Home>Finance>Shortfall: Definition, What Happens, How It’s Corrected And Types

Finance

Shortfall: Definition, What Happens, How It’s Corrected And Types

Published: January 29, 2024

Learn the definition, causes, and types of shortfalls in finance. Discover what happens when a shortfall occurs and how it can be corrected.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Shortfall: Definition, What Happens, How It’s Corrected, and Types

Welcome to the world of finance! Today, we’re diving into a crucial concept that can have a significant impact on your financial well-being – shortfall. In this blog post, we’ll cover everything you need to know about what a shortfall is, what happens when you encounter one, how it can be corrected, and the different types of shortfalls you may come across. So, let’s get started!

Key Takeaways:

- A shortfall refers to a situation where there is an inadequate amount or shortage, typically in the context of finances.

- Shortfalls can occur in various scenarios, such as budgeting, investment returns, loan repayments, or retirement savings.

What is a Shortfall?

A shortfall, in simple terms, is when there is not enough of something that is expected or required. In the realm of finance, a shortfall often refers to a deficit or insufficiency of funds or resources to meet a particular goal or obligation.

Consider a scenario where you have budgeted a certain amount for your monthly expenses but unexpectedly face additional costs or a reduction in income. The resulting financial gap between what you have and what you need is a shortfall. This situation can cause stress and create challenges in managing your finances effectively.

What Happens When You Encounter a Shortfall?

When you encounter a shortfall, it can have various consequences depending on the specific situation. Here are a few common outcomes:

- Financial Strain: Shortfalls can cause financial strain, leading to difficulties in meeting your financial obligations, such as paying bills or loans on time.

- Accrued Debts: In order to bridge the shortfall, you may resort to borrowing money or using credit cards, which can lead to accumulating debts.

- Delayed Goals: If you experience a shortfall in your savings or investment returns, it can delay your progress towards achieving long-term financial goals.

- Stress and Anxiety: Dealing with financial shortfalls can result in emotional stress and anxiety, impacting your overall well-being.

How Can a Shortfall be Corrected?

Correcting a shortfall involves taking proactive steps to bridge the financial gap and ensure you meet your financial obligations. Here are some strategies you can consider:

- Budget Review: Evaluate your budget and identify areas where you can cut expenses or find savings to address the shortfall.

- Supplemental Income: Explore opportunities to increase your income, such as taking on a side job or freelancing, to generate additional funds.

- Negotiate or Restructure Debts: If you’re facing a shortfall in repaying debts, reach out to your creditors to explore options for negotiation or restructuring.

- Seek Financial Assistance: Depending on the situation, you may consider seeking financial assistance from family, friends, or relevant organizations.

- Professional Advice: If the shortfall seems overwhelming or you’re unsure about the best course of action, consult with a financial advisor who can provide personalized guidance.

Types of Shortfalls

Shortfalls can occur in various areas of personal finance. Here are some common types of shortfalls you may encounter:

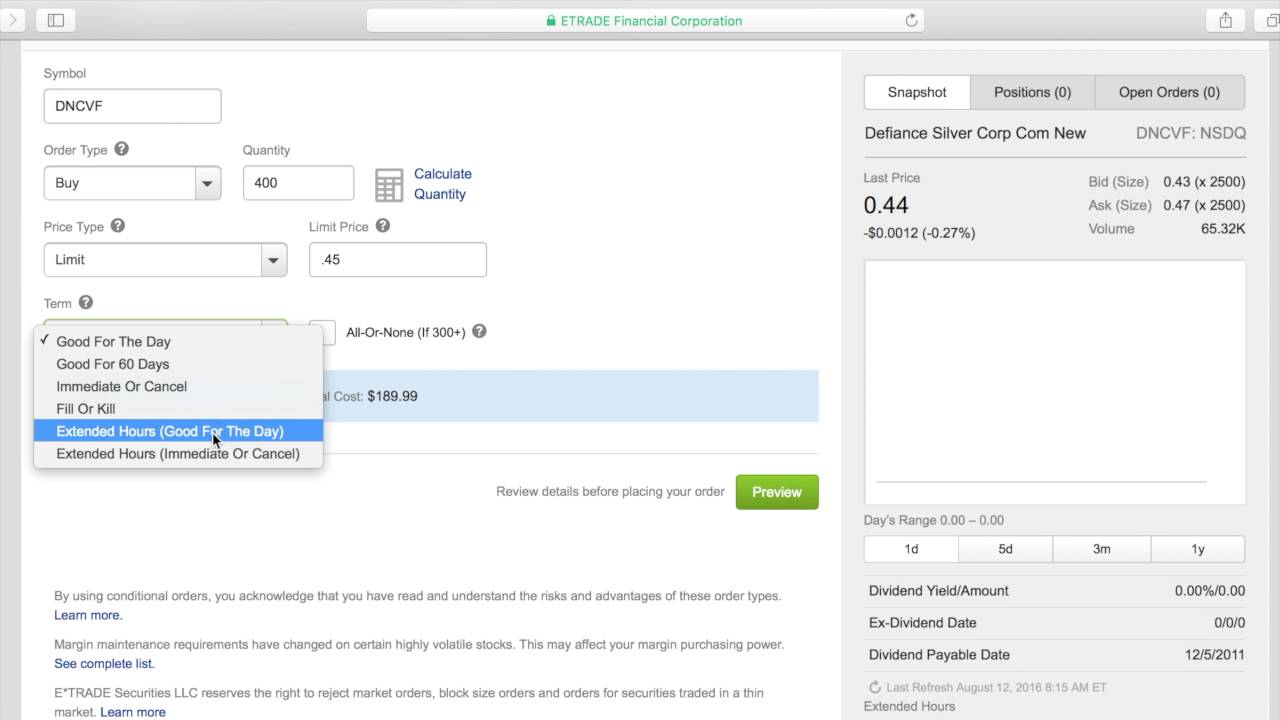

- Budget Shortfall: When your actual expenses exceed the allocated budget, resulting in a shortfall of available funds.

- Investment Shortfall: If your investment returns fall short of the expected or targeted amount, it can lead to a shortfall in achieving your investment goals.

- Loan Repayment Shortfall: When you are unable to make the required loan repayments in full or on time, resulting in a shortfall.

- Retirement Savings Shortfall: If your retirement savings are insufficient to meet your anticipated expenses during retirement, it can lead to a retirement savings shortfall.

Understanding what a shortfall is, its potential implications, and how to address it can help you navigate financial challenges with greater confidence and control. By implementing appropriate strategies and seeking professional advice when needed, you can work towards remedying shortfalls and improving your overall financial well-being.

Remember, finance is often a journey, and encountering occasional shortfalls is not uncommon. What matters is how you respond, adapt, and learn from these situations to build a stronger financial future.