Finance

How To Read A Life Insurance Policy

Modified: February 21, 2024

Learn how to read a life insurance policy and make sense of the complex finance jargon. Understanding your insurance coverage is crucial for financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Structure of a Life Insurance Policy

- Key Definitions and Terminology

- Coverage and Benefits

- Premiums and Payment Options

- Policy Exclusions and Limitations

- Riders and Additional Coverage Options

- Beneficiary Designations

- Policy Owner Rights and Responsibilities

- Policy Renewal and Conversion Options

- Policy Surrender and Cash Value

- Policy Loans and Withdrawals

- Policy Termination and Cancellation

- Understanding Policy Illustrations

- Frequently Asked Questions (FAQs)

- Conclusion

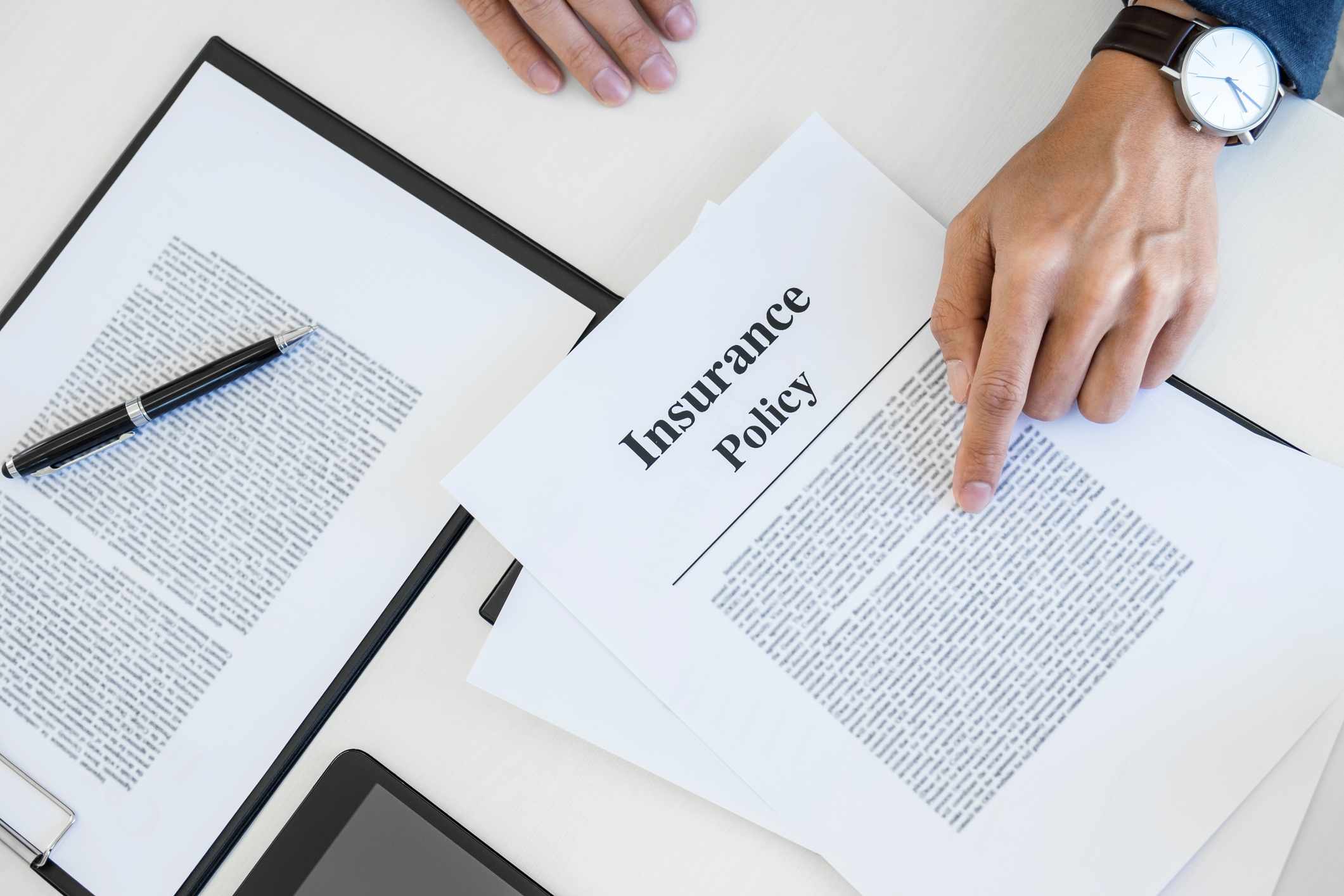

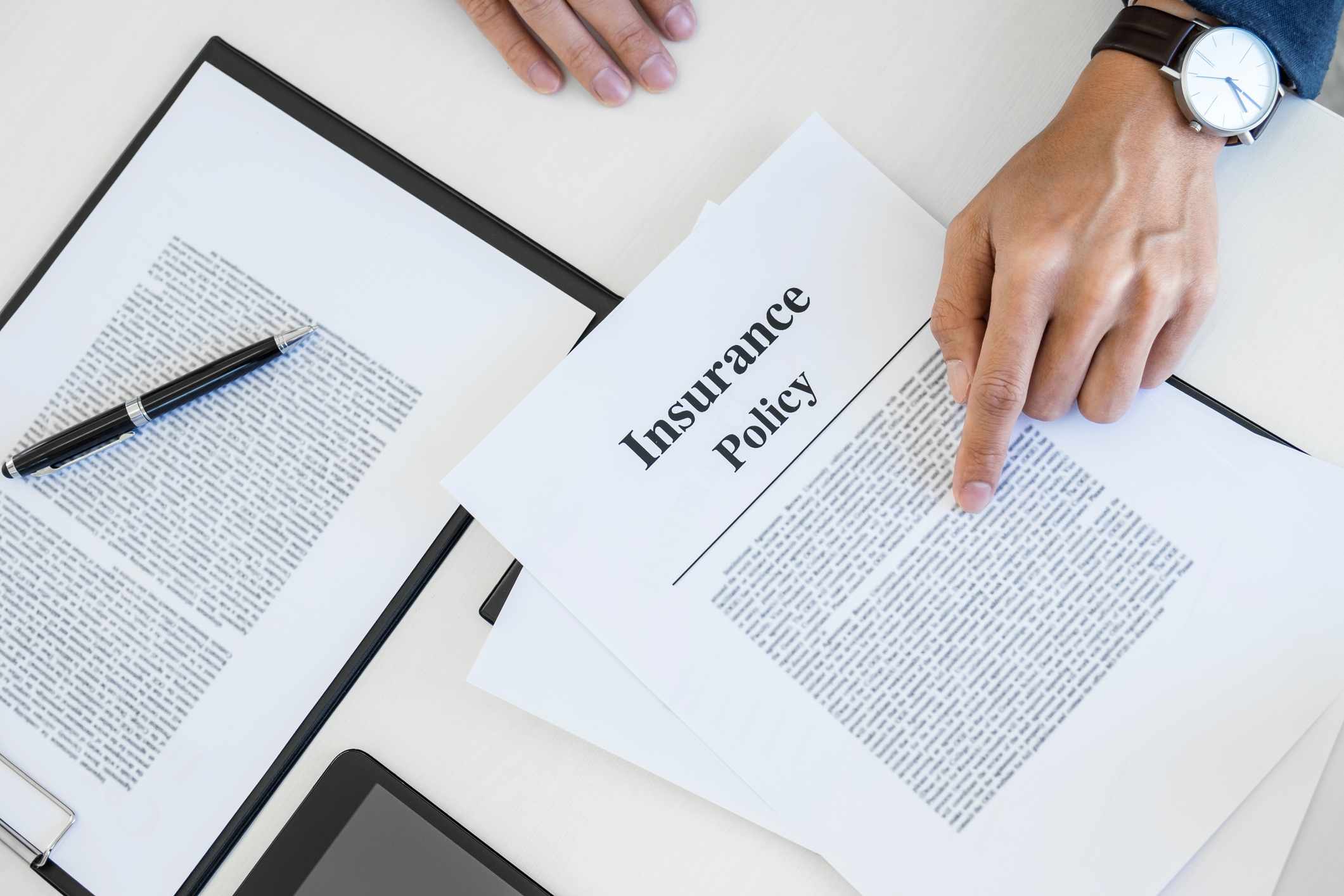

Introduction

Welcome to the world of life insurance policies! If you’re new to the realm of financial protection and planning, understanding the intricacies of a life insurance policy can seem overwhelming. However, fear not! In this article, we will guide you through the basics of reading a life insurance policy, demystifying its structure, terminology, and key components.

Life insurance provides a financial safety net for your loved ones in the event of your untimely demise. It offers a lump sum payment to the beneficiaries designated in the policy, ensuring that they can manage their financial obligations and maintain their standard of living even after you’re no longer there to provide for them.

But before diving into the details, it’s important to note that life insurance policies vary in their terms, conditions, and coverage options. Different types of policies, such as term life insurance, whole life insurance, or universal life insurance, have their own unique features. Therefore, it’s essential to carefully review the specific policy you hold to fully understand its provisions.

In the following sections, we will break down the various aspects of a typical life insurance policy. From understanding the structure and terminology to exploring the coverage, premiums, benefits, and additional options, we’ll equip you with the knowledge you need to navigate your policy with confidence.

Remember, reading a life insurance policy thoroughly and asking questions when in doubt is crucial in order to avoid any surprises or misunderstandings down the road. So, let’s begin our journey of unraveling the intricacies of a life insurance policy!

Understanding the Structure of a Life Insurance Policy

A life insurance policy is a legal contract between the policyholder (the insured) and the insurance company. To effectively understand and interpret your policy, it’s essential to grasp its structure. While policies may vary in layout and organization, they generally consist of the following sections:

