Home>Finance>How Far Back Do Insurance Companies Check Medical Records?

Finance

How Far Back Do Insurance Companies Check Medical Records?

Published: November 3, 2023

Insurance companies typically review medical records for the past five years when evaluating finance-related insurance policies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

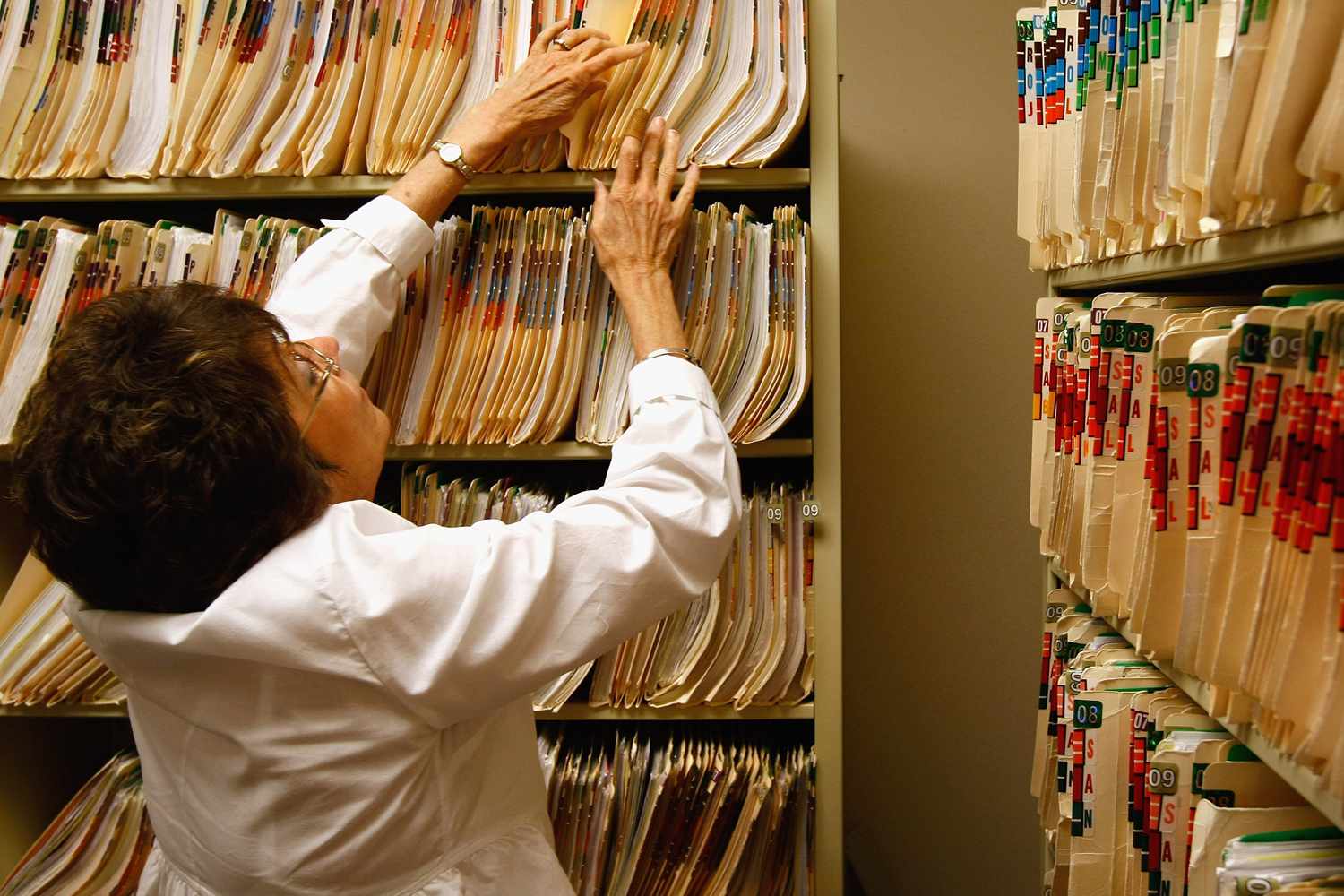

Welcome to the world of insurance, where coverage and protection are paramount. When it comes to insuring your health or life, insurance companies often conduct comprehensive checks to evaluate risk and determine the appropriate premiums. One crucial aspect of this evaluation process is reviewing medical records.

