Finance

Distressed Borrower Definition

Published: November 12, 2023

Learn the distress borrower definition and its implications in the world of finance. Understand the challenges faced by troubled borrowers and their impact on financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Distressed Borrower: Definition and Implications

Welcome to the FINANCE category of our blog! In this post, we will delve into an important concept in the world of finance – the distressed borrower. If you’ve ever come across this term and wondered what it means, you’re in the right place. We’ll unlock the definition of a distressed borrower and explore the implications it holds for both the borrower and the lender.

Key Takeaways:

- A distressed borrower refers to an individual or entity who is facing financial challenges and is struggling to meet their debt obligations.

- Distressed borrowers often require assistance, whether through debt restructuring, refinancing, or seeking external financing.

What is a Distressed Borrower?

Imagine a scenario where an individual or a business has taken on debt but is facing difficulties in repaying it. This is where the concept of a distressed borrower comes into play. A distressed borrower is generally defined as someone who is experiencing financial distress and is unable to fulfill their debt obligations on time.

Financial distress could arise due to various reasons, such as economic downturns, unexpected events, mismanagement, or a combination of factors. As a result, these borrowers find themselves in a challenging situation where their financial position is compromised and their ability to meet their debt repayments becomes difficult.

Implications of Distressed Borrowers:

The presence of distressed borrowers has significant implications for both the borrowers themselves and the lenders involved in the lending arrangement. Let’s take a closer look at these implications:

- Financial Burden: Distressed borrowers often find themselves burdened by the weight of their debt, leading to increased stress and anxiety. They may struggle to maintain their standard of living or meet essential financial obligations.

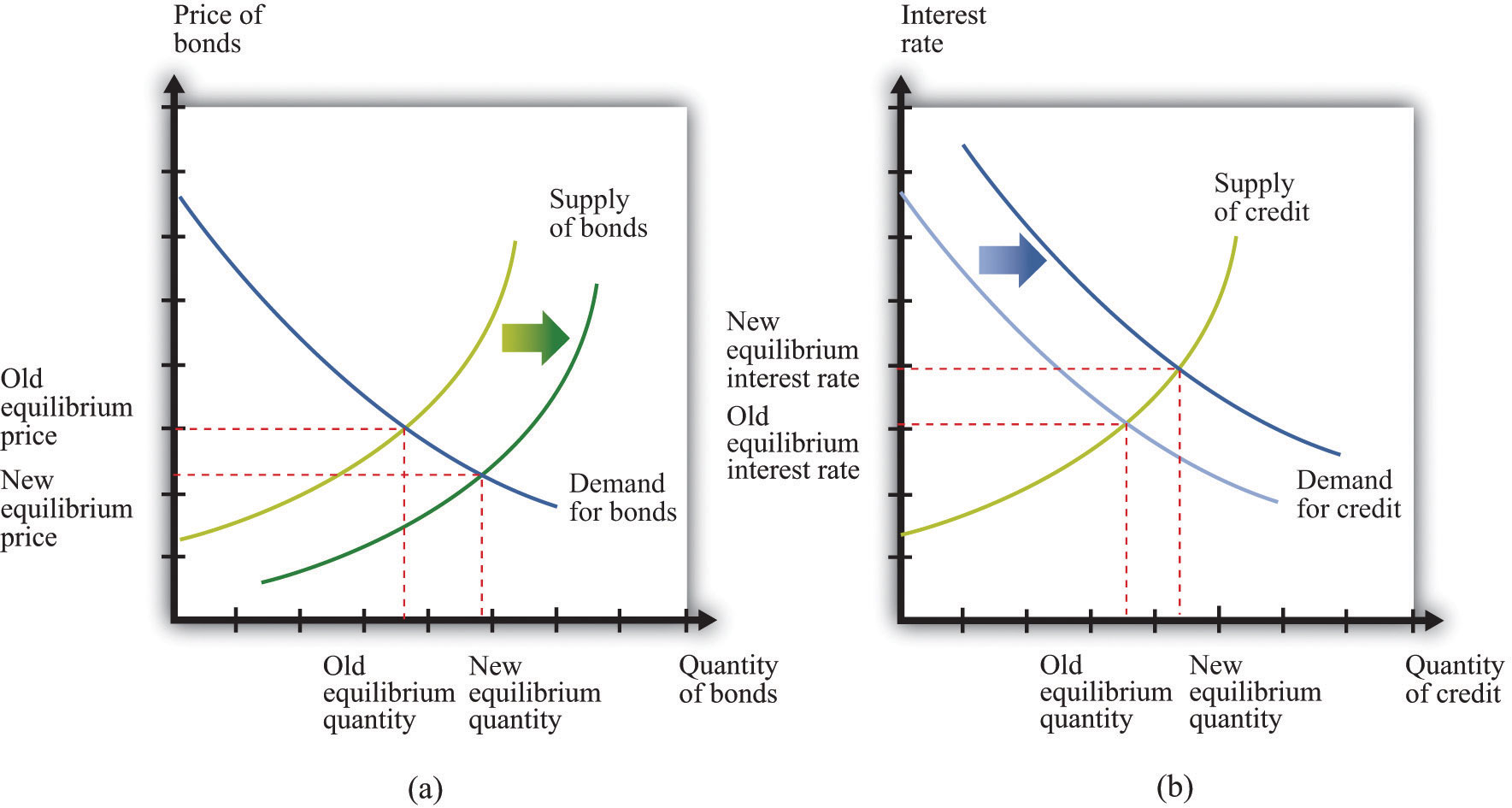

- Risk for Lenders: Lenders who have extended credit to distressed borrowers face the risk of potential default. This puts their financial stability at stake and requires them to manage their risk exposure effectively.

- Need for Assistance: Distressed borrowers often require some form of assistance to overcome their financial challenges. This may involve debt restructuring, refinancing, seeking external financing, or engaging in negotiations with creditors to find a mutually beneficial solution.

- Opportunity for Investors: For investors who specialize in distressed assets, the presence of distressed borrowers presents an opportunity. They may be able to acquire these assets at a discounted price and anticipate a turnaround in value, generating potential profits.

By understanding the implications of distressed borrowers, both borrowers and lenders can make informed decisions to navigate through challenging financial situations.

In Conclusion

A distressed borrower is someone who is facing financial challenges and is unable to fulfill their debt obligations. This can lead to significant implications for both the borrower and the lender. However, these situations also present an opportunity for investors specializing in distressed assets.

Whether you find yourself as a distressed borrower seeking assistance or a lender looking to manage risk, understanding the dynamics of distressed borrowing can help you make better-informed decisions for a more stable financial future.