Home>Finance>How Long Does A Eviction Stay On Your Credit Report

Finance

How Long Does A Eviction Stay On Your Credit Report

Modified: February 21, 2024

Find out how long an eviction remains on your credit report and its impact on your finances. Learn more about credit repair and financial recovery.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit reports and the impact they can have on your financial life. When it comes to managing your finances, it’s essential to understand how certain events can affect your creditworthiness. One such event is an eviction. An eviction can have severe implications, not just on your living situation but also on your credit report.

Whether you’re a renter facing the possibility of eviction or a homeowner struggling to make mortgage payments, it’s crucial to comprehend the long-term consequences of this legal process. In this article, we will delve into the world of evictions and explore how they can impact your credit report.

An eviction can occur when a tenant fails to pay rent, violates the lease agreement, or breaches the terms of the rental contract in some other way. It is a legal process in which the landlord takes action to remove the tenant from the property.

Now, you might be wondering, how does this process affect your credit reports? To understand that, let’s first discuss how credit reports work.

When you apply for credit, such as a loan or credit card, lenders assess your creditworthiness by reviewing your credit reports. These reports provide a summary of your financial history, including information about your payment behavior, outstanding debts, and public records.

One of the significant factors that lenders look at is your payment history, which includes whether or not you have had any evictions. Evictions are considered negative marks on your credit history and can have a lasting impact on your creditworthiness.

Next, we will explore the impact of eviction on credit reports and how long this information stays on your credit file.

Understanding Evictions

Evictions are legal proceedings initiated by landlords or property owners to remove tenants from a rental property. They are typically a result of a tenant’s failure to fulfill their obligations outlined in the lease agreement, such as non-payment of rent, violation of lease terms, or engaging in illegal activities on the premises.

Evictions can be a distressing and disruptive experience for both tenants and landlords. They can lead to financial hardships, damage credit scores, and make it difficult for tenants to find new housing in the future.

It’s important to note that eviction laws and procedures vary by country and even by state within a country. The specific rules and timelines for evictions will depend on the jurisdiction in which the rental property is located. However, certain general steps are typically involved in the eviction process.

