Finance

How Did Credit Work In The 1920S

Modified: February 21, 2024

Discover how credit functioned during the 1920s and its impact on the economy. Explore the role of finance in shaping this pivotal decade.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of the 1920s

- Economic Boom

- Consumer Culture

- Credit in the 1920s

- Role of Credit

- Types of Credit

- Credit Availability

- Impact of Credit on the Economy

- Increased Spending Power

- Expansion of Industries

- Rise of Installment Purchasing

- Dangers and Risks of Credit

- Overextension of Credit

- Debt and Bankruptcy

- Lack of Savings Culture

- Government Regulations and Responses to Credit

- Emergence of Consumer Protection Laws

- Formation of Regulatory Agencies

- Conclusion

Introduction

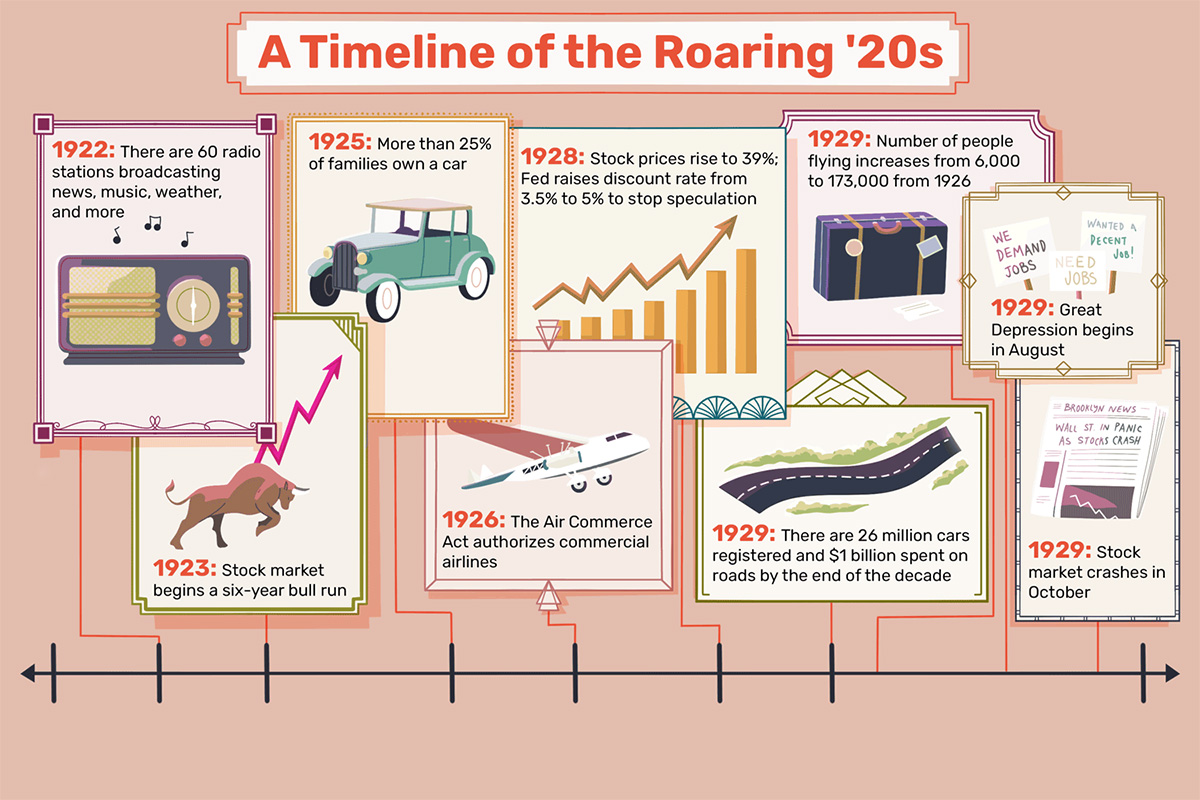

The 1920s, often referred to as the “Roaring Twenties,” were a significant period in American history characterized by economic prosperity and societal change. One of the key factors driving this transformative decade was the increasing accessibility and popularity of credit. During this time, credit played a pivotal role in shaping consumer culture and fueling economic growth. In this article, we will delve into the workings of credit in the 1920s, its impact on the economy, the risks involved, and the government’s response.

The 1920s marked a time of great optimism and exuberance after the end of World War I. The economy experienced a boom with a surge in industrial production, urbanization, and technological advancements. This period saw the rise of mass production and the emergence of new consumer goods, such as automobiles, radios, and household appliances.

With the introduction of these modern conveniences, there was a growing desire among Americans to own these products. However, many individuals did not have the necessary funds to make large purchases outright. This is where credit became a game-changer.

Credit allowed consumers to purchase goods and services on installment plans, where they could pay in regular installments over a set period. This enabled individuals to enjoy the benefits of these products immediately, even if they didn’t have the full amount upfront. As a result, credit became a catalyst for driving consumer spending and stimulating economic growth.

There were various forms of credit available during the 1920s. Department stores, for example, offered credit accounts to customers, allowing them to make purchases and pay later. Mail-order companies also extended credit to customers who bought goods from their catalogs. Additionally, banks and finance companies provided loans for various purposes, including home purchases and business investments.

The availability of credit expanded during this period, making it easier for individuals to obtain loans. Banks relaxed their lending standards and offered lower interest rates, making credit more accessible to a wider population. This increased accessibility sparked a consumer frenzy as people could now afford to buy goods that were previously out of their reach.

In the next sections, we will explore the impact of credit on the economy and delve into the potential dangers and risks associated with excessive borrowing in the 1920s. We will also discuss how the government responded to the rise of credit and the regulatory measures put in place to protect consumers.

Overview of the 1920s

The 1920s, also known as the “Roaring Twenties” or the “Jazz Age,” was a transformative decade in American history. It was characterized by rapid economic growth, social change, and cultural dynamism. Following the end of World War I, the United States experienced a period of unprecedented prosperity and optimism.

One of the defining features of the 1920s was the economic boom that swept the nation. The aftermath of the war brought about favorable conditions for economic expansion, with the US emerging as a dominant industrial and financial power on the global stage. Industries such as manufacturing, construction, and consumer goods experienced substantial growth, fueled by technological advancements and increased consumer demand.

The expansion of industries created new job opportunities, leading to increased urbanization as people moved from rural areas to cities in search of employment. The urban centers underwent significant changes, with the development of skyscrapers, the proliferation of electric power, and the rise of automobile culture.

This period also witnessed a remarkable shift in consumer culture. The widespread adoption of mass production techniques enabled the production of goods on a large scale, resulting in reduced costs and greater affordability. The availability of new consumer goods, such as automobiles, radios, and household appliances, gave rise to a desire for modern conveniences.

Advertising played a crucial role in shaping consumer desires and promoting consumption. Advertisements showcased the latest products and presented them as essential to modern living. Through persuasive marketing techniques, companies convinced consumers that these products were not only desirable but also necessary for a fulfilling and prosperous life.

The 1920s also marked a period of changing societal norms and cultural values. The younger generation, often referred to as the “Flappers,” rejected traditional Victorian ideals and embraced a more liberated lifestyle. Women challenged societal expectations by cutting their hair short, wearing makeup, and engaging in activities traditionally reserved for men, such as smoking and drinking.

