Home>Finance>How Are Survivorship Life Insurance Policies Helpful In Estate Planning?

Finance

How Are Survivorship Life Insurance Policies Helpful In Estate Planning?

Modified: December 30, 2023

Survivorship life insurance policies are crucial in estate planning as they provide financial security for loved ones and help manage estate taxes. Discover how these policies can benefit your finance and family.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is survivorship life insurance?

- How does survivorship life insurance work?

- Benefits of survivorship life insurance in estate planning

- Maximizing the estate tax exemption

- Providing for heirs and beneficiaries

- Equalizing inheritance among multiple beneficiaries

- Creating liquidity for estate taxes and expenses

- Protecting and preserving the family business

- Utilizing survivorship life insurance trusts

- Conclusion

Introduction

When it comes to estate planning, ensuring the financial security of your loved ones and the preservation of your assets is of utmost importance. One effective tool that can help achieve these goals is a survivorship life insurance policy.

Survivorship life insurance, also known as second-to-die life insurance, is a type of policy that covers two individuals, typically spouses or business partners, and pays out the death benefit after both insured parties pass away. Unlike traditional life insurance policies that pay out upon the death of a single individual, survivorship life insurance provides benefits for estate planning purposes.

So how does survivorship life insurance work in the context of estate planning? In this article, we will explore the benefits and importance of survivorship life insurance and how it can play a crucial role in preserving your legacy and providing for your heirs and beneficiaries.

By understanding the mechanics and advantages of survivorship life insurance, you can make more informed decisions when it comes to your estate planning strategies. Let’s dive deeper into this topic and uncover how survivorship life insurance can be helpful in your estate planning endeavors.

What is survivorship life insurance?

Survivorship life insurance, also known as second-to-die life insurance, is a unique type of life insurance policy that covers two individuals under a single policy. This means that the death benefit is not paid out until both insured parties pass away. It is commonly used by couples or business partners as part of their estate planning strategy.

Unlike traditional life insurance policies that provide coverage for the death of one individual, survivorship life insurance offers coverage for the death of both insured parties. This makes it an attractive option for individuals looking to protect their estates and leave a legacy behind.

Survivorship life insurance policies can be either whole life or universal life policies. Whole life policies provide coverage for the entire lifetime of the insured parties, while universal life policies offer more flexibility in terms of premium payments and death benefit amount.

One of the main reasons why survivorship life insurance is used in estate planning is that it can provide significant financial support to beneficiaries after the death of both insured parties. This can be crucial in ensuring the financial security and stability of heirs, especially if they rely on the assets and income of the insured individuals.

Another important aspect of survivorship life insurance is that it can help cover estate taxes and other expenses that may arise upon the death of both insured parties. Since the death benefit is paid out after the second insured person passes away, this allows the policy to provide liquidity and ensure that there are sufficient funds available to cover any financial obligations.

While survivorship life insurance policies may not be suitable for everyone, they can offer unique benefits for those who are looking to create a solid estate plan. Whether you have substantial assets, a family business, or complex estate planning needs, survivorship life insurance can be a valuable tool in achieving your goals and preserving your legacy.

How does survivorship life insurance work?

Survivorship life insurance operates on the premise that the death benefit is paid out after both insured parties pass away. This means that the policy remains in force as long as one of the insured individuals is alive, but the payout is deferred until the death of the second insured person. This unique feature distinguishes survivorship life insurance from traditional life insurance policies that pay out upon the death of a single individual.

When the second insured party dies, the death benefit is paid out to the specified beneficiaries or the designated trust. The beneficiaries can include children, grandchildren, or any other individuals or organizations that the policyholder wishes to provide for. The death benefit can be a lump sum payment or structured as periodic payments, depending on the terms of the policy and the preferences of the policyholder.

It is important to note that survivorship life insurance is often used for estate planning purposes, rather than for the immediate financial needs of the insured parties. The primary goal is to ensure the financial security of beneficiaries and provide a source of funding to cover estate taxes, debts, and other expenses that may arise upon the death of both insured individuals.

One of the advantages of survivorship life insurance is that the premium payments are typically lower compared to individual life insurance policies. Since the policy covers two individuals, the risk for the insurance company is spread across both lives, leading to lower premiums. This can be particularly beneficial for individuals who may have difficulty obtaining individual life insurance due to health issues or other factors.