- Declaration Page: This is the first page of the policy and contains important information such as the policyholder’s name, policy number, effective date, and premium amount. It also provides an overview of the coverage and any riders or additional options.

- Insuring Clause: This section outlines the basic agreement between the policyholder and the insurance company. It states that the insurance company will pay a death benefit to the designated beneficiaries upon the insured’s death, subject to the terms and conditions of the policy.

- Policy Schedule: Also known as the policy specifications or summary of benefits, this section provides a summary of the coverage details, such as the policy type, face amount, and any additional riders or endorsements attached to the policy.

- Conditions: The conditions section outlines the rights and obligations of both the insurance company and the policyholder. It typically covers topics such as policy renewal, grace periods, policy loans, and the policy’s incontestability period.

- Exclusions and Limitations: This section specifies the circumstances under which the insurance company will not provide coverage or will limit the payout amount. Common exclusions may include death by suicide within a specified period after policy issuance or death resulting from engaging in hazardous activities.

Understanding the structure of your life insurance policy will help you navigate through the various sections and locate the information you need. It’s important to carefully read each section and consult with your insurance agent or financial advisor if you have any questions or concerns.

Key Definitions and Terminology

When reading a life insurance policy, it’s important to familiarize yourself with the key definitions and terminology used throughout the document. By understanding these terms, you’ll be better equipped to comprehend the provisions and coverage details of your policy. Here are some common terms you may encounter:

- Premium: The premium refers to the amount of money you pay to the insurance company in exchange for the coverage provided by the policy. It can be paid monthly, quarterly, annually, or in some cases, as a single lump sum.

- Face Amount: Also known as the death benefit, the face amount is the amount of money the insurance company will pay to your beneficiaries upon your death.

- Policyholder: The policyholder, also known as the insured, is the individual who owns the life insurance policy and is responsible for paying premiums.

- Beneficiary: A beneficiary is the person or entity designated to receive the death benefit upon the insured’s passing. Beneficiaries can be individuals, such as family members or friends, or institutions, such as charities or trusts.