The era also witnessed the rise of jazz music, which soon became synonymous with the spirit of the Roaring Twenties. Jazz was a symbol of rebellion against the restrictions of the past and served as a unifying force among diverse groups, breaking down racial and cultural barriers.

However, beneath the surface of prosperity and cultural vibrancy, the seeds of economic instability were being sown. The rapid expansion of credit and the excesses of speculation laid the groundwork for the stock market crash of 1929 and the subsequent Great Depression.

In the next sections, we will explore the role of credit in the 1920s and its impact on the economy, as well as the risks and dangers associated with the widespread availability of credit.

Economic Boom

The 1920s were marked by a significant economic boom, propelled by factors such as increased industrial production, technological advancements, and growing consumer demand. This period of rapid economic growth laid the foundation for the prosperity and lifestyle changes that came to define the Roaring Twenties.

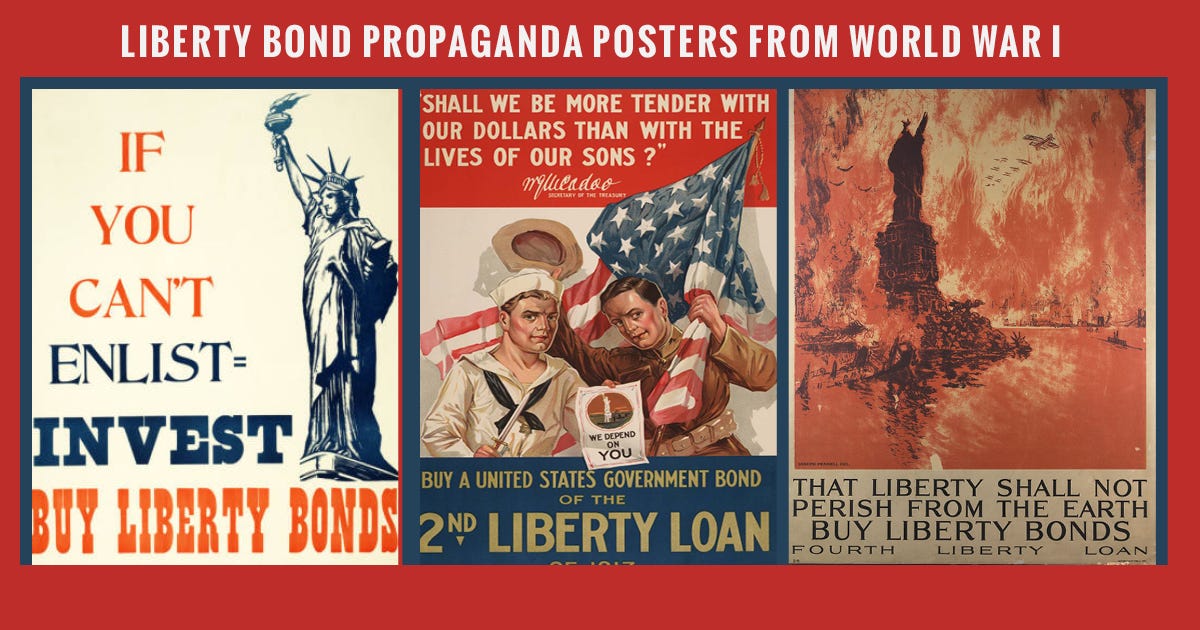

Following the end of World War I, the United States experienced a surge in industrial production. Industries such as manufacturing, construction, and mining flourished as the nation transitioned from a wartime economy to peacetime production. Advances in technology, such as assembly line methods and electrification, allowed for greater efficiency and output.

The automobile industry was a major driving force behind the economic boom of the 1920s. Henry Ford’s innovative assembly line techniques enabled mass production of affordable automobiles, such as the Model T. This resulted in increased mobility and accessibility, as more Americans could afford to own a car. The automobile industry also stimulated related industries, such as steel and rubber, further fueling economic growth.

Another contributing factor to the economic boom was the expansion of consumer goods. Advances in manufacturing and distribution allowed for the production of a wide range of affordable products, from radios to household appliances. As these products became more accessible, consumer spending soared, driving demand and stimulating economic activity.

The construction industry saw significant growth during the 1920s, with the development of skyscrapers in urban centers. The construction of iconic buildings, such as the Empire State Building in New York City, symbolized progress and prosperity. The demand for housing also increased as more people migrated to urban areas in search of job opportunities.

The success of industries and the resulting increase in employment led to rising wages and a higher standard of living for many Americans. With greater disposable income, people had more money to spend on leisure activities, entertainment, and luxury goods.

The economic boom of the 1920s also had a positive impact on agriculture. Mechanization and improved farming techniques led to increased agricultural productivity. However, the agricultural sector faced challenges later in the decade, as overproduction and falling prices led to financial difficulties for farmers.

Overall, the economic boom of the 1920s brought about significant changes in American society. It fostered a sense of optimism and the belief that prosperity would continue indefinitely. However, the excessive speculation and unregulated credit expansion of the era would ultimately lead to the stock market crash of 1929 and the subsequent Great Depression.

In the next sections, we will explore the role of credit in the 1920s and its impact on consumer culture and spending.

Consumer Culture

The economic boom of the 1920s not only transformed the American economy but also shaped a new consumer culture. The increased availability of goods, combined with changing societal attitudes, led to a significant shift in how people viewed and participated in consumerism.

With the rise of mass production techniques, an array of new and improved consumer goods flooded the marketplace. From automobiles to radios, vacuum cleaners to refrigerators, Americans had access to a wide range of modern conveniences that promised to make their lives easier and more enjoyable.

This newfound abundance of goods sparked a consumer frenzy. Americans embraced the idea of owning the latest gadgets and products, believing that possessing these items was a status symbol and a sign of modernity. Advertising played a crucial role in promoting consumption, as companies crafted persuasive marketing campaigns to convince individuals of the necessity and desirability of their products.

Consumer culture became intertwined with notions of personal identity and social status. Possessing the right goods was seen as an indication of one’s wealth and success. It became a way for individuals to express themselves and fit into the rapidly changing society.

One of the driving forces behind the consumption boom was the emergence of installment purchasing. This allowed individuals to buy goods on credit, paying for them in regular installments over a set period of time. Installment plans made expensive purchases attainable for the average person, as they no longer had to save up the full amount before making a purchase. Consumers could enjoy the benefits of the product immediately, paying for it over time.

The concept of “keeping up with the Joneses” became prevalent during this time. People felt pressure to match or surpass their neighbors in terms of material possessions. The desire to have the latest products and keep up with prevailing fashion trends fueled consumer spending. Owning the right gadgets, wearing fashionable clothing, and living in modern homes became important markers of social status.

Consumer culture also extended beyond simply acquiring goods. It encompassed experiences and leisure activities as well. Americans embraced the idea of leisure time, and businesses responded by providing a wide range of entertainment options. The 1920s saw the rise of movie theaters, dance halls, amusement parks, and sports stadiums, where people could indulge in recreational activities and escape the pressures of daily life.

However, the consumer culture of the 1920s was not without its critics. Some argued that the excessive focus on material possessions and the pursuit of pleasure was superficial and contributed to societal problems. There were concerns about the growing emphasis on conspicuous consumption and the potential erosion of moral values.

