Finance

How Long To Keep Medical Insurance Statements

Modified: February 21, 2024

Learn how long you should keep your medical insurance statements to stay organized and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why is it important to keep medical insurance statements?

- How long should you keep medical insurance statements?

- What information should you look for in your medical insurance statements?

- Organizing and storing your medical insurance statements

- Tips for going paperless with your medical insurance statements

- Legal and financial considerations for keeping medical insurance statements

- Conclusion

Introduction

Medical insurance is a crucial aspect of personal finance, providing financial protection and access to quality healthcare. Throughout your life, you may generate numerous medical insurance statements, which serve as records of the medical services you have received and the corresponding insurance payments made. These statements contain valuable information that can be vital for various purposes, such as tracking medical expenses, resolving billing disputes, and ensuring accurate reimbursement.

However, with the increasing digitization of healthcare and insurance processes, the question arises: how long should you keep these medical insurance statements? It is essential to strike a balance between maintaining the necessary documentation and avoiding unnecessary clutter.

In this article, we will explore the importance of keeping medical insurance statements, the recommended duration for retaining them, the key information to look for, and tips for organizing and storing these records effectively. Additionally, we will touch on the benefits of going paperless with your medical insurance statements and discuss the legal and financial considerations surrounding the retention of these documents.

By understanding the significance of medical insurance statements and implementing appropriate record-keeping practices, you can ensure a smooth healthcare experience, streamline your financial management, and make informed decisions when it comes to your healthcare expenses.

Why is it important to keep medical insurance statements?

Keeping your medical insurance statements serves several important purposes that can greatly benefit your financial well-being and ensure smooth healthcare management. Here are some key reasons why it is important to retain these documents:

- Verification of Services: Medical insurance statements provide a detailed record of the services you have received, including the date, type of service, and associated costs. By keeping these statements, you can verify that the services billed align with the services you actually received, ensuring accuracy and preventing potential fraudulent charges.

