Finance

Why Did Governments Sell War Bonds

Modified: December 30, 2023

Discover the reasons why governments sold war bonds and how they impacted finance during periods of conflict. Explore the historical significance and economic implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

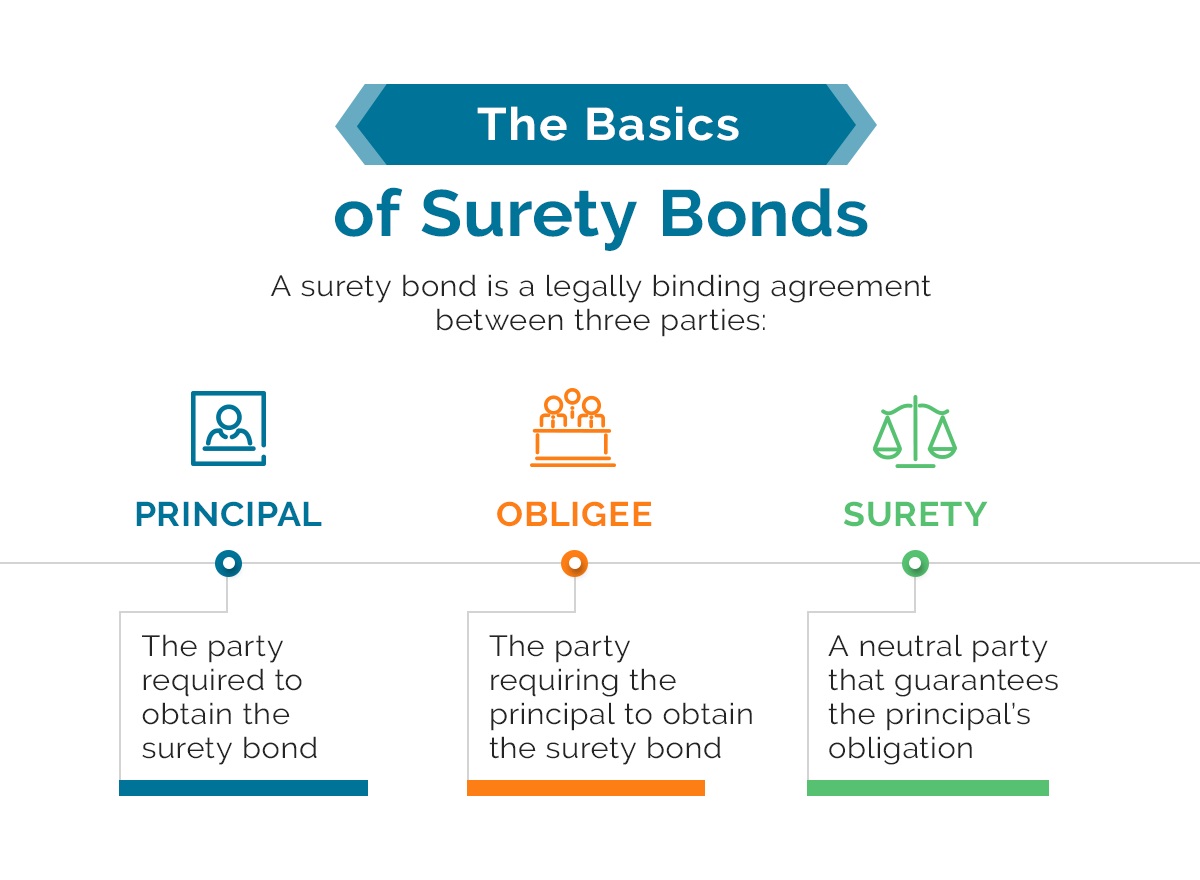

In times of conflict and war, governments often need significant financial resources to fund their efforts. One mechanism that has historically been used to raise funds is the issuance of war bonds. These financial instruments, also known as defense bonds or liberty bonds, were sold to the public as a way to rally support for the war effort and provide a means for citizens to contribute.

