Home>Finance>How Long Do I Have To Pay The Deposit For Discover It Secured Card?

Finance

How Long Do I Have To Pay The Deposit For Discover It Secured Card?

Published: March 1, 2024

Find out the timeline for paying the deposit for the Discover It Secured Card and manage your finances effectively. Learn more about securing your card and building credit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Deposit for Discover It Secured Card

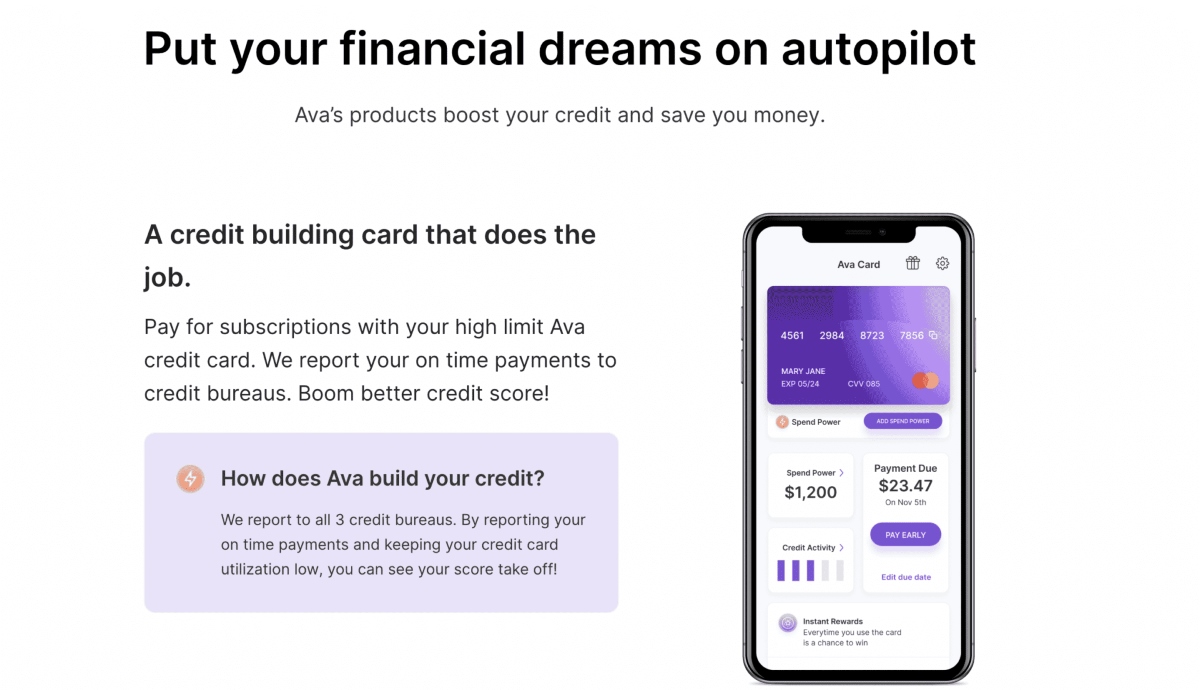

Secured credit cards offer a valuable opportunity for individuals looking to build or rebuild their credit. Among the various secured credit card options available, the Discover it® Secured Credit Card stands out as a popular choice. This card not only provides a pathway to improving credit but also offers cashback rewards, making it an attractive option for many consumers.

One of the key aspects of obtaining a Discover it® Secured Credit Card is the required deposit. Understanding the deposit requirements and the associated timelines is crucial for anyone considering this financial tool. In this article, we will delve into the specifics of the deposit for the Discover it® Secured Credit Card, including the time frame for paying the deposit, the consequences of not meeting the payment deadline, and tips for effectively managing the deposit payment process.

By gaining a comprehensive understanding of the deposit requirements and payment timeline, individuals can make informed decisions and take proactive steps to leverage the benefits of the Discover it® Secured Credit Card while establishing or rebuilding their credit history.

Understanding the Deposit for Discover It Secured Card

When applying for the Discover it® Secured Credit Card, applicants are required to provide a security deposit to establish a line of credit. The deposit serves as collateral and determines the initial credit limit on the card. The minimum deposit amount for the Discover it® Secured Credit Card is $200, while the maximum amount is $2,500.

It’s important to note that the deposit is fully refundable, provided that the cardholder maintains good standing and eventually closes the account. The deposit is held in a separate account and does not act as a payment toward the card balance. Instead, it serves as security for the issuer in case the cardholder defaults on payments.

Unlike a prepaid card, a secured credit card allows cardholders to build credit by making timely payments and managing their balances responsibly. The card activity, including payments and credit utilization, is reported to the major credit bureaus, contributing to the cardholder’s credit history.

Additionally, the Discover it® Secured Credit Card offers cashback rewards on purchases, providing an incentive for responsible card usage. This feature sets it apart from many other secured credit cards and adds value for cardholders seeking to improve their credit while earning rewards.

Understanding the role of the deposit in securing a line of credit and the potential for credit-building opportunities is essential for individuals considering the Discover it® Secured Credit Card. By recognizing the purpose and impact of the deposit, applicants can approach the card application process with clarity and confidence, knowing that their deposit serves as a stepping stone toward a stronger credit profile.

Time Frame for Paying the Deposit

Once approved for the Discover it® Secured Credit Card, applicants are required to submit the initial security deposit to activate the card. The deposit must be paid within a specific timeframe, typically within a few weeks of approval. This timeframe allows applicants to make the necessary arrangements to secure the funds for the deposit.