Despite the criticisms, consumer culture was a defining characteristic of the 1920s. It shaped the way people interacted with products, the way businesses marketed their goods, and the way society as a whole embraced a new way of life. The consumer-driven economy of the 1920s had far-reaching implications and laid the groundwork for the consumer culture that continues to dominate today.

In the next sections, we will explore the role of credit in the 1920s and its impact on the economy, as well as the potential dangers and risks associated with excessive borrowing.

Credit in the 1920s

Credit played a pivotal role in the consumer-driven economy of the 1920s. It provided individuals with the means to make purchases beyond their immediate financial capabilities, driving consumer spending and fuelling economic growth. The availability and accessibility of credit transformed the way people bought goods and services during this era.

One of the primary functions of credit in the 1920s was to facilitate installment purchasing. This allowed consumers to buy goods and pay for them over time, in regular installments. This system made expensive purchases more attainable, particularly for middle-class Americans who previously might have struggled to save up the full amount before making a purchase.

Various forms of credit were available to consumers in the 1920s. Department stores and mail-order companies offered credit accounts to customers, enabling them to make purchases and pay off the balance over time. Banks and finance companies also provided loans for a range of purposes, from home purchases to business investments.

The advent of installment purchasing fueled consumer spending and allowed people to enjoy the benefits of products immediately. Automobiles were a prime example of this trend. With the rise of the automobile industry, purchasing a car on credit became commonplace. Americans could now own a vehicle without having to pay the full price upfront, further driving the demand for automobiles and stimulating the economy.

The increased availability of credit was facilitated by changes in the banking sector. Banks began to relax their lending standards and offer loans at lower interest rates. They recognized the potential for profit in extending credit to a wider population and meeting the growing demand for consumer goods. The willingness of banks to provide credit, combined with the public’s desire for modern products, created a perfect storm for increased borrowing and spending.

However, the widespread availability of credit also posed risks. Many individuals, enticed by easy access to credit and the allure of owning the latest products, overextended themselves financially. They accumulated high levels of debt, often taking on multiple loans to fund their purchases. This reliance on credit left individuals vulnerable when economic conditions deteriorated.

The lack of a savings culture was another consequence of the credit-driven economy. Instead of setting money aside for future needs, individuals depended on credit to fund their immediate desires, leaving them financially vulnerable in times of economic downturn.

The role of credit in the 1920s cannot be understated. It transformed consumer behavior, shaping a culture of immediate gratification and materialism. While credit provided opportunities for individuals to enjoy the benefits of modern products, it also carried significant risks and contributed to the economic instability that led to the Great Depression.

In the following sections, we will delve into the impact of credit on the economy during the 1920s and explore the potential dangers and risks associated with excessive borrowing.

Role of Credit

In the vibrant consumer culture of the 1920s, credit played a vital role in driving economic growth and shaping purchasing patterns. It provided individuals with the means to make purchases beyond their immediate financial capabilities, enabling the growth of installment purchasing and transforming the way goods were bought and sold.

One of the primary functions of credit during this period was to facilitate installment buying. Instead of having to save up the full purchase price of an item before being able to own it, consumers could purchase goods on credit and repay the amount over a set period in regular installments. This allowed individuals to enjoy the benefits of products immediately, without depleting their savings.

The availability of credit opened up a world of possibilities for consumers. It gave them access to high-priced items such as automobiles, household appliances, and furniture, which would have otherwise been unaffordable. By spreading out payments over several months or years, credit made these purchases more attainable for ordinary Americans, driving consumer spending and fueling economic growth.

Credit was particularly instrumental in driving the car culture of the 1920s. With the rise of the automobile industry, owning a car became a symbol of prestige and mobility. However, automobiles were expensive, making it challenging for the average person to purchase one outright. Credit allowed individuals to make monthly car payments, expanding car ownership and stimulating the industry.

Furthermore, credit played a critical role in enabling homeownership during this era. Banks and financial institutions provided mortgage loans to prospective homebuyers. This opened up opportunities for more Americans to own a house, contributing to the growth of the real estate sector and providing a platform for wealth accumulation through property ownership.

The accessibility and availability of credit in the 1920s also fueled the growth of the retail industry. Department stores, in particular, embraced the concept of credit accounts for customers. Through these accounts, individuals could purchase goods on credit and make payments over time. This not only increased customer spending but also fostered brand loyalty and customer retention for retailers.

Overall, credit played an essential role in the consumer-driven economy of the 1920s. It allowed individuals to participate in the expanding marketplace by providing them with purchasing power beyond their immediate financial means. By driving installment purchasing, credit stimulated consumer spending, boosted economic growth, and facilitated the purchase of big-ticket items that were otherwise inaccessible to many Americans.

However, as we will explore in the subsequent sections, the unchecked expansion of credit came with its own set of risks and dangers, ultimately leading to the economic instability of the 1930s.