It is important to consult with a financial advisor or an experienced insurance professional when considering survivorship life insurance. They can help assess your unique needs and circumstances and guide you in choosing the right policy that aligns with your estate planning goals. Additionally, they can provide insight into the tax implications, cash value accumulation, and other important factors associated with survivorship life insurance.

In summary, survivorship life insurance offers a distinct approach to estate planning by providing coverage for two insured individuals and paying out the death benefit after both parties pass away. Its deferred payout feature, lower premiums, and ability to cover estate taxes and expenses make survivorship life insurance an attractive option for individuals looking to protect their assets and provide for their loved ones in the long term.

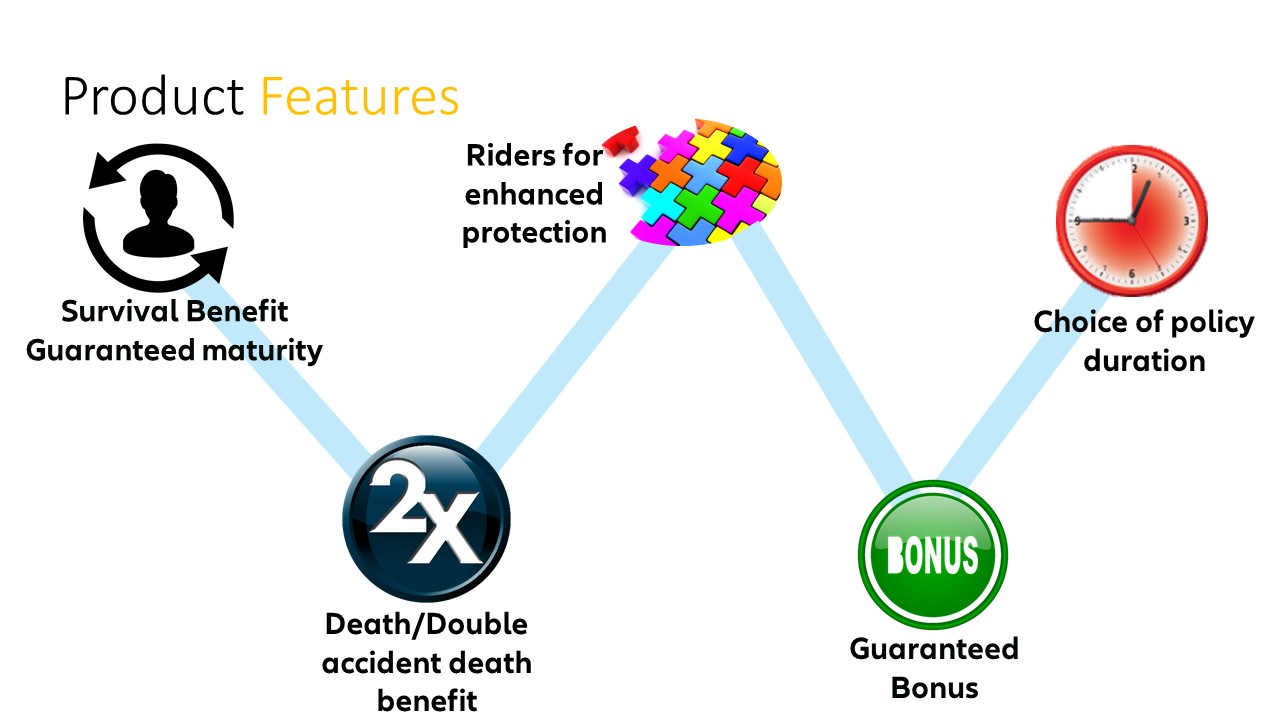

Benefits of survivorship life insurance in estate planning

Survivorship life insurance can play a crucial role in estate planning by providing a range of benefits that help ensure the financial security of your loved ones and the preservation of your assets. Let’s explore some of the key advantages of incorporating survivorship life insurance into your estate planning strategy:

- Maximizing the estate tax exemption: Since the death benefit from a survivorship life insurance policy is paid out after both insured parties pass away, it can be used to cover estate taxes that may be levied on high-value estates. By utilizing the death benefit, you can maximize the estate tax exemption and ensure that more of your assets are passed on to your beneficiaries.

- Providing for heirs and beneficiaries: Survivorship life insurance ensures that your loved ones are financially supported even after you and your partner are no longer present. The death benefit can provide a source of income for beneficiaries, allowing them to maintain their standard of living, pay for education expenses, or accomplish other financial goals.

