Home>Finance>Series E Bond Definition-From War Bond To Savings Bond

Finance

Series E Bond Definition-From War Bond To Savings Bond

Published: January 27, 2024

Learn about the history and benefits of Series E bonds, from their origins as war bonds to their evolution into savings bonds. Discover how these bonds can help you save and grow your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Series E Bond Definition—From War Bond to Savings Bond

Gone are the days when investing in bonds was only for the wealthy and well-connected. Thanks to the creation of savings bonds, now anyone with a few dollars to spare can become a bondholder and take a step towards securing their financial future. One such bond that has stood the test of time is the Series E bond. But what exactly is a Series E bond, and how has it evolved over the years? In this blog post, we dive into the history and definition of Series E bonds, how they have transitioned into savings bonds, and their significance in the world of finance today.

Key Takeaways

- Series E bonds were first introduced in 1941 as a way to finance the United States’ efforts during World War II.

- Series E bonds have transitioned into savings bonds, which are backed by the United States government and considered one of the safest investments available.

The Origins of Series E Bonds

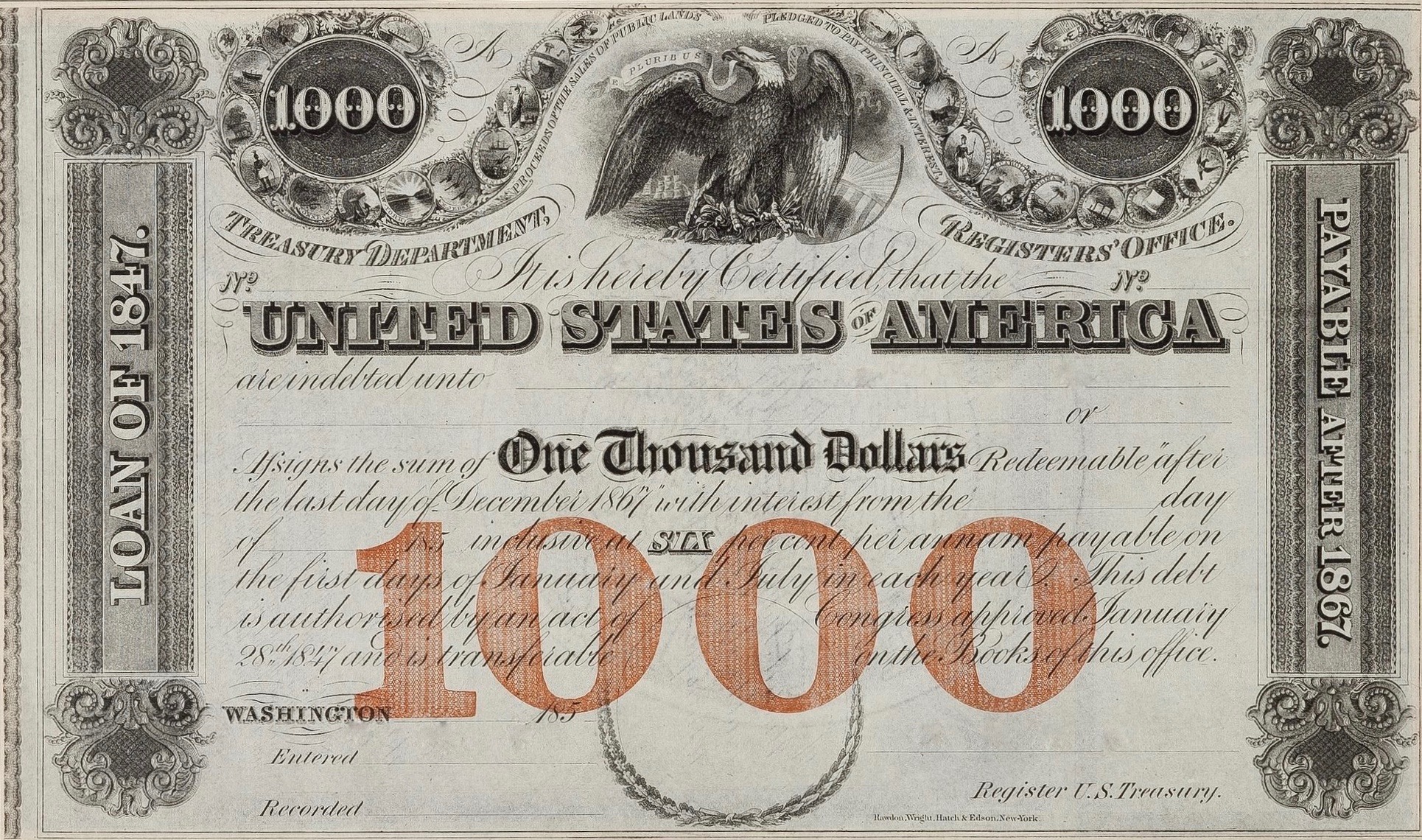

The journey of Series E bonds begins during a critical period in history—World War II. In an effort to raise funds for the war, the United States government launched the Series E bond program in 1941. These bonds were marketed to the general public, and citizens from all walks of life stepped forward to support their country’s war efforts by purchasing these bonds.

Series E bonds were non-transferable and came in denominations of $25, $50, $75, $100, $200, $500, $1,000, $5,000, and $10,000. They had a maturity period of ten years and earned interest on a fixed schedule. These bonds were a symbol of patriotism and financial support from the American people to their government.

The Transition to Savings Bonds

With the end of World War II, the United States government realized the potential of savings bonds as a means of promoting savings and investment among its citizens. In 1952, the Series E bonds were redesigned and introduced as the more versatile Series E Savings Bonds.

The shift from Series E bonds to savings bonds brought several key changes. The new savings bonds became more accessible to the public, with lower minimum denominations of $25 and $50, making them affordable for a wider range of investors. Additionally, the new bonds featured an extended maturity period of up to 40 years along with reduced interest rates.

Series E Bonds Today

Today, the Series E bond has completely transformed into the modern-day savings bond program in the United States. The former Series E bonds are no longer issued, and all existing Series E bonds have stopped earning interest. However, holders of these bonds can continue to redeem them at face value.

Series E bonds laid the foundation for the savings bond program that continues to serve investors today. These savings bonds are backed by the full faith and credit of the United States government, making them one of the safest investments available. They offer a low-risk way to save money for future expenses such as education, retirement, or even a down payment on a home.

In Conclusion

The evolution of Series E bonds into savings bonds represents the democratization of investing. What started as a means to finance war efforts during World War II has now become a tool for fostering savings and financial security. Whether you are a seasoned investor or just starting your financial journey, understanding the history and definition of Series E bonds can provide valuable insights into the world of finance and guide you towards making informed investment decisions.