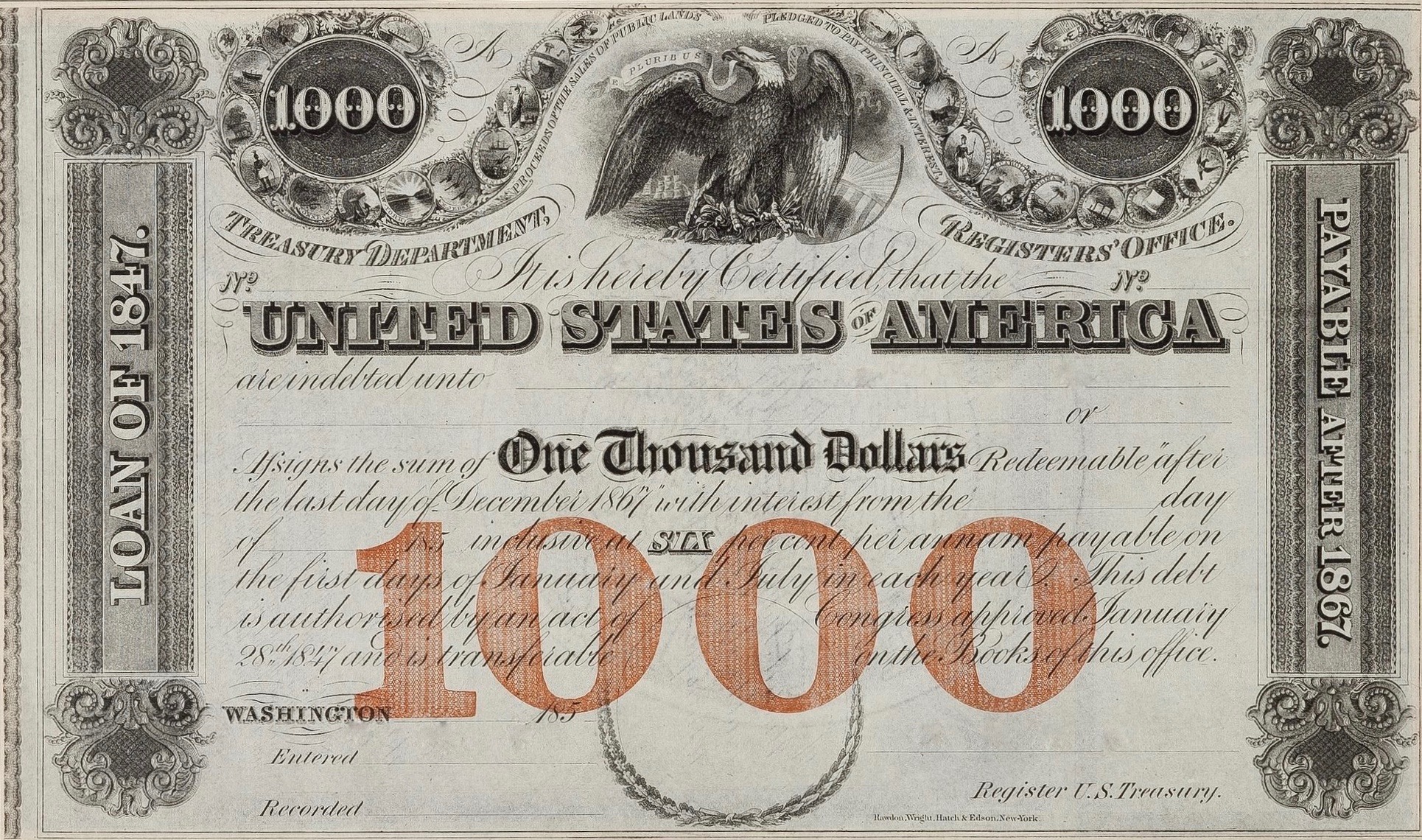

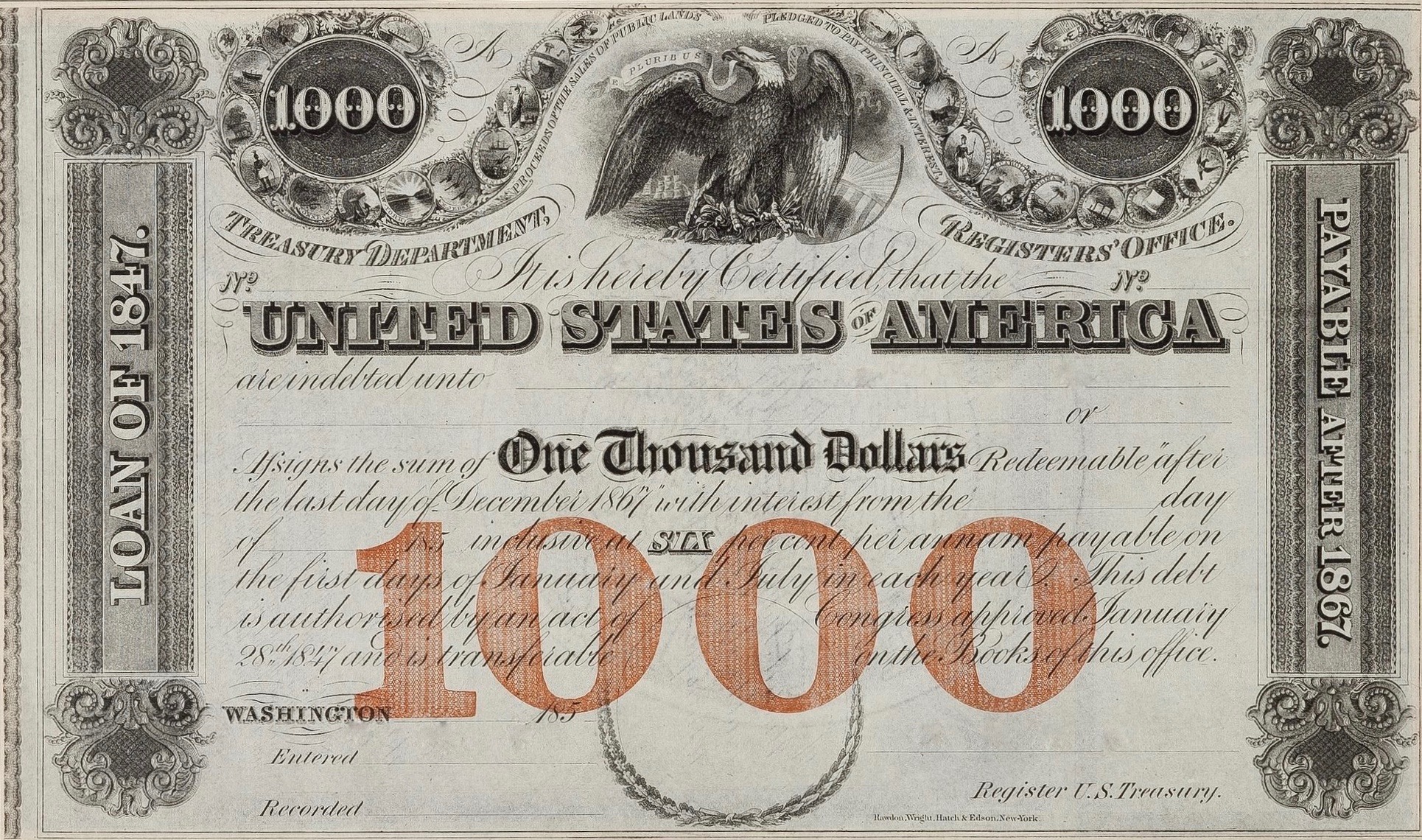

The concept of war bonds dates back to the 18th century, with notable examples including the British War Loan introduced during the Napoleonic Wars and the U.S. Liberty Bonds issued during World War I and II. Today, while war bonds are not as commonly issued, they remain an important part of financial history and provide valuable insights into the motivations and impact of government financing during times of crisis.

In this article, we will explore the historical context of war bonds, the motivations behind governments selling them, the economic impact they have had, the role of propaganda in promoting their sale, the successes and failures of previous war bond programs, and their legacy in modern times.

By examining the use of war bonds, we can gain a deeper understanding of the financial strategies deployed during times of war, and the societal and economic implications that follow. So, let’s delve into the fascinating world of war bonds and discover why governments have turned to this method of financing in times of conflict.

