Home>Finance>How Long Do Series Ee Savings Bonds Earn Interest

Finance

How Long Do Series Ee Savings Bonds Earn Interest

Modified: February 21, 2024

Looking for answers about the duration of interest earnings on Series EE Savings Bonds? Explore the ins and outs of finance with this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Series EE Savings Bonds

- How Series EE Savings Bonds Earn Interest

- The Initial Earning Period of Series EE Savings Bonds

- The Extended Earning Period of Series EE Savings Bonds

- Factors Affecting Interest Rates on Series EE Savings Bonds

- When Series EE Savings Bonds Stop Earning Interest

- Conclusion

Introduction

Series EE Savings Bonds are a popular investment option for individuals looking to save money for the long-term. These bonds are issued by the U.S. Department of the Treasury and offer a safe and secure way to build your savings. One of the main considerations for individuals investing in Series EE Savings Bonds is how long these bonds earn interest.

In this article, we will explore the details of Series EE Savings Bonds and discuss the timeframe during which they earn interest. We will delve into the initial earning period as well as the extended earning period. Additionally, we will highlight the factors that can affect the interest rates on these bonds and discuss when Series EE Savings Bonds stop earning interest.

Understanding how Series EE Savings Bonds earn interest is essential for individuals who are planning to invest in them. Not only will this knowledge help you make informed decisions about your investments, but it will also enable you to maximize the potential return on your savings.

So, let’s dive into the world of Series EE Savings Bonds and explore how they work.

Understanding Series EE Savings Bonds

Series EE Savings Bonds are a type of savings bond issued by the U.S. Department of the Treasury. They are considered a low-risk investment option, as they are backed by the full faith and credit of the United States government.

These bonds are primarily purchased by individuals who want to save money for the long term, whether it’s for education, retirement, or other financial goals. When you invest in a Series EE Savings Bond, you are essentially lending money to the government in exchange for a guaranteed return on your investment.

One of the attractions of Series EE Savings Bonds is their simplicity. They are available in two forms: paper bonds and electronic bonds. Paper bonds can be purchased in various denominations, ranging from $25 to $10,000, while electronic bonds can be bought in any amount starting as low as $25.

Series EE Savings Bonds are purchased at a percentage of their face value. For example, if you buy a $100 bond at a 50% discount, you will pay $50 for it. The bond will then earn interest over a certain period of time until it reaches its full face value.

It’s important to note that Series EE Savings Bonds have a fixed interest rate which is determined at the time of purchase. This interest rate remains the same throughout the life of the bond. The interest on these bonds is typically compounded semiannually.

Now that we have a basic understanding of what Series EE Savings Bonds are, let’s take a closer look at how these bonds actually earn interest.

