Finance

How Long Is A Billing Cycle On Credit Cards

Published: March 7, 2024

Learn about the duration of billing cycles on credit cards and how they impact your finances. Find out how to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

The world of credit cards can be both enticing and perplexing. As you navigate through the realm of credit, one of the fundamental aspects to comprehend is the billing cycle. Understanding the billing cycle is crucial for managing your finances effectively and optimizing the benefits of your credit card usage. In this article, we will delve into the concept of billing cycles on credit cards, exploring their length, significance, and the factors that influence them.

The billing cycle is the duration between two successive credit card statements. During this period, all the transactions made using the credit card are compiled to generate the statement, which outlines the total amount due, minimum payment, and the due date. This cycle not only impacts the timing of your payments but also influences the interest accrual and the utilization of credit limits.

As we embark on this exploration, we will unravel the intricacies of billing cycles, shedding light on their duration, the variables that shape their length, and the implications for cardholders. By gaining a comprehensive understanding of billing cycles, you can wield greater control over your financial obligations and leverage the features of your credit card to your advantage. Let's embark on this enlightening journey into the realm of credit card billing cycles.

**

Understanding Billing Cycles

**

Before delving into the specifics of the length of billing cycles, it’s essential to grasp the concept of billing cycles themselves. A billing cycle, also known as a statement period, is the timeframe during which your credit card transactions are recorded and compiled to generate a statement. This statement serves as a summary of your spending and payment obligations for that period.

Typically, a billing cycle ranges from 28 to 31 days, although it can vary depending on the credit card issuer. During this period, all the purchases, payments, credits, and fees associated with your credit card are tallied to calculate the total amount due. It’s important to note that the billing cycle doesn’t necessarily align with the calendar month, as it commences on the day your account is opened or the day your statement is generated, and ends on the day before the next statement is generated.

Understanding the billing cycle is pivotal for managing your finances effectively. It dictates the timeframe within which you must make payments to avoid late fees and interest charges. Additionally, comprehending the nuances of the billing cycle empowers you to strategize your spending, optimize your credit utilization, and maximize the benefits offered by your credit card, such as rewards and cashback programs.

Moreover, being cognizant of your billing cycle enables you to track your expenses efficiently. By aligning your budgeting and expenditure patterns with the billing cycle, you can gain better control over your financial obligations and identify any discrepancies or unauthorized charges promptly.

As we navigate through the intricacies of credit card billing cycles, it’s imperative to recognize the pivotal role they play in shaping your financial responsibilities and opportunities. By comprehending the dynamics of billing cycles, you can harness the potential of your credit card while mitigating the risks associated with mismanagement and oversight.

**

Length of Billing Cycles

**

The length of a billing cycle is a crucial aspect of credit card management, influencing the timing of payments, interest accrual, and financial planning. Typically, billing cycles span from 28 to 31 days, with variations based on the credit card issuer’s policies. The duration of the billing cycle can have significant implications for cardholders, impacting their cash flow, budgeting strategies, and overall financial management.

It’s important to note that the length of the billing cycle directly influences the frequency of credit card statements. A shorter billing cycle results in more frequent statements, which may necessitate more frequent payments and meticulous tracking of expenses. Conversely, a longer billing cycle provides a more extended timeframe for managing and settling transactions, offering greater flexibility in budgeting and payment scheduling.

Understanding the length of your billing cycle is crucial for optimizing your financial planning and leveraging the benefits of your credit card. It allows you to align your payment schedule with your cash flow, ensuring that you can meet your financial obligations without incurring late fees or interest charges. Moreover, being aware of the billing cycle duration enables you to strategize your spending and credit utilization effectively, maximizing rewards and minimizing interest expenses.

As a cardholder, being mindful of the length of your billing cycle empowers you to plan and allocate your financial resources prudently. It provides insights into the timing of major purchases, the management of recurring expenses, and the synchronization of payments with your income schedule. By optimizing your approach to the billing cycle, you can streamline your financial management and enhance your overall credit card experience.

Ultimately, the length of the billing cycle is a pivotal factor in the dynamic landscape of credit card usage. By comprehending its implications and tailoring your financial strategies accordingly, you can navigate the realm of credit with confidence and proficiency, harnessing the potential of your credit card while maintaining sound financial health.

**

Factors Affecting Billing Cycle Length

**

The duration of a billing cycle is influenced by various factors that are integral to the operations and policies of credit card issuers. Understanding these determinants sheds light on the nuances of billing cycles and their impact on cardholders’ financial management. Several key factors contribute to the variability in billing cycle length:

- Issuer Policies: Credit card issuers establish their own policies regarding billing cycles, often aligning them with operational and administrative considerations. These policies may dictate the standard duration of billing cycles and any variations or exceptions based on specific card products or customer segments.

- Regulatory Requirements: Regulatory guidelines and consumer protection laws may stipulate certain parameters for billing cycles, aiming to ensure transparency, fairness, and consistency in credit card operations. Compliance with these regulations can influence the length of billing cycles and the associated disclosures provided to cardholders.

- Calendar Alignment: The alignment of billing cycles with the calendar month or specific dates can impact their length. Some issuers may synchronize billing cycles with the calendar month for simplicity and convenience, while others may opt for alternative commencement and closure dates to streamline their operational processes.

- Customer Preferences: Credit card issuers may offer flexibility in billing cycle options, allowing customers to select a preferred cycle duration based on their financial preferences and obligations. This customizable approach enables cardholders to align their billing cycles with their income schedules and financial planning.