Historical Context of War Bonds

The concept of war bonds can be traced back centuries, with their earliest recorded use dating back to the 18th century. However, it was during the global conflicts of the 20th century that war bonds gained significant prominence. World War I and World War II saw governments across the globe turn to their citizens for financial support through the issuance of war bonds.

During World War I, countries such as the United States, United Kingdom, Canada, and Australia implemented war bond programs to raise funds for the war effort. These bonds were sold to the public, often at a lower denomination, making them accessible to the average citizen. The funds raised were used to finance military operations, purchase equipment, and support troops on the frontlines.

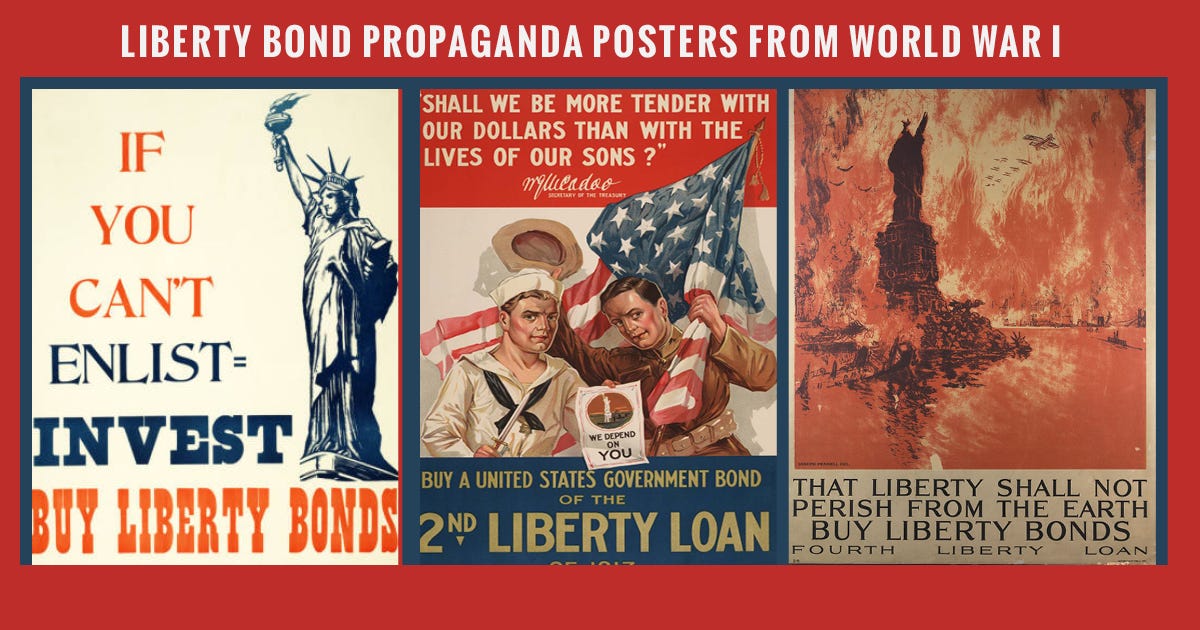

In the United States, the government launched the Liberty Bond program, offering various bond options with attractive interest rates. The campaign to sell these bonds was supported by massive propaganda efforts, encouraging citizens to contribute to the war effort by purchasing bonds. Notable figures like Charlie Chaplin, Mary Pickford, and Douglas Fairbanks actively participated in bond rallies, boosting public morale and spurring sales.

World War II further intensified the use of war bonds as governments faced the need for massive funding. The United States introduced the Series E War Bond, commonly known as the “war loan.” With a maturity period of 10 years and a low minimum investment amount, the government targeted a wide range of citizens for participation. The sale of war bonds became a patriotic duty, with campaigns reminding individuals that their contributions would directly support the military and aid in the fight against fascism.

War bond campaigns were not limited to the Allied nations. Germany, Japan, and other Axis powers also employed similar strategies to finance their war efforts. These campaigns, however, often relied heavily on coercion and forced contributions from citizens.

Overall, the historical context of war bonds reveals their significance in times of conflict. The mass mobilization of citizens through the sale of war bonds allowed governments to tap into public sentiment and generate substantial funds to support their military objectives. It is within this context that we can examine the motivations behind governments’ decision to sell war bonds and the economic impact of such programs.

