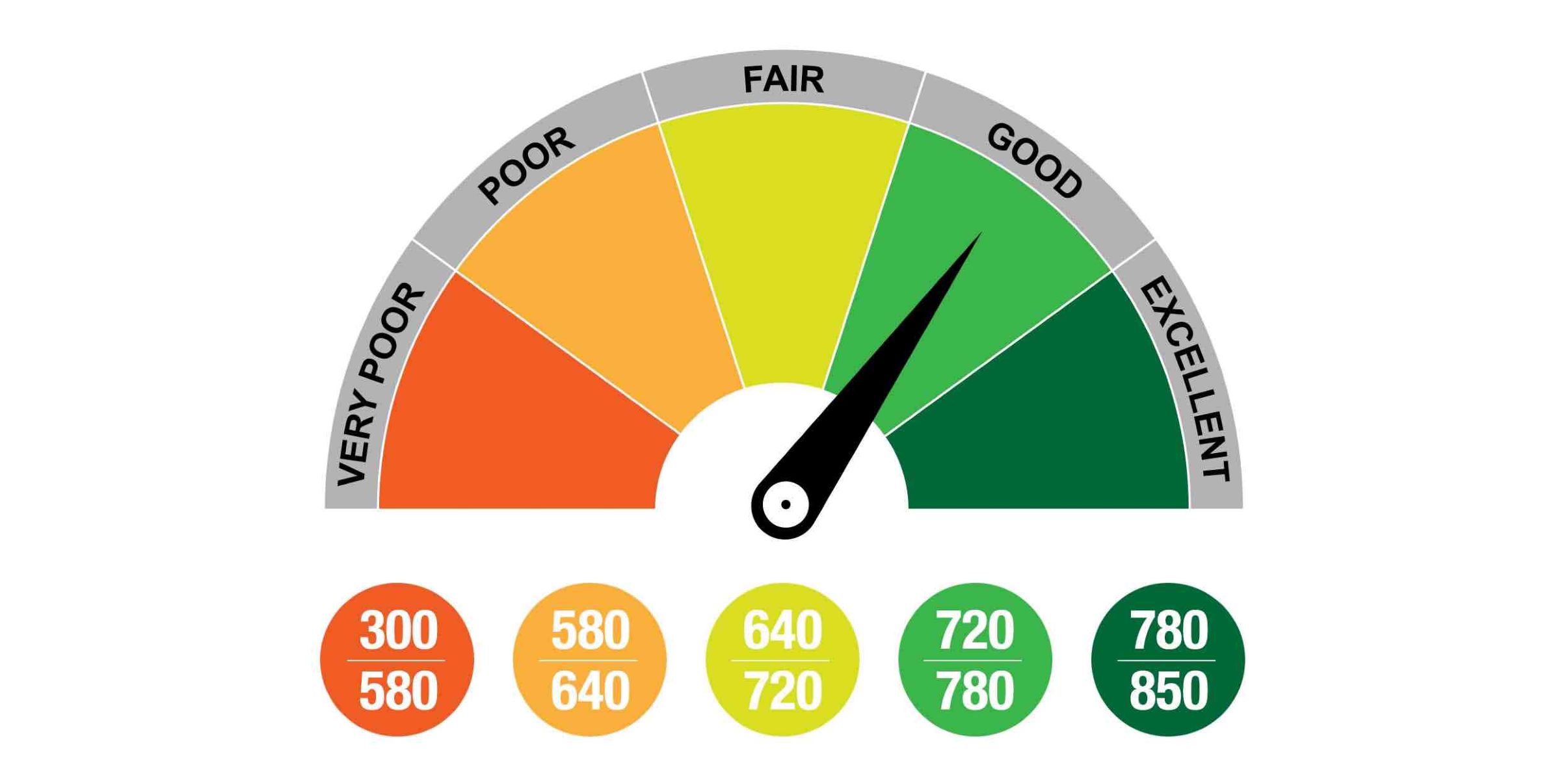

- Evaluate your financial situation: Assess your current financial situation, including your credit score, income, and assets. This will determine your eligibility for financing and influence the terms and conditions you can secure.