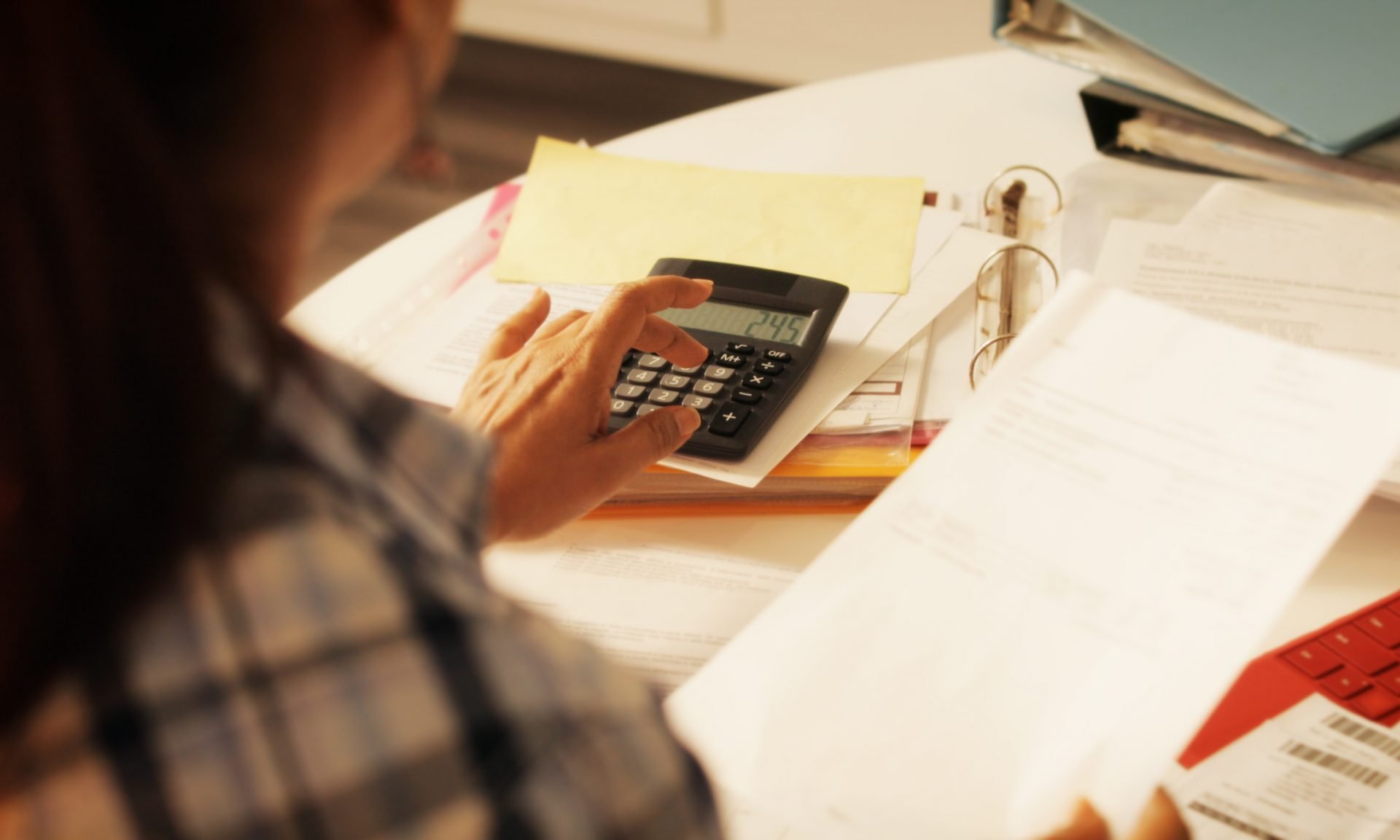

- Tracking Medical Expenses: Medical expenses can quickly add up, and keeping track of them is crucial for budgeting purposes, tax deductions, and potential reimbursement or insurance claims. Insurance statements provide an itemized breakdown of the medical services and associated costs, allowing you to monitor and analyze your healthcare expenses effectively.

- Resolving Billing Disputes: Medical billing errors are not uncommon. By retaining your insurance statements, you have documentation to reference and compare against medical bills received from healthcare providers. This empowers you to identify any discrepancies or inaccuracies in the charges and work towards resolving billing disputes with the provider or insurer.

- Ensuring Reimbursement: In some cases, you may need to submit medical expenses for reimbursement by your insurance provider or employer’s flexible spending account (FSA) or health savings account (HSA). Insurance statements serve as proof of payment and document the eligible expenses, helping you substantiate your claims and ensuring you receive the reimbursement you are entitled to.

- Insurance Coverage Review: Insurance policies can be complex, with coverage limitations and exclusions. By reviewing your insurance statements, you can gain insights into the specific benefits and coverage provided by your plan, helping you make informed decisions about your healthcare and understand any out-of-pocket expenses you may be responsible for.

By keeping your medical insurance statements, you not only maintain vital records of your healthcare history, expenses, and insurance coverage but also empower yourself to navigate the healthcare system effectively, dispute erroneous charges, and manage your finances with confidence.

How long should you keep medical insurance statements?

The duration for which you should keep your medical insurance statements depends on various factors, including legal requirements, tax considerations, and personal preference. While there is no one-size-fits-all answer, here are some general guidelines to help you determine how long to retain these documents:

- Short-Term Retention: It is advisable to keep your most recent medical insurance statements easily accessible. These statements can be useful for verifying services, tracking expenses, and resolving any immediate billing or reimbursement issues. Keeping the statements from the past year or two readily available may be sufficient for your day-to-day needs.

- Medium-Term Retention: For ongoing medical conditions or situations where you anticipate the need for continued access to these statements, consider retaining them for a longer duration. This could include statements from the past three to five years. Doing so ensures that you have sufficient documentation to address any potential disputes, claims, or audits.

- Long-Term Retention: Certain medical insurance statements may hold long-term significance beyond the immediate needs. This can include statements related to major medical procedures, significant illnesses, or catastrophic events. It is advisable to retain these statements indefinitely, or at least for several years, as they may serve as valuable historical records for healthcare monitoring, insurance claims, or potential legal requirements.

- Legal and Financial Considerations: It is essential to understand any legal obligations or financial requirements related to medical documentation retention. For example, different jurisdictions may have specific regulations regarding the retention of medical records by healthcare providers, insurers, or employers. Additionally, for tax purposes, you may need to retain records to support deductions or claims. Consider consulting with legal or financial professionals to ensure compliance with any applicable laws or regulations.