Motivations for Governments to Sell War Bonds

Governments have several motivations for selling war bonds during times of conflict. These motivations range from raising much-needed funds for the war effort to fostering a sense of national unity and patriotism among citizens. Let’s explore some of the key motivations behind governments’ decision to issue war bonds.

1. Financial Resources: One of the primary motivations for governments to sell war bonds is to raise the necessary funds to finance military operations. Wars are expensive, requiring significant financial resources to procure weapons, supplies, and support troops. Selling war bonds allows governments to tap into the savings of individual citizens and institutional investors, providing a vital source of funding.

2. Economic Stability: War bonds can also help stabilize the economy during times of conflict. By encouraging citizens to invest in war bonds, governments can reduce the strain on their national treasuries and avoid excessive borrowing from international sources. This can help maintain a stable currency and prevent runaway inflation, which can undermine the war effort and the overall economy.

3. National Unity and Patriotism: Selling war bonds is often accompanied by extensive propaganda campaigns aimed at promoting a sense of national unity and patriotism. Governments motivate citizens to purchase bonds by linking their contributions directly to the success of the war effort. It becomes a symbol of solidarity and a way for individuals to show their support for their country and troops.

4. Spreading the Financial Burden: By selling war bonds, governments distribute the financial burden of war among a broader segment of the population. This helps prevent the concentration of war-related expenses on a small group, such as the wealthy. Additionally, the availability of bonds in smaller denominations makes it possible for individuals with varying income levels to contribute.

5. Building Post-War Relationships: The issuance of war bonds can help foster post-war relationships between the government and its citizens. By involving the public in the financing of the war effort, governments create a sense of shared responsibility and long-term commitment. After the war, the bondholders often become stakeholders in the country’s future, ensuring a continued connection and potential for investment in rebuilding efforts.

Overall, the motivations for governments to sell war bonds are driven by a combination of financial needs, economic stability, fostering national unity, and spreading the financial burden. The sale of war bonds provides a practical means for governments to raise funds while tapping into the patriotic sentiment of their citizens.

Economic Impact of Selling War Bonds

The sale of war bonds can have significant economic impacts, both during times of conflict and in the post-war period. Let’s explore some of the key economic effects that arise from governments selling war bonds.

1. Capital Formation: Selling war bonds helps governments raise capital for financing the war effort without resorting to excessive borrowing or inflationary measures. By tapping into the savings of citizens and investors, war bonds contribute to capital formation in the economy. These funds can be allocated towards various sectors, including defense manufacturing, infrastructure development, and research and development, stimulating economic activity.

2. Risk Diversification: War bonds serve as a means for individuals to diversify their investment portfolios and spread their risk across different assets. The availability of government-backed bonds provides a relatively safe investment option during times of uncertainty. This diversification helps stabilize financial markets and mitigates the risk of excessive capital flight from other sectors of the economy.

3. Constrained Consumer Spending: The purchase of war bonds often requires individuals to divert a portion of their disposable income away from immediate consumption. This can lead to a curtailed level of consumer spending during the period of war bond campaigns. As a result, inflationary pressures can be dampened, preventing excessive demand-pull inflation in the economy.

4. Stimulating Aggregate Demand: While war bonds may temporarily reduce consumer spending, the influx of funds from bond sales can positively impact aggregate demand in other sectors. The government’s use of the raised capital for defense-related expenditures, infrastructure development, and job creation can boost economic activity and employment levels. This injection of spending can offset the initial contraction in consumer spending, leading to an overall increase in aggregate demand.

5. Post-War Debt Repayment: The economic impact of war bonds extends beyond the period of conflict. Governments often face the challenge of repaying the debt incurred during wartime. This debt can be serviced through various means, such as tax revenues, economic growth, or issuing new bonds. The economic implications of debt repayment strategies can affect interest rates, taxation policies, and government spending patterns in the post-war period.

It is important to note that the economic impact of selling war bonds is influenced by various factors, including the scale and duration of the conflict, the level of public participation, and the effectiveness of financial management by the government. While war bonds can provide immediate financial resources, their long-term economic effects depend on how effectively the proceeds are utilized and how the post-war debt burden is managed.

