Finance

How Did Liberty Bonds Work

Published: October 14, 2023

Discover the mechanics of Liberty Bonds, a financing tool used during World War I. Learn how these bonds influenced the American public and war efforts. #Finance #LibertyBonds

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

During times of war, governments often need to find ways to finance their military operations and meet the immense costs associated with armed conflicts. One such method that emerged during World War I was the issuance of Liberty Bonds. These bonds provided an opportunity for the general public to contribute financially to the war effort while also providing the government with much-needed funds to support and sustain its military endeavors. The concept of Liberty Bonds not only served as a means of raising capital but also as a patriotic call to action, encouraging citizens to actively participate in the war and support their country.

As the war waged on, the sale of Liberty Bonds became an integral part of the government’s financial strategy. These bonds were introduced by the United States as a way to fund the nation’s involvement in World War I, but they also served a broader purpose of promoting unity and patriotism among the American population. By investing in these bonds, individuals not only contributed to the war effort but also played a crucial role in bolstering the country’s economic stability.

Liberty Bonds offered a unique opportunity for citizens to financially support their country, and their popularity was fueled by a sense of duty and national pride. These bonds were not solely limited to the wealthy; they were accessible to individuals from all walks of life, making it a true democratic approach to financing a war. The success of the Liberty Bond campaigns relied heavily on effective marketing and persuasive appeals to patriotism. Through a combination of marketing efforts and emotional pleas, the government was able to mobilize millions of Americans to invest in these bonds.

In this article, we will explore the intricacies of Liberty Bonds, including their purpose, types, subscription process, features, and impact on the war effort. We will also delve into the criticisms and controversies that surrounded these bonds, shedding light on the multifaceted nature of their role in financing World War I. By understanding the historical significance and mechanics of Liberty Bonds, we can gain a deeper insight into the financial dynamics of war and the ways in which governments engage their citizens in times of conflict.

What are Liberty Bonds?