Ultimately, the decision of how long to keep your medical insurance statements should be based on your individual needs, risk tolerance, and storage capacity. It is worth considering digitizing your statements to save physical space and ensure easy accessibility. By striking a balance between retaining the necessary documentation and reducing clutter, you can effectively manage your medical records and maintain financial peace of mind.

What information should you look for in your medical insurance statements?

When reviewing your medical insurance statements, it is crucial to understand and analyze the information provided. This will help you ensure the accuracy of the statements, track your healthcare expenses, and make informed decisions regarding your insurance coverage. Here are key pieces of information to look for:

- Patient Information: Verify that your personal information, such as your name, address, and insurance policy number, is correctly listed on the statement. Any errors or discrepancies should be addressed with your insurance provider to ensure accurate record-keeping and claims processing.

- Service Details: Examine the details of the medical services rendered, including the date, description of the service, and the name of the healthcare provider. Make sure that the services listed align with the treatments or procedures you received. If you notice any discrepancies, reach out to the provider or insurer to clarify or resolve any billing errors.

- Cost Breakdown: Review the charges associated with each service or procedure. This can include the healthcare provider’s fees, deductible amounts, copayments, coinsurance, and any out-of-pocket expenses. Make sure that the charges are accurate and conform to the terms of your insurance policy. If you have any questions or concerns about the costs, contact your insurance provider for clarification.

- Insurance Payments: Assess the insurance payments made on your behalf by your insurance company. These payments represent the portion of the medical expenses covered by your insurance plan. Verify that the insurance payments are correctly allocated and applied towards your outstanding healthcare bills. If there are any discrepancies or missing payments, inform your insurance company to ensure accurate records and payment processing.

- Benefits and Coverage: Understand the details of your insurance coverage outlined on the statement. This can include the services covered, pre-authorization requirements, limitations, and exclusions. Familiarize yourself with your policy to make informed decisions regarding healthcare procedures, referrals to specialists, and any potential out-of-pocket expenses you may be responsible for.

By diligently reviewing your medical insurance statements and ensuring the accuracy of the information provided, you can track your medical expenses, identify any billing errors or discrepancies, and gain a comprehensive understanding of your insurance coverage. This knowledge will empower you to make informed decisions about your healthcare and effectively manage your insurance claims and expenses.

Organizing and storing your medical insurance statements

Effective organization and proper storage of your medical insurance statements are essential for easy access, accurate record-keeping, and timely retrieval when needed. Here are some tips to help you organize and store your medical insurance statements:

- Create a dedicated folder or file: Designate a specific folder or file on your computer or in a physical filing cabinet to store all your medical insurance statements. This will help keep them organized and easily accessible.

- Sort and label: Arrange your statements in chronological order, with the most recent on top. Consider labeling each statement with the date range or any relevant details to quickly identify and locate specific records when needed.

- Digitalize your statements: Consider scanning or taking digital photos of your paper statements to create digital copies. Save them on a secure and backup-enabled storage device, such as an external hard drive, cloud storage service, or password-protected online platform. This will not only help save physical space but also enable easy retrieval and reduce the risk of losing important documents.

- Back up your digital copies: Ensure you have a reliable backup system in place for your digital copies. Regularly backup your files to multiple secure locations to minimize the risk of data loss due to hardware failure or other unforeseen events.

- Consider using electronic document management tools: Explore electronic document management tools that can help you organize and categorize your digital medical insurance statements. These tools often allow you to add tags, metadata, and search capabilities, making it easier to locate specific records quickly.

- Keep supporting documents together: If you receive any supporting documents related to your medical insurance statements, such as receipts, itemized bills, or explanation of benefits (EOB), keep them together with the corresponding statements. This will provide a more comprehensive record of your healthcare expenses and facilitate easier referencing.

- Keep hard copies in a secure location: If you choose to retain physical copies of your medical insurance statements, ensure they are stored in a secure location, such as a locked file cabinet or a fireproof safe. Protecting these documents from damage, theft, or unauthorized access is crucial.