- Equalizing inheritance among multiple beneficiaries: If you have multiple children or beneficiaries, survivorship life insurance can help equalize their inheritance. By using the death benefit to supplement assets that may be distributed unequally, you can ensure fair and balanced financial support for all beneficiaries.

- Creating liquidity for estate taxes and expenses: Estate taxes and other expenses, such as probate fees and legal costs, can quickly deplete the value of an estate. Survivorship life insurance provides a source of immediate liquidity to cover these costs, enabling your loved ones to receive their inheritance without the burden of financial obligations.

- Protecting and preserving the family business: Many family businesses face significant challenges when transitioning from one generation to the next. Survivorship life insurance can help protect the business by providing funds to buy out the interests of surviving family members or other shareholders, maintaining the continuity and financial stability of the company.

In addition to these benefits, survivorship life insurance can be utilized in conjunction with other estate planning tools, such as trusts, to maximize the effectiveness of your overall strategy. Creating a survivorship life insurance trust can provide additional tax benefits and help facilitate the seamless transfer of assets to your chosen beneficiaries.

It is important to work closely with a knowledgeable estate planning attorney or financial advisor to tailor a survivorship life insurance plan that aligns with your specific needs and objectives. They can assist in determining the appropriate coverage amount, policy structure, and beneficiary designations to ensure that your estate planning goals are met.

By incorporating survivorship life insurance into your estate planning, you can protect your assets, provide for your loved ones, and leave a lasting legacy for future generations.

Maximizing the estate tax exemption

One of the significant benefits of using survivorship life insurance in estate planning is the ability to maximize the estate tax exemption. Estate taxes can be a substantial burden on high-value estates, potentially leading to the depletion of assets that were intended for beneficiaries.

The estate tax exemption is the threshold at which an estate becomes subject to federal estate taxes. By strategically utilizing survivorship life insurance, you can effectively leverage the death benefit to minimize or eliminate estate taxes, allowing more of your assets to be passed on to your loved ones.

Here’s how it works:

1. Pooling the exemption: Married couples often have the advantage of combining their individual estate tax exemptions. This means that they can pass on a higher value of assets to their beneficiaries without incurring estate taxes. Survivorship life insurance allows couples to maximize this pooled exemption by providing a source of funds to cover any remaining estate tax liability.

2. Preserving and growing assets: By using survivorship life insurance to pay estate taxes, you can keep more of your assets intact for your beneficiaries. This is especially beneficial if you have valuable assets, such as real estate, investments, or business interests, that you want to pass on to the next generation. The death benefit from the policy can help ensure that these assets remain in the family without the need for a forced sale to cover estate tax liabilities.

3. Taking advantage of a step-up in basis: When beneficiaries inherit assets, their cost basis for those assets is typically “stepped-up” to the fair market value at the time of the original owner’s death. This means that if the assets are sold later, the capital gains tax owed will be based on the increase in value from the date of inheritance. By using survivorship life insurance to cover estate taxes, you can preserve the value of these assets, potentially allowing your beneficiaries to benefit from a higher stepped-up basis.

It is important to note that the federal estate tax exemption threshold is subject to change based on legislation and government regulations. As of 2021, the federal estate tax exemption is set at $11.7 million per person, which means that married couples can pass on up to $23.4 million without incurring federal estate taxes. However, it is recommended to consult with a tax professional or estate planning attorney to stay updated on any potential changes and assess your specific situation.

In summary, survivorship life insurance can be a valuable tool in maximizing the estate tax exemption by pooling the exemption amounts of married couples, preserving and growing assets for beneficiaries, and taking advantage of the step-up in basis. By leveraging the death benefit from a survivorship life insurance policy, you can significantly reduce the impact of estate taxes and ensure that more of your wealth is transferred to your loved ones.

Providing for heirs and beneficiaries

One of the primary goals of estate planning is to ensure that your loved ones are financially supported even after you’re no longer there to provide for them. Survivorship life insurance can be a powerful tool in achieving this objective by providing a reliable source of funds for your heirs and beneficiaries.

Here are some key ways in which survivorship life insurance can help provide for your loved ones:

- Financial stability: The death benefit from a survivorship life insurance policy can provide a significant financial cushion for your beneficiaries. This can be especially crucial if you are the primary breadwinner or if your assets are tied up in illiquid investments, such as real estate or a family business. The funds from the policy can help your beneficiaries maintain their standard of living, pay for essential expenses, and pursue their own financial goals.