Types of Credit

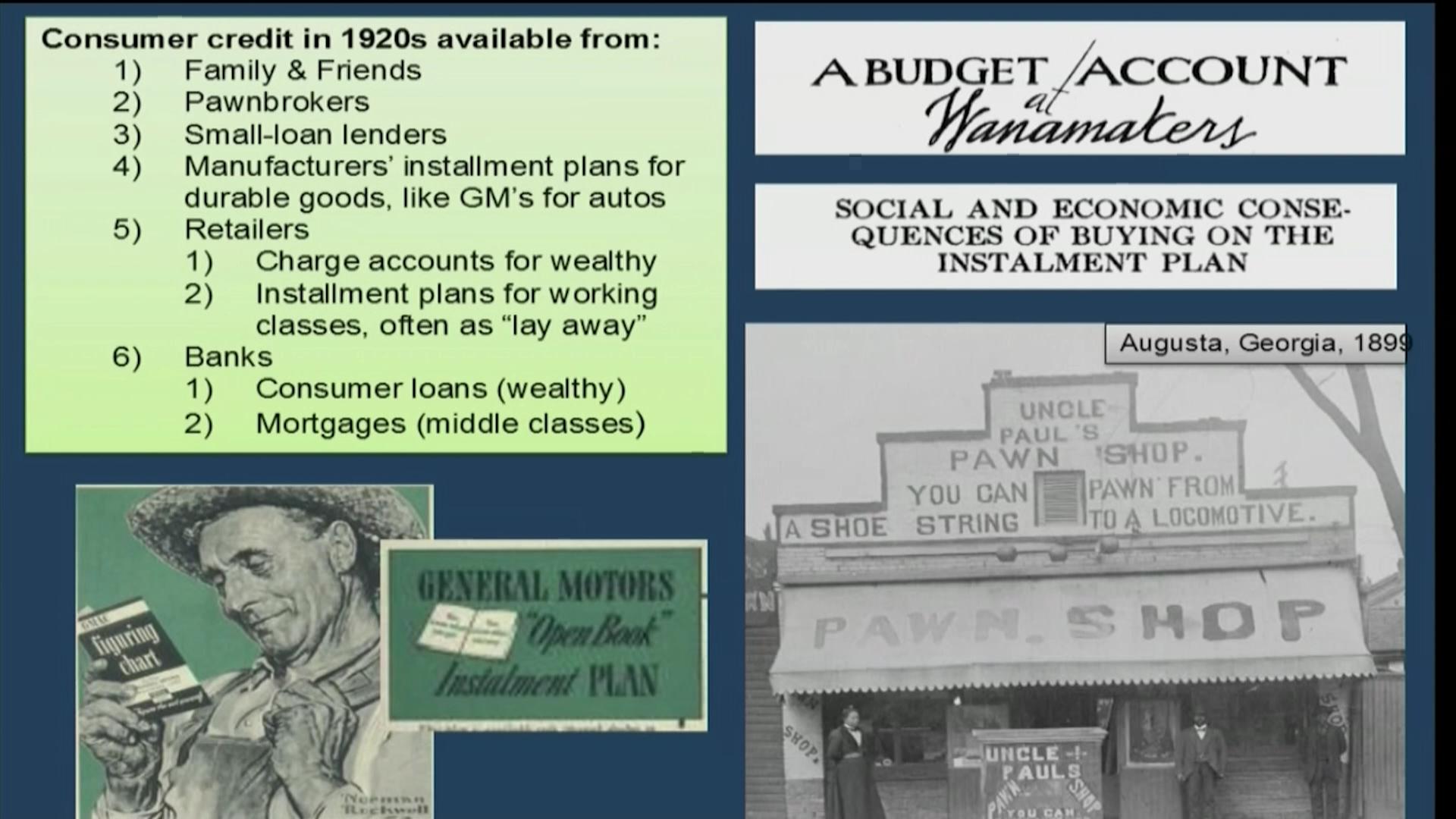

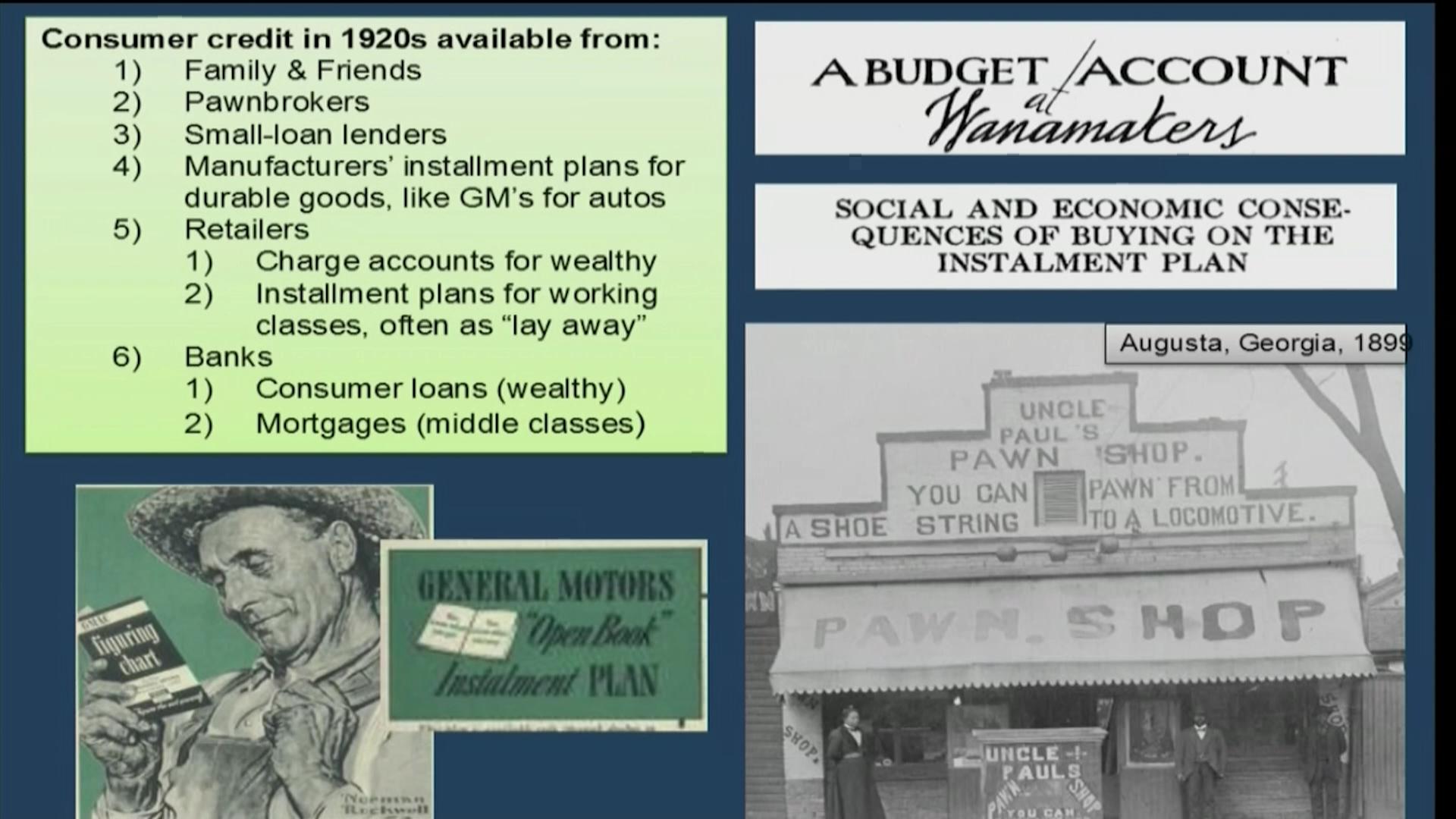

In the 1920s, various types of credit were available to consumers, allowing them to make purchases without immediate payment. These different forms of credit played a significant role in shaping the consumer culture and driving the economic boom of the era.

One common form of credit during this period was the establishment of credit accounts with department stores. Department stores offered customers the option to buy goods on credit and pay off the balance over time. These credit accounts allowed individuals to make purchases without needing to have the full amount available at the time of purchase.

Mail-order companies also offered credit to customers through their catalogs. Consumers could select items from the catalog and pay for them in installments. This credit option made it possible for people in rural areas or those with limited access to physical stores to purchase goods and enjoy the convenience of mail-order shopping.

Banks and finance companies played a significant role in providing loans for various purposes. They offered personal loans, which individuals could use to finance purchases or fund personal expenses. Homeowners could leverage credit to obtain mortgage loans for purchasing property or making improvements to their homes.

Automobile financing was particularly important in the 1920s, as owning a car became a symbol of status and freedom. Auto manufacturers and dealerships worked with banks and financial institutions to offer loans and installment plans to potential buyers. These financing options made it possible for more individuals to afford cars and participate in the growing car culture.

Another type of credit that gained popularity during this period was consumer credit associations. These associations, also known as “credit unions,” were organized by groups of individuals who pooled their savings to provide credit to members of the association. This form of credit was primarily utilized by working-class individuals and served as an alternative to traditional banking institutions.

In addition to these forms of credit, individuals could obtain loans from pawnbrokers, who accepted personal property as collateral. This allowed individuals to obtain short-term loans based on the value of their belongings, providing them with immediate access to cash in times of need.

The types of credit available during the 1920s expanded the purchasing power of consumers, enabling them to acquire goods and services that would have been otherwise unattainable. Whether through department store accounts, mail-order catalogs, bank loans, or car financing, credit options provided opportunities for individuals to participate in the growing consumer culture and stimulate the economy.

However, as we will explore in the following sections, the increased availability of credit also posed risks and contributed to the underlying instabilities that eventually led to the stock market crash of 1929 and the subsequent Great Depression.

Credit Availability

The 1920s witnessed a significant expansion in credit availability, making it easier for individuals to obtain loans and finance their purchases. This increased accessibility of credit played a pivotal role in driving consumer spending and fueling the economic growth of the era.