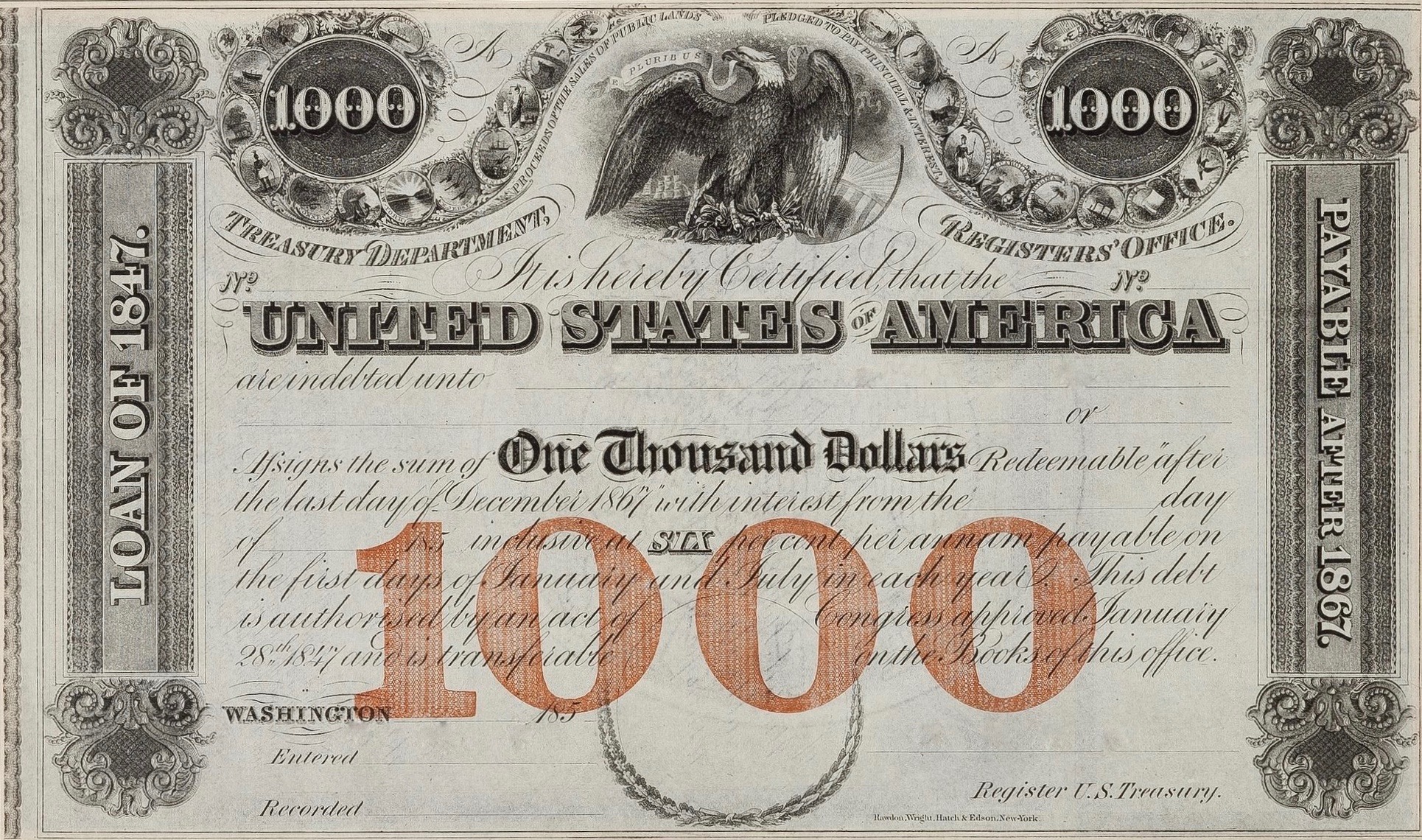

Liberty Bonds, also known as War Bonds or Defense Bonds, were government-issued securities or debt instruments that were sold to the public during World War I. These bonds were a key element of the government’s strategy to finance the war effort by raising funds from individual citizens. By purchasing Liberty Bonds, individuals essentially loaned money to the government, which would later be repaid with interest. These bonds were considered a safe and patriotic investment, providing individuals with a way to financially contribute to the war while earning a return on their investment.

The issuance of Liberty Bonds allowed the government to tap into a wide pool of potential investors, ranging from large institutions to ordinary citizens. The bonds were typically sold in denominations of $50, $100, $500, and $1,000, making them accessible to a broad spectrum of the population. Additionally, Liberty Bonds were often marketed as a form of civic duty, appealing to citizens’ sense of patriotism and encouraging them to play an active role in supporting their country’s war efforts.

Liberty Bonds were not new to the United States. Prior to World War I, the government had already issued bonds to finance various projects and activities. However, the scale and significance of the war prompted the government to introduce a new series of bonds specifically dedicated to funding the war effort. The first Liberty Bond series, known as the First Liberty Loan, was launched in 1917. This was followed by subsequent series such as the Second Liberty Loan and the Third Liberty Loan.

Overall, Liberty Bonds played a crucial role in mobilizing funds needed for the war. The government’s ability to successfully market and sell these bonds to the public helped secure significant financial resources. By participating in the purchase of Liberty Bonds, individuals not only provided financial support but also demonstrated their patriotism and solidarity with the troops on the frontlines. The sense of national unity fostered by these bonds was instrumental in rallying the American public behind the war effort and symbolized a shared sacrifice towards the ultimate goal of victory.

Purpose of Liberty Bonds

The issuance of Liberty Bonds served multiple purposes during World War I. At the most basic level, these bonds were a means for the government to raise the massive amounts of capital needed to finance the war. The war effort required substantial resources, including funding for troops, supplies, equipment, and infrastructure. Liberty Bonds provided a way for the government to tap into the wealth of the nation and secure necessary funds.

Another significant purpose of Liberty Bonds was to promote a sense of unity and patriotism among the American populace. By investing in these bonds, individuals felt a personal connection to the war effort and believed they were contributing to the nation’s cause. The government actively marketed these bonds as a way for ordinary citizens to do their part in supporting the troops and defending their country.