- Rider: A rider is an additional provision or coverage that can be attached to a life insurance policy. It offers extra benefits beyond the basic policy. Common riders include accidental death benefit riders or accelerated death benefit riders.

- Cash Value: Certain types of life insurance, such as whole life or universal life insurance, accumulate cash value over time. Cash value is the portion of the policy that can be accessed or borrowed against, providing a potential source of funds while the policy is still in force.

- Incontestability Period: The incontestability period is a specific timeframe, usually one or two years from the policy’s issuance, during which the insurance company cannot dispute or contest the validity of the policy, except in cases of fraud.

- Surrender Value: If you decide to terminate your policy before its maturity, the surrender value is the amount of money the insurance company will pay you, which may be less than the total cash value accumulated. Surrendering a policy typically means forfeiting the coverage provided.

- Grace Period: The grace period is a timeframe after a premium payment is due, during which the policyholder can make the payment without the policy lapsing. If the premium is not paid within the grace period, the policy may be terminated or converted to a reduced coverage amount.

Building a solid understanding of these key definitions and terminology will enable you to grasp the terms and conditions of your policy more effectively. If you come across any unfamiliar terms while reading your policy, referring to the policy’s glossary or consulting with your insurance agent can help clarify their meanings.

Coverage and Benefits

The coverage and benefits provided by a life insurance policy are the core components that determine the financial protection offered to your loved ones upon your passing. It’s crucial to thoroughly understand what is covered and the benefits available to ensure the policy meets your specific needs. Here are some key points to consider:

- Death Benefit: The death benefit is the lump sum payment that the insurance company will provide to your designated beneficiaries upon your death. This benefit can be used by your beneficiaries to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or everyday living expenses.

- Term or Permanent Coverage: Life insurance policies generally fall into two categories – term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period or term, such as 10, 20, or 30 years. On the other hand, permanent life insurance, which includes whole life and universal life insurance, offers lifelong coverage as long as the premiums are paid.

- Add-On Riders: Many life insurance policies allow you to customize your coverage by adding riders. These riders provide additional benefits such as coverage for critical illness, disability, or accidental death. It’s important to review the available riders and assess whether they align with your specific needs and circumstances.

- Accelerated Death Benefits: Some life insurance policies include accelerated death benefits, which allow policyholders to access a portion of the death benefit while living if diagnosed with a terminal illness. This can help cover medical expenses or provide financial support during a difficult time.

- Policy Renewability: Term life insurance policies typically come with the option to renew the coverage at the end of the term. However, the premium may increase based on your age and health conditions at that time. Permanent life insurance policies, on the other hand, do not require renewal as long as the premiums are paid.

- Conversion Options: Term life insurance policies often offer conversion options, allowing you to convert the policy into a permanent life insurance policy without the need for additional medical underwriting. This can be beneficial if you want to extend your coverage into your later years.

- Living Benefits: Some permanent life insurance policies, such as universal life or variable universal life, may accumulate cash value over time. This cash value can be accessed while the policy is active and can provide a source of funds for various purposes, such as supplementing retirement income or funding educational expenses.

Understanding the coverage and benefits provided by your life insurance policy is essential to ensure that it aligns with your financial goals and provides adequate protection for your loved ones. Take the time to thoroughly review these aspects of your policy and consult with a financial advisor or insurance professional if you have any questions or require further clarification.

Premiums and Payment Options

When purchasing a life insurance policy, understanding the premium and payment options is crucial. The premium is the amount you pay to the insurance company in exchange for the coverage provided by the policy. Here are some important points to consider regarding premiums and payment options:

- Determining Factors: Several factors influence the premium amount that you are required to pay. These factors typically include your age, gender, health condition, lifestyle choices, occupation, and the coverage amount you select. For example, younger individuals generally enjoy lower premiums compared to older individuals.

- Payment Frequency: Life insurance premiums can typically be paid on a monthly, quarterly, semi-annual, or annual basis. The payment frequency will depend on your preference and financial situation. Some insurance companies may even offer a discount for choosing annual payments instead of more frequent ones.

- Level vs. Increasing Premiums: With term life insurance, you may have the option of selecting either level or increasing premiums. Level premiums remain the same throughout the term of the policy, providing stability and predictability. Increasing premiums, on the other hand, start lower but gradually increase over time.

- Grace Period: Life insurance policies typically come with a grace period, which is a specified timeframe after a premium due date during which you can make the payment without the policy lapsing. It’s important to make your premium payments within the grace period to keep your policy active.

- Lapsed Policies: If you fail to make premium payments within the grace period, your policy may lapse, meaning the coverage will no longer be in effect. When a policy lapses, the insurance company will no longer be obligated to pay the death benefit. However, some policies may offer a reinstatement option within a certain timeframe.

- Premium Payment Options: Insurance companies offer various methods for premium payment. You can typically make payments through electronic funds transfer (EFT) from your bank account, credit card payments, or even automatic deductions from your paycheck if your employer offers such a service.

- Premium Discounts: Depending on the insurance company and policy type, you may be eligible for premium discounts. These discounts can be based on factors such as your overall health, non-smoking status, or if you have multiple policies with the same insurance provider.

- Policy Lapse Due to Non-Payment: If you miss premium payments and your policy lapses, it may be possible to reinstate the coverage by paying the overdue premiums along with any applicable fees or interest. However, the reinstatement period is typically limited, so it’s important to be proactive if you miss a payment.

Understanding the premiums and payment options associated with your life insurance policy is essential to ensure that you can comfortably afford the coverage and keep your policy active. Take the time to review your payment options and consider setting up a reliable payment method to avoid any potential lapses in coverage.

Policy Exclusions and Limitations

While life insurance policies provide essential coverage for your loved ones, it’s important to understand that there are certain exclusions and limitations within the policy. These exclusions define circumstances under which the insurance company may refuse to pay the death benefit or limit the coverage amount. Here are some key points to consider:

- Policy Exclusions: Exclusions specify situations or causes of death that are not covered by the life insurance policy. Common exclusions include death resulting from participating in hazardous activities, acts of war or terrorism, or certain pre-existing medical conditions.