One of the main factors contributing to the growing availability of credit was the relaxation of lending standards by financial institutions, particularly banks. Banks recognized the potential for profit in extending credit to a wider population and meeting the increasing demand for consumer goods. As a result, they began to offer loans at more favorable terms, such as lower interest rates and longer repayment periods.

Furthermore, the establishment of the Federal Reserve System in 1913 played a crucial role in ensuring the stability of the banking system and facilitating credit availability. The Federal Reserve acted as a lender of last resort, providing banks with a safety net during times of financial stress. This helped to instill confidence in the banking sector and encouraged banks to extend credit to consumers.

The rise of the automobile industry also contributed to the availability of credit. Auto manufacturers and dealerships worked closely with banks and financial institutions to develop financing options for car purchases. This allowed individuals to purchase cars on credit and make monthly payments, making automobile ownership more accessible to a wider population.

Department stores played a significant role in making credit widely available to consumers. Many department stores offered their own credit accounts, allowing customers to buy goods on credit and pay off the balance over time. These credit accounts provided individuals with the convenience of making purchases without needing to have the full amount upfront.

Another factor that expanded credit availability was the emergence of consumer credit associations, also known as credit unions. These associations were formed by groups of individuals who pooled their savings to provide credit to members. This cooperative model allowed individuals to access credit without having to rely solely on traditional banking institutions.

The increased availability of credit during the 1920s played a significant role in stimulating consumer spending and fueling economic growth. It allowed individuals to afford big-ticket items, such as automobiles and household appliances, that were previously out of reach. The expansion of credit also created opportunities for individuals to invest in homes and start businesses, contributing to the overall prosperity of the era.

However, the accessibility of credit also came with risks. The easy availability of credit led some individuals to take on excessive amounts of debt. As borrowing and spending increased, many Americans found themselves overextended, leading to financial difficulties and contributing to the underlying instabilities that eventually led to the stock market crash of 1929 and the subsequent Great Depression.

In the next sections, we will explore the impact of credit on the economy during the 1920s and the potential dangers and risks associated with excessive borrowing.

Impact of Credit on the Economy

The widespread availability of credit had a profound impact on the economy of the 1920s. It played a crucial role in driving consumer spending, expanding industries, and fueling economic growth. However, it also contributed to underlying instabilities that eventually led to the economic downturn of the 1930s.

One of the notable impacts of credit was the increased spending power it provided to consumers. With the ability to purchase goods on credit, individuals could afford big-ticket items such as automobiles, appliances, and furniture. This surge in consumer spending stimulated demand and fueled the expansion of industries, creating a ripple effect throughout the economy.

The automobile industry, in particular, benefited immensely from the availability of credit. Consumers could finance the purchase of cars through loans and installment plans, leading to a significant increase in automobile ownership. This, in turn, fueled the growth of related industries, such as rubber, steel, and petroleum, contributing to job creation and economic expansion.

Additionally, the availability of credit led to a rise in installment purchasing. Consumers could purchase goods and pay for them over time, spreading out the cost of payments. This encouraged individuals to make larger purchases and engage in more frequent transactions, boosting consumer spending and stimulating economic activity.

Credit also played a crucial role in promoting economic mobility and entrepreneurship. Individuals could obtain loans to start businesses, invest in real estate, or expand their existing ventures. This increased access to capital fueled economic innovation and contributed to the expansion of industries and job opportunities.

However, the reliance on credit and the debt accumulation that ensued carried inherent risks. As consumers took on more debt, their ability to repay became increasingly dependent on sustained economic growth and stable employment. This left individuals vulnerable to financial hardships when economic conditions deteriorated.

In addition, the excessive expansion of credit contributed to speculative investment and overvaluation of assets, creating an unsustainable bubble in the stock market. When the stock market crashed in 1929, it led to a severe economic downturn, triggering the Great Depression.

The impact of credit on the economy of the 1920s was twofold. On one hand, it fueled economic growth, expanded industries, and provided individuals with increased purchasing power. On the other hand, it contributed to financial fragility and instability, ultimately leading to the catastrophic collapse of the economy.

In the subsequent sections, we will delve into the dangers and risks associated with excessive credit, as well as the government’s response and regulatory measures implemented in response to the credit-driven economy of the 1920s.

Increased Spending Power

One of the significant impacts of credit on the economy of the 1920s was the increased spending power it provided to consumers. The availability of credit allowed individuals to purchase goods and services beyond their immediate financial means, stimulating consumer spending and driving economic growth.

Credit provided individuals with the ability to make larger purchases by spreading out the cost over time. Instead of having to save up for months or even years to afford a high-priced item, consumers could simply finance the purchase and make regular payments. This accessibility to credit opened up opportunities for individuals to afford big-ticket items, such as automobiles, household appliances, and furniture, that were previously out of reach.

The increased purchasing power resulting from credit had a multiplier effect on the economy. As consumers bought goods, businesses experienced increased demand, leading to higher production levels and job creation. The expansion of industries, such as automobile, manufacturing, and retail, fueled economic growth and prosperity.

Moreover, increased spending power had a positive impact on the overall standard of living. Americans could now afford modern conveniences and luxuries that were once considered a luxury. The rise of consumer culture and materialism was fueled by the allure of credit, as individuals felt empowered to fulfill their desires in the present rather than waiting to accumulate savings.

By providing individuals with immediate access to goods and services, credit helped stimulate demand and encourage economic activity. This not only benefited businesses but also contributed to the emergence of new industries and a dynamic marketplace.

However, the increased spending power resulting from credit was not without its risks. It created a culture of immediate gratification and reliance on debt rather than savings. Individuals became more focused on acquiring material possessions and less inclined to prioritize long-term financial stability.

Furthermore, the reliance on credit for increased spending power left individuals vulnerable to economic downturns. When the economy experienced a downturn, the ability of consumers to repay their debts became compromised, leading to a spiral of defaults and financial hardships.

Overall, the increased spending power resulting from credit had a profound impact on the economy of the 1920s. It fueled consumer spending, stimulated economic growth, and transformed the way individuals bought and consumed goods. However, the temporary boost in spending power had long-term consequences, as the excessive reliance on credit contributed to the underlying instabilities that led to the economic collapse of the 1930s.

In the next sections, we will explore the dangers and risks associated with the credit-driven economy of the 1920s, as well as the government’s response and regulatory measures implemented to address these issues.

Expansion of Industries

The availability of credit in the 1920s played a significant role in driving the expansion of industries and fueling economic growth. The increased consumer spending power, made possible by credit, led to a surge in demand for goods and services, creating ample opportunities for businesses to thrive and innovate.

One of the industries that experienced remarkable growth during this period was the automobile industry. Credit played a crucial role in making automobile ownership more accessible to the average consumer. By providing loans and installment plans, credit allowed individuals to purchase cars without having to pay the full amount upfront. This led to a sharp increase in demand for automobiles, which in turn stimulated production, job creation, and technological advancements within the industry.

Another sector that benefited from the expansion of credit was the manufacturing industry. The increased purchasing power of consumers, coupled with the ease of borrowing, led to higher demand for consumer goods. This prompted manufacturers to ramp up production to meet the growing market needs. The development of mass production techniques and assembly line methods allowed for the efficient production of goods at a large scale, contributing to the expansion of the manufacturing industry.

