Home>Finance>How Do Account Line Of Credit Work Billing Cycle

Finance

How Do Account Line Of Credit Work Billing Cycle

Published: March 7, 2024

Learn how account lines of credit work within the billing cycle to manage your finances effectively. Explore the ins and outs of finance management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, having access to a line of credit can provide a valuable safety net during times of financial need. Whether it's for managing unexpected expenses, covering short-term cash flow gaps, or seizing investment opportunities, an account line of credit offers flexibility and convenience. However, understanding the workings of this financial tool is crucial for making informed decisions and maximizing its benefits.

A line of credit operates as a revolving credit account, allowing individuals to borrow funds up to a specified limit and repay them on a flexible schedule. Unlike a traditional loan with a fixed term, a line of credit offers ongoing access to funds, replenishing the available credit as payments are made. This dynamic nature empowers individuals to address varying financial needs without the hassle of reapplying for a new loan each time.

In this comprehensive guide, we will delve into the intricacies of account lines of credit, shedding light on their functionality, billing cycles, interest calculations, payment options, and effective account management strategies. By gaining a deeper understanding of these aspects, individuals can harness the full potential of their line of credit while effectively managing their financial resources. Let's embark on this enlightening journey to demystify the world of account lines of credit and empower ourselves to make sound financial decisions.

Understanding Account Line of Credit

Before delving into the intricacies of how the billing cycle works, it’s essential to grasp the fundamental concept of an account line of credit. Essentially, an account line of credit is a flexible financial tool that provides individuals with access to a predetermined amount of funds that can be borrowed on an as-needed basis. This revolving form of credit allows borrowers to withdraw funds, repay them, and then borrow again, up to the established credit limit. This dynamic nature sets it apart from traditional installment loans, offering unparalleled flexibility and convenience.

Account lines of credit come in various forms, such as personal lines of credit, home equity lines of credit (HELOC), and business lines of credit. Personal lines of credit are often unsecured, meaning they do not require collateral, while HELOCs are secured by the borrower’s home equity. Business lines of credit are tailored to meet the financial needs of businesses, providing access to funds for operational expenses, inventory purchases, and other business-related costs.

One of the key benefits of an account line of credit is its flexibility. Borrowers have the freedom to use the funds for a wide range of purposes, including home improvements, debt consolidation, emergency expenses, and more. Moreover, interest is only accrued on the amount borrowed, offering cost-effective financing compared to traditional loans where interest is charged on the entire loan amount.

Another advantage of a line of credit is its revolving nature, which means that as payments are made, the available credit is replenished, providing ongoing access to funds without the need to reapply for a new loan. This feature makes it an ideal financial tool for managing fluctuating expenses and addressing unforeseen financial needs.

By understanding the versatile nature of account lines of credit, individuals can leverage this financial tool to their advantage, effectively managing their cash flow and addressing financial needs with ease and flexibility.

