Home>Finance>How Long Does It Take For The IRS To Release Funds For Child Support?

Finance

How Long Does It Take For The IRS To Release Funds For Child Support?

Published: November 1, 2023

Find out how long it takes for the IRS to release funds for child support and more on finance. Stay informed and plan accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Child support is a vital component of ensuring the well-being of children in divorced or separated families. It is the financial contribution made by a non-custodial parent to support the expenses of raising a child. In many cases, child support payments are determined by a court order, and failure to comply with these obligations can have serious consequences for the non-paying parent.

When it comes to the release of funds for child support, many factors come into play. One significant factor is the involvement of the Internal Revenue Service (IRS). The IRS plays a crucial role in facilitating the collection and disbursement of child support funds, particularly through the tax refund offset program.

In this article, we will explore the process and timeline involved in the release of funds for child support by the IRS. We will delve into the various factors that influence the release of funds, the processing time for the IRS to complete the offset, the different payment options available, and the impact of tax refund offsets on child support. Additionally, we will discuss avenues for appeals and dispute resolution, helping parents navigate the often complex landscape of child support.

Factors That Influence the Release of Funds

Several factors can influence the release of funds by the IRS for child support. Understanding these factors can help parents anticipate and navigate the process more effectively.

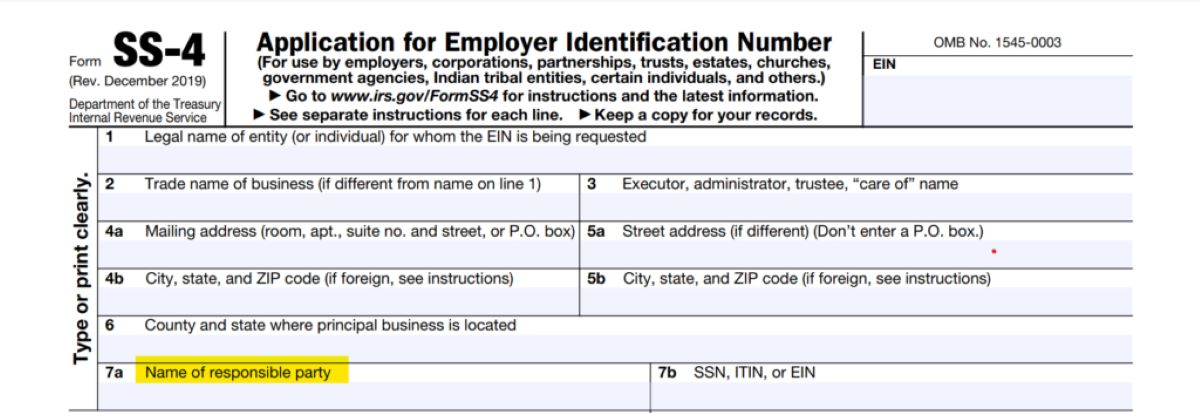

- Court Order: A court order is typically required for the collection and release of child support funds. The court order lays out the terms and conditions regarding the payment of child support, including the amount to be paid, the frequency of payments, and any other relevant details. It is crucial for both the custodial and non-custodial parents to comply with the court order to avoid potential legal consequences.

- Tax Refund Offset: One of the most common methods used by the IRS to collect unpaid child support is through tax refund offsets. If a non-custodial parent owes past-due child support, the IRS can intercept their federal tax refund and redirect it to the custodial parent. However, it’s important to note that not all child support payments are eligible for tax refund offsets, and certain rules and thresholds must be met.

- Arrears Owed: The amount of arrears owed by the non-custodial parent can impact the release of funds. If there are substantial unpaid child support arrears, the IRS may require a larger portion or the entirety of the tax refund to be offset to satisfy the outstanding debt.

- Tax Return Liabilities: In some cases, the non-custodial parent may have certain tax liabilities or debts that need to be paid, such as back taxes or student loans. In such situations, the IRS may offset the tax refund to cover these liabilities, which can delay or reduce the amount available for child support payments.

- Processing Time: The processing time for the IRS to release funds for child support can vary. It depends on various factors, including the volume of cases, the accuracy of the information provided, and any additional documentation required. It’s essential for parents to be aware that the release of funds may not be immediate and may take several weeks or even months.

By understanding these factors and ensuring compliance with court orders, parents can better understand and manage the release of funds by the IRS for child support. It’s important to stay informed, communicate with the relevant authorities, and, if necessary, seek legal guidance to navigate any challenges that may arise along the way.

Processing Time for IRS to Release Funds

The processing time for the IRS to release funds for child support can vary depending on several factors. While the exact timeline may differ in each case, it’s essential for parents to have a general understanding of the processing time to manage expectations.

Typically, once the IRS receives a tax refund claim, it takes around two to three weeks to process the claim and determine if any part of the refund will be offset for child support. This initial processing time involves verifying the taxpayer’s information, including their social security number and the amount of child support owed.

If the IRS determines that an offset is necessary, an additional processing time may be required to calculate the exact amount to be offset and update the necessary records. The IRS will notify both the non-custodial and custodial parents about the offset and the amount that will be redirected towards child support.

It’s important to note that the processing time can be extended if there are discrepancies or issues with the taxpayer’s information. This could include incorrect or incomplete personal details, incorrect social security numbers, or unresolved disputes regarding the amount of child support owed.