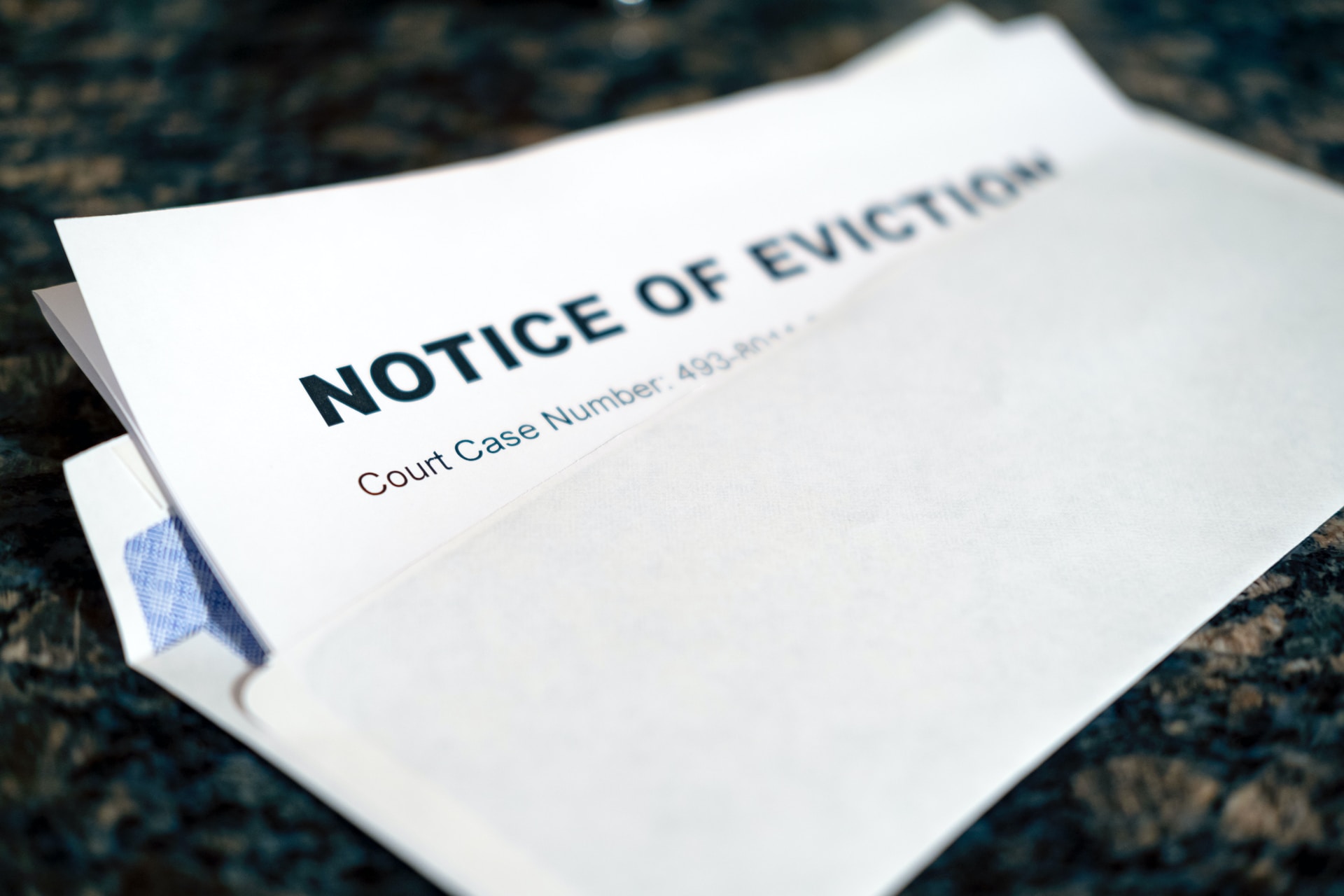

The first step is the landlord providing the tenant with a written notice of eviction, specifying the reason for the eviction and a timeframe for compliance or vacating the premises. If the tenant does not resolve the issue or move out within the specified timeframe, the landlord can file an eviction lawsuit with the appropriate court.

Once the lawsuit is filed, both the tenant and the landlord will have the opportunity to present their case in court. If the court rules in favor of the landlord, an eviction order will be issued. The tenant will then be legally required to vacate the property, and if they refuse to do so, law enforcement may be involved to forcibly remove them.

Evictions can have significant implications for both parties involved. Tenants may face difficulties in finding future housing due to the eviction record, while landlords may experience financial losses from unpaid rent or property damage caused by the tenant.

Now that we have a better understanding of what evictions entail, let’s explore how they can impact your credit reports.

How Credit Reports Work

Credit reports play a pivotal role in the financial world. They provide lenders and creditors with a comprehensive overview of an individual’s financial history and help them assess the level of risk associated with extending credit. Understanding how credit reports work is crucial in comprehending the impact that evictions can have on your creditworthiness.

Credit reports are compiled by credit reporting agencies, also known as credit bureaus. The three major credit bureaus in the United States are Equifax, Experian, and TransUnion. These agencies collect data from various sources, including lenders, financial institutions, and public records, to create a detailed report of an individual’s credit history.

The information found in a credit report typically includes personal identifying information, such as name, address, and social security number. It also includes details about credit accounts, such as credit cards, loans, and mortgages, along with the payment history associated with those accounts.

When it comes to evictions, they fall under the category of public records on a credit report. Public records are legal documents that are accessible to the public, and they can have a significant impact on a consumer’s creditworthiness.

Public records are considered negative items on a credit report, as they indicate financial difficulties or legal issues. In addition to evictions, other types of public records include bankruptcies, tax liens, and civil judgments.

Now that we understand the basics of credit reports and the role of public records, let’s explore the specific impact that evictions can have on your credit.

The Impact of Evictions on Credit

Evictions can have a significant impact on your creditworthiness and financial future. When an eviction occurs, it becomes a public record on your credit report, indicating to potential lenders that you have failed to meet your financial obligations as a tenant.

Having a public record, such as an eviction, on your credit report can result in a lower credit score. Credit scores are numerical representations of an individual’s creditworthiness, and they play a crucial role in determining loan approvals, interest rates, and credit limits.

