Home>Finance>Where Does Accumulated Amortization Go On The Balance Sheet

Finance

Where Does Accumulated Amortization Go On The Balance Sheet

Modified: December 30, 2023

Learn about where accumulated amortization is reported on the balance sheet in the field of finance. Understand its impact on financial statements and how it affects a company's overall financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to this comprehensive guide on understanding where accumulated amortization goes on the balance sheet. As an essential element of financial reporting, the balance sheet provides a snapshot of a company’s financial position at a given point in time. It includes assets, liabilities, and equity. One crucial aspect of the balance sheet is capturing the amortization of intangible assets.

Amortization refers to the systematic write-off of intangible assets over their useful life. Intangible assets, such as patents, trademarks, copyrights, and goodwill, are valuable assets that contribute to a company’s long-term success but cannot be physically touched or measured. Unlike tangible assets like buildings or equipment, which can be depreciated over time, intangible assets are amortized.

In this guide, we will explore where accumulated amortization is recorded on the balance sheet. We will delve into the treatment of accumulated amortization, its impact on financial statements, and why understanding this concept is crucial for investors, creditors, and other stakeholders.

Understanding the placement of accumulated amortization on the balance sheet is vital because it provides transparency regarding the true value and cost of intangible assets. This knowledge allows users of financial statements to make informed decisions about a company’s financial health and its ability to generate future profits.

So, let’s dive into the fascinating world of accumulated amortization and discover its significance in financial reporting.

Balance Sheet Overview

Before we delve into the details of where accumulated amortization goes on the balance sheet, let’s start with a brief overview of what the balance sheet is and its purpose in financial reporting.

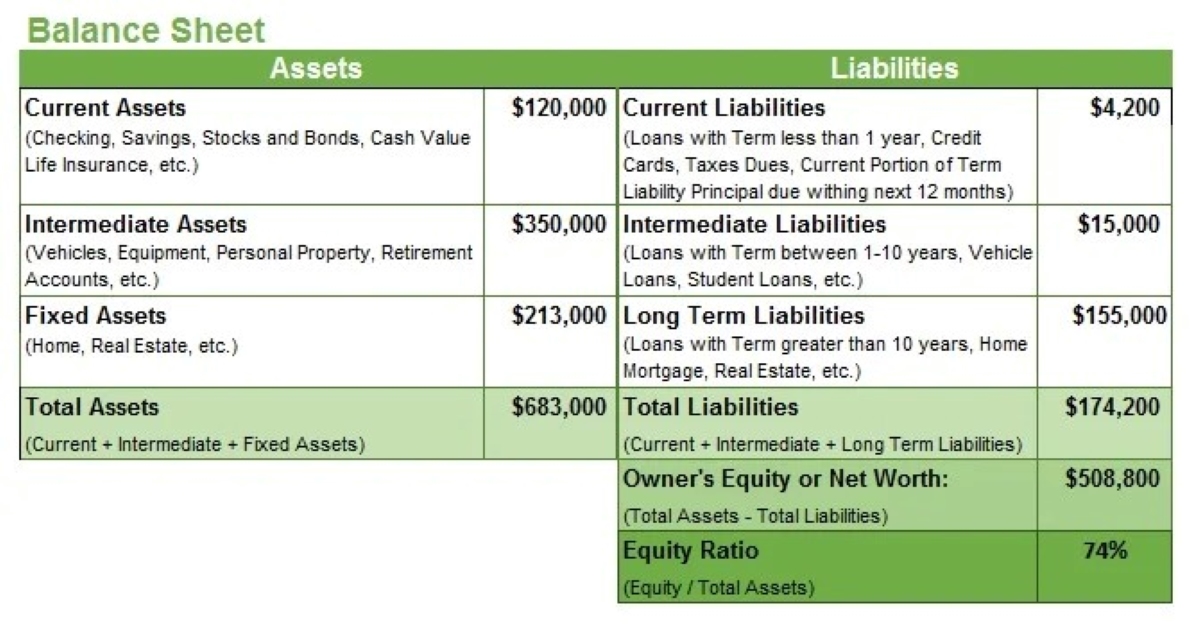

The balance sheet, also known as the statement of financial position, is a fundamental financial statement that provides a snapshot of a company’s financial position. It presents a summary of what a company owns (assets), what it owes (liabilities), and its net worth (equity) at a specific point in time.

The balance sheet follows the basic accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet always balances, hence the name.

Assets represent the resources owned by a company, which can be classified into current assets (those expected to be converted into cash within one year) and non-current assets (those expected to be held for more than one year). Liabilities are the obligations of the company, and they can also be classified into current liabilities (due within one year) and non-current liabilities (due after one year). Equity represents the residual interest in the assets after deducting liabilities.