- Grace Period for Suicide: Most life insurance policies have a suicide clause that applies within a specific period, typically two years from the policy’s effective date. If the insured dies by suicide within this period, the insurance company may not pay the full death benefit. Instead, they may refund the premiums paid or provide a partial benefit.

- Fraud and Misrepresentation: If you intentionally provide false information or misrepresent relevant facts during the application process, it could result in the denial of the death benefit. It’s essential to be truthful and accurate when completing your application to avoid coverage disputes later on.

- Contestability Period: The contestability period is a specific timeframe after the policy is issued, typically one or two years. During this period, the insurance company has the right to investigate and contest claims based on misrepresentation or non-disclosure of material facts. Once the contestability period expires, the insurer cannot void the policy based on inaccurate information unless it was intentional fraud.

- Riskier Activities: If you participate in certain high-risk activities, such as skydiving or mountaineering, it’s important to disclose these activities during the application process. Failing to do so may result in a denial of coverage or the application of additional exclusions related to these activities.

- Policy Limitations: Life insurance policies may also have certain limitations or restrictions. These limitations could relate to the time period within which the policy will pay the death benefit or the coverage amount for specific types of death, such as accidental death.

Understanding the policy exclusions and limitations is crucial to ensuring that you have a clear understanding of the circumstances under which the death benefit may be denied or reduced. It’s essential to thoroughly review these provisions in your policy and consult with your insurance agent or financial advisor to clarify any questions or concerns.

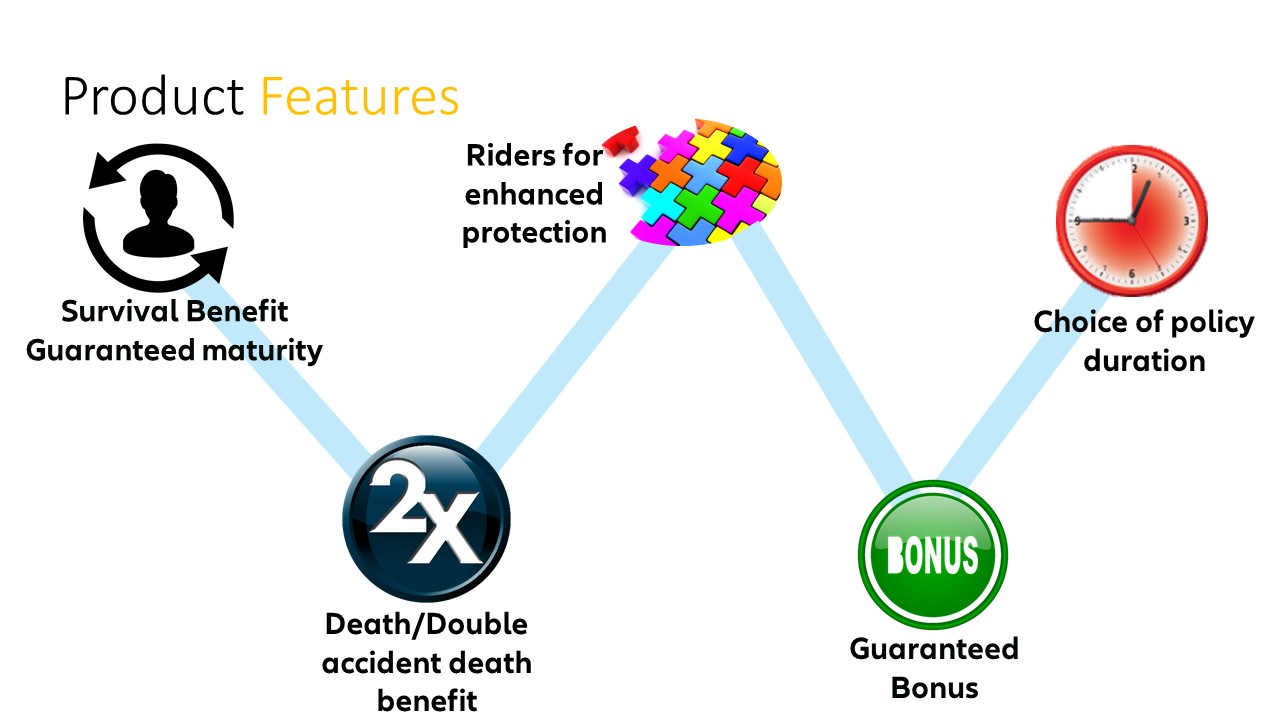

Riders and Additional Coverage Options

Life insurance policies often provide the flexibility to customize and enhance your coverage through the use of riders and additional options. These riders offer additional benefits that can be added to your base policy, tailoring it to better suit your specific needs. Here are some common riders and coverage options to consider:

- Accidental Death Benefit Rider: This rider provides an additional payout if the insured’s death is a result of an accident. It offers extra financial protection to your loved ones in the event of an unforeseen accident.

- Disability Income Rider: If you become disabled and are unable to work, the disability income rider provides a monthly income to help replace your lost wages. This rider can provide financial security and support during a time when your income is affected.

- Critical Illness Rider: This rider offers a lump sum payment if you are diagnosed with a critical illness covered by the policy, such as cancer, stroke, or heart attack. It provides funds to cover medical expenses or other financial obligations during your recovery.

- Long-Term Care Rider: With this rider, a portion of the death benefit can be used to pay for long-term care expenses in the event that you require assistance with activities of daily living or suffer from a cognitive impairment. It helps protect your assets while ensuring you receive the care you need.

- Waiver of Premium Rider: If you become permanently disabled and are unable to work, the waiver of premium rider waives your premium payments, keeping your policy in force while you are unable to pay the premiums due to the disability.