Furthermore, the issuance of Liberty Bonds helped to stabilize the economy during the war. The massive government spending necessitated by the war effort had the potential to create inflation and disrupt the nation’s financial stability. By offering bonds, the government was able to absorb excess funds from the economy, effectively controlling inflationary pressures. Additionally, the interest paid on these bonds provided individuals with a reliable investment that could generate income, ensuring that their savings were relatively protected during the war.

Liberty Bonds also played a crucial role in financing war-related industries and stimulating economic growth. The funds raised from the sale of these bonds were used to support industries involved in the production of war materials such as munitions, uniforms, and equipment. This injection of capital helped to create jobs, spur industrial innovation, and propel economic activity. In essence, Liberty Bonds not only provided funding for the war effort but also sparked economic development and expansion.

Lastly, the issuance of Liberty Bonds carried a psychological impact. By actively participating in the purchase of these bonds, individuals felt a sense of ownership and investment in the outcome of the war. This emotional connection to the war effort strengthened the bond between the American people and their government, fostering a united front in the face of a global conflict.

In summary, the purpose of Liberty Bonds during World War I was threefold: to raise funds for the war effort, to instill a sense of patriotism and unity among the population, and to stabilize the economy by controlling inflation and stimulating industrial growth. These bonds not only served as a means of financial support but also as a symbol of national solidarity and collective sacrifice in the pursuit of victory.

Types of Liberty Bonds

During World War I, the United States government issued different series and types of Liberty Bonds in order to raise the necessary funds for the war effort. Each series had its own distinct features and characteristics. Let’s explore the various types of Liberty Bonds:

- First Liberty Loan: This was the initial series of Liberty Bonds introduced in 1917. The First Liberty Loan offered a 3.5% interest rate and had a maturity period of 10 to 20 years. It targeted a wide range of investors, including individuals, corporations, and financial institutions. The minimum denomination for these bonds was $50.

- Second Liberty Loan: The Second Liberty Loan was issued in 1917, following the success of the First Liberty Loan. This series offered a higher interest rate of 4%, making it more attractive to potential investors. It had a shorter maturity period, typically ranging from 5 to 20 years. The minimum purchase amount for these bonds was $100.

- Third Liberty Loan: The Third Liberty Loan was introduced in 1918 to fund the ongoing war efforts. This series had various denominations and interest rates, depending on the specific bond. The bonds under the Third Liberty Loan were also known as “Victory Liberty Loan” to reflect the growing optimism of victory for the Allied forces. These bonds typically had a maturity period of 10 to 30 years.

- Fourth Liberty Loan: The Fourth Liberty Loan was issued in 1918 and aimed to raise significant funds to support the war effort in its final stages. These bonds had higher interest rates than previous series, often around 4.25% to 4.5%. The Fourth Liberty Loan featured different types of bonds, including the “Treasury 4.25% Fourth Liberty Loan” and the “Victory Liberty Loan.” The maturity periods varied, ranging from 5 to 25 years.

- Fifth Liberty Loan: The Fifth Liberty Loan was the final series of Liberty Bonds issued during World War I. Introduced in 1919, this series was primarily aimed at financing the post-war reconstruction efforts. The interest rates and maturity periods varied depending on the specific bond type. The Fifth Liberty Loan included bonds like the “Liberty Loan 4 3/4%” and the “4 1/2% Victory Liberty Loan.”

Each series of Liberty Bonds had its own unique characteristics, such as interest rates, maturity periods, and denominations. These different types of bonds allowed the government to attract a wide range of investors and effectively raise funds for the war effort. The success of the Liberty Bond campaigns relied on the engagement and participation of the American public, who eagerly invested in these bonds to support their country in its time of need.