The primary purpose of the balance sheet is to provide stakeholders with a snapshot of a company’s financial health, including its liquidity, solvency, and ability to generate future profits. Investors, creditors, and analysts use the balance sheet to assess a company’s financial position and make informed decisions.

Now that we have a basic understanding of the balance sheet, let’s explore how amortization fits into this financial statement and where accumulated amortization is recorded.

Understanding Amortization

In order to understand where accumulated amortization goes on the balance sheet, it’s important to first grasp the concept of amortization and its significance in financial reporting.

Amortization is the process of allocating the cost of intangible assets over their estimated useful life. Intangible assets are assets that lack physical substance but have value to the business. Examples of intangible assets include patents, trademarks, copyrights, franchises, and goodwill.

Unlike tangible assets, which can be depreciated over time, intangible assets are amortized. Depreciation is the allocation of the cost of tangible assets, such as buildings or equipment, whereas amortization applies to intangible assets.

The purpose of amortization is to match the cost of acquiring intangible assets with the periods over which they provide value to the business. It recognizes that the economic benefits derived from intangible assets are typically spread over several accounting periods rather than being realized immediately.

When an intangible asset is acquired, its cost is recorded on the balance sheet as an asset. However, rather than being reported at its original cost indefinitely, the asset’s cost is gradually reduced over time through amortization.

The amortization expense is recognized and recorded on the income statement, reducing the asset’s value on the balance sheet. As a result, each year, a portion of the asset’s cost is expensed, reflecting the consumption of its economic benefits over time.

It’s important to note that not all intangible assets are amortized. Some intangible assets, such as trademarks with indefinite useful lives, are not subject to amortization. Instead, they are tested for impairment periodically to ensure their carrying value is not higher than their recoverable amount.

Now that we have a clear understanding of amortization and its purpose, let’s explore where accumulated amortization is recorded on the balance sheet.

Where Does Accumulated Amortization Go on the Balance Sheet

Accumulated amortization is the cumulative amount of amortization expenses recorded for an intangible asset since its acquisition. It represents the total reduction in value of the asset over time. Accumulated amortization is a contra-asset account, meaning it has a credit balance and is subtracted from the cost of the intangible asset on the balance sheet.

On the balance sheet, accumulated amortization is typically presented as a deduction below the intangible asset it relates to. It is commonly found in the non-current asset section of the balance sheet, alongside the intangible asset being amortized.

This presentation allows stakeholders to see the original cost of the intangible asset and the cumulative reduction in value due to amortization. By subtracting the accumulated amortization from the intangible asset’s cost, the net carrying value or book value of the asset can be determined.

For example, let’s say a company purchased a patent with a cost of $100,000. Over the years, it has recorded $20,000 in annual amortization expense. After three years, the accumulated amortization would be $60,000, and the net carrying value of the patent would be $40,000 ($100,000 – $60,000).

It’s important to note that accumulated amortization is specific to each intangible asset and is not combined with other contra-asset accounts, such as accumulated depreciation for tangible assets. Each intangible asset has its own accumulated amortization account to track the reduction in value separately.

By separating accumulated amortization from other balances, such as accumulated depreciation, the balance sheet provides transparency regarding the amortization expense for each intangible asset. This allows stakeholders to assess the impact of amortization on the company’s overall financial position and the remaining value of its intangible assets.

To summarize, accumulated amortization is recorded as a contra-asset account on the balance sheet, deducted from the cost of the intangible asset it relates to. This presentation provides stakeholders with a clear view of the amortization expense and the net carrying value of the intangible asset.

Treatment of Accumulated Amortization

The treatment of accumulated amortization on the balance sheet reflects the gradual reduction in the value of intangible assets over time. As mentioned earlier, accumulated amortization is presented as a contra-asset account, deducted from the cost of the intangible asset it relates to.

When an intangible asset is initially recorded on the balance sheet, it is reported at its cost. As each accounting period passes, the accumulated amortization account is incrementally increased by the amortization expense recorded on the income statement. This reduces the carrying value of the asset and reflects its decreasing value as it is used or consumed over time.

The treatment of accumulated amortization has several important implications:

- Reduction in Carrying Value: Accumulated amortization represents the total amount of the intangible asset’s cost that has been expensed thus far. As the accumulated amortization increases, the carrying value of the intangible asset decreases. This reflects the fact that the asset’s value is being gradually used up or diminished through the amortization process.