- Research different financing options: Explore various financing options available for commercial properties, such as traditional bank loans, commercial mortgage-backed securities (CMBS), or Small Business Administration (SBA) loans. Each option has its own requirements, rates, and repayment terms, so consider working with a mortgage broker to help identify the best fit for your investment.

- Prepare a strong loan application: Create a comprehensive loan application package that includes financial statements, property information, business plans, and other supporting documents. Presenting a well-prepared application to lenders will increase your chances of securing favorable financing terms.

- Consider down payment and collateral: Commercial property lenders typically require a larger down payment percentage compared to residential properties. Prepare your finances to provide a substantial down payment to secure financing. Additionally, be aware that lenders may require additional collateral, such as other properties, to minimize their risk.

- Review loan terms and interest rates: Analyze and compare loan terms, interest rates, and fees offered by different lenders. Ensure that the loan terms align with your investment strategy and financial goals. Consider seeking assistance from a financial advisor or mortgage broker to help you navigate the complexities of loan terms and conditions.

- Plan for ongoing expenses: Besides the loan payments, consider the ongoing expenses associated with owning and maintaining the commercial property. Account for costs such as property taxes, insurance, maintenance, and potential tenant vacancies. Proper budgeting will help you manage the property’s cash flow and ensure that you can meet your financial obligations.

- Safeguard against interest rate fluctuations: If you opt for a variable interest rate loan, be aware of potential interest rate fluctuations. Consider the impact of rising interest rates on your cash flow and ensure that you have contingency plans in place to manage any potential financial challenges.

- Consult with professionals: Seek advice from professionals in the finance and real estate industries. Mortgage brokers, attorneys, and financial advisors can provide valuable insights and guidance to help you secure financing that aligns with your investment goals.

Securing appropriate financing is an essential step in the commercial property buying process. Conduct thorough research, carefully assess your financial capabilities, and work with knowledgeable professionals to ensure that you secure the best financing option for your investment.

Negotiating the Purchase Agreement

Once you have identified a suitable commercial property and secured financing, the next step is navigating the negotiation process for the purchase agreement. Negotiating favorable terms can impact your investment outcome and protect your interests. Here are some key considerations when negotiating the purchase agreement:

- Engage a real estate attorney: It is crucial to work with a qualified real estate attorney who specializes in commercial transactions. They will review the purchase agreement, ensure that it protects your rights, and provide guidance throughout the negotiation process.

- Formulate your negotiation strategy: Clearly define your negotiation objectives and priorities. Understand your limits and be prepared to make compromises while still safeguarding your financial interests and investment goals.

- Thoroughly review the purchase agreement: Carefully read and understand all aspects of the purchase agreement, including price, contingencies, financing terms, closing date, and any special provisions or addendums. Identify any areas that require clarification or modification.

- Consider contingencies and due diligence: Include contingencies in the purchase agreement that allow you to conduct further due diligence, perform inspections, and ensure financing approval. These contingencies provide you with an exit strategy if any issues arise during the due diligence process.

- Negotiate the purchase price: Determine a fair and competitive purchase price based on market conditions, property evaluations, and potential returns. Be prepared to negotiate with the seller to reach a mutually beneficial agreement. Consider factors such as property condition, market trends, and any potential value-add opportunities.

- Negotiate financing terms: If there are specific financing terms outlined in the purchase agreement, negotiate to secure the most favorable terms for your investment. Negotiate interest rates, loan fees, down payment requirements, and any other financing-related clauses.

- Include appropriate warranties and representations: Ensure that the purchase agreement includes appropriate warranties and representations from the seller regarding the property’s condition, title, and any existing leases or contracts. These provisions protect your interests and provide legal recourse if there are issues discovered after closing.