Subscription and Purchase Process

The subscription and purchase process of Liberty Bonds during World War I was designed to be accessible and inclusive, allowing individuals from all walks of life to contribute financially to the war effort. Here is an overview of how the subscription and purchase of Liberty Bonds worked:

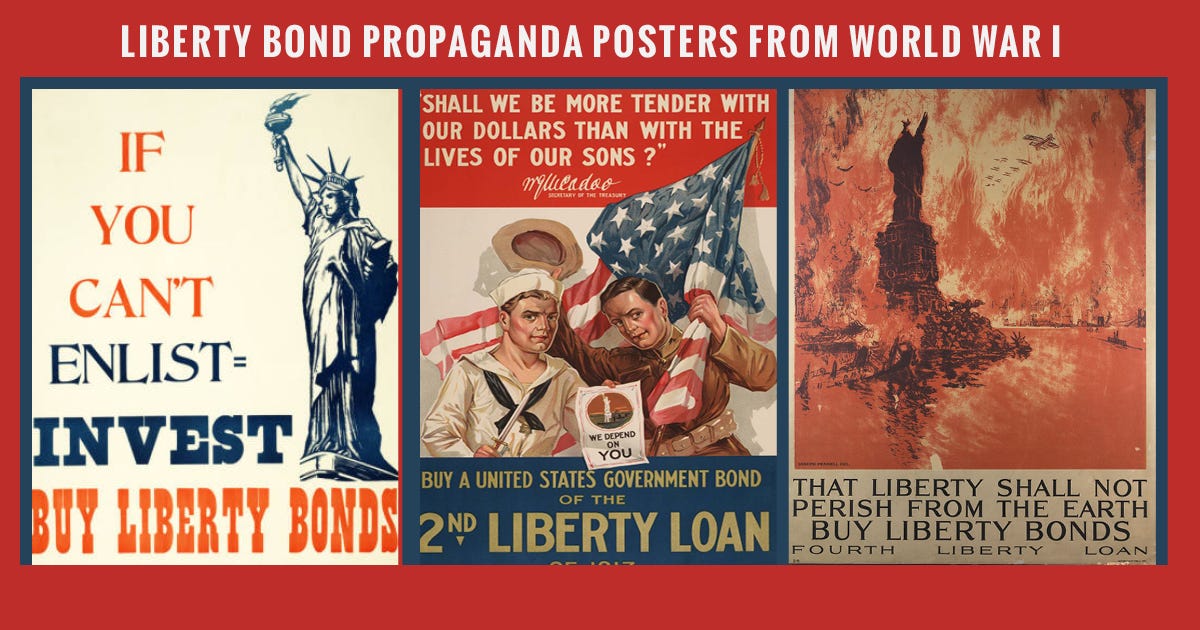

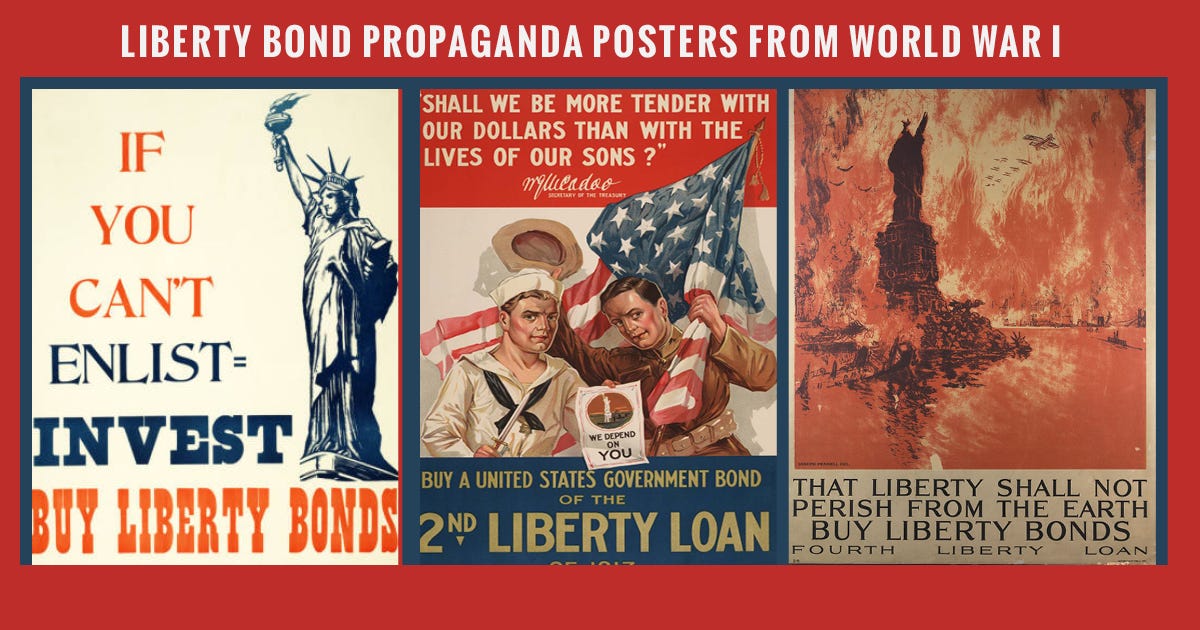

- Marketing and Promotion: The government launched extensive marketing campaigns to promote Liberty Bonds. Posters, pamphlets, and advertisements were deployed to create awareness and generate interest among the general public. These marketing efforts emphasized patriotism and the importance of supporting the war effort through investment in Liberty Bonds.

- Sales Campaigns: Public rallies and events were organized to mobilize potential investors. Celebrities, government officials, and prominent figures delivered speeches and encouraged citizens to purchase bonds as an act of patriotism. These sales campaigns created a sense of urgency and excitement, motivating individuals to participate.

- Subscription Periods: The government announced specific subscription periods during which individuals could purchase Liberty Bonds. These subscription periods were typically several weeks long, allowing sufficient time for people to make their investment decisions and complete the necessary paperwork.

- Authorized Dealers and Banks: Individuals interested in purchasing Liberty Bonds could approach authorized dealers or banks to make their investments. These dealers and banks acted as intermediaries between the government and the public, facilitating the purchase process and collecting subscriptions.

- Subscription Forms: Investors were required to fill out subscription forms, providing their personal information and specifying the amount of bonds they wished to purchase. These forms were available at authorized dealers and banks or could be obtained through postal services, making it convenient for individuals to participate.

- Payment Options: Investors could choose to make their payments for Liberty Bonds in several ways. Cash, checks, or money orders were commonly accepted forms of payment. Some individuals even used installment plans to spread out their investments over time, making it more affordable and manageable.