Medical records are a detailed documentation of an individual’s health history, including diagnoses, treatments, and any other pertinent information. These records play a crucial role in helping insurance companies assess an applicant’s health status and any pre-existing conditions that may impact their coverage.

In this article, we will delve into the intricacies of insurance companies’ examination of medical records. We will explore the reasons behind these checks, how deep they typically go, and the factors that influence the scope of such investigations. Additionally, we will highlight the legal and ethical considerations surrounding the access and use of medical records by insurance companies.

While the thought of insurance companies scrutinizing your medical history may seem invasive, it is essential to understand that these checks serve a purpose. By taking a closer look at an applicant’s medical records, insurance companies can mitigate risk, ensure accurate underwriting decisions, and maintain a fair pricing system for their policies.

Let’s dive into the world of medical record checks and gain a better understanding of how insurance companies utilize this information to provide coverage and protect both their interests and the interests of their policyholders.

Understanding Medical Records

Before we explore how insurance companies use and evaluate medical records, it is essential to understand what medical records encompass and how they are structured.

Medical records are comprehensive collections of an individual’s health-related information. They include a wide range of details, such as medical history, diagnostic test results, surgical procedures, prescribed medications, and specialist consultations. These records are typically created and maintained by healthcare providers, such as doctors, hospitals, and clinics.

The structure of medical records varies, but they generally contain the following key components:

- Patient Information: This section includes details like name, address, contact information, date of birth, and insurance information.

- Chief Complaint: Here, patients describe their primary reason for seeking medical assistance.

- Medical History: This section captures the patient’s past illnesses, surgeries, allergies, and any ongoing medical conditions.

- Physical Examinations: Healthcare providers document their observations, such as vital signs, physical findings, and overall assessment of the patient’s health.

- Diagnostic Tests: This portion includes results from laboratory tests, imaging studies, biopsies, and other diagnostic procedures.

- Treatment Plans: Here, healthcare providers outline their proposed or ongoing treatment strategies, including prescribed medications, therapies, and surgeries.

- Progress Notes: These are regular updates on the patient’s progress during their medical journey, including follow-up visits, changes in treatment plans, and other relevant information.

- Consultations and Referrals: If a patient has seen other specialists or has been referred for specialized care, these records are also included.

- Consent Forms and Signed Documents: Any legal documents, consents, or waivers signed by the patient related to their healthcare are also part of the medical record.

Medical records are kept in secure electronic or physical formats and are strictly protected under patient privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. The access and sharing of medical records require patient consent or in situations where authorized by law.

Now that we have a basic understanding of what medical records entail, let’s explore why insurance companies find them crucial in the evaluation of insurance applications.

Why Insurance Companies Check Medical Records

Insurance companies have a vested interest in thoroughly reviewing an applicant’s medical records before issuing a policy. The primary reasons for conducting these checks include:

- Assessing Risk: Insurance is all about risk management. By reviewing medical records, insurance companies can evaluate the potential health risks associated with an applicant. This information helps insurers determine the likelihood of future claims and set appropriate premiums. For instance, if an individual has a pre-existing condition or a history of chronic illnesses, it may impact the cost of their health or life insurance policy.

- Identifying Pre-existing Conditions: Pre-existing conditions refer to any health conditions that an individual has before applying for insurance coverage. Insurance companies want to determine if an applicant has any pre-existing conditions as these can influence policy coverage and premium rates. Pre-existing conditions could range from chronic ailments like diabetes or heart disease to previous surgeries or mental health disorders.

- Verifying Accuracy of Application: The information provided by an applicant on their insurance application must be accurate and complete. By cross-referencing the information with medical records, insurance companies can ensure that there are no discrepancies or misrepresentations. This step is vital to maintain fairness in the underwriting process and prevent fraudulent claims.

- Determining Exclusions and Limitations: Based on the information found in an applicant’s medical records, insurance companies may include specific exclusions or limitations in the policy. These exclusions and limitations may relate to pre-existing conditions or certain procedures that will not be covered under the policy. It is crucial for applicants to understand these limitations before choosing a policy.