- Term Conversion Rider: If you have a term life insurance policy, the term conversion rider allows you to convert your policy to a permanent life insurance policy without the need for undergoing further medical underwriting. This rider provides flexibility for extending your coverage beyond the initial term.

- Child Term Rider: This rider offers coverage for your children, providing a death benefit in the unfortunate event of their passing. It can help cover funeral expenses and serve as a financial safety net for your family during a difficult time.

- Additional Coverage Amounts: In addition to riders, some insurance policies allow you to increase your coverage amount over time. This can be useful as your financial responsibilities grow, such as when you have a mortgage, children, or other financial obligations.

When considering riders and additional coverage options, it’s important to carefully review and assess your specific needs. Each rider comes with its own cost, so it’s essential to balance the additional benefits with your budget and overall financial goals. Consult with your insurance agent or financial advisor to determine which riders are most suitable for your circumstances.

Beneficiary Designations

When setting up a life insurance policy, one of the most important decisions you will make is designating your beneficiaries – the individuals or entities who will receive the death benefit upon your passing. Here’s what you need to know about beneficiary designations:

- Primary Beneficiary: A primary beneficiary is the person or entity who will receive the death benefit if you pass away. You can designate one or multiple primary beneficiaries, and you can allocate specific percentages or fixed amounts to each beneficiary.

- Contingent Beneficiary: A contingent beneficiary is the backup beneficiary who will receive the death benefit if the primary beneficiary predeceases you. If no contingent beneficiary is designated or if all the contingent beneficiaries predecease you, the death benefit may be paid to your estate or according to state laws.

- Beneficiary Designation Forms: Most insurance companies provide beneficiary designation forms that allow you to specify the individuals or entities you want to receive the death benefit. It’s essential to keep these forms up to date and review them periodically, especially after major life events such as marriage, divorce, or the birth of a child.

- Revocable vs. Irrevocable Beneficiary Designations: A revocable beneficiary designation allows you to change or revoke the beneficiary designation at any time, as long as you are the policyholder. An irrevocable beneficiary designation, on the other hand, requires the consent of the beneficiary to make changes. It’s important to understand the implications of each designation and consult with a legal professional if you have specific concerns.

- Controlling the Distribution: When designating beneficiaries, you have the option to specify how the death benefit will be distributed to them. Depending on your preference and the circumstances, you may choose to have the benefit paid out in a lump sum or in installments over time.

- Estate as the Beneficiary: Designating your estate as the beneficiary is an option, but it may have certain implications. If the death benefit is paid to your estate, it may be subject to probate, which can delay the distribution of funds and potentially increase administrative costs.

- Secondary Beneficiary Designation: Some policies allow for multiple levels of contingent beneficiaries. If your primary and contingent beneficiaries have passed away or are no longer eligible to receive the benefit, the secondary beneficiaries come into play. It’s important to consider these designations to ensure your wishes are carried out.

Beneficiary designations are a crucial aspect of your life insurance policy and can have a significant impact on how the death benefit is distributed. It’s important to review and update your beneficiary designations regularly to ensure they align with your current wishes and life circumstances. When making decisions regarding beneficiaries, it may be helpful to consult with your insurance agent or an estate planning attorney to ensure your intentions are clear and legally binding.

Policy Owner Rights and Responsibilities

As the owner of a life insurance policy, you have specific rights and responsibilities that come with your role. Understanding these rights and responsibilities is important in effectively managing and maximizing the benefits of your policy. Here are some key points to consider:

- Ownership Rights: As the policy owner, you have the right to make changes to your policy, such as updating beneficiaries, changing coverage amounts, or adding riders. You also have the right to access any cash value that has accumulated in a permanent life insurance policy, subject to certain terms and conditions.

- Premium Payments: The policy owner is responsible for making timely premium payments to keep the policy in force. Failure to pay premiums within the grace period can result in the policy lapsing and the loss of coverage. It’s important to budget for the premium payments and understand the consequences of missed payments.

- Policy Updates and Changes: You have the responsibility to review your policy periodically and update it as needed. Life events like marriage, divorce, the birth of a child, or changes in financial circumstances may require adjustments to your coverage or beneficiary designations.

- Communicating Changes to the Insurance Company: It’s your responsibility to notify the insurance company of any changes, such as address changes or updates to contact information. Promptly communicating changes ensures that you receive important policy correspondence and that the company has accurate and up-to-date information.

- Policy Loans and Withdrawals: If you have a permanent life insurance policy with cash value, you have the right to borrow against or make withdrawals from the policy’s cash value. However, it’s important to understand the terms and potential consequences, such as interest charges or a reduction in the death benefit, associated with policy loans or withdrawals.

- Keeping Beneficiaries Informed: As the policy owner, it is your responsibility to make sure that your beneficiaries are aware of the existence and details of the policy. Sharing this information with your loved ones ensures a smooth claims process and can help them prepare for the future.

- Understanding Policy Provisions: It’s essential to thoroughly review and understand the terms, conditions, exclusions, and limitations outlined in the policy. Knowing what is covered, what is excluded, and the circumstances under which the policy may not pay the death benefit is important to avoid any surprises or misunderstandings.

- Policy Review and Evaluation: Periodically reviewing your policy with your insurance agent or financial advisor is a responsible practice. Changes in your financial situation, family dynamic, or overall goals may require adjustments to your coverage or the addition of riders to better align with your current needs.

Understanding your rights and responsibilities as the policy owner is crucial to effectively manage your life insurance policy. By fulfilling your responsibilities and exercising your rights knowledgeably, you can ensure that your policy remains up to date, your beneficiaries are informed, and you make the most of the benefits provided by your life insurance coverage.

Policy Renewal and Conversion Options

Life insurance policies typically have specific terms and expiration dates, and understanding the options available for policy renewal and conversion is important. Here’s what you need to know:

Policy Renewal:

- Term Life Insurance: Term life insurance policies generally have a specific term, such as 10, 20, or 30 years. At the end of the term, the policy typically expires, unless it is renewed. However, the renewal may come with increased premiums based on your age and health status at the time of renewal. Renewing your policy allows you to maintain the coverage for an extended period.

