Finance

Home Modification Definition

Published: December 5, 2023

Discover the definition of home modification and how it relates to finance. Learn about the financial aspects of adapting your home to meet your needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Home Modification and Its Impact on Finances

Welcome to our blog post on home modification, an essential category on our page dedicated to finance. In this article, we will delve into the definition of home modification and explore how it can have a significant impact on your financial situation. So, if you’re curious to know more about this topic, keep reading!

What is Home Modification?

Home modification refers to the process of making changes or improvements to your home to better suit your needs and enhance your quality of life. These modifications are typically done to accommodate varying abilities and to make the home more accessible and safe for individuals with disabilities or elderly people.

Key Takeaways:

- Home modification is a process that involves making changes to your home to meet specific needs.

- These modifications are usually intended to improve accessibility and safety for individuals with disabilities or elderly residents.

Now that we have a better understanding of what home modification entails, let’s explore how it can impact your finances.

Financial Impact of Home Modification:

Undertaking home modification can have both immediate and long-term financial implications. Below are a few key points to consider:

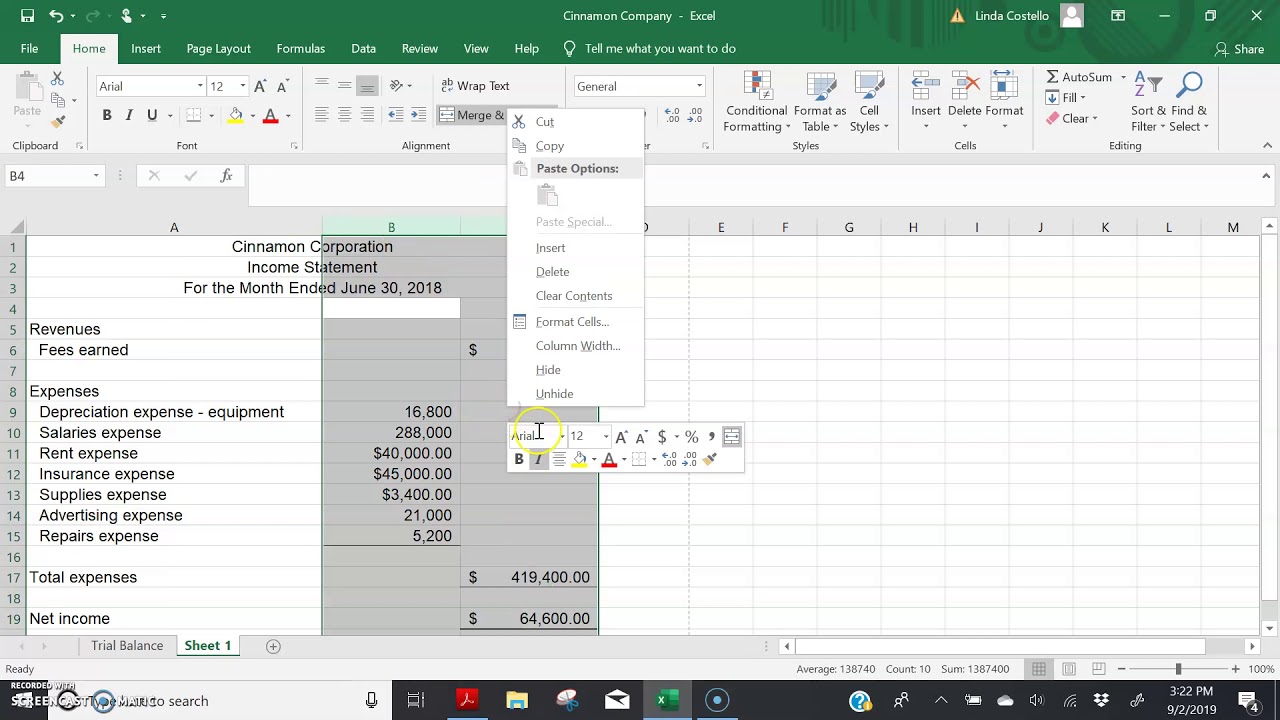

- Upfront Costs: Home modifications can involve various expenses, such as hiring contractors, purchasing specialized equipment, or installing assistive technologies. These upfront costs can be significant, and it’s crucial to budget and plan accordingly.

- Return on Investment: While home modification expenses can be substantial, they may also result in a higher resale value for your property. Features such as wheelchair ramps, accessible bathrooms, or modified entryways can make your home more attractive to potential buyers, allowing you to recoup some of your investment in the future.

- Funding Options: It’s important to explore funding options available for home modifications. These may include government assistance programs, grants, or loans specifically designed to help individuals with disabilities or senior citizens make necessary modifications to their homes.

- Insurance Coverage: Depending on your insurance policy, certain home modification expenses may be covered. It is advisable to review your policy and consult with your insurance provider to understand what costs can be reimbursed.

- Long-Term Savings: Home modifications can lead to long-term savings. For example, energy-efficient upgrades like installing solar panels or improving insulation can lower utility bills, making your home more cost-effective in the long run.

Understanding the financial impact of home modification is crucial for making informed decisions. It’s always wise to consult with financial advisors or experts who can guide you through this process and help you assess the potential benefits and drawbacks.

Conclusion

Home modification is a process that involves making changes to your home to better suit your needs. It can have a significant impact on your finances, with upfront costs, potential return on investment, available funding options, insurance coverage, and long-term savings considerations. By understanding these financial implications, you can make informed decisions and ensure that home modifications are a positive investment for your overall financial well-being.