- Estimating Long-term Costs: Insurance companies need to anticipate the long-term costs associated with providing coverage for an individual. By reviewing medical records, they can consider factors such as the severity of an illness, the need for ongoing treatment, potential hospitalizations, and the cost of medications. This information aids insurers in determining the appropriate premium rates to sustain their ability to pay out claims efficiently.

It is important to note that insurance companies are not looking to deny coverage outright based on an applicant’s medical history. Instead, the goal is to accurately assess risk and provide coverage that aligns with the individual’s health and potential future needs.

Now that we understand why insurance companies conduct medical record checks, let’s delve into how far back insurers typically delve into an applicant’s medical history.

How Far Back Do Insurance Companies Check Medical Records?

The extent to which insurance companies check an individual’s medical records can vary depending on various factors. However, as a general rule of thumb, insurance companies typically review medical records from the past five to ten years.

The reason for this time frame is to gain insight into an applicant’s recent medical history and determine if there are any ongoing or recurring health concerns. By focusing on the most recent years, insurance companies can better assess an individual’s current health status and make accurate underwriting decisions.

While five to ten years is the standard timeframe, some specific factors may influence how far back insurance companies delve into an applicant’s medical records:

- Type of Insurance Policy: Different insurance policies have varying levels of scrutiny when it comes to medical record checks. For example, life insurance policies generally require a more thorough review of medical history compared to auto insurance policies.

- Age of the Applicant: The age of the applicant can also play a role in the depth of the medical record check. Insurance companies often pay closer attention to medical records for older applicants due to the higher likelihood of age-related health conditions.

- Type of Coverage: The type and amount of coverage being sought may also impact the extent of the medical record check. For instance, if an applicant is applying for a substantial life insurance policy or a policy with critical illness coverage, insurance companies may conduct a more detailed analysis of medical records.

- Policy Application Questions: Insurance applications typically include questions about an individual’s medical history. If an applicant provides specific information that raises concerns, insurance companies may investigate further to ensure accuracy and assess the potential risk.

- Underwriting Guidelines: Insurance companies have their own underwriting guidelines that dictate how far back they look into an applicant’s medical records. These guidelines are designed to establish consistency and fairness in the underwriting process.

- Previous Claims: If an applicant has made previous claims on their insurance policies, insurance companies may review medical records beyond the standard timeframe to evaluate the nature and frequency of past claims.

It is important to note that insurance companies are interested in the overall health status of applicants. They are not solely focused on pre-existing conditions. The objective is to gather a comprehensive understanding of an individual’s medical history to make informed decisions regarding coverage and premium rates.

Next, we will explore the factors that influence the scope of medical record checks by insurance companies.

Factors Affecting the Scope of Medical Record Checks

When it comes to the scope of medical record checks conducted by insurance companies, several factors come into play. These factors can influence how extensively insurers review an applicant’s medical history. Let’s take a closer look at some of the key factors:

- Type of Insurance Policy: The type of insurance policy being applied for can greatly impact the scope of medical record checks. Health insurance policies often require a more thorough examination of an applicant’s medical history compared to other types of insurance, such as auto or property insurance.

- Amount of Coverage: The amount of coverage being sought also plays a role in the depth of the medical record check. For policies with higher coverage limits, insurance companies may perform more extensive evaluations to accurately assess the potential risk they are taking on.

- Age and Health of the Applicant: Insurance companies take into account an applicant’s age and overall health when determining the scope of medical record checks. Older applicants or individuals with underlying health conditions may face more thorough evaluations as these factors can increase the likelihood of future claims.

- Pre-existing Conditions: If an applicant has disclosed pre-existing conditions on their insurance application, insurance companies may conduct more detailed assessments of the related medical records. This allows insurers to understand the severity and impact of these conditions on coverage decisions.

- Policy Underwriting Guidelines: Insurance companies have their own underwriting guidelines that dictate the scope of medical record checks. These guidelines outline specific criteria, such as the time frame for reviewing medical records and the types of conditions that are of particular concern to the insurer.

- Industry Regulations: Insurance companies must comply with industry regulations and legal requirements that govern the access and use of medical records. These regulations often define the permissible scope of medical record checks and help establish the boundaries within which insurers can operate.