- Regularly review and purge: Periodically review your medical insurance statements and purge any outdated or irrelevant records. This will help keep your records organized and prevent unnecessary clutter.

By implementing these organizational strategies, you can effectively manage your medical insurance statements, reduce the risk of losing important records, and ensure easy access when necessary, allowing for efficient tracking of your healthcare expenses and insurance claims.

Tips for going paperless with your medical insurance statements

Transitioning to a paperless system for managing your medical insurance statements can offer numerous benefits, including reduced clutter, improved accessibility, and enhanced document security. Here are some useful tips to help you go paperless with your medical insurance statements:

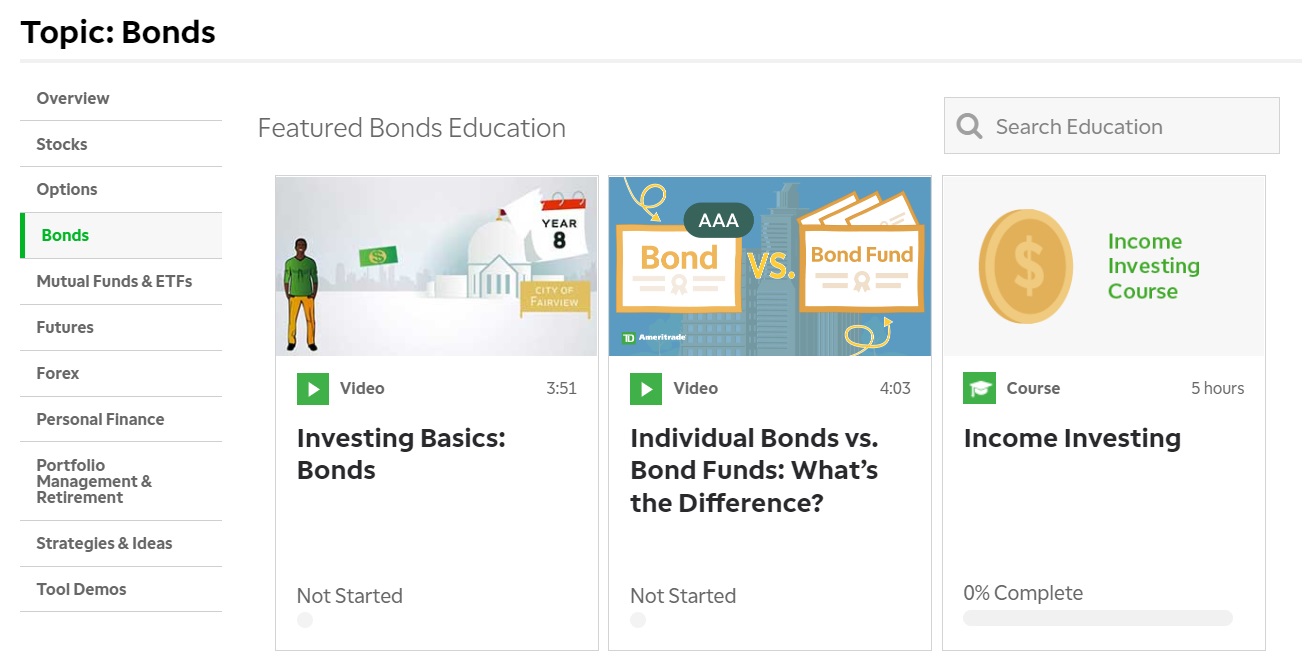

- Opt for electronic delivery: Contact your insurance provider and request to receive your statements electronically via email or through your online account. This eliminates the need for physical copies and ensures you receive your statements in a timely manner.

- Set up online account access: Create an online account with your insurance provider and enroll in paperless communications. This will allow you to access your statements and related documents securely from anywhere at any time.

- Use a designated email folder: Create a specific folder in your email account to store all your electronic medical insurance statements. By keeping them organized in one place, you can easily locate and retrieve them when needed.

- Consider using a document management app: Explore document management apps or software that can help you organize and store your electronic medical insurance statements. These apps often provide features like document categorization, search capabilities, and reminders for upcoming payments or important deadlines.

- Sync your digital statements: If you store your electronic statements on multiple devices, ensure they are synced across all devices to maintain consistency and accessibility.