Since evictions are considered negative marks on your credit history, they can make it more challenging to get approved for new credit or loans in the future. Lenders often view evictions as a sign of financial instability and an increased risk of defaulting on credit obligations.

Furthermore, the presence of an eviction on your credit report can also impact your ability to secure rental housing in the future. Landlords and property management companies often check credit reports as part of the tenant screening process to assess an applicant’s reliability and financial responsibility. An eviction on your record may lead landlords to consider you a higher-risk tenant, potentially leading to denials or requiring larger security deposits.

It’s essential to remember that the impact of an eviction on your credit will depend on various factors, including the severity of the eviction, the overall credit history, and the individual policies of lenders or landlords evaluating your application. However, it’s generally safe to say that an eviction can have a lasting negative impact on your creditworthiness.

Next, let’s explore how long an eviction stays on your credit report and the factors that influence its duration.

The Duration of Evictions on Credit Reports

The duration for which an eviction remains on your credit report depends on several factors. While credit reporting laws vary by country, in the United States, the Fair Credit Reporting Act (FCRA) governs how long negative information, including evictions, can be reported on credit reports.

According to the FCRA, evictions can typically stay on your credit report for up to seven years from the date they were filed. This means potential lenders and landlords can see this negative mark on your credit history for a significant period of time.

However, it’s important to note that the impact of an eviction on your credit score lessens over time. As the eviction moves further into the past, its effect on your creditworthiness diminishes, especially if you have taken steps to rebuild your credit since then.

It’s worth mentioning that some credit bureaus may remove evictions from your credit report before the seven-year mark if they are found to be inaccurate or if they were resolved in your favor. Therefore, it’s essential to regularly review your credit reports for any errors or inaccuracies and dispute them if necessary.

In addition to the FCRA guidelines, local laws regarding evictions may also impact the duration of how long an eviction stays on your credit report. Some states have stricter rules regarding reporting evictions, potentially shortening the duration for which they are visible on your credit history.

It’s important to remember that even after an eviction is no longer visible on your credit report, the record of the eviction may still exist in public records, such as court documents. These public records can be accessed by landlords, property managers, and other relevant parties during tenant screening processes or background checks.

Now that we understand the general duration of evictions on credit reports, let’s explore the factors that influence how evictions can impact credit scores.

Factors That Influence the Duration of Evictions

While the Fair Credit Reporting Act (FCRA) sets a standard timeframe for how long evictions can be reported on credit reports, there are several factors that can influence the actual duration of how long an eviction stays on your credit history. These factors can vary depending on individual circumstances and local regulations.

1. Local Laws: Some states or jurisdictions may have specific laws that impact how long an eviction can remain on your credit report. These laws may differ from the FCRA guidelines and can either shorten or extend the reporting period.

2. Resolutions and Judgments: If the eviction case was resolved in your favor or if a judgment was entered in your favor, you may be able to have the eviction removed from your credit report earlier. Providing evidence of the resolution or judgment to the credit reporting agencies can help in disputing and removing the eviction from your report.

3. Credit Bureau Policies: Each credit bureau may have its own policies regarding the duration of reporting evictions. While the FCRA sets a maximum of seven years, credit bureaus may choose to remove evictions from credit reports earlier if they are found to be inaccurate or if the required time period has elapsed.

4. Credit Repair Efforts: Taking steps to rebuild and improve your credit after an eviction can help mitigate its impact. Making consistent on-time payments, paying off outstanding debts, and establishing new positive credit accounts can demonstrate to lenders that you have become financially responsible and reliable, leading to an improved credit score over time.

It’s important to note that while these factors can influence the duration of an eviction on your credit report, the impact of the eviction on your credit score may still be felt during the reporting period. Lenders and landlords may still consider the eviction as a significant factor when evaluating your creditworthiness or rental applications.

Now that we understand the factors that influence the duration of evictions, let’s explore how evictions can affect credit scores.

How Evictions Affect Credit Scores

Evictions have a significant impact on credit scores, which are numerical representations of an individual’s creditworthiness. While the exact score drop can vary depending on various factors, it’s generally safe to say that an eviction can lead to a significant decrease in your credit score.

When an eviction appears on your credit report, it signals to lenders and creditors that you have failed to meet your financial obligations as a tenant. This negative mark on your credit history can have lasting consequences for your creditworthiness.