Upon approval, cardholders receive detailed instructions on how to submit the deposit, including the available payment methods and the deadline for payment. It’s important for applicants to review this information carefully and take prompt action to ensure timely payment and activation of the card.

Understanding the time frame for paying the deposit is crucial to avoid any delays in accessing the benefits of the Discover it® Secured Credit Card. By adhering to the payment deadline, cardholders can initiate the credit-building process and begin utilizing the card for everyday expenses and purchases.

It’s worth noting that the timely payment of the deposit sets the stage for establishing a positive payment history, a key factor in building credit. By meeting the deposit payment deadline, cardholders demonstrate their commitment to responsible credit management, laying the groundwork for future credit opportunities and financial growth.

Moreover, paying the deposit within the specified timeframe allows cardholders to start earning cashback rewards on their purchases, maximizing the benefits of the card from the outset. This incentivizes timely deposit payment and responsible card usage, aligning with the card’s objective of promoting healthy credit habits.

By understanding and adhering to the time frame for paying the deposit, individuals can embark on their credit-building journey with confidence, knowing that they have taken the necessary steps to activate their Discover it® Secured Credit Card and leverage its potential for financial advancement.

Consequences of Not Paying the Deposit

Failing to pay the required deposit for the Discover it® Secured Credit Card within the specified timeframe can have several significant consequences. Firstly, the card will not be activated until the deposit is received, which means that the individual will not be able to use the card for purchases or to begin building their credit history. This delay in accessing the card’s benefits can hinder the individual’s progress toward improving their credit profile.

Additionally, not paying the deposit within the designated timeframe may result in the application being cancelled or denied. This can be a setback for individuals who are actively seeking to establish or rebuild their credit and were counting on the secured card as a valuable tool in achieving this goal.

Furthermore, failing to meet the deposit payment deadline can lead to missed opportunities to earn cashback rewards on purchases. The cashback feature of the Discover it® Secured Credit Card is a valuable incentive for responsible card usage, and not being able to access this benefit due to delayed deposit payment can be a disadvantage for the cardholder.

From a credit-building perspective, not paying the deposit on time delays the initiation of positive credit reporting. Timely payments and responsible credit utilization are essential for establishing a solid credit history, and any delays in activating the card can postpone the cardholder’s progress in this regard.

Ultimately, the consequences of not paying the deposit for the Discover it® Secured Credit Card within the specified timeframe can impede the individual’s ability to leverage the card’s benefits for credit improvement and financial advancement. It is crucial for applicants to recognize the importance of meeting the deposit payment deadline and to take proactive steps to ensure timely payment, thereby avoiding potential setbacks and maximizing the opportunities offered by the secured card.

Tips for Managing the Deposit Payment

Managing the deposit payment for the Discover it® Secured Credit Card effectively is essential for a smooth and successful application process. Here are some valuable tips to help individuals navigate the deposit payment process:

- Plan Ahead: Upon approval for the card, carefully review the instructions for submitting the deposit and take note of the payment deadline. Planning ahead and setting aside the necessary funds in a timely manner can help ensure that the deposit is paid promptly.

- Consider Payment Methods: Explore the available payment methods for the deposit, such as electronic bank transfers or mailing a check. Choose the method that aligns with your preferences and allows for a seamless and timely transaction.

- Set Reminders: Utilize reminders or calendar notifications to stay informed about the deposit payment deadline. Setting up reminders can help prevent oversight and ensure that the payment is made within the required timeframe.

- Budget Wisely: If needed, adjust your budget to accommodate the deposit payment. Consider reallocating funds or reducing discretionary expenses to free up the necessary amount for the deposit without causing financial strain.

- Monitor the Payment Status: After submitting the deposit, monitor the payment status to confirm that it has been received and processed. This proactive approach can provide peace of mind and address any potential issues promptly.

- Maximize the Deposit: While the minimum deposit for the Discover it® Secured Credit Card is $200, individuals have the option to deposit up to $2,500. Consider depositing a higher amount if feasible, as this can result in a higher credit limit and potentially improve credit utilization ratios.

By implementing these tips, individuals can navigate the deposit payment process with confidence and ensure that they meet the requirements for activating the Discover it® Secured Credit Card without unnecessary delays or complications. Effectively managing the deposit payment sets the stage for leveraging the card’s benefits and embarking on a journey toward credit improvement and financial stability.

Conclusion

The deposit requirement for the Discover it® Secured Credit Card plays a pivotal role in providing individuals with the opportunity to build or rebuild their credit. Understanding the nuances of the deposit, including the payment timeframe and potential consequences of non-payment, is crucial for those considering this financial tool. By grasping the significance of the deposit and effectively managing the payment process, individuals can position themselves for success in utilizing the card to enhance their credit profile.

It is essential for applicants to recognize that the deposit serves as a stepping stone toward accessing the benefits of the Discover it® Secured Credit Card, including cashback rewards and the ability to establish a positive credit history. By paying the deposit within the specified timeframe and taking proactive steps to manage the payment, individuals can set the stage for a positive credit-building journey.

Furthermore, the responsible use of the Discover it® Secured Credit Card, coupled with timely deposit payment, can pave the way for improved financial opportunities and a stronger credit foundation. By adhering to the deposit requirements and leveraging the card’s features, individuals can embark on a path toward long-term financial wellness and credit empowerment.

In conclusion, the deposit for the Discover it® Secured Credit Card represents more than a financial obligation—it symbolizes a gateway to credit improvement and a brighter financial future. By embracing the deposit requirement as a strategic investment in their credit journey and effectively managing the payment process, individuals can harness the full potential of the card and take significant strides toward achieving their financial goals.