Role of Propaganda in War Bond Campaigns

Propaganda plays a vital role in war bond campaigns, serving as a powerful tool to mobilize public support and encourage the sale of bonds. Governments employ various techniques to promote the purchase of war bonds, using persuasive messaging, emotional appeals, and celebrity endorsements. Let’s explore the key aspects of propaganda in war bond campaigns.

1. Patriotism and Nationalism: Propaganda in war bond campaigns often invokes a strong sense of patriotism and nationalism among citizens. Messages emphasize the duty and honor of supporting the war effort through the purchase of bonds. Positive imagery, such as national symbols, flags, and heroic portrayals of soldiers, taps into citizens’ love for their country and stirs up emotions of pride and loyalty.

2. Moral Obligation: Propaganda aims to create a sense of moral obligation among citizens to contribute to the war effort. It emphasizes that by purchasing war bonds, individuals are actively assisting their country and soldiers in the fight against the enemy. Emotional appeals highlight the sacrifices made by soldiers and the need for citizens to do their part in ensuring victory and protecting their way of life.

3. Celebrity Endorsements: War bond campaigns often feature popular figures, such as actors, musicians, and athletes, endorsing the purchase of bonds. Celebrities lend their credibility and influence to the cause, encouraging their fans and followers to support the war effort by investing in war bonds. These endorsements help to heighten public interest and create a sense of excitement and importance around the bond campaigns.

4. Community Engagement: Propaganda emphasizes community engagement in war bond campaigns. It highlights the collective nature of the effort, portraying citizens as part of a united front against the enemy. War bond rallies and events bring communities together, creating a sense of solidarity and camaraderie. These gatherings often incorporate entertainment, music, and public speeches, further fueling the spirit of support for war bond sales.

5. Financial Incentives: Propaganda also leverages financial incentives to encourage the purchase of war bonds. Governments may offer attractive interest rates, tax incentives, or the possibility of redemption at a higher value in the future. These incentives appeal to individuals’ financial interests and encourage them to invest in war bonds as a profitable investment option.

Overall, propaganda plays a crucial role in war bond campaigns by invoking patriotism, appealing to moral obligations, utilizing celebrity endorsements, fostering community engagement, and offering financial incentives. These tactics aim to create a sense of urgency and importance, compelling citizens to actively contribute to the war effort by purchasing war bonds.

Successes and Failures of War Bond Programs

War bond programs have seen varying degrees of success throughout history. While some campaigns have achieved remarkable results, others have faced challenges in achieving their objectives. Let’s examine the successes and failures of war bond programs.

1. Successes:

- Significant Funds Raised: War bond programs have been successful in raising substantial amounts of money for governments during times of conflict. Citizens have often responded to the call to support their country, resulting in billions of dollars worth of bonds being sold. These funds have played a vital role in financing war efforts, supporting military operations, and advancing wartime initiatives.

- National Unity and Patriotism: War bond programs have successfully fostered a sense of national unity and patriotism among citizens. The campaigns have instilled a collective responsibility and purpose, creating a strong bond between the government and its people. By participating in the purchase of war bonds, individuals have expressed their commitment to the cause and contributed to the overall morale and support for the war effort.

- Stabilizing Financial Markets: War bond programs have helped stabilize financial markets during times of conflict. By offering a safe investment option, war bonds have provided individuals with a way to protect their wealth and assets. The sale of these bonds has helped prevent excessive capital flight and contributed to maintaining a sense of stability amidst economic uncertainty.

2. Failures:

- Limited Public Participation: Some war bond programs have struggled to garner significant public participation. Factors such as economic hardships, skepticism about government intentions, or lack of trust in the effectiveness of the campaign have contributed to low participation rates. In such cases, governments have had to rely on other financial strategies or international borrowing to meet their funding needs.

- Inflation and High Debt Levels: In certain instances, war bond programs have contributed to inflation and high levels of post-war debt. Excessive bond issuance can lead to increased money supply and inflationary pressures, eroding the purchasing power of citizens. Additionally, post-war debt repayment can place a burden on future generations, potentially affecting their economic prospects.