The specific impact of an eviction on your credit score will depend on several factors, including the severity of the eviction, your overall credit history, and the scoring model used by the credit bureau. However, it’s essential to understand that an eviction is considered a serious derogatory event and can result in a significant drop in your credit score.

The credit scoring models used by credit bureaus take into account various factors when calculating credit scores. These factors include payment history, credit utilization, length of credit history, types of credit, and the presence of negative items like evictions or late payments.

An eviction can affect your credit score in multiple ways:

1. Payment History: Payment history is one of the most crucial factors in credit scoring. An eviction reflects a failure to fulfill your financial obligations, which can lower your credit score significantly.

2. Credit Utilization: Evictions can often be accompanied by financial difficulties, such as unpaid rent. These unpaid debts can increase your credit utilization ratio, which is the amount of credit you’re using compared to your overall credit limit. High credit utilization can harm your credit score.

3. Negative Impact on Credit Report: A visible eviction on your credit report is seen by lenders as a significant red flag. It signals a potential risk in extending credit to you, resulting in a lower credit score.

It’s important to note that the impact of an eviction on your credit score can diminish over time as the eviction moves further into the past. However, it’s crucial to take steps to rebuild your credit and demonstrate responsible financial behavior to mitigate the negative impact of the eviction.

In the next section, we will explore options for removing evictions from your credit report.

Removing Evictions from Credit Reports

If you have an eviction on your credit report, you may be wondering if there are any options for removing it. While removing accurate information from your credit report can be challenging, there are steps you can take to address any inaccuracies or errors that may be present.

1. Dispute Inaccurate Information: Start by reviewing your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). If you find any inaccuracies or inconsistencies regarding the eviction, such as incorrect dates or wrong information about the eviction itself, you can file disputes with the credit bureaus to have the information corrected or removed.

2. Provide Supporting Documentation: If you have evidence or documentation showing that the eviction was resolved in your favor or that it was reported incorrectly, gather and submit this documentation along with your dispute. This can strengthen your case and increase the chances of having the eviction removed from your credit report.

3. Seek Legal Assistance: If you believe that the eviction was unjust or violated your rights as a tenant, you may consider consulting with a lawyer who specializes in tenant law. They can provide guidance on challenging the eviction and potentially having it removed from your credit report through legal means.

4. Focus on Rebuilding Credit: While it may not be possible to remove an accurate eviction from your credit report, you can still work on improving your credit score by focusing on positive credit behaviors. Make on-time payments, pay off outstanding debts, and maintain low credit utilization to demonstrate responsible financial management.

It’s important to note that the process of removing an eviction from your credit report can take time and may not always be successful. It’s crucial to stay vigilant and regularly monitor your credit reports to ensure the accuracy of the information being reported.

Lastly, remember that as time passes, the impact of the eviction on your credit score diminishes. Lenders and creditors often prioritize recent credit history over past events, so by maintaining positive financial habits, you can enhance your creditworthiness.

Now that we have explored the various aspects of evictions and their impact on credit reports, let’s conclude our discussion.

Conclusion

Evictions can have a significant impact on your creditworthiness and financial future. They are considered negative items on credit reports and can result in a lower credit score. The duration for which evictions stay on credit reports is generally up to seven years, although it may vary depending on local laws, credit bureau policies, and individual circumstances.

Having an eviction on your credit report can make it more challenging to access new credit or secure rental housing in the future. Landlords and lenders view evictions as a sign of financial instability and increased risk. However, the impact of an eviction on your credit score diminishes over time, especially if you take steps to rebuild and improve your credit.

If you have an eviction on your credit report, you can explore options for removing inaccuracies or errors through the dispute process. Providing supporting documentation and seeking legal assistance may also be effective strategies. However, it’s important to focus on rebuilding your credit by practicing responsible financial behavior, such as making on-time payments and managing your debts wisely.

Remember, while an eviction can have a lasting impact on your credit reports, it does not define your entire financial future. By taking proactive steps to address the eviction and improving your credit habits, you can work towards a brighter financial outlook.

As always, staying informed and regularly monitoring your credit reports can help you identify and address any issues that may arise, ensuring the accuracy of your credit history. By being proactive and responsible, you can strive for better financial stability and future opportunities.