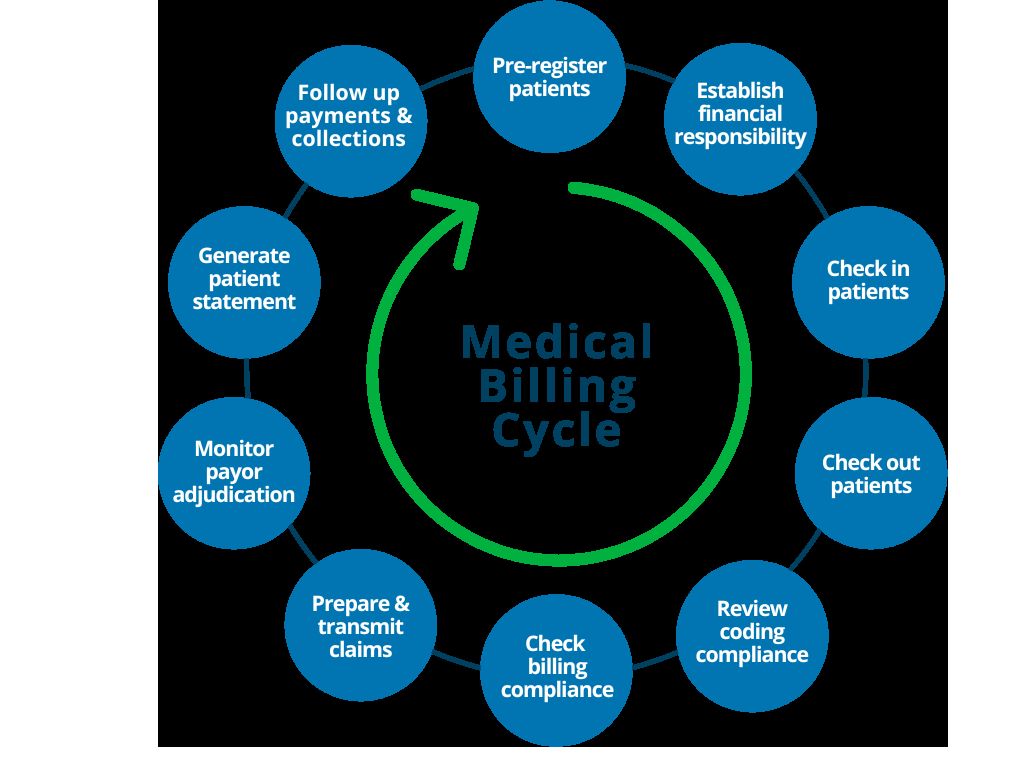

How Billing Cycle Works

The billing cycle of an account line of credit plays a pivotal role in determining the timing of statements, interest calculations, and payment due dates. Understanding how the billing cycle works is crucial for effectively managing the financial aspects of a line of credit.

Typically, the billing cycle spans a specific period, such as a month, during which the account activity is recorded. At the end of the cycle, a statement is generated, detailing the transactions, outstanding balance, minimum payment due, and other pertinent information. This statement serves as a snapshot of the account’s financial status at that point in time.

During the billing cycle, any new purchases, cash advances, or payments made are recorded and factored into the subsequent statement. It’s important for account holders to review their statements regularly to monitor their spending, track their outstanding balance, and ensure the accuracy of the transactions.

Furthermore, the billing cycle directly influences the calculation of interest on the outstanding balance. The average daily balance method is commonly used to determine the interest accrued during the billing cycle. This method involves calculating the average balance each day and multiplying it by the daily periodic rate and the number of days in the billing cycle. Understanding this calculation can shed light on how interest charges are applied and empower individuals to make informed decisions regarding their borrowing and repayment strategies.

Moreover, the billing cycle determines the payment due date, which is the deadline for making at least the minimum payment to avoid late fees and negative impacts on credit scores. By being aware of the billing cycle and the associated payment due dates, account holders can effectively plan their finances and ensure timely payments, thereby maintaining a positive credit standing.

Overall, comprehending the mechanics of the billing cycle is essential for managing an account line of credit responsibly, optimizing interest costs, and maintaining financial discipline.