- Bond Issuance: Once the subscription period ended, the government would determine the total amount of bonds sold and allocate them accordingly. Investors were issued physical bonds or bond certificates as evidence of their investment.

- Interest Payments and Maturity: Liberty Bonds carried fixed interest rates, and the government made regular interest payments to bondholders. The maturity period varied depending on the specific series and type of bonds. At the end of the maturity period, investors would receive the full face value of their bonds.

The subscription and purchase process of Liberty Bonds was carefully orchestrated to engage the American public and ensure widespread participation. By simplifying the process and making it accessible to a range of individuals, the government successfully raised substantial funds for the war effort and fostered a sense of unity and patriotism among the population.

Features and Benefits of Liberty Bonds

Liberty Bonds offered a range of features and benefits that made them an attractive investment option for individuals during World War I. Here are some of the notable features and benefits of Liberty Bonds:

- Patriotic Investment: Liberty Bonds provided individuals with a tangible way to contribute to the war effort and demonstrate their patriotism. By investing in these bonds, citizens could actively support their country’s military operations and show solidarity with the troops on the frontlines.

- Accessible to All: Liberty Bonds were designed to be accessible to individuals from all socioeconomic backgrounds. With different denominations available, ranging from $50 to $1,000, almost anyone could participate and invest in Liberty Bonds, regardless of their financial status.

- Risk-free Investment: Investing in Liberty Bonds was considered a safe and secure option. Backed by the full faith and credit of the United States government, these bonds were seen as a reliable investment that carried a low risk of default. This assurance made them an attractive choice for risk-averse investors.

- Steady Income Stream: Liberty Bonds provided investors with a steady income stream through regular interest payments. The bonds carried fixed interest rates, typically ranging from 3.5% to 4.5%. These interest payments provided bondholders with a reliable source of income during a time of economic uncertainty.