- Consider seller concessions: Negotiate for potential seller concessions such as financial credits towards repairs, upgrades, or closing costs. These concessions can reduce your upfront expenses and improve the overall financial outcome of the investment.

- Review timelines and closing details: Clarify the timeline for due diligence, financing approval, and closing. Ensure that you have sufficient time to complete all required tasks and that the closing process is well-coordinated with all parties involved.

- Seek professional advice: Throughout the negotiation process, consult with your real estate attorney, financial advisor, or other professionals to obtain expert advice and guidance. Their expertise can help you navigate complex legal terms, protect your interests, and secure a favorable purchase agreement.

Negotiating the purchase agreement requires careful consideration and effective communication. Prioritize your objectives, be prepared to negotiate, and seek professional guidance to ensure that the final purchase agreement aligns with your investment goals and protects your financial interests.

Closing the Deal and Transferring Ownership

After successfully negotiating the purchase agreement, the final step in buying commercial property is the closing process. This is when the legal transfer of ownership takes place. Here are the key steps involved in closing the deal and transferring ownership:

- Coordinate with professionals: Work closely with your real estate attorney, lender, and other professionals involved in the transaction to ensure a smooth closing process. They will guide you through the necessary paperwork and tasks.

- Perform a final property walkthrough: Before the closing date, conduct a final walkthrough of the property to ensure that it is in the agreed-upon condition and any repairs or agreed-upon work have been completed.

- Review closing documents: Prior to closing, carefully review all closing documents prepared by your attorney. These may include the closing statement, deed, title insurance policy, loan documents, and other relevant paperwork. Ensure that all terms and details align with the negotiated purchase agreement.

- Arrange for funds: Work with your lender to arrange for the necessary funds to complete the purchase. This may involve wiring the funds or obtaining a cashier’s check for the closing costs, down payment, and any other agreed-upon expenses.

- Attend the closing: On the agreed-upon closing date, attend the closing meeting with your attorney, seller, and any other necessary parties (such as the title company or lender). During this meeting, you will sign the necessary documents to transfer ownership of the property.

- Verify title and insurance: Ensure that the title of the property is clear and transferred to you without any encumbrances or issues. Review the title insurance policy to protect your ownership interests and address any potential claims in the future.

- Pay closing costs: Pay the applicable closing costs, which may include fees for the title search, title insurance, attorney fees, transfer taxes, and other closing expenses. Your attorney or closing agent will provide a breakdown of these costs in advance.

- Record the deed: After the closing, the deed needs to be recorded with the appropriate government office to establish the legal transfer of ownership. Your attorney or title company will handle this step on your behalf.

- Obtain insurance and change utilities: Arrange for property insurance coverage and update utility accounts in your name. This ensures that the property is adequately protected and that you are responsible for the ongoing utility bills.

- Take possession of the property: Once the closing is complete and ownership is officially transferred, you can take possession of the property. Coordinate with the seller and any tenants to ensure a smooth transition.

Closing the deal and transferring ownership of a commercial property requires careful attention to detail and coordination with professionals. By following these steps and working closely with your attorney and other involved parties, you can successfully complete the transaction and take ownership of the commercial property.

Managing and Maintaining Your Commercial Property

Once you have purchased a commercial property, successful management and maintenance are crucial for maximizing its value and return on investment. Effective property management ensures smooth operations, tenant satisfaction, and long-term profitability. Here are key considerations for managing and maintaining your commercial property:

- Hire a property manager: Consider hiring a professional property manager to handle day-to-day operations, lease negotiations, tenant communications, and property maintenance. A skilled property manager can save you time, provide expert advice, and ensure that your property is well-maintained.

- Regular inspections: Perform regular inspections of the property to identify any maintenance or repair needs. Addressing issues promptly can prevent further damage and ensure tenant satisfaction.