Calculation of Interest

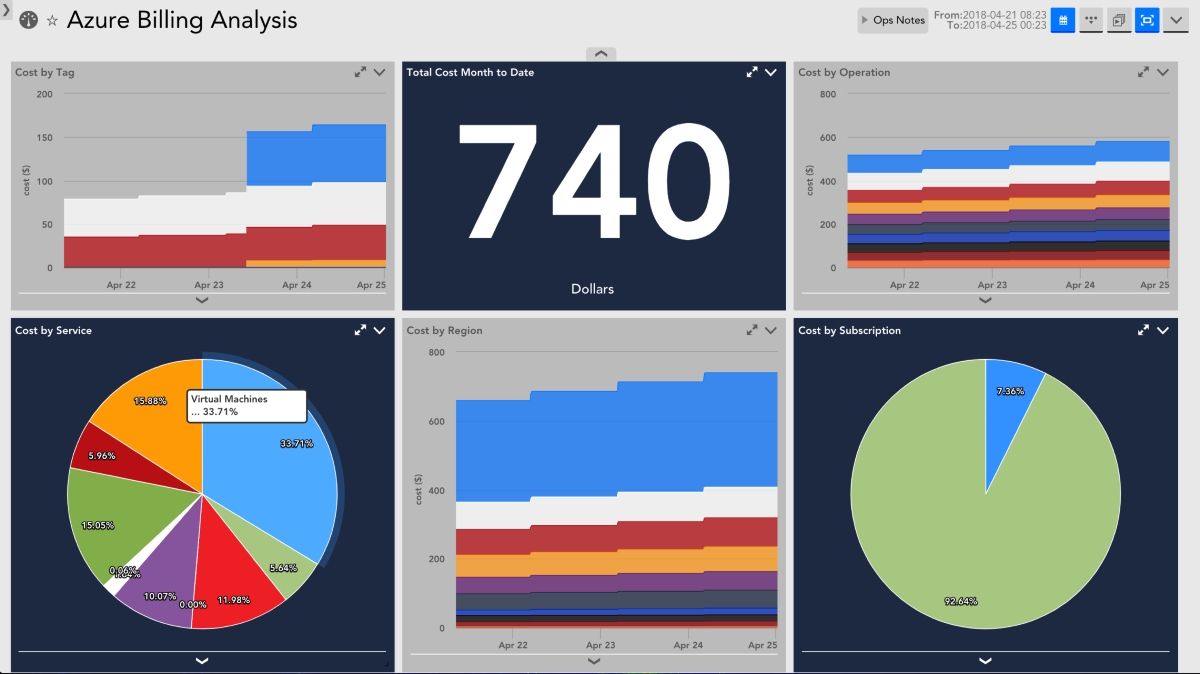

Understanding how interest is calculated on an account line of credit is crucial for managing borrowing costs and making informed financial decisions. The calculation of interest typically revolves around the concept of the average daily balance, which plays a central role in determining the interest charges incurred during a billing cycle.

The average daily balance is computed by adding up the outstanding balance at the end of each day and dividing the total by the number of days in the billing cycle. This method provides a comprehensive view of the account’s daily financial status, allowing for the accurate assessment of interest charges based on the fluctuating balance over time.

Once the average daily balance is determined, it is multiplied by the daily periodic rate, which is the annual percentage rate (APR) divided by the number of days in the year. This calculation yields the daily interest charge, reflecting the cost of borrowing on a day-to-day basis.

Subsequently, the daily interest charges are aggregated over the billing cycle to ascertain the total interest accrued. This total interest amount is typically included in the statement, providing transparency regarding the cost of borrowing and enabling account holders to assess the financial implications of their borrowing activities.

It’s important for individuals to be mindful of the factors that can influence the calculation of interest on their line of credit. For instance, making timely payments and reducing the outstanding balance can mitigate interest costs, as the average daily balance decreases. Conversely, carrying a higher balance or utilizing a larger portion of the available credit limit can lead to higher interest charges, emphasizing the importance of prudent borrowing and repayment practices.

By gaining insight into the calculation of interest on an account line of credit, individuals can make informed decisions regarding their borrowing behavior, optimize interest costs, and effectively manage their financial resources.

Payment Options

When it comes to managing an account line of credit, understanding the available payment options is essential for maintaining financial discipline and effectively servicing the outstanding balance. Most financial institutions offer a variety of convenient methods for making payments, catering to the diverse needs and preferences of account holders.

One of the most common and straightforward payment options is the online payment portal, which allows account holders to securely log in to their accounts and initiate payments from their linked bank accounts. This method offers the convenience of scheduling one-time or recurring payments, providing flexibility and ensuring timely settlements of the outstanding balance.

Additionally, many financial institutions facilitate payments through mobile banking applications, enabling account holders to make payments on the go using their smartphones or tablets. The intuitive interfaces of these applications streamline the payment process, offering a seamless and user-friendly experience.