- Consent from the Applicant: Insurance companies typically require applicants to provide consent for accessing their medical records. The extent of the consent given by the applicant can impact the depth and breadth of the medical record check performed by the insurer.

It’s important to note that while insurance companies have the authority to access an applicant’s medical records, they are bound by ethical obligations to maintain the confidentiality of this information. They are only allowed to use the information gathered for underwriting and risk assessment purposes and must adhere to privacy laws and regulations.

Understanding the factors that affect the scope of medical record checks can provide valuable insights into the evaluation process conducted by insurance companies. Now, let’s explore the legal and ethical considerations surrounding the access and use of medical records in insurance applications.

Legal and Ethical Considerations

When insurance companies access and evaluate an applicant’s medical records, they must adhere to legal and ethical considerations to ensure the fair and responsible use of this sensitive information. These considerations include:

Privacy Laws: Insurance companies must comply with privacy laws such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. These laws protect the confidentiality and privacy of an individual’s medical records. Insurance companies are required to obtain the applicant’s consent before accessing their medical records and must handle the information with the utmost care.

Confidentiality: Insurance companies have a responsibility to keep an applicant’s medical information confidential. They are obligated to maintain strict internal policies and safeguards to prevent unauthorized access, use, or disclosure of this information to protect the privacy rights of the individual.

Non-Discrimination: Insurance companies are prohibited from discriminating against applicants based on their medical history or the presence of pre-existing conditions. In many countries, laws mandate insurers to provide coverage regardless of a person’s health status. However, they may adjust premiums or apply limitations based on the assessed risk associated with an individual’s health conditions.

Informed Consent: Insurance applicants must provide informed consent for the insurance company to access and review their medical records. This ensures that applicants are aware of how their medical information will be used and allows them to make informed decisions regarding their insurance coverage.

Fair Underwriting: Insurance companies must engage in fair underwriting practices, taking into consideration an applicant’s overall health status and medical history when determining coverage and pricing. They must assess risk based on valid and relevant information and avoid unfair discrimination or arbitrary decisions.

Transparency: Insurance companies are expected to be transparent about their policies and practices regarding the access and use of medical records. Applicants should be aware of how their medical information will be used and have the opportunity to ask questions or seek clarification if needed.

Data Security: Insurance companies must implement robust data security measures to protect the confidentiality and integrity of medical records. This includes encryption, secure storage practices, and regular security audits to ensure that the information remains protected from unauthorized access or breaches.

By respecting legal and ethical considerations, insurance companies can ensure the responsible use of medical records and maintain the trust and confidence of their policyholders. The balance between accessing necessary medical information for underwriting purposes and respecting an individual’s privacy rights is essential.

Now, let’s wrap up by summarizing the key insights we have gained regarding insurance companies’ review of medical records.

Conclusion

Insurance companies conduct thorough checks of an applicant’s medical records to assess risk, determine appropriate coverage, and set premiums. This process plays a vital role in ensuring that insurers can provide reliable coverage while managing their financial obligations effectively.

Medical records act as a comprehensive source of an individual’s health history and help insurance companies evaluate pre-existing conditions, estimate long-term costs, verify application accuracy, and identify potential exclusions or limitations. The scope of medical record checks typically spans the past five to ten years, although it can vary based on factors such as the type of insurance policy, applicant’s age, and the amount of coverage being sought.

Insurance companies must adhere to legal and ethical considerations when accessing and using medical records. Privacy laws, confidentiality obligations, non-discrimination policies, informed consent, fair underwriting practices, transparency, and data security form the foundation for responsible handling of this sensitive information.

While medical record checks may seem intrusive, they serve a purpose in ensuring accurate underwriting decisions, maintaining fairness in the insurance system, and offering appropriate coverage for individuals’ health needs. It is crucial for applicants to provide honest and accurate information during the application process and be aware of their rights regarding the access and use of their medical records.

By understanding the processes and considerations involved in insurance companies’ evaluation of medical records, individuals can make informed decisions when applying for insurance and ensure their medical information is handled responsibly.

Remember, insurance exists to provide peace of mind and protection. Through the thorough examination of medical records, insurance companies can fulfill this purpose while maintaining the integrity of the insurance industry as a whole.