These factors interact to shape the length of billing cycles, reflecting the intricate interplay between operational considerations, regulatory compliance, and customer-centric initiatives. By recognizing the influences that govern billing cycle duration, cardholders can adapt their financial strategies and payment schedules to harmonize with the dynamics of their credit card usage.

**

Importance of Billing Cycle Length

**

The length of a billing cycle holds significant importance in the realm of credit card management, exerting a profound impact on cardholders’ financial dynamics and obligations. Understanding the implications of billing cycle length is pivotal for optimizing financial planning, cash flow management, and credit utilization. Several key aspects underscore the importance of billing cycle length:

- Payment Timing: The duration of the billing cycle determines the timeframe within which cardholders must make payments to fulfill their financial obligations. A longer billing cycle provides a more extended window for payment, offering greater flexibility in aligning payments with income schedules and budgeting priorities.

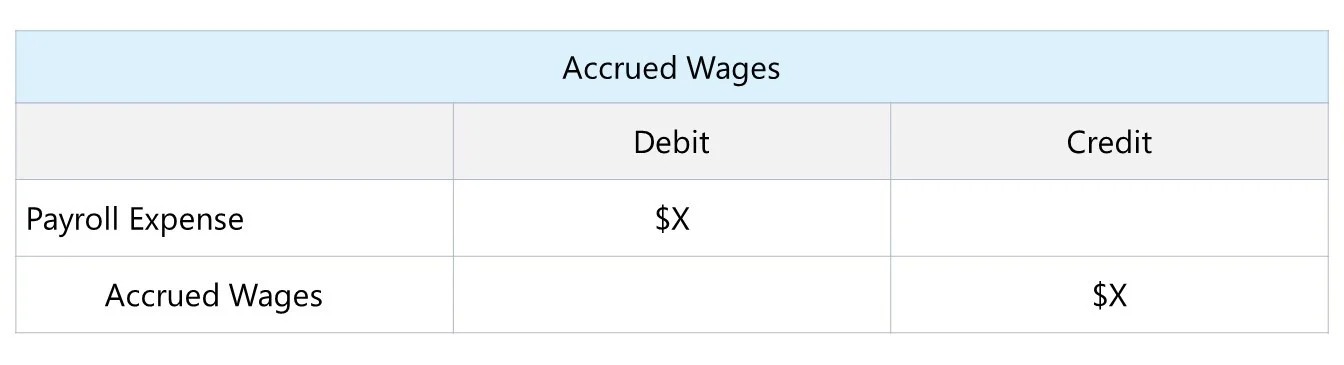

- Interest Accrual: The length of the billing cycle influences the duration over which interest accrues on outstanding balances. A shorter billing cycle may result in more frequent interest calculations, impacting the overall interest expenses incurred by cardholders. Understanding this aspect is crucial for managing interest costs and optimizing debt repayment strategies.

- Budgeting Flexibility: A longer billing cycle affords cardholders more time to manage their expenses and plan their payments, enhancing budgeting flexibility and mitigating the risk of missed or delayed payments. This extended timeframe enables individuals to synchronize their spending patterns with their income cycles, fostering greater control over their financial resources.

- Credit Utilization: The billing cycle duration directly influences credit utilization, which is the ratio of credit used to the total credit available. Cardholders can strategically manage their credit utilization within the billing cycle, optimizing this metric to bolster their credit score and financial standing.

Recognizing the importance of billing cycle length empowers cardholders to tailor their financial strategies and payment schedules to align with the dynamics of their credit card usage. By leveraging the nuances of billing cycles, individuals can optimize their cash flow, minimize interest expenses, and fortify their financial stability, thereby enhancing their overall credit management experience.

**

Conclusion

**

As we conclude our exploration of credit card billing cycles, it becomes evident that these periodic timelines wield substantial influence over the financial landscape of cardholders. The intricacies of billing cycle length, encompassing factors such as payment timing, interest accrual, budgeting flexibility, and credit utilization, underscore the pivotal role played by these cycles in shaping financial responsibilities and opportunities.

Understanding the dynamics of billing cycles empowers individuals to navigate the realm of credit cards with prudence and proficiency, enabling them to optimize their financial planning, cash flow management, and credit utilization. By aligning payment schedules with income cycles, strategizing spending within the billing cycle, and leveraging the flexibility offered by varying cycle durations, cardholders can harness the potential of their credit cards while safeguarding their financial well-being.

Moreover, the customizable nature of billing cycles, influenced by issuer policies, regulatory requirements, and customer preferences, offers cardholders the opportunity to tailor their credit management strategies to suit their individual financial needs and obligations. This adaptability fosters a harmonious synergy between credit card usage and financial planning, enabling individuals to wield greater control over their financial resources and obligations.

As we navigate the intricacies of credit card billing cycles, it is imperative to recognize the symbiotic relationship between these cycles and the financial dynamics of cardholders. By embracing a nuanced understanding of billing cycle length and its implications, individuals can embark on a journey of financial empowerment, leveraging the potential of their credit cards while maintaining sound financial health.

In essence, the length of a billing cycle transcends mere temporal duration, embodying a realm of financial opportunities and responsibilities that can be harnessed with insight and prudence. By embracing this understanding, individuals can navigate the credit landscape with confidence, leveraging the potential of their credit cards while fortifying their financial well-being.