- Permanent Life Insurance: Permanent life insurance policies, such as whole life or universal life insurance, do not have specific terms and do not require renewal as long as the premiums are paid. These policies provide lifelong coverage and also accumulate cash value over time.

Conversion Options:

- Term to Permanent Conversion: Many term life insurance policies offer a conversion option that allows you to convert the policy to a permanent policy without the need for additional medical underwriting. This can be beneficial if you want to extend your coverage beyond the initial term or if you prefer the additional benefits and cash value accumulation offered by permanent policies.

- Conversion Deadlines: Conversion options typically have specific deadlines. It’s important to review your policy to understand the timeframe within which you can exercise the conversion option. Failing to convert within the specified timeframe may result in the loss of this opportunity.

- Conversion Terms and Conditions: When converting a policy, be sure to review the terms and conditions associated with the newly converted policy. The premium, coverage amount, and other policy provisions may differ from the original term policy.

Policy renewal and conversion options offer flexibility and the opportunity to adapt your life insurance coverage to your changing needs. Whether you choose to renew your term policy or convert it to a permanent policy, these options allow you to continue protecting your loved ones and building cash value. It’s important to review your options before the policy expiration date and consult with your insurance agent or financial advisor to understand the best course of action for your specific circumstances.

Policy Surrender and Cash Value

In certain types of life insurance policies, such as whole life or universal life insurance, a policy may accumulate cash value over time. Understanding the concept of policy surrender and cash value is important. Here’s what you need to know:

- Cash Value Accumulation: Some permanent life insurance policies come with a cash value component. A portion of the premiums you pay goes into a cash value account that grows over time, based on factors such as the policy’s interest rate and any dividends earned.

- Surrendering a Policy: If you decide that you no longer need the coverage provided by your permanent life insurance policy, you have the option to surrender the policy. Surrendering your policy means terminating it and receiving the available cash value accumulated in the policy.

- Cash Value Calculation: The cash value is the amount of money you are entitled to receive upon surrendering the policy. The cash value is determined by deducting any outstanding loans or unpaid premiums from the total cash value accumulated in the policy.

- Policy Surrender Process: To surrender your policy and receive the cash value, you will need to contact your insurance company. They will guide you through the necessary paperwork and requirements, such as providing the policy documents, completing surrender forms, and providing identification.

- Tax Considerations: It’s important to be aware of the potential tax implications of surrendering a policy. Withdrawals from the cash value component of a permanent life insurance policy may be subject to taxes. Additionally, surrendering a policy may have different tax consequences depending on factors such as the policy’s gain or the total amount of premiums paid.

- Alternative Options: Surrendering your policy is not your only option if you no longer need the coverage. Depending on your circumstances, you may have alternatives such as a policy loan or partial surrender, which allows you to access a portion of the cash value while keeping the policy in force.

- Consulting a Financial Advisor: Before making any decisions about surrendering your policy, it’s important to consult with a financial advisor or insurance professional. They can help assess your needs, understand potential tax implications, and explore alternatives that may better align with your financial goals.

Understanding the concept of policy surrender and the cash value within a permanent life insurance policy is crucial. It allows you to make informed decisions about whether to continue with the coverage or surrender the policy and access the accumulated cash value. Consider your specific financial situation and goals before deciding to surrender your policy, and consult with professionals to understand the potential implications and explore alternative options.

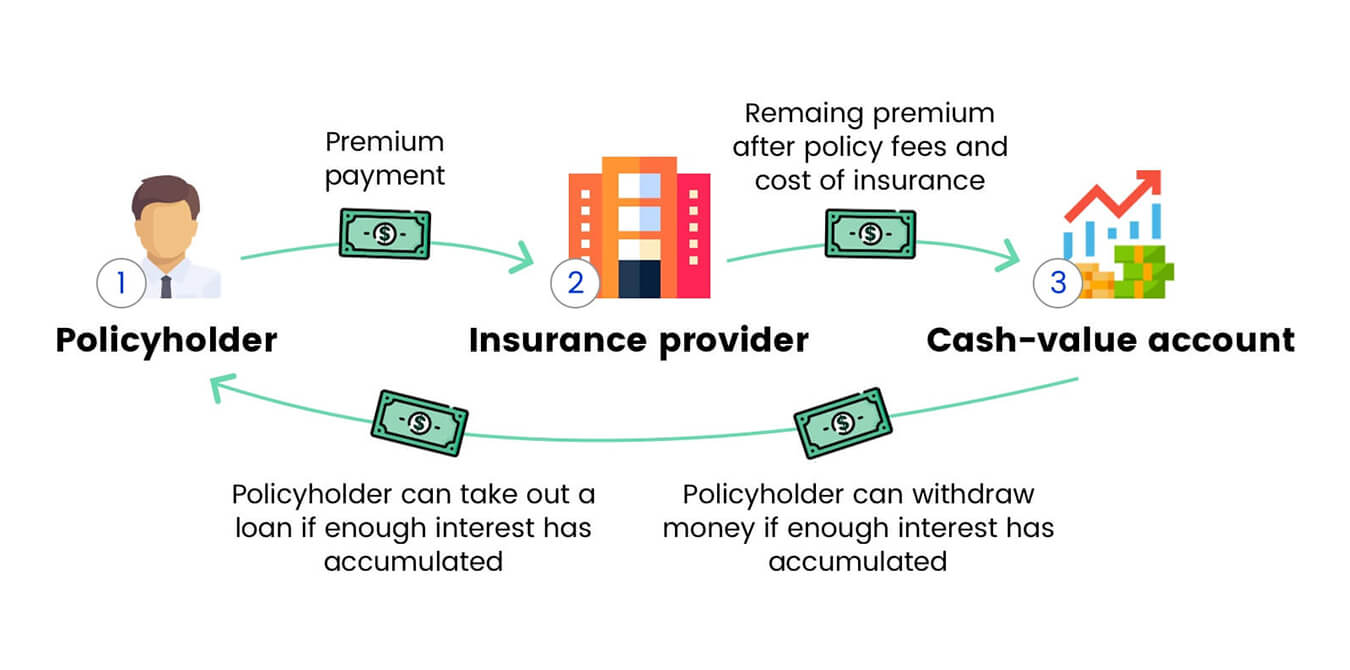

Policy Loans and Withdrawals

Permanent life insurance policies, such as whole life or universal life insurance, often come with a cash value component that policyholders can access through loans or withdrawals. Understanding policy loans and withdrawals is important for making informed decisions about your life insurance coverage. Here’s what you need to know:

- Policy Loans: Policy loans allow you to borrow against the cash value accumulated in your permanent life insurance policy. The loan amount is typically limited to a percentage of the available cash value. The loan is secured by the policy’s cash value and accrues interest.

- Withdrawals: You can also make partial withdrawals from the cash value of your permanent life insurance policy. Unlike loans, withdrawals do not need to be repaid. However, withdrawals reduce the available cash value and may impact the policy’s death benefit.

- Loan and Withdrawal Interest: Policy loans and withdrawals are subject to interest charges imposed by the insurance company. The interest rates may vary, and any outstanding loan balance together with accrued interest will be deducted from the death benefit if not repaid.

- Impact on Policy: Taking a loan or withdrawal from your policy reduces the available cash value. If the outstanding loan balance, combined with interest, exceeds the cash value, it may result in policy lapse or require additional premium payments to keep the policy in force.

- Potential Tax Considerations: Policy loans are generally not taxable, as you are borrowing against your own policy’s cash value. However, if the policy lapses or is surrendered with an outstanding loan balance, there may be tax consequences on the canceled debt. Withdrawals may also have tax implications if they exceed the cumulative premiums paid into the policy.

- Repayment of Policy Loans: Policy loans have flexible repayment terms. You have the option to repay the loan in full or make interest payments to keep the loan balance from increasing. If the loan remains outstanding, it will be deducted from the death benefit when the insured passes away.

- Impact on Cash Value and Death Benefit: Policy loans and withdrawals reduce the available cash value in your policy. If not repaid, they can also impact the death benefit payable to your beneficiaries. It’s important to consider the long-term effects of these transactions on the policy’s value and coverage.

- Consulting a Financial Advisor: Before taking a policy loan or withdrawal, it’s advisable to consult with a financial advisor or insurance professional. They can help assess your financial needs, explain the potential impacts on your policy, and provide guidance on loan repayment strategies.

Policy loans and withdrawals offer a way to access the cash value within your permanent life insurance policy. However, it’s important to carefully consider the long-term implications, including interest charges, potential tax consequences, and impact on the death benefit. Consulting with a professional can help you understand the potential effects on your policy and make informed decisions based on your financial goals and circumstances.

Policy Termination and Cancellation

Life insurance policies can be terminated or canceled for various reasons. Understanding the process and implications of policy termination and cancellation is important to ensure you are aware of the potential outcomes. Here’s what you need to know:

- Voluntary Policy Termination: You have the right to terminate your life insurance policy at any time. The termination process typically involves notifying the insurance company in writing and surrendering the policy documents. Upon termination, any cash value or surrender value accumulated may be paid out to you, subject to any outstanding loans or fees.

- Lapsed Policy: If you fail to pay your premiums within the grace period, your policy may lapse, resulting in termination. When a policy lapses, the insurance company is no longer obligated to provide coverage or pay the death benefit. Lapsed policies can generally be reinstated within a specific timeframe, often by paying the overdue premiums and any applicable fees.

- Policy Conversion: Term life insurance policies may offer a conversion option, allowing you to convert the policy to a permanent life insurance policy without the need for additional medical underwriting. If you choose not to convert, the policy will typically expire at the end of the term as originally specified.

- Policy Surrender: Surrendering a policy, as mentioned earlier, involves terminating the coverage and receiving the available cash value. Surrendering a policy means forfeiting the death benefit, and the cash value may be subject to taxes or surrender fees depending on the policy and the duration of coverage.

- Policy Cancellation by the Insurance Company: In certain circumstances, the insurance company may cancel a policy. This can occur if you provided false information during the application process or engaged in fraudulent activities. The insurance company may also cancel the policy if you fail to disclose material information that affects the underwriting of the policy.

- Impact on Premiums and Benefits: Terminating or canceling a policy means that you will no longer be required to pay premiums. However, it also means that you will no longer have coverage, and your beneficiaries will not receive a death benefit. Additionally, surrendering or canceling a policy may have financial implications, such as potential surrender fees or taxable income.

- Consultation and Considerations: Before terminating or canceling a policy, it’s important to consider your overall financial situation, long-term needs, and consult with a financial advisor or insurance professional. They can assess your specific circumstances and guide you on the potential impacts and alternatives to policy termination.

Understanding the termination and cancellation processes, as well as their implications, is crucial when managing your life insurance policy. Whether it’s a voluntary termination, a lapsed policy, or a policy cancellation by the insurance company, carefully evaluate the financial consequences and consider consulting with a professional to ensure you are making informed decisions that align with your needs and goals.

Understanding Policy Illustrations

Policy illustrations are provided by insurance companies to give policyholders a visual representation of how their life insurance policy may perform over time. These illustrations can help you understand the potential growth of your policy’s cash value, death benefit, and other policy features. Here’s what you need to know:

- Definition: A policy illustration is a projection of how your policy may perform based on certain assumptions, such as interest rates, premium payments, and policy expenses. It is not a guarantee of future results but rather an estimate.

- Components of an Illustration: A policy illustration typically provides information on the policy’s cash value accumulation, death benefit, premium payments, and other policy details. It may also include charts or graphs to visualize the growth over time.