- Misallocation of Funds: In some cases, the funds raised through war bonds have not been effectively allocated or managed. Poor financial planning, corruption, or misappropriation of funds can diminish the impact of bond programs. This can lead to a lack of transparency and accountability, eroding public trust and hindering the overall success of the campaign.

It is important to recognize that the success or failure of war bond programs can be influenced by numerous factors, including the overall economic climate, government policies, public sentiment, and the effectiveness of propaganda campaigns. The careful management and utilization of funds raised through war bonds, along with transparent communication and accountability, are crucial in ensuring the success of these programs.

Legacy and Continued Use of War Bonds

The legacy of war bonds extends beyond the periods of conflict in which they were utilized. While their prominence has diminished in recent decades, war bonds have left a lasting impact on the financial landscape and continue to be explored as an option for government financing in certain circumstances. Let’s explore the legacy and continued use of war bonds.

1. Post-War Redevelopment: After times of conflict, war bonds have played a significant role in post-war redevelopment efforts. The funds raised through bond programs have been used to rebuild infrastructure, stimulate economic growth, and invest in social programs. War bonds have allowed governments to harness the patriotic spirit and financial support of their citizens, laying the foundation for post-war recovery.

2. Historical Record: War bonds have become an integral part of financial history, preserving a record of the economic and societal impact of major conflicts. Studying the issuance of war bonds provides valuable insights into government strategies, public sentiment, and the financial implications of war. This historical record helps shape our understanding of the role of finance in times of crisis and aids in the development of future financial strategies.

3. Inspiration for Government Financing: While the issuance of war bonds is less common in modern times, the concept continues to inspire alternative forms of government financing. Governments may explore variations of war bonds, such as infrastructure bonds or green bonds, to rally public support for specific initiatives. These bonds serve as instruments to fund projects that benefit society, leveraging the power of citizen participation and investment.

4. Commemorative and Collectible Items: War bonds have also left a legacy as commemorative and collectible items. Historical war bonds, particularly those from iconic campaigns like the U.S. Liberty Bonds or British War Loans, are highly sought after by collectors and enthusiasts. They serve as tangible reminders of significant historical events and are valued for their aesthetic appeal and historical significance.

5. Public Awareness and Education: War bonds have helped raise public awareness about government financing and the role of citizen contributions in times of crisis. They have provided a platform for educating citizens about the economic implications of war and the importance of responsible financial management. By engaging citizens directly in the financing process, war bonds have fostered a sense of civic responsibility and financial literacy.

While the use of war bonds has become less prevalent in recent years, their legacy endures in various forms. The lessons learned from their historical use continue to shape financial strategies and public perception of government financing. Whether as artifacts of history, inspiration for alternative funding mechanisms, or reminders of the sacrifices made during times of conflict, war bonds continue to hold a unique place in the collective memory of nations around the world.

Conclusion

War bonds have played a significant role in financing wars and fostering national unity throughout history. Governments have utilized war bond programs to raise funds, stabilize economies, and mobilize citizens in times of conflict. The success of these programs has varied, with some achieving significant financial support and others facing challenges in garnering public participation. However, the legacy of war bonds extends beyond the immediate impact of raising funds.

War bonds have left an indelible mark on financial history, providing insights into government strategies and the societal impact of major conflicts. They have played a crucial role in post-war redevelopment efforts, financing infrastructure projects, and contributing to economic recovery. Moreover, the issuance of war bonds has helped educate citizens about the role of finance in times of crisis and fostered a sense of civic responsibility and financial literacy.

While the use of war bonds has diminished in recent decades, the concept continues to inspire alternative forms of government financing. Bonds targeted at specific initiatives, such as infrastructure or environmental projects, leverage the power of citizen investment and participation. Additionally, historical war bonds have become collectible items, serving as tangible reminders of significant historical events and artifacts of financial history.

In conclusion, war bonds have played a vital role in funding wars and rallying public support. They have left a lasting impact on the financial landscape, shaped historical records of conflicts, and continue to inspire modern-day financial strategies. The significance of war bonds extends beyond the financial contributions they generate; they symbolize the unity and commitment of nations in times of adversity, while also serving as a reminder of the sacrifices made by citizens during turbulent times.