- Backup your digital statements: Just as you would with any other important digital files, make sure to back up your electronic medical insurance statements regularly. Store them on an external hard drive or cloud storage service to protect against data loss.

- Be mindful of document security: Protect your electronic statements with strong passwords and encryption. Regularly update your password and ensure you have security measures in place to prevent unauthorized access to your sensitive medical information.

- Implement auto-payment and reminders: Set up auto-payment options for your medical insurance premiums to ensure timely payments. Additionally, utilize digital calendar reminders to stay on top of any important deadlines or renewal dates.

- Engage in regular document purging: Periodically review your electronic medical insurance statements and delete any outdated or irrelevant records. By keeping your digital files organized and clutter-free, you can maintain an efficient system of record-keeping.

By following these tips, you can successfully transition to a paperless system for managing your medical insurance statements. Not only will this streamline your document organization, but it will also contribute to a greener and more environmentally-friendly approach to managing your financial records.

Legal and financial considerations for keeping medical insurance statements

When it comes to keeping your medical insurance statements, there are certain legal and financial considerations that you should be aware of. These considerations can help ensure compliance with regulations and provide financial protection. Here are some important points to keep in mind:

- Legal obligations: Healthcare providers, insurers, and employers are often bound by legal requirements regarding the retention of medical records. It is important to familiarize yourself with the laws and regulations specific to your jurisdiction. In some cases, providers may be required to retain medical records for a certain period of time, while individuals may have the right to request access to their records.

- Tax deductions and claims: Your medical insurance statements may be essential for claiming tax deductions or filing insurance claims. Keep your statements for the period prescribed by tax laws to support any medical expenses you plan to deduct. Additionally, retain statements related to insurance claims until the claim is settled, as they may be required for documentation and reimbursement purposes.

- Healthcare spending accounts: If you have a healthcare spending account, such as a flexible spending account (FSA) or health savings account (HSA), it is important to retain your medical insurance statements to substantiate eligible expenses. These statements will be necessary if you are audited or if you need to provide documentation to your account administrator.

- Insurance disputes and audits: Medical insurance statements can serve as crucial evidence in case of disputes or audits related to your insurance coverage. By retaining your statements, you can provide documentation that supports your claims and helps resolve any issues effectively.

- Statute of limitations: Depending on your jurisdiction, there may be a statute of limitations for legal actions related to medical claims and expenses. To safeguard your rights, it is advisable to keep your medical insurance statements for the duration specified by the applicable statute of limitations.

- Identity theft protection: Medical insurance statements contain sensitive personal and financial information. Properly storing and disposing of these statements can help protect against identity theft. Shred physical statements before discarding them, and secure your digital statements with strong passwords and encryption.

It is crucial to consult with legal and financial professionals to understand and comply with the specific legal and financial considerations related to the retention of medical insurance statements. They can provide guidance tailored to your individual circumstances and ensure that you are meeting all necessary requirements.

By being aware of these legal and financial considerations, you can effectively manage your medical insurance statements, protect your rights, and maintain the necessary documentation to support your healthcare needs and financial obligations.

Conclusion

Keeping track of your medical insurance statements plays a vital role in managing your healthcare expenses, verifying services, resolving billing disputes, and ensuring accurate reimbursement. While the duration for retaining these statements may vary based on individual circumstances, it is important to strike a balance between maintaining necessary records and avoiding unnecessary clutter.

By understanding the significance of medical insurance statements and implementing effective organization strategies, such as creating a dedicated folder or going paperless, you can streamline the management of your records and ensure easy access when needed. Additionally, considering legal and financial considerations, such as compliance with regulations and tax obligations, can provide added protection and peace of mind.

Remember to review your medical insurance statements regularly, familiarize yourself with the information they contain, and keep supporting documents and records organized together. By doing so, you can track your medical expenses, detect any billing errors or discrepancies, and make informed decisions about your insurance coverage and healthcare options.

Consulting with legal and financial professionals can offer valuable insights and guidance regarding the specific legal and financial considerations related to your medical insurance statements, ensuring that you meet all necessary requirements.

By effectively managing and retaining your medical insurance statements, you can empower yourself to navigate the healthcare system with confidence, protect your financial interests, and ensure a seamless healthcare experience.