The retail industry, particularly department stores, experienced substantial growth thanks to the availability of credit. Department stores were quick to capitalize on the consumer desire for immediate gratification and convenience. They offered credit accounts to customers, enabling them to make purchases and pay off the balance over time. This credit option not only stimulated sales but also fostered customer loyalty and propelled the growth of retail chains across the country.

Additionally, the expansion of credit fueled growth in the housing and construction sectors. With the availability of mortgage loans, individuals could finance the purchase of homes or fund home improvement projects. This led to an increase in the demand for housing, which drove the construction industry and created jobs in areas such as architecture, engineering, and contracting.

The expansion of industries had a cascading effect on the economy. As industries grew, they created job opportunities, increasing employment levels and disposable income. This, in turn, further fueled consumer spending, creating a positive feedback loop of economic growth.

However, the expansion of industries driven by credit had its limits. The overreliance on credit and the inability of consumers to sustain debt payments ultimately contributed to the economic downturn of the 1930s.

In the following sections, we will explore the risks associated with excessive borrowing and the regulatory measures put in place to address the problems arising from the expansion of credit in the 1920s.

Rise of Installment Purchasing

The 1920s witnessed a significant rise in installment purchasing, fueled by the availability of credit. Installment purchasing revolutionized the way people bought goods and services, allowing them to make purchases and pay for them over time in regular installments. This trend had a profound impact on consumer behavior, the retail industry, and the overall economy.

Credit played a crucial role in driving the rise of installment purchasing. With the availability of credit, individuals could afford high-priced items that were previously out of reach. Instead of having to save up for months or years to afford a purchase, individuals could simply finance it and make affordable monthly payments.

The rise of installment purchasing was particularly evident in the automobile industry. Automobile manufacturers and dealerships, in collaboration with banks and financial institutions, introduced financing options and installment plans that allowed consumers to buy cars on credit. This transformed the automobile industry, making car ownership more accessible to the masses and driving up demand for cars.

Similarly, the retail industry embraced installment purchasing as a way to attract customers and boost sales. Department stores, for example, offered credit accounts to customers, allowing them to make purchases and pay off the balance over time. This provided individuals with the immediate gratification of owning desired items while spreading out the cost of payments.

The rise of installment purchasing had profound implications for consumer behavior. It fueled a culture of immediate gratification and impulse buying, as individuals no longer needed to save up for a long period before making a purchase. This shift in consumer mindset led to increased spending and a higher turnover of goods.

Additionally, installment purchasing contributed to the growth of the retail industry. Department stores and other retailers experienced a surge in sales as consumers took advantage of credit options to make purchases. The retail industry adapted to this trend, offering a wider range of products and increasing their marketing efforts to entice consumers to buy on credit.

Moreover, installment purchasing played a significant role in stimulating economic growth. As consumers made purchases on credit, businesses experienced increased demand for their products, leading to higher production levels and job creation. The expansion of industries, such as manufacturing and automobile manufacturing, can be attributed in part to the rise of installment purchasing.

However, the rise of installment purchasing also carried risks. The ease of obtaining credit and the allure of immediate gratification often led individuals to overextend themselves financially. Excessive borrowing and debt accumulation were among the factors that contributed to the economic instabilities that eventually led to the Great Depression in the 1930s.

In response to the risks associated with installment purchasing, the government implemented regulatory measures to protect consumers and prevent excessive borrowing. Regulations were put in place to ensure transparency and fair lending practices, aiming to prevent predatory lending and the exploitation of consumers.

Despite the risks, the rise of installment purchasing in the 1920s transformed consumer behavior and contributed to the economic prosperity of the era. It fueled consumer spending, drove industry growth, and reshaped the retail landscape. However, the excesses of installment purchasing also highlighted the dangers of unsupervised credit expansion.

Dangers and Risks of Credit

The widespread availability of credit in the 1920s brought about tremendous economic growth and increased consumer spending. However, this credit-driven economy also carried inherent dangers and risks that contributed to the economic instabilities of the era.

One of the major dangers of credit in the 1920s was the overextension of borrowing. The easy access to credit, combined with the allure of immediate gratification and the desire to keep up with social and cultural trends, led many individuals to accumulate excessive levels of debt. Borrowing beyond one’s means increased the risk of financial instability, as individuals became burdened with debt they could not afford to repay.

Another risk associated with credit was the potential for financial mismanagement and difficulty in maintaining responsible borrowing habits. Some individuals lacked the necessary financial literacy to navigate the complexities of credit, leading them to make poor borrowing decisions and fall into a cycle of debt. The reliance on credit also discouraged the development of a savings culture, as people became more dependent on borrowing to finance their consumption.

Excessive borrowing and rising levels of debt created a vulnerable financial position for individuals when economic conditions deteriorated. As the economy faced a downturn, such as the stock market crash of 1929, many borrowers found themselves unable to make their debt payments. This resulted in widespread defaults and financial hardships, exacerbating the economic crisis and contributing to the onset of the Great Depression in the 1930s.

Furthermore, the credit-driven economy of the 1920s led to speculative investment practices and asset bubbles. As credit was readily available, individuals and businesses engaged in risky speculation, particularly in the stock market. The unchecked expansion of credit contributed to inflated asset prices and overvaluation of stocks, creating an unsustainable bubble that eventually burst.

Lastly, the reliance on credit as a means of financing purchases contributed to a lack of savings. Instead of setting money aside for future needs, many individuals preferred to rely on credit to fulfill immediate desires. This lack of savings created a vulnerable position for individuals when faced with unexpected financial challenges or economic downturns.

In response to the dangers and risks of credit, the government took steps to implement regulations and address the issues arising from excessive borrowing. The Federal Reserve, for example, implemented monetary policies to regulate credit and stabilize the banking system. Consumer protection laws were also introduced to promote transparency and fair lending practices, aiming to prevent predatory lending and protect borrowers.

The dangers and risks associated with credit in the 1920s served as valuable lessons learned. They highlighted the need for responsible lending practices, financial education, and regulatory oversight to ensure the sustainable and stable growth of the economy.

In the next section, we will explore the government’s response to the rise of credit and the formation of regulatory agencies to address the risks and dangers associated with the credit-driven economy of the 1920s.

Overextension of Credit

One of the significant dangers of the credit-driven economy of the 1920s was the overextension of borrowing. The easy availability of credit, combined with societal pressures and the desire for immediate gratification, led many individuals to accumulate excessive levels of debt.

The allure of credit allowed people to purchase goods and services beyond their immediate financial means. Individuals were enticed by the ability to own the latest products and keep up with societal trends, even if they did not have the funds to make the purchases outright. The widespread accessibility of credit made it tempting for individuals to borrow beyond what they could afford to repay.

Overextension of credit had severe consequences for both individuals and the economy as a whole. When borrowers accumulated excessive amounts of debt, they often found themselves burdened with high-interest payments and struggled to meet their financial obligations. This overextension of borrowing created a vulnerable financial position for individuals, leaving them susceptible to financial hardships in the event of an economic downturn or a change in personal circumstances.

Furthermore, the overextension of credit had broader implications for the economy. As individuals struggled to repay their debts, widespread defaults and financial distress ensued, contributing to the economic instabilities that eventually led to the Great Depression in the 1930s. Financial institutions also faced significant risks, as their assets became burdened with non-performing loans, reducing their ability to extend further credit and stifling economic growth.