- Education expenses: Survivorship life insurance can help ensure that your children or grandchildren have the financial means to pursue higher education. The death benefit can be used to cover tuition fees, textbooks, and other educational expenses, alleviating the burden on your heirs and allowing them to invest in their future.

- Debt repayment: Inheriting debts can create a significant burden for your loved ones. The death benefit from the survivorship life insurance policy can be used to settle outstanding debts, such as mortgages, loans, and credit card balances, relieving your beneficiaries of this financial obligation and providing them with a fresh start.

- Special needs considerations: If you have a dependent with special needs, ensuring their long-term financial security is a top priority. Survivorship life insurance can help create a financial safety net for their ongoing care and support, covering medical expenses, therapy, and other specialized needs that may arise.

- Legacy preservation: By providing for your heirs and beneficiaries through survivorship life insurance, you can leave behind a lasting legacy. The financial support you provide can help your loved ones achieve their dreams and aspirations, creating a positive impact for generations to come.

It is crucial to carefully consider the coverage amount when selecting a survivorship life insurance policy. Take into account the future financial needs of your beneficiaries, including anticipated expenses, potential inflation, and any outstanding obligations.

Consulting with a financial advisor or estate planning professional can help ensure that the survivorship life insurance policy aligns with your unique circumstances and the specific needs of your heirs and beneficiaries. They can assist in assessing the appropriate coverage amount and guide you in making informed decisions to provide maximum financial support for your loved ones.

By incorporating survivorship life insurance into your estate plan, you can have peace of mind knowing that your heirs and beneficiaries will be well taken care of, even in your absence.

Equalizing inheritance among multiple beneficiaries

When it comes to estate planning, one common concern is ensuring that all beneficiaries receive an equal share of the inheritance. This is particularly important when there are multiple heirs, as unequal distribution can lead to disputes and strained relationships among family members. Survivorship life insurance can be a valuable tool in equalizing inheritance and promoting fairness in the distribution of assets.

Here’s how survivorship life insurance can help achieve this:

1. Balancing asset distribution: Assets may not be easily dividable or distributed equally among beneficiaries. For example, if your estate consists of a large family home or a business, it may be challenging to split these assets into equal portions. Survivorship life insurance can provide an additional source of funds to balance out the value of the assets, ensuring that each beneficiary receives an equitable portion.

2. Offset disparities in other inheritances: In some cases, you may have already gifted or bequeathed substantial assets to some of your beneficiaries during your lifetime. Survivorship life insurance can provide a means to compensate for any disparities in inheritances, allowing you to balance out the distribution of wealth among all your heirs.

3. Providing for charitable beneficiaries: If you have charitable organizations or causes that are important to you, survivorship life insurance can also help ensure that they receive a fair share of your estate. By naming a charitable organization as a beneficiary on the policy, you can designate a portion of the death benefit to be directed towards philanthropic endeavors, further equalizing the overall distribution of assets.

4. Managing family dynamics: Unequal inheritances can often lead to family conflicts and strained relationships. By implementing a survivorship life insurance policy to equalize inheritance, you can mitigate potential disagreements and disputes among your beneficiaries. This can help foster harmony and maintain strong family connections after your passing.

Incorporating survivorship life insurance into your estate plan can give you the peace of mind that your heirs will be treated fairly and receive an equivalent portion of your assets. It is essential to work with an experienced estate planning attorney or financial advisor to ensure that the policy is structured in a way that aligns with your specific intentions and addresses the unique needs of your beneficiaries.

Regular reviews of your estate plan are also crucial, as life circumstances and family dynamics may change over time. Updating your survivorship life insurance policy and related beneficiary designations can help ensure that the equal distribution of assets among beneficiaries is maintained and reflective of your current wishes.

By utilizing survivorship life insurance in your estate plan, you can promote fairness and harmony among your beneficiaries, helping to preserve familial relationships and minimize potential conflicts over inheritance.

Creating liquidity for estate taxes and expenses

When it comes to estate planning, one consideration that should not be overlooked is the potential financial burden of estate taxes and various expenses that may arise after your passing. These costs can put a strain on your estate and even force the sale of valuable assets to cover them. Survivorship life insurance can play a crucial role in creating liquidity to cover these obligations, ensuring that your loved ones can inherit your assets without the financial burden.