- Assumptions: Illustrations are based on specific assumptions set by the insurance company, such as the interest rate credited to the policy’s cash value, mortality rates, and expenses. These assumptions can significantly impact the projected results, and they may or may not align with actual policy performance in the future.

- Interest Rates: The projected interest rates used in policy illustrations are often based on current market conditions. It’s important to note that these rates are not guaranteed and may vary over time, affecting the actual performance of the policy.

- Flexibility: Policy illustrations can often show different scenarios based on premium payment options, changes in premium amounts, or the effect of adding or removing riders. They provide a tool to understand how these changes may impact the policy’s projected performance.

- Reviewing Illustrations: When reviewing policy illustrations, it’s crucial to consider them as one piece of the overall financial planning puzzle. Assessing the long-term affordability of the premium payments, considering your financial goals, and consulting with a financial professional are key steps in making informed decisions.

- Limitations: Policy illustrations have limitations and do not capture all possible scenarios or outcomes. They are based on numerous assumptions that may or may not align with future reality. It’s important to read the fine print, understand the limitations, and ask questions to gain a comprehensive understanding of your policy’s performance.

- Ongoing Policy Performance: While illustrations provide a snapshot of potential performance, it’s important to review the actual performance of your policy on an ongoing basis. Periodically assess the cash value growth, death benefit, and other policy features to ensure they align with your expectations and financial goals.

Policy illustrations can be valuable tools for understanding the potential performance of your life insurance policy. However, it’s essential to remember that they are projections based on assumptions, and actual performance may vary. Understanding the assumptions, limitations, and ongoing policy performance are key factors in gaining a comprehensive understanding of your policy’s value and performance over time.

Frequently Asked Questions (FAQs)

Here are some common questions and answers that may help clarify any lingering doubts or concerns about life insurance policies:

- What is the purpose of life insurance?

Life insurance provides financial protection for your loved ones in the event of your death. It ensures that they can maintain their standard of living, cover outstanding debts, and meet ongoing financial obligations. - What types of life insurance policies are available?

There are various types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its own features and benefits, so it’s important to choose the one that aligns with your needs and goals. - How much life insurance coverage do I need?

The amount of life insurance coverage you need depends on various factors, including your income, financial obligations, outstanding debts, and future expenses (such as education or healthcare costs). It’s advisable to assess your specific circumstances and consult with a financial advisor to determine an appropriate coverage amount. - How do premiums for life insurance policies work?

Premiums are the payments made to the insurance company to maintain your life insurance coverage. The amount of the premium is determined by factors such as your age, health condition, lifestyle, coverage amount, and policy type. The premium can generally be paid monthly, quarterly, annually, or as a single lump sum. - Can I change the beneficiaries on my life insurance policy?

Yes, you can typically change the beneficiaries on your life insurance policy. Life events such as marriage, divorce, or the birth of a child may necessitate updating your beneficiary designations. Contact your insurance company and follow their process for changing the beneficiaries. - Can I borrow money from my life insurance policy?

If you have a permanent life insurance policy with accumulated cash value, you may be able to borrow against it. Policy loans allow you to access a portion of the cash value, which must be repaid with interest. It’s important to understand the terms and potential consequences of policy loans before borrowing. - What happens if I stop paying premiums?

If you stop paying premiums, your life insurance coverage may lapse, resulting in the discontinuation of the policy and the loss of the death benefit. However, some policies have a grace period during which you can catch up on missed payments to keep the coverage in force. - Can I have multiple life insurance policies?

Yes, it’s possible to have multiple life insurance policies. Owning multiple policies can provide additional coverage and flexibility. However, it’s important to consider your overall financial situation and ensure that the total coverage amount aligns with your needs. - Can I cancel my life insurance policy?

Yes, you can cancel your life insurance policy at any time. If you choose to cancel, you may receive a surrender value, which is the accumulated cash value, minus any outstanding loans or fees. It’s important to understand the potential financial consequences and consult with a financial advisor before canceling your policy. - Is life insurance taxable?

Typically, the death benefit paid out to beneficiaries is generally not taxable. However, there may be tax implications if the policy has been surrendered or if the death benefit is paid to the policyholder’s estate. Consult with a tax professional to understand the tax implications specific to your situation.

These are just a few frequently asked questions about life insurance. It’s important to remember that each individual’s situation is unique, and it’s advisable to consult with a financial advisor or insurance professional to address any specific concerns or questions you may have about life insurance policies.

Conclusion

Understanding the ins and outs of a life insurance policy is essential for making informed decisions about your financial future and protecting your loved ones. Throughout this article, we’ve explored the various aspects of a life insurance policy, including its structure, key terminology, coverage options, premiums, and additional features.

By comprehending the policy’s structure, you can navigate through its sections and find the information you need with ease. Familiarizing yourself with the key definitions and terminology allows you to grasp the policy’s provisions and better communicate with your insurance provider.

Knowing the coverage and benefits available to you ensures that you choose a policy that aligns with your specific needs and goals. Understanding the different premium payment options and their implications helps you manage your financial obligations and maintain the policy in force.

Being aware of the policy exclusions and limitations ensures that you have a clear understanding of the circumstances under which the insurance company may deny or restrict coverage. Exploring riders and additional coverage options provides flexibility to tailor your policy to meet your unique requirements.

Recognizing your rights and responsibilities as the policy owner empowers you to effectively manage and make changes to your policy as needed. And understanding the policy renewal and conversion options allows you to adapt your coverage as your circumstances evolve over time.

Lastly, becoming familiar with policy illustrations and frequently asked questions offers valuable insights into the potential performance of your policy and helps address common concerns and uncertainties.

Remember, life insurance is a valuable tool that provides financial security and peace of mind. It’s important to regularly review your policy, stay informed about any changes, and consult with professionals when needed to ensure your coverage aligns with your evolving financial goals.

Now armed with this knowledge, you can confidently navigate the world of life insurance and make wise decisions to safeguard the financial well-being of yourself and your loved ones.