How Series EE Savings Bonds Earn Interest

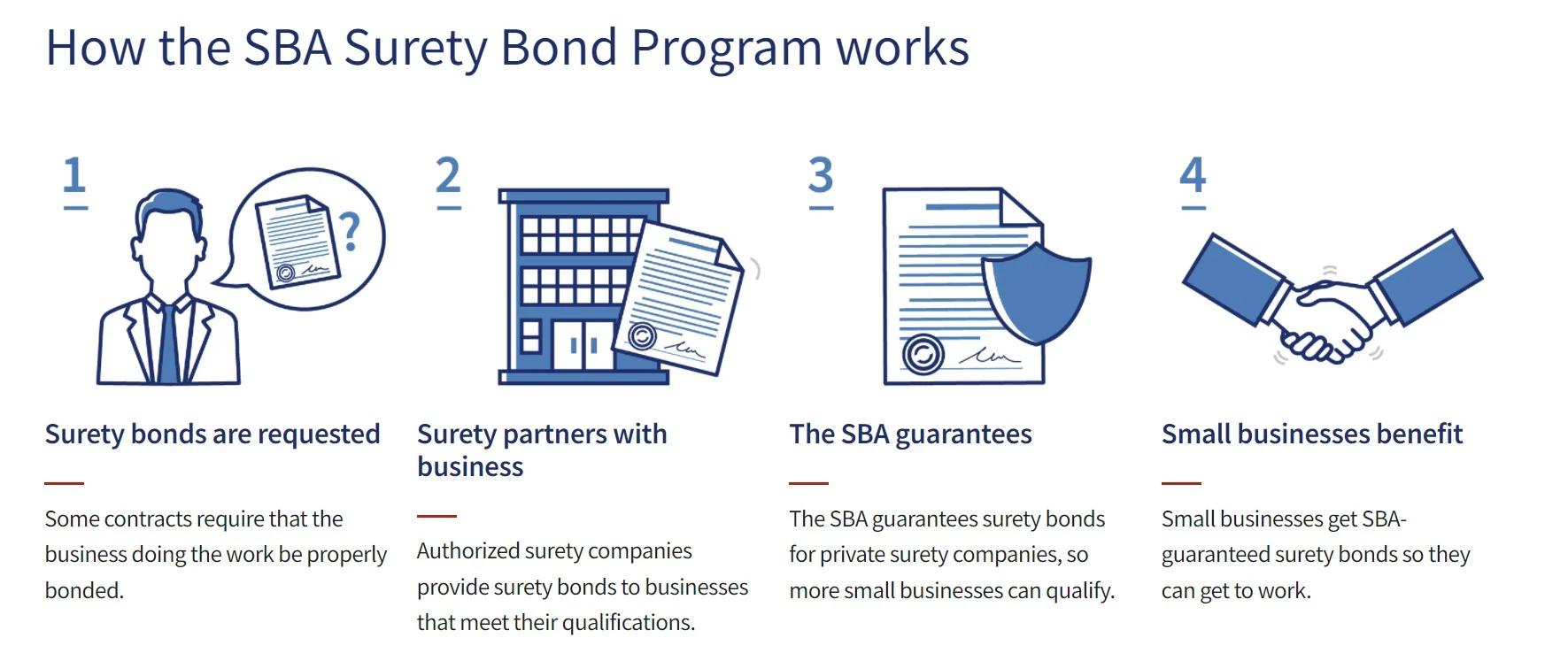

Series EE Savings Bonds earn interest through a combination of two components: the guaranteed yield and the variable market-based rate. Let’s break down how these components work:

1. Guaranteed Yield: When you purchase a Series EE Savings Bond, it comes with a guaranteed yield. This yield is determined at the time of purchase and remains fixed for the life of the bond. The rate for Series EE Savings Bonds issued between May 1997 and April 2005 is typically 90% of the average yields on five-year Treasury securities. Bonds issued after April 2005 have a rate based on a fixed percentage for the first 20 years.

2. Variable Market-Based Rate: In addition to the guaranteed yield, Series EE Savings Bonds also earn a variable market-based rate. This rate is adjusted twice a year, on May 1st and November 1st, based on changes in the market. The variable rate is influenced by factors such as current interest rates and inflation rates.

The combination of the guaranteed yield and the variable market-based rate determines the total interest earned on a Series EE Savings Bond. The interest is added to the bond’s value and continues to compound semiannually until the bond reaches its maximum value.

It’s important to note that the interest earned on Series EE Savings Bonds is subject to federal income tax. However, they are exempt from state and local taxes, making them an attractive option for individuals looking to minimize their tax obligations.

Now that we understand how Series EE Savings Bonds earn interest, let’s explore the duration of the initial earning period.

The Initial Earning Period of Series EE Savings Bonds

The initial earning period of Series EE Savings Bonds typically lasts for 20 years. During this time, the bond accumulates interest based on the combination of the guaranteed yield and the variable market-based rate.

For bonds purchased between May 1997 and April 2005, the initial earning period is split into two phases: the original maturity period and the extended maturity period. The original maturity period is typically 17 years, during which the bond earns interest based on the guaranteed yield. After the original maturity period, the bond enters the extended maturity period, where it continues to earn interest based on the variable market-based rate.

Bonds purchased after April 2005 have a fixed rate that is determined at the time of purchase. The initial earning period for these bonds is 20 years, during which they earn interest based on the combination of the fixed rate and the variable market-based rate.

It’s important to note that the interest earned during the initial earning period is added to the bond’s value and continues to compound semiannually. This means that the total return on your investment increases over time as the bond accrues more interest.

After the initial earning period, Series EE Savings Bonds enter the extended earning period. However, the bond will stop earning interest once it reaches its final maturity date. The length of the extended earning period and the final maturity date vary depending on when the bond was issued.

In the next section, we will explore the extended earning period of Series EE Savings Bonds and discuss the factors that can affect the interest rates on these bonds.

The Extended Earning Period of Series EE Savings Bonds

After the initial earning period, Series EE Savings Bonds enter the extended earning period. During this phase, the bond continues to accumulate interest based on the variable market-based rate.

The length of the extended earning period varies depending on when the bond was issued. For bonds purchased between May 1997 and April 2005, the extended earning period begins after the original maturity period of 17 years. These bonds can earn interest for an additional 10 years in the extended maturity period, resulting in a total earning period of 30 years.

For bonds purchased after April 2005, the extended earning period is not divided into separate phases. These bonds can earn interest for a total period of 30 years, starting from the date of purchase.

It’s important to note that the interest rate during the extended earning period is adjusted every six months based on changes in the market rates. The variable market-based rate is influenced by factors such as current interest rates and inflation rates.

During the extended earning period, the interest earned on Series EE Savings Bonds continues to compound semiannually. This means that the bond’s value will continue to increase as it accumulates more interest over time.

However, it’s crucial to keep in mind that the bond will stop earning interest once it reaches its final maturity date. Therefore, it’s essential to be aware of the maturity date of your Series EE Savings Bonds to plan your investment goals accordingly.

Now that we understand the extended earning period, let’s explore the factors that can affect the interest rates on Series EE Savings Bonds.

Factors Affecting Interest Rates on Series EE Savings Bonds

Several factors can influence the interest rates on Series EE Savings Bonds. It’s important to understand these factors to make informed decisions when investing in these bonds. Here are the key factors that can affect the interest rates:

1. Market Interest Rates: The interest rates on Series EE Savings Bonds are tied to market interest rates. If market rates increase, the variable market-based rate on the bonds will also rise. Conversely, if market rates decrease, the variable rate will decrease as well. Changes in market interest rates are determined by various economic factors and monetary policy decisions.