Here are some key advantages of using survivorship life insurance to create liquidity for estate taxes and expenses:

1. Immediate availability of funds: Upon the death of both insured parties, the survivorship life insurance policy pays out the death benefit to the specified beneficiaries or trusts. This provides immediate access to a significant sum of money that can be used to cover estate taxes and other expenses without the need to liquidate assets hastily.

2. Preserving family assets: By using survivorship life insurance to cover estate taxes and expenses, you can safeguard your family’s valuable assets, such as real estate, business interests, or investment portfolios. This ensures that these assets remain intact and can be passed on to future generations without being forced to sell them at potentially unfavorable terms.

3. Avoiding a forced sale: If your estate lacks the necessary liquidity to cover estate taxes and expenses, your beneficiaries may be forced to sell assets quickly to meet these obligations. This could lead to the sale of assets at lower than market value or under less favorable circumstances. Utilizing survivorship life insurance can prevent such a scenario, providing the necessary funds to cover these costs and allowing your beneficiaries to retain the assets for future use or strategic planning.

4. Simplifying estate settlement: Survivorship life insurance proceeds are typically not subject to probate, allowing for a smoother and more efficient settlement process. This can help expedite the transfer of funds to beneficiaries and alleviate any delays or complexities resulting from the probate process.

5. Supplementing other sources of funds: Even if you have other assets or savings set aside to cover estate taxes and expenses, survivorship life insurance can provide an additional layer of financial support. This can help preserve your other assets for other purposes, such as providing ongoing income for your surviving spouse or supporting specific bequests or charitable donations.

It is important to regularly review and update your survivorship life insurance coverage to ensure that it aligns with your current estate planning goals and financial circumstances. As your estate grows or changes, you may need to adjust the policy’s coverage amount to maintain adequate liquidity for potential tax liabilities and expenses.

Working with an experienced estate planning attorney or financial advisor can help ensure that your survivorship life insurance policy is structured in a way that optimizes liquidity for estate taxes and expenses. They can provide valuable guidance on the appropriate coverage amount, beneficiary designations, and trustee selection to maximize the benefits of the policy in your specific situation.

By utilizing survivorship life insurance to create liquidity for estate taxes and expenses, you can protect your family assets, streamline the estate settlement process, and alleviate the financial burden on your loved ones, allowing them to focus on the legacy you leave behind.

Protecting and preserving the family business

A family business is often the result of years of hard work, dedication, and passion. It holds not just financial value but also sentimental significance for the family members involved. Protecting and preserving the family business for future generations is a vital aspect of estate planning, and survivorship life insurance can play a crucial role in achieving this goal.

Here are some key ways in which survivorship life insurance helps in safeguarding the family business:

1. Continuity in ownership: Survivorship life insurance can provide the necessary funding to buy out the interests of surviving family members or other shareholders in the event of the death of one or both owners. This ensures that control and ownership of the business remain in the hands of the family and allows for a seamless transition to the next generation.

2. Providing liquidity for business expenses: When a key person in the family business passes away, there can be immediate financial needs and expenses, such as funeral costs, estate settlement fees, and liabilities. Survivorship life insurance can provide the liquidity required to cover these expenses, allowing the family business to continue operating smoothly without disruptions.

3. Funding a succession plan: Survivorship life insurance can be used to finance a well-thought-out succession plan for the family business. It can provide the funds needed to implement the plan, whether it involves providing training and support for the next generation or bringing in external professionals to manage the business after the owners’ passing.

4. Equalizing the distribution among heirs: In family businesses with multiple heirs, the challenge of allocating shares or ownership interests fairly can be complex. Survivorship life insurance can help equalize the distribution by providing funds to heirs who may not be directly involved in the business, while ensuring that those who wish to continue running the business have the necessary financial resources to do so.

5. Protecting against estate taxes: Estate taxes can pose a significant challenge for family businesses, as they often have a high value tied up in tangible and intangible assets. Survivorship life insurance can help cover estate taxes upon the death of both owners, ensuring that the family business does not need to be sold or divided to settle these tax obligations.

It is important to work closely with a team of professionals, including an estate planning attorney, financial advisor, and possibly a business valuation expert, to create a comprehensive plan that incorporates survivorship life insurance into the overall strategy for your family business. They can help navigate the complexities of business succession planning, tax considerations, and the specific needs of your family situation.

Regularly reviewing and updating your survivorship life insurance coverage is essential as the value of the business and family dynamics may change over time. This ensures that the policy remains aligned with the evolving needs of the family business and the goals you have set for its long-term success.