The overextension of credit also sewed the seeds of economic inequality. While some individuals were able to accumulate wealth through credit-fueled spending and investments, many others were driven into financial ruin and faced long-lasting consequences. The unequal distribution of the benefits and risks of credit widened the wealth gap and created social tension within society.

The overextension of credit in the 1920s serves as a cautionary tale about the importance of responsible borrowing and the need for financial literacy. It highlights the risks associated with relying too heavily on credit and failing to consider the long-term financial consequences of excessive debt accumulation.

In response to these risks, regulatory measures were implemented to protect consumers and ensure responsible lending practices. These measures aimed to promote transparency, discourage predatory lending, and encourage banks and financial institutions to assess the creditworthiness of borrowers more diligently.

Overall, the overextension of credit in the 1920s was a significant factor contributing to the economic instabilities of the era. It showcased the dangers of unrestricted borrowing and the importance of responsible credit management to maintain a stable and sustainable economy.

In the following section, we will discuss the government’s response to the challenges posed by credit and the formation of regulatory agencies to address the risks associated with the credit-driven economy of the 1920s.

Debt and Bankruptcy

One of the most profound risks associated with the credit-driven economy of the 1920s was the high level of debt and increased incidence of bankruptcy. The availability of credit and the allure of immediate gratification led many individuals to accumulate significant amounts of debt, often beyond their capacity to repay.

The overextension of borrowing resulted in a substantial increase in personal debt. Borrowers found themselves burdened with high-interest payments and struggled to meet their financial obligations. As the economy faced a downturn, such as the stock market crash of 1929, many individuals were unable to make their debt payments, leading to a sharp rise in defaults and bankruptcies.

Bankruptcy became a prevalent issue during this period. Individuals who found themselves drowning in debt often resorted to declaring bankruptcy as a means of seeking relief. Bankruptcy filings soared as borrowers were unable to keep up with their debt payments or sell their assets at a price sufficient to cover their liabilities.

The increasing number of bankruptcy cases had far-reaching implications on the economy. It resulted in a loss of confidence in financial institutions, leading to a reduction in lending and a contraction of credit availability. This, in turn, impeded economic growth as businesses struggled to access the necessary capital for operations and expansion.

The impact of rising debt and bankruptcy extended beyond individual borrowers. Financial institutions, too, faced significant risks as borrowers defaulted on their loans. Banks and other lenders experienced a surge in non-performing loans, leading to potential insolvency and creating a ripple effect throughout the financial system.

The consequences of high debt levels and bankruptcy were felt not only in the financial sector but also in society as a whole. Families and individuals faced financial ruin, losing their homes, possessions, and livelihoods. The social and emotional toll of bankruptcy was significant, as individuals grappled with the consequences of financial distress and struggled to rebuild their lives.

The impact of debt and bankruptcy during the 1920s highlighted the need for better financial education and responsible lending practices. The risks associated with high levels of debt served as a reminder of the importance of financial literacy and financial planning to ensure sustainable personal finances.

In response to the increase in bankruptcies and the risks posed by excessive debt, the government implemented regulatory measures and established institutions to address these issues. Bankruptcy laws were revised to provide relief for individuals in financial distress, while regulatory agencies were created to oversee lending practices and protect consumers from predatory lending.

The debt and bankruptcy challenges of the 1920s served as a valuable lesson, emphasizing the need for responsible credit management and the importance of striking a balance between access to credit and avoiding excessive debt. The experiences of the era continue to shape financial policies and regulations to this day.

Lack of Savings Culture

One of the consequences of the credit-driven economy in the 1920s was the lack of a savings culture among individuals. The ready availability of credit and the allure of immediate gratification discouraged saving habits and contributed to a society reliant on borrowing rather than personal savings.

With credit readily accessible, individuals had the means to make purchases without having to save up in advance. The emphasis on consumer culture and material possessions led many people to prioritize the enjoyment of goods and experiences in the present, rather than planning and saving for the future.

The lack of a savings culture had implications for both individuals and the broader economy. On an individual level, the absence of savings meant that individuals had little or no financial cushion to fall back on during times of economic uncertainty or personal emergencies. A lack of savings also reduced the ability to invest in long-term goals, such as homeownership or retirement planning.

Furthermore, the reliance on credit rather than savings left individuals vulnerable to economic downturns. When the economy faced a recession, the high levels of debt incurred through credit became difficult to manage. This further exacerbated financial hardships and increased the risk of default and bankruptcy.

From an economic perspective, a lack of savings limited the pool of capital available for investment in productive endeavors. Personal savings are a vital source of funds for businesses and entrepreneurs, allowing for investment in new ventures, expansion, and innovation. Without a robust savings culture, the capacity for long-term economic growth and stability was diminished.

The lack of a savings culture also created challenges for financial institutions. Banks and other lending institutions rely on individuals’ savings to fund loans and investments. When savings are scarce, the availability of credit becomes constrained, inhibiting economic growth and job creation.

The absence of a savings culture in the 1920s underlined the importance of promoting responsible financial habits and instilling a sense of financial discipline among individuals. The downturn of the Great Depression that followed the credit-fueled 1920s further underscored the need for individuals to build personal savings as a buffer against economic uncertainties.

In response to the lack of a savings culture, initiatives were put in place to encourage savings and promote thrift. Financial education programs and campaigns emphasized the importance of saving for future needs and educated individuals on the benefits of compound interest and long-term financial planning.

The lessons of the lack of savings culture in the 1920s serve as a reminder that while credit can provide immediate benefits, it is essential to strike a balance with savings for long-term financial security and stability.

In the following section, we will explore the government’s response to the challenges posed by the reliance on credit and the measures undertaken to promote financial stability and responsible personal finance.

Government Regulations and Responses to Credit

The rise of credit and the associated risks in the 1920s prompted the government to introduce regulations and implement responses to address the challenges posed by the credit-driven economy.

One significant response was the enactment of consumer protection laws to safeguard borrowers and promote fair lending practices. These laws aimed to ensure transparency and prevent predatory lending. They required lenders to disclose the terms and conditions of credit agreements, including interest rates and fees, enabling borrowers to make informed decisions.

Additionally, the government established regulatory agencies to oversee lending practices and protect consumers. One such agency was the Federal Reserve, which was granted the authority to regulate monetary policy and stabilize the banking system. The Federal Reserve played a crucial role in providing liquidity to banks during times of financial stress and implementing measures to control credit expansion.

The government’s response also involved the revision and reform of bankruptcy laws. The goal was to provide relief for individuals overwhelmed by debt, enabling them to reorganize their finances and obtain a fresh start. The reform of bankruptcy laws aimed to strike a balance between protecting the interests of creditors and ensuring that individuals burdened by excessive debt could have a path to financial recovery.

Furthermore, efforts were made to promote financial education and responsible personal finance. Educational programs and campaigns were initiated to raise awareness about the importance of budgeting, saving, and making informed financial decisions. The government recognized the need to improve financial literacy and empower individuals to navigate the complexities of credit responsibly.

The response to the challenges posed by credit in the 1920s was multifaceted. Government regulations sought to strike a balance between stimulating economic growth and protecting consumers from the risks of excessive borrowing. The regulatory measures implemented aimed to ensure transparency, stability, and responsible lending practices within the financial sector.