- A Hedge Against Inflation: The fixed interest rates on Liberty Bonds acted as a hedge against potential inflation during the war. As the government spent large sums of money to support the war effort, inflationary pressures could have eroded the value of currency. However, the regular interest payments on Liberty Bonds helped to mitigate the impact of inflation on investors’ savings.

- Tax Advantages: Liberty Bond interest payments were exempt from federal income tax, making them an attractive investment from a tax perspective. This exemption allowed bondholders to maximize their returns and retain a larger portion of their interest income.

- Supporting National Growth: By investing in Liberty Bonds, individuals were indirectly supporting the nation’s economic growth. The funds raised from the sale of these bonds were used to finance war-related industries, fostering industrial development, job creation, and overall economic expansion.

- Post-war Redemption: Liberty Bonds had a maturity period at which point the bondholders would receive the full face value of their bonds. This post-war redemption provided individuals with a financial windfall, allowing them to recover their initial investment and potentially realize a profit.

Overall, Liberty Bonds offered individuals a combination of financial benefits and a sense of patriotic duty. They provided a secure investment option that generated income, protected against inflation, and supported the nation’s war efforts and economic growth. By investing in Liberty Bonds, individuals not only made a financial contribution but also became active participants in the war, aligning their interests with those of their country.

Impact of Liberty Bonds on the War Effort

The issuance of Liberty Bonds had a significant impact on the war effort during World War I. Here are some of the key ways in which Liberty Bonds influenced and supported the war:

- Financial Support: One of the primary goals of Liberty Bonds was to raise much-needed funds for the war effort. Through the sale of these bonds, the government was able to secure large sums of capital, which were used to finance the military operations, purchase equipment, provide supplies to troops, and maintain essential infrastructure. The financial support generated through Liberty Bonds played a crucial role in sustaining the war efforts of the United States.

- Domestic Economic Impact: The sale of Liberty Bonds not only provided funds for the war, but it also had a positive impact on the domestic economy. The massive government spending on war-related industries stimulated industrial growth and job creation. The increased production of weapons, ammunition, and other war materials created employment opportunities and boosted economic activity in various sectors. Liberty Bonds, in this way, helped fuel economic expansion and recovery during and after the war.

- Promotion of Patriotism and Unity: Liberty Bonds were not just financial instruments; they were also powerful symbols of patriotism and national unity. The government’s marketing campaigns and rallies associated with these bonds created a sense of collective responsibility and solidarity among Americans. By investing in Liberty Bonds, citizens demonstrated their commitment to the nation’s cause and the well-being of their fellow countrymen serving on the front lines.

- Widespread Citizen Involvement: Liberty Bonds offered an opportunity for citizens from all walks of life to actively contribute to the war effort. The accessibility of these bonds, with various denominations and payment options, allowed widespread citizen involvement. This inclusive approach to financing the war fostered a sense of ownership among the public, creating a shared sense of sacrifice and participation in the war effort.

- Stabilization of the Economy: The issuance of Liberty Bonds played a vital role in stabilizing the economy during the war. The massive government spending required to support the war effort could have led to inflation. However, by offering bonds and absorbing excess funds from the economy, the government was able to control inflationary pressures. The fixed interest payments on Liberty Bonds also provided individuals with a stable income stream, protecting their savings from the impact of rising prices.

- Inspiration for Future Generations: The success of Liberty Bonds in raising funds for the war effort set a precedent for future generations. The government’s ability to mobilize widespread citizen involvement and financial support through the sale of these bonds demonstrated the potential for individuals to play an active role in national endeavors. This legacy of citizen participation and financial contribution continued to influence subsequent war financing strategies and inspired a sense of civic duty among future generations.

Overall, the impact of Liberty Bonds on the war effort during World War I was multi-faceted. They provided critical financial support, stimulated economic growth, fostered patriotism and unity, encouraged citizen involvement, stabilized the economy, and left a lasting legacy of civic engagement. Through Liberty Bonds, the American people actively contributed to the war effort and played an integral role in the nation’s ultimate victory.