- Separation from the Intangible Asset: By presenting accumulated amortization as a separate contra-asset account beneath the intangible asset, financial statements provide transparency in tracking the reduction in value for each specific asset. This separation allows stakeholders to assess the remaining value of individual intangible assets more accurately.

- Assessment of Impairment: The accumulated amortization balance is vital in evaluating the need for impairment of intangible assets. If the carrying value of an intangible asset exceeds its recoverable amount (i.e., the higher of its fair value less costs of disposal or its value in use), impairment must be recognized by reducing the carrying value and creating a separate impairment loss on the income statement. Assessing the accumulated amortization balance is crucial in determining the potential impairment of intangible assets.

- Different Treatment Than Tangible Assets: Accumulated amortization is specific to intangible assets and should not be confused with accumulated depreciation, which is used for tangible assets. While both accumulated amortization and accumulated depreciation represent the reduction in value of assets over time, they are reported separately on the balance sheet to provide clarity and distinction between the different types of assets.

The treatment of accumulated amortization ensures accurate and transparent reporting of intangible asset value and its gradual consumption over time. By deducting accumulated amortization from the cost of the intangible asset, stakeholders can assess the net carrying value and make informed decisions about the asset’s remaining value and potential impairment.

Impact on Financial Statements

The recording of accumulated amortization on the balance sheet has a significant impact on a company’s financial statements. It affects both the balance sheet and the income statement, providing valuable insights into the company’s financial position and performance.

Let’s explore the impact of accumulated amortization on the financial statements:

- Balance Sheet: The balance sheet reflects the cumulative effect of accumulated amortization on the value of intangible assets. As discussed earlier, accumulated amortization is deducted from the cost of the intangible asset, resulting in a reduction in the asset’s carrying value. This reduction represents the portion of the asset’s cost that has been expensed to reflect its decrease in value over time. By deducting accumulated amortization, the balance sheet presents the net carrying value of the intangible asset, enabling stakeholders to assess its remaining value.

- Income Statement: The income statement reflects the impact of amortization expenses on a company’s profitability. Each period, a portion of the intangible asset’s cost is recorded as an amortization expense on the income statement. This expense reduces the company’s net income, reflecting the consumption of the asset’s economic benefits over time. The amortization expense is typically recognized on a straight-line basis, evenly allocating the cost over the asset’s estimated useful life.