For individuals who prefer traditional methods, in-person payments at bank branches or designated payment locations remain a viable option. This approach allows for face-to-face interactions with bank representatives, making it suitable for those who prefer personalized assistance or require immediate confirmation of their payments.

Furthermore, automatic payments can be set up to ensure that the minimum payment or a predetermined amount is deducted from the account holder’s linked bank account on a recurring basis. This hands-off approach to payments can help individuals stay current on their obligations and avoid late fees, contributing to a positive credit history.

It’s important for account holders to consider the various payment options available and choose the method that aligns with their preferences, lifestyle, and financial management practices. By staying proactive in making timely payments and exploring the available payment channels, individuals can effectively manage their account line of credit and cultivate healthy financial habits.

Managing Your Account

Effectively managing an account line of credit entails proactive financial stewardship and prudent decision-making to optimize its benefits while maintaining sound fiscal health. Several key strategies can empower individuals to manage their accounts responsibly and leverage the flexibility of a line of credit to their advantage.

Regular monitoring of account activity is paramount for staying informed about the utilization of the line of credit, tracking expenses, and identifying any unauthorized transactions. By reviewing statements and transaction histories, account holders can promptly detect and address any discrepancies, ensuring the accuracy and security of their accounts.

Furthermore, maintaining a disciplined approach to borrowing and repayment is essential for managing an account line of credit effectively. By borrowing only what is necessary and repaying the outstanding balance in a timely manner, individuals can minimize interest costs and avoid falling into a cycle of debt accumulation. Additionally, keeping the credit utilization ratio—the amount borrowed relative to the credit limit—moderate can positively impact credit scores and financial well-being.

Proactively communicating with the financial institution can also contribute to effective account management. In cases of financial hardship or unforeseen circumstances that may impact the ability to make payments, reaching out to the institution to explore alternative arrangements or hardship programs can help mitigate potential negative repercussions and demonstrate a commitment to fulfilling financial obligations.

Moreover, staying informed about changes in the terms and conditions of the account, such as interest rate adjustments or fee revisions, is crucial for making informed financial decisions. Being aware of these changes empowers individuals to adapt their borrowing and repayment strategies accordingly and explore alternative financial products if necessary.

Lastly, leveraging the flexibility of a line of credit to address short-term financial needs while maintaining a long-term financial plan is integral to effective account management. By aligning the utilization of the line of credit with financial goals and priorities, individuals can harness its benefits without compromising their overall financial well-being.

By implementing these proactive strategies and staying attuned to the nuances of account management, individuals can effectively navigate the complexities of an account line of credit and optimize its utility as a valuable financial tool.

Conclusion

As we conclude this comprehensive exploration of account lines of credit, it becomes evident that these financial tools offer unparalleled flexibility and convenience for addressing varying financial needs. Understanding the mechanics of account lines of credit, including the billing cycle, interest calculation, payment options, and effective account management, is essential for harnessing their full potential and making informed financial decisions.

Account lines of credit empower individuals to navigate unforeseen expenses, manage cash flow gaps, and seize opportunities without the constraints of traditional loan structures. The revolving nature of these credit accounts provides ongoing access to funds, allowing for agile responses to evolving financial circumstances.

By comprehending the intricacies of the billing cycle, individuals can strategically plan their payments, optimize interest costs, and maintain a positive credit standing. Moreover, exploring the diverse payment options and implementing prudent account management practices can contribute to financial discipline and long-term fiscal well-being.

It is imperative for individuals to approach the management of their account lines of credit with diligence, staying attuned to their financial activities, and aligning their borrowing and repayment behaviors with their broader financial goals. By doing so, they can leverage the flexibility and benefits of account lines of credit while safeguarding their financial stability.

In essence, account lines of credit represent a dynamic and versatile financial resource that, when managed thoughtfully, can serve as a valuable ally in navigating the complexities of personal finance. By integrating the insights gained from this guide into their financial practices, individuals can optimize the utility of their account lines of credit and embark on a path toward sustained financial empowerment and well-being.