Criticisms and Controversies Surrounding Liberty Bonds

While Liberty Bonds played a significant role in financing the war effort during World War I, they were not without criticism and controversy. Here are some of the key criticisms and controversies surrounding Liberty Bonds:

- Compulsory Purchases: One of the criticisms leveled against Liberty Bonds was the perception that they were effectively mandatory, rather than voluntary. While the government encouraged citizens to invest in these bonds through marketing and peer pressure, some individuals felt coerced into purchasing them. The fear of being seen as unpatriotic or disloyal led some people to invest in bonds against their will.

- Disproportionate Burden: Critics argued that the burden of financing the war effort through Liberty Bonds fell disproportionately on the middle and lower classes. Wealthier individuals had the means to invest in bonds on a much larger scale, thereby benefiting more from the potential returns. This disparity in investment capacity was seen as unfair and raised questions about the effectiveness of Liberty Bonds as a truly democratic financing method.

- Conflict with Labor Movements: Labor unions and socialist groups often criticized Liberty Bonds, viewing them as a mechanism for suppressing working-class activism. These groups argued that while the ordinary citizens were called upon to invest in bonds, the wealthy elite were profiting off the war through war profiteering or avoiding military service. This critique highlighted the socio-economic divisions perpetuated by the bond system.

- Inequality in Interest Payments: Liberty Bonds offered fixed interest rates, which meant that wealthier investors with larger bond holdings received higher interest payments. This disparity in interest income further exacerbated the perception of the bond system favoring the wealthy while placing a higher burden on the less affluent investors.

- Government Influence: Some critics expressed concerns about the government’s control and influence over the economy through the issuance of Liberty Bonds. These concerns arose from the government’s ability to manipulate interest rates, absorb excess funds from the economy, and direct investment towards specific industries. The centralized control exerted through Liberty Bonds raised questions about the potential for government overreach and distortion of market forces.

- Propaganda and Emotional Manipulation: Critics argued that the marketing campaigns associated with Liberty Bonds relied heavily on emotional manipulation and propaganda tactics. Some viewed these tactics as a way to exploit citizens’ sense of duty and patriotism, suppressing dissent and critical thinking. The use of emotional appeals raised ethical concerns about the government’s methods of persuasion and public messaging.

It is important to note that while these criticisms and controversies emerged during the time of World War I, they reflect the diverse perspectives and complexities surrounding the financing of war efforts. While Liberty Bonds were instrumental in raising funds and rallying patriotic support, they also raised legitimate concerns about fairness, government control, and the ethical implications of emotional manipulation.

Conclusion

Liberty Bonds played a crucial role in financing the war effort and fostering patriotic unity during World War I. These government-issued securities allowed individuals from all walks of life to contribute financially to the war while providing a sense of ownership and investment in the outcome. The accessibility and marketing efforts surrounding Liberty Bonds mobilized millions of Americans, raising significant funds and instilling a shared sense of sacrifice and duty.

The issuance of Liberty Bonds had a multi-faceted impact on the war effort and the nation as a whole. Not only did the bonds provide essential financial support, but they also stimulated economic growth, stabilized the economy, and inspired future generations to actively participate in national endeavors. The symbolic significance of Liberty Bonds as a patriotic investment cannot be understated, as they symbolized a collective effort to support the troops and defend the nation.

However, Liberty Bonds were not immune to criticism and controversy. Concerns were raised about the fairness of the bond system, the disproportionate burden placed on certain socioeconomic groups, and the perception of government influence and control. Critics also questioned the ethics of emotional manipulation and the pressure to invest in bonds.

In spite of these criticisms, Liberty Bonds left an enduring legacy. They demonstrated the potential for individuals to make a tangible impact on national affairs and showcased the power of financial mobilization in times of war. The success of the Liberty Bond campaigns laid the groundwork for future war financing strategies and influenced subsequent generations’ understanding of civic duty and citizen involvement in national efforts.

Ultimately, the story of Liberty Bonds during World War I is a testament to the complex dynamics of financing war and the role of patriotism in inspiring collective action. By understanding and reflecting on the history of Liberty Bonds, we can gain valuable insights into the ways in which governments engage their citizens in times of conflict and the enduring impact of financial mobilization on national unity and resilience.