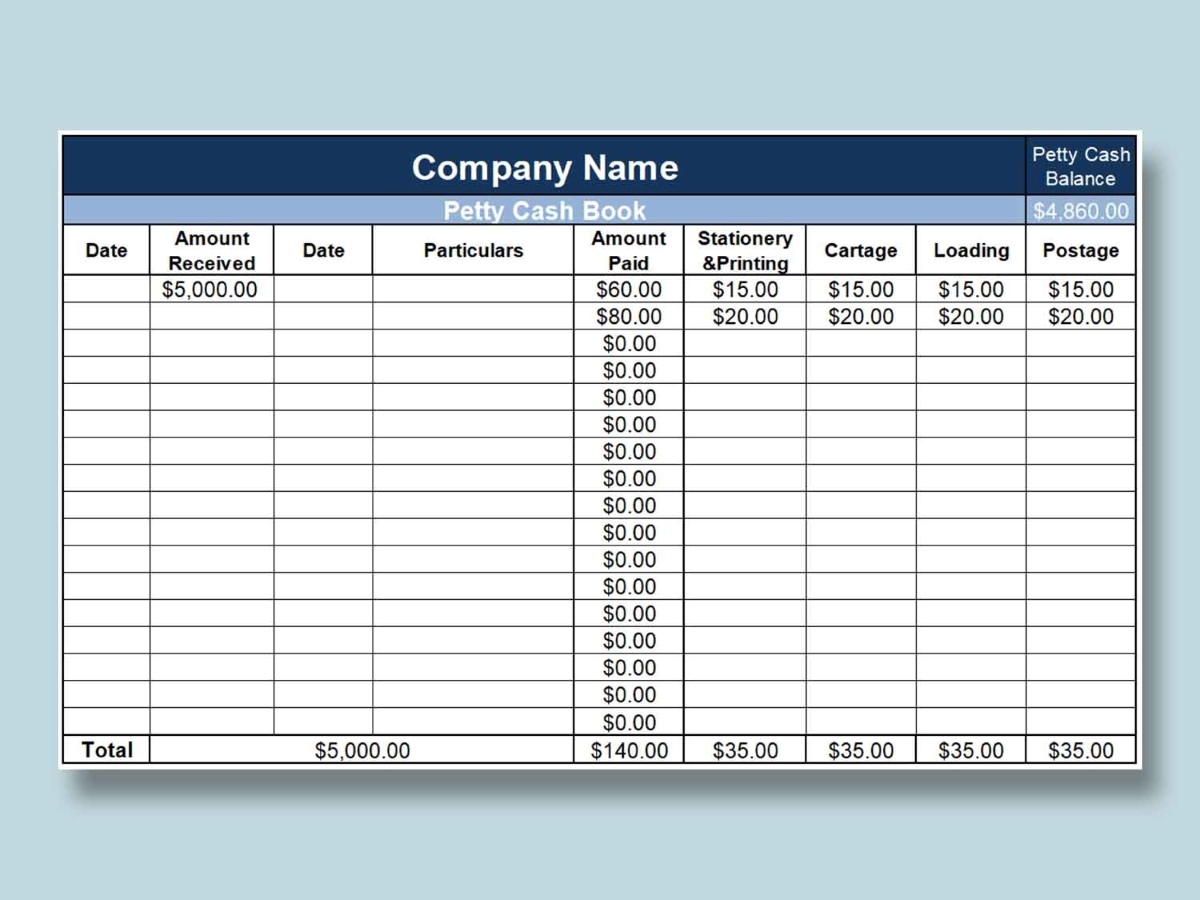

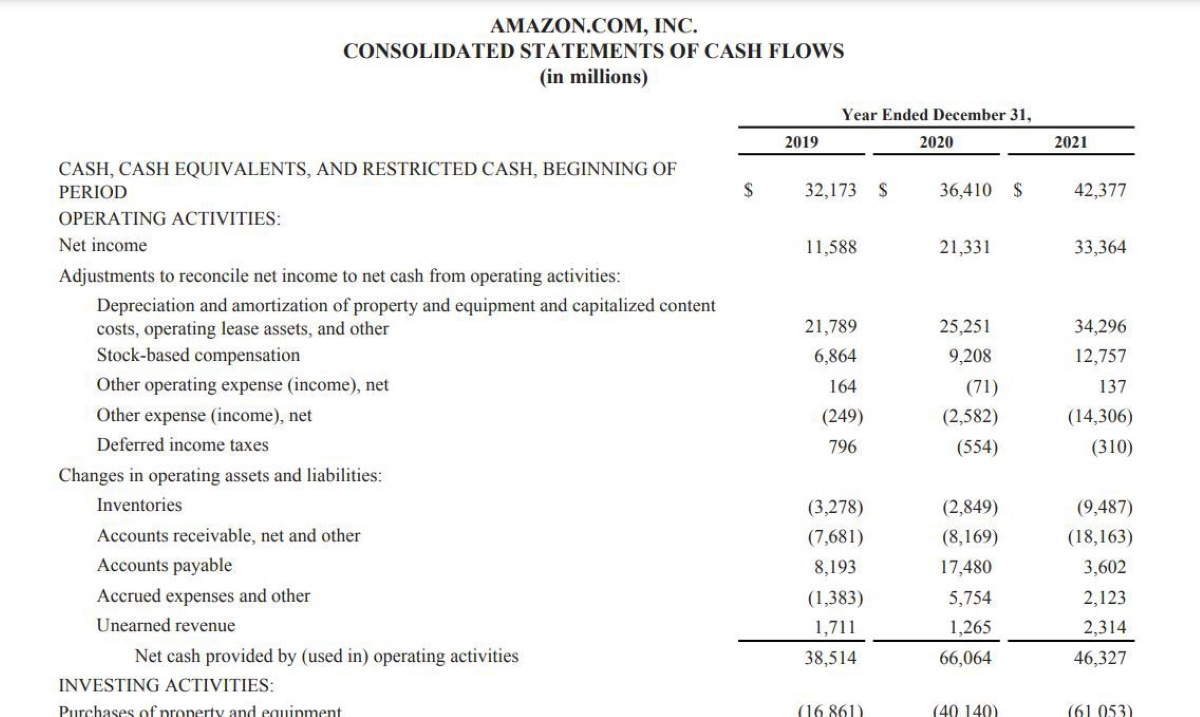

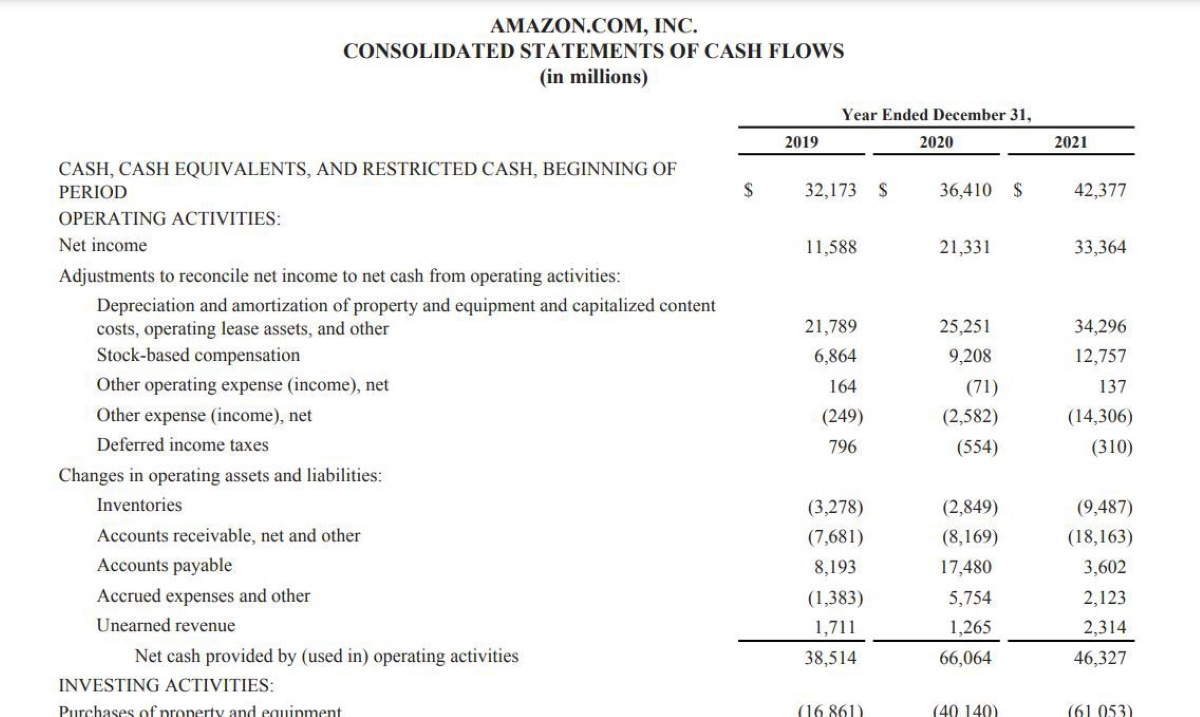

- Cash Flow Statement: The cash flow statement captures the impact of accumulated amortization indirectly through the reconciliation of net income to cash flow from operating activities. As amortization expense is a non-cash item, it is added back to net income in the operating activities section. This adjustment demonstrates that the amortization expense does not represent an actual cash outflow, but rather a shift in the allocation of the asset’s cost over time.

The impact of accumulated amortization on the financial statements provides stakeholders with crucial information for decision-making:

- Investors can evaluate the impact of accumulated amortization on the net carrying values of intangible assets, potentially influencing buy/sell decisions.

- Creditors can assess the remaining value of intangible assets when determining a company’s creditworthiness and the adequacy of collateral.

- Analysts can evaluate a company’s ability to generate future profits by considering the decrease in the value of intangible assets through accumulated amortization.

Overall, the impact of accumulated amortization on the financial statements is vital for stakeholders in understanding the value and cost of intangible assets, the company’s profitability, and the potential impairment of these assets.

Conclusion

In conclusion, understanding where accumulated amortization goes on the balance sheet is crucial for accurately presenting the value and cost of intangible assets. Accumulated amortization is a contra-asset account that represents the cumulative reduction in the value of an intangible asset over time.

On the balance sheet, accumulated amortization is recorded as a deduction below the intangible asset it relates to. This presentation allows stakeholders to see the original cost of the asset and the amount by which its value has been reduced due to amortization. By subtracting accumulated amortization from the cost of the intangible asset, the net carrying value or book value of the asset can be determined.

The treatment of accumulated amortization ensures accurate and transparent reporting of the diminishing value of intangible assets. It also provides valuable information for stakeholders in assessing the financial position and performance of a company.

Accumulated amortization impacts both the balance sheet and the income statement. On the balance sheet, it reflects the cumulative effect on the carrying value of intangible assets. On the income statement, it represents the amortization expense, which reduces net income and reflects the consumption of the asset’s economic benefits over time.

By understanding the impact of accumulated amortization on the financial statements, investors, creditors, and analysts can make informed decisions about a company’s financial health, future profitability, and the remaining value of its intangible assets.

In the dynamic world of finance, where intangible assets play a significant role in a company’s success, accurately reporting and understanding accumulated amortization is essential. It provides clarity, transparency, and valuable insights into the true value and cost of intangible assets, enabling stakeholders to make sound financial decisions.