By leveraging the benefits of survivorship life insurance, you can protect the legacy of your family business, ensure a smooth transition to the next generation, and preserve the values and hard work that have been invested in building the business over the years.

Utilizing survivorship life insurance trusts

A survivorship life insurance trust, also known as a second-to-die life insurance trust, is a valuable estate planning tool that can enhance the benefits of survivorship life insurance policies. By establishing and utilizing such a trust, you can enjoy additional advantages and increased control over the distribution of the policy’s death benefit.

Here are some key reasons to consider using a survivorship life insurance trust:

1. Estate tax efficiency: Placing the survivorship life insurance policy within a trust can help minimize estate taxes. By removing the policy from your taxable estate, the death benefit can be shielded from estate taxes, potentially increasing the overall amount available to beneficiaries.

2. More control and flexibility: Through the trust, you can define how and when the death benefit is distributed to beneficiaries. Whether it is disbursing the funds outright or establishing specific rules for distribution, a trust provides a level of control and flexibility that allows you to tailor the timing and conditions of the benefit payments according to your wishes.

3. Protecting the death benefit: Assets held within the trust are protected from creditors, lawsuits, and potential financial difficulties that beneficiaries may face. This can help ensure that the death benefit remains intact for its intended purpose and does not become vulnerable to external claims.

4. Preserving eligibility for government benefits: If you have beneficiaries with special needs who rely on government benefits, receiving a substantial inheritance directly may jeopardize their eligibility. By using a trust, you can safeguard their eligibility by structuring the distribution of the death benefit in a way that does not affect their access to essential government assistance programs.

5. Encouraging responsible financial management: A trust allows you to designate a trustee who will manage and administer the death benefit on behalf of the beneficiaries. This arrangement ensures that the funds are disbursed responsibly and according to your wishes, protecting beneficiaries from making impulsive or financially unwise decisions.

In order to establish a survivorship life insurance trust, it is crucial to work with an experienced estate planning attorney. They will guide you through the process of setting up the trust and help you navigate the legal intricacies involved, including drafting the trust document, reviewing beneficiary designations, and ensuring compliance with applicable laws and regulations.

It is also important to review and update your survivorship life insurance trust regularly to ensure that it remains aligned with your changing circumstances and objectives. Regular communication with the trustee is key to ensure that they understand your intentions and have the necessary information to carry out your wishes effectively.

By utilizing a survivorship life insurance trust, you can maximize the benefits of your policy, maintain control over the distribution of the death benefit, and provide added protection and financial security for your beneficiaries in a structured and responsible manner.

Conclusion

In the realm of estate planning, survivorship life insurance offers significant advantages for individuals and families looking to secure their financial future and create a lasting legacy. By understanding the benefits and mechanics of survivorship life insurance, you can make informed decisions that align with your estate planning goals and objectives.

Survivorship life insurance not only provides financial security for your loved ones but also offers unique advantages in various areas of estate planning. It can help maximize the estate tax exemption, ensuring that more of your assets are passed on to your beneficiaries. Additionally, survivorship life insurance enables you to provide for your heirs and beneficiaries, balancing inheritances among multiple individuals and offering financial stability for their future endeavors.

Furthermore, survivorship life insurance creates liquidity to cover estate taxes and expenses, protecting valuable assets and avoiding the need for a forced sale. It also plays a vital role in safeguarding and preserving the family business, ensuring a smooth transition and long-term continuity.

Utilizing a survivorship life insurance trust allows for additional benefits, such as estate tax efficiency, increased control over distribution, and the protection of the death benefit from creditors. It also helps ensure responsible financial management and preserves eligibility for government benefits for beneficiaries with special needs.

To make the most of survivorship life insurance in your estate planning, it is essential to consult with experienced professionals, such as estate planning attorneys and financial advisors. They will guide you through the intricacies of establishing and maintaining a survivorship life insurance policy and help tailor the strategy to your unique circumstances and goals.

As you journey through the estate planning process, remember that it is important to regularly review and update your survivorship life insurance coverage and overall estate plan. Life circumstances, tax laws, and family dynamics may change over time, requiring adjustments to ensure that your intentions are effectively carried out.

By leveraging the benefits of survivorship life insurance, you can create a solid foundation for your estate plan, preserve your wealth, provide for your loved ones, and leave a lasting legacy that positively impacts future generations.