2. Inflation Rates: Inflation has a direct impact on the purchasing power of money. When inflation is high, the value of money decreases over time. To compensate for inflation, the U.S. Treasury adjusts the variable market-based rate on Series EE Savings Bonds. This ensures that the bonds keep up with the rising costs of goods and services.

3. Federal Reserve Policies: The Federal Reserve plays a crucial role in setting monetary policies that influence interest rates. The decisions made by the Federal Reserve, such as changes in the federal funds rate, can impact market interest rates. These policy changes can, in turn, affect the interest rates on Series EE Savings Bonds.

4. Economic and Financial Conditions: Economic conditions, such as GDP growth, employment rates, and consumer spending, can also impact interest rates. During times of economic expansion and stability, interest rates tend to rise. Conversely, during economic downturns or periods of uncertainty, interest rates may decrease to stimulate borrowing and investment.

5. U.S. Treasury Auctions: The U.S. Treasury holds regular auctions to sell new government securities, including Series EE Savings Bonds. The demand and competition for these bonds can impact their interest rates. If demand is high, the interest rates may be lower, whereas if demand is low, the rates may be higher.

It’s important to note that once you purchase a Series EE Savings Bond, the interest rate remains fixed for the life of the bond. However, the rates on newly issued bonds may vary based on the factors discussed above.

By considering these factors, you can have a better understanding of how the interest rates on Series EE Savings Bonds are determined. This knowledge can help you make informed decisions when investing in these bonds and align your investment strategy with prevailing market conditions.

Next, let’s discuss when Series EE Savings Bonds stop earning interest.

When Series EE Savings Bonds Stop Earning Interest

Series EE Savings Bonds will stop earning interest once they reach their final maturity date. The length of time a bond can earn interest varies depending on when it was issued.

For bonds issued between January 1980 and June 1983, the original maturity period was 11 years. These bonds earn interest for a total of 30 years. Bondholders have the option to extend the earning period for an additional 10 years after the original maturity by submitting a request to the Treasury Department.

For bonds issued between July 1983 and April 1985, the original maturity period was 9 years. These bonds earn interest for a total of 30 years.

For bonds issued between May 1985 and May 1995, the original maturity period was 8 years. These bonds earn interest for a total of 30 years.

For bonds issued between June 1995 and April 1997, the original maturity period was 6 years. These bonds earn interest for a total of 30 years.

For bonds issued from May 1997 onwards, the original maturity period is 20 years. These bonds earn interest for a total of 30 years, including the initial earning period and the extended earning period.

It’s important to note that if you choose to hold onto your Series EE Savings Bonds beyond their final maturity date, they will no longer accrue additional interest. Once a bond reaches its final maturity date, it is considered fully matured and the interest accumulation ceases.

When Series EE Savings Bonds stop earning interest, you have the option to cash them in. Generally, it’s recommended to redeem your bonds when they have reached their full maturity to take advantage of the maximum return on your investment.

However, it’s worth noting that if you choose to redeem your bonds before they have reached their final maturity, you may forfeit some of the interest earned. Redeeming a bond early can result in a penalty equivalent to three months’ worth of interest if you have held the bond for less than five years.

It’s always advisable to review the specific terms and conditions of your Series EE Savings Bonds and consult with a financial advisor before making any decisions regarding the redemption of your bonds.

Now that we have explored when Series EE Savings Bonds stop earning interest, let’s summarize what we have covered in this article.

Conclusion

Series EE Savings Bonds are a popular investment option for individuals looking to save money for the long term. Understanding how these bonds earn interest is crucial for maximizing their potential and achieving your financial goals.

We have learned that Series EE Savings Bonds earn interest through a combination of a guaranteed yield and a variable market-based rate. The initial earning period typically lasts for 20 years, during which the bond accrues interest based on both components. After the initial earning period, the bond enters the extended earning period, continuing to earn interest based on the variable rate.

The interest rates on Series EE Savings Bonds are influenced by factors such as market interest rates, inflation rates, Federal Reserve policies, economic conditions, and U.S. Treasury auctions. Understanding these factors can help you stay informed and make informed investment decisions.

It’s important to note that Series EE Savings Bonds stop earning interest once they reach their final maturity date. The length of time a bond earns interest varies depending on when it was issued. Once a bond has reached its final maturity, it is considered fully matured, and the interest accumulation ceases.

If you hold Series EE Savings Bonds, it’s essential to keep track of their maturity dates and consider redeeming them once they have fully matured to maximize your investment return. However, redeeming bonds before their final maturity may result in a penalty in certain cases.

In conclusion, Series EE Savings Bonds offer a reliable and secure way to save money for the long term. Understanding how these bonds earn interest, the initial earning period, and factors influencing interest rates can help you make informed decisions and achieve your financial goals.

Before investing in Series EE Savings Bonds or redeeming your existing bonds, it is always advisable to seek guidance from a financial advisor who can provide personalized advice based on your specific financial situation and goals.