However, it is worth noting that the efficacy and enforcement of these regulatory measures varied, and some loopholes remained. The excesses of the credit-driven economy ultimately led to the stock market crash of 1929 and the subsequent Great Depression, underscoring the need for continued evaluation and refinement of regulations to prevent future financial crises.

The government’s response to the challenges posed by credit in the 1920s laid the foundation for future financial regulations and consumer protection measures. The lessons learned from this era continue to shape financial policies and practices today, focusing on promoting responsible lending, protecting consumers, and maintaining a stable and sustainable financial system.

Emergence of Consumer Protection Laws

During the credit-driven economy of the 1920s, the emergence of consumer protection laws was a response to the growing concerns over predatory lending practices and the need to safeguard the rights and interests of borrowers. These laws aimed to promote transparency, fairness, and responsible lending within the financial industry.

One significant development was the passage of state and federal laws that required lenders to disclose relevant information to borrowers, ensuring transparency in credit agreements. These laws mandated the inclusion of clear terms and conditions, interest rates, fees, and repayment schedules in loan contracts. By providing borrowers with comprehensive information, these laws aimed to empower individuals to make informed decisions about borrowing.

Consumer protection laws also sought to prevent predatory lending practices. These laws placed restrictions on practices such as high-interest loans, excessive fees, and unfair collection methods. They established limits on interest rates that lenders could charge, protecting borrowers from unscrupulous lending practices that could push them further into debt.

One significant piece of legislation during this period was the Uniform Small Loan Law, enacted in several states. This law sought to regulate small loans, often associated with high-interest rates, by imposing interest rate caps and establishing licensing requirements for lenders. It aimed to protect borrowers from exploitative lending practices and promote fair lending standards.

In addition to disclosure and interest rate regulations, consumer protection laws included provisions to address unfair debt collection practices. These provisions prohibited aggressive and abusive tactics used by debt collectors, ensuring that borrowers were treated fairly and respectfully when dealing with their outstanding debts.

The emergence of consumer protection laws reflected a growing recognition of the need to safeguard individuals from unscrupulous lending practices. These laws aimed to restore balance in the borrower-lender relationship and protect vulnerable consumers who may not have had the information or power to protect themselves in the credit marketplace.

While the development of consumer protection laws was a step toward promoting responsible lending practices, it is important to acknowledge that enforcement and effectiveness varied across jurisdictions. Some predatory practices persisted despite these laws, highlighting the ongoing need for vigilance and further refinements in regulatory oversight.

The legacy of consumer protection laws remains significant, with the principles introduced in the 1920s continuing to shape current laws and regulations. Today, these laws continue to protect borrowers from deceptive lending practices, promote transparency in credit agreements, and ensure fair treatment for consumers in their interactions with lenders.

The emergence of consumer protection laws during the credit-driven economy of the 1920s represented an important milestone in the ongoing effort to strike a balance between promoting access to credit and protecting individuals from exploitative lending practices. These laws aimed to empower borrowers and establish a more equitable and transparent credit marketplace.

Formation of Regulatory Agencies

The credit-driven economy of the 1920s paved the way for the formation of regulatory agencies tasked with overseeing lending practices, maintaining financial stability, and protecting consumers. These agencies were established as a response to the risks and challenges associated with the expanding credit market.

One of the key regulatory agencies that emerged during this period was the Federal Reserve. Established in 1913, the Federal Reserve was designed to serve as the central bank of the United States. It was responsible for regulating monetary policy, controlling credit expansion, and maintaining stability within the banking system. The Federal Reserve played a critical role in overseeing financial institutions, promoting responsible lending practices, and mitigating the risks associated with excessive credit expansion.

Another regulatory agency that emerged was the Federal Trade Commission (FTC). The FTC was created in 1914 to protect consumers from unfair or deceptive practices in interstate commerce. Although the FTC’s primary role was not directly related to credit, it played a crucial role in investigating and taking action against fraudulent and deceptive lending practices to protect consumers from exploitation.

State-level regulatory agencies also emerged to address the challenges of lending practices within their jurisdictions. These agencies had the responsibility of overseeing lending institutions, enforcing local laws, and regulating credit practices at the state level. They played a critical role in monitoring and restricting predatory lending practices that negatively impacted borrowers.

The formation of these regulatory agencies aimed to strike a balance between promoting economic growth and maintaining stability, ensuring fair lending practices, and protecting consumers from fraudulent or exploitative behavior in the credit market. These agencies established supervisory and enforcement mechanisms to monitor and regulate financial institutions, enforce consumer protection laws, and promote responsible lending practices.

The existence of regulatory agencies provided a framework for oversight and accountability within the financial industry. They developed guidelines and regulations, conducted examinations, and enforced compliance with lending standards, fostering confidence in the financial system and ensuring fair treatment for consumers.

While the regulatory agencies formed during the 1920s represented crucial steps toward protecting consumers and maintaining financial stability, it is important to acknowledge that challenges remained. The effectiveness and enforcement capabilities varied, and some predatory practices persisted despite regulatory efforts. The financial crisis of the 1930s further highlighted the need to strengthen regulatory measures and refine the supervision of financial institutions.

The legacy of the regulatory agencies formed during the credit-driven economy of the 1920s continues to shape financial regulations today. The lessons learned from this era have contributed to the ongoing development of regulatory frameworks, with a focus on maintaining stability, promoting responsible lending practices, and protecting consumers within the credit market.

In summary, the formation of regulatory agencies during the credit-driven economy of the 1920s played a crucial role in safeguarding the financial system and protecting consumers. These agencies established oversight and enforcement mechanisms to regulate lending practices, promoting transparency, stability, and fair treatment in the credit marketplace.

Conclusion

The credit-driven economy of the 1920s marked a transformative period in American history, characterized by economic growth, consumer culture, and significant changes in lending and borrowing practices. Easy access to credit fueled consumer spending, expanded industries, and propelled the nation towards unprecedented prosperity. However, it also introduced inherent risks and dangers that led to economic instability and eventually the Great Depression.

Credit played a central role in driving the economic boom of the era. It provided individuals with the means to make purchases beyond their immediate financial capabilities, increasing their spending power and stimulating economic growth. Installment purchasing, made possible by credit, revolutionized consumer behavior and fueled demand for goods and services.

However, the credit-driven economy also had its downsides. The overextension of borrowing, lack of savings culture, and risks associated with excessive debt accumulation drove many individuals into financial hardship when the economy faced a downturn. The widespread defaults, bankruptcies, and loss of savings had far-reaching implications for both individuals and the financial system.

In response to these risks, the government introduced consumer protection laws and established regulatory agencies to safeguard borrowers and promote responsible lending practices. These measures aimed to ensure transparency, fairness, and stability within the credit market. However, the effectiveness of these regulations varied, and challenges persisted.

The lessons learned from the credit-driven economy of the 1920s continue to shape financial policies and regulations today. The legacy of this era underscores the importance of responsible borrowing, financial literacy, and the need for a balance between access to credit and the preservation of long-term financial stability.

In conclusion, while the credit-driven economy of the 1920s brought tremendous economic prosperity and transformed consumer behavior, it also revealed the risks associated with excessive borrowing and the lack of a savings culture. The era serves as a reminder of the importance of maintaining a healthy balance between credit accessibility, responsible borrowing practices, and consumer protection to foster a stable and sustainable financial system.