- Maintain tenant relationships: Cultivate positive relationships with your tenants to promote tenant retention. Address their concerns promptly, communicate clearly, and provide necessary support to maintain a mutually beneficial relationship.

- Handle lease agreements: Ensure that lease agreements are well-drafted, enforceable, and compliant with local laws. Regularly review and renew leases, addressing any changes in rental rates, lease terms, or tenant requirements. Monitor lease expirations to proactively address tenant turnover.

- Enforce rent collection: Implement a streamlined rent collection process to ensure timely payments from tenants. Enforce lease terms regarding late fees, payment methods, and lease violations.

- Regular property maintenance: Implement a proactive maintenance plan to address repairs, renovations, and upkeep of the property. This includes routine cleaning, landscaping, and addressing any maintenance issues promptly to prevent further damage or safety hazards.

- Manage finances: Maintain meticulous financial records for the property, including income, expenses, and operating costs. Implement a budget and regularly review financial performance to ensure the property remains financially viable.

- Stay updated on regulations and trends: Stay informed about changes in local regulations, property codes, and industry trends. Comply with legal requirements, address safety concerns, and adapt to changing market conditions to stay competitive.

- Maintain communication: Establish clear lines of communication with tenants, property managers, and other stakeholders. Encourage open dialogue, address concerns promptly, and provide regular updates on property-related matters.

- Keep comprehensive records: Maintain thorough records of all property-related documents, including leases, maintenance logs, financial statements, and property improvements. This documentation is essential for legal compliance, financial reporting, and future property evaluations.

Effective management and maintenance of your commercial property require attention to detail, proactive measures, and open communication. By ensuring proper property management, you can safeguard the value of your investment, enhance tenant satisfaction, and optimize the financial performance of your commercial property.

Conclusion

Investing in commercial property can be a rewarding venture, offering a steady income stream and long-term appreciation potential. However, successfully buying and managing commercial property requires careful planning, thorough research, and strategic decision-making. In this comprehensive guide, we have explored the key steps involved in buying commercial property for investment.

We started by emphasizing the importance of researching the commercial property market and understanding your investment goals and budget. By conducting thorough research and setting clear objectives, you set the foundation for a successful investment journey.

Identifying suitable commercial properties involves considering factors like location, property type, rental income potential, and market trends. Carefully evaluating these factors helps you select properties that align with your investment goals and have the potential for long-term profitability.

Assessing the potential return on investment is crucial in understanding the financial viability of a commercial property. By considering financial metrics like NOI, cash-on-cash return, and cap rate, you can make informed investment decisions.

Conducting due diligence is essential to identify any potential risks or issues associated with the property. By thoroughly inspecting the property, reviewing financial statements, and assessing legal and environmental factors, you minimize the chances of surprises and protect your interests.

Financing your commercial property investment involves exploring different financing options, evaluating loan terms, and considering your financial capabilities. A well-structured financing plan ensures that you can afford the property and manage ongoing expenses effectively.

Negotiating the purchase agreement requires careful consideration of terms, price, contingencies, and other essential details. By working with professionals and having a clear negotiation strategy, you can secure a favorable agreement that aligns with your investment goals.

Closing the deal and transferring ownership involves coordinating with professionals, reviewing closing documents, and ensuring a smooth transition. The successful completion of the closing process finalizes the purchase and grants you ownership of the commercial property.

Finally, managing and maintaining your commercial property is crucial for its long-term success. By hiring a property manager, conducting regular inspections, maintaining tenant relationships, and staying on top of maintenance and finances, you can maximize the value and profitability of your investment.

Buying commercial property for investment requires knowledge, careful planning, and thorough execution. By following the steps outlined in this guide, you are well-equipped to embark on your journey as a successful commercial property investor. Remember to consult with professionals and adapt your strategies based on market conditions and trends. With the right approach, commercial property investment can be a lucrative and rewarding endeavor.