In some cases, the release of funds may be delayed if there are other outstanding debts or liabilities that need to be addressed before the child support offset can occur. If the non-custodial parent has other federal or state tax liabilities, student loan defaults, or other outstanding debts, the IRS may need to offset the refund towards these debts first, which can further extend the processing time.

It’s important for parents to be patient and allow sufficient time for the IRS to complete the necessary processing. If there are any concerns or delays, it’s advisable to contact the IRS or seek guidance from a qualified professional, such as a family law attorney or tax advisor, who can provide assistance and advocacy throughout the process.

Payment Options for Child Support

There are several payment options available for child support, allowing parents to choose the method that best suits their needs and preferences. It’s important to select a payment option that ensures timely and consistent support for the child.

- Direct Payment: This is the most common method of child support payment, where the non-custodial parent makes regular payments directly to the custodial parent. This can be done through various means, such as cash, checks, bank transfers, or electronic payment platforms. It’s important to diligently track and document these payments to avoid any misunderstandings or disputes.

- Income Withholding: Income withholding, also known as wage garnishment, involves deducting the child support amount directly from the non-custodial parent’s paycheck. This method ensures consistent payments and minimizes the risk of non-payment or late payments. Income withholding is often utilized when there is a history of non-compliance or when ordered by the court.

- State Disbursement Unit: In some cases, child support payments may be processed through a State Disbursement Unit (SDU). The SDU serves as an intermediary, collecting payments from the non-custodial parent and disbursing them to the custodial parent. This method provides an added layer of transparency and accountability, as the SDU maintains a record of all transactions.

- Electronic Payment Services: Many states offer electronic payment services that facilitate convenient and secure child support payments. These services may include online payment portals or mobile applications that allow parents to make payments electronically, ensuring timely and efficient transfers.

- Money Order or Certified Check: For parents who prefer not to use direct bank transfers or electronic methods, money orders or certified checks can be utilized as a secure form of payment. These methods provide a paper trail and proof of payment, which can be important for record-keeping purposes.

It’s crucial to select a payment option that aligns with both parents’ preferences and circumstances. Additionally, it’s important to communicate and agree upon the chosen method to avoid confusion and ensure the child’s financial needs are consistently met. If there are any difficulties or disputes regarding child support payments, seeking legal advice can help address and resolve the issues effectively.

Impact of Tax Refund Offsets on Child Support

Tax refund offsets can have a significant impact on child support payments, both for the custodial and non-custodial parents. Understanding how tax refund offsets work and their implications can help parents better manage their financial responsibilities.

For the custodial parent, tax refund offsets can provide a crucial source of financial support. If the non-custodial parent owes past-due child support, the IRS can intercept their federal tax refund and redirect the amount owed to the custodial parent. This can help alleviate some of the financial burden and ensure that the child’s needs are met.

However, it’s important to note that tax refund offsets may not cover the full amount owed in child support. The offset is typically limited to the amount of the tax refund available, and if the arrears are higher, the custodial parent may still have to seek other means to collect the remaining balance.

On the other hand, tax refund offsets can be challenging for the non-custodial parent. Having a portion or the entirety of their tax refund offset for child support can impact their own financial situation. It’s essential for non-custodial parents to be aware of their child support obligations and make timely payments to avoid tax refund offsets and any potential legal consequences.

It’s also important to understand that tax refund offsets may not be the only method used for child support collection. Other enforcement actions, such as wage garnishment, property liens, or bank account levies, may be employed to ensure compliance with child support obligations.

Overall, tax refund offsets play a vital role in helping enforce child support payments and providing financial support to custodial parents. It’s crucial for both parents to communicate, comply with court orders, and seek legal guidance if there are any disputes or difficulties in meeting child support obligations.

Appeals and Resolving Disputes

It is not uncommon for disputes or disagreements to arise regarding child support payments and tax refund offsets. In such cases, there are options available for appeals and resolving disputes, allowing parents to seek fair resolutions and ensure the best interests of the child.

If a parent believes there is an error or inaccuracy in the tax refund offset, they have the right to appeal the decision. The appealing parent can work directly with the IRS to provide evidence or documentation that supports their claim. This may include providing proof of a different payment arrangement or demonstrating that the amount owed in child support has been satisfied.

It is advisable for the appealing parent to seek legal advice or engage a family law attorney who specializes in child support cases. An attorney can assist in navigating the appeals process, gathering relevant information, and advocating for a fair resolution. They can also help ensure that all necessary paperwork and documentation are submitted within the required timeframe.

If a parent believes there is an error in the calculation of child support arrears or there is a dispute over the amount owed, they may need to pursue resolution through the family court system. They can file a motion with the court to review the child support order and request a modification or clarification.

Mediation or alternative dispute resolution methods may also be utilized to resolve conflicts regarding child support. Mediation involves the assistance of a neutral third party who helps facilitate discussion and negotiation between the parents. The goal is to reach a mutually agreeable solution that satisfies both parties’ concerns and meets the child’s needs.

If the dispute remains unresolved, it may be necessary to proceed to a formal hearing or trial in family court. The court will consider all relevant evidence and make a determination based on the best interests of the child and applicable laws and guidelines.

It’s crucial for parents to maintain open lines of communication, seek legal advice when necessary, and approach dispute resolution with a focus on the child’s welfare. Resolving conflicts and disputes in a respectful and cooperative manner can help mitigate the negative impact on both parents and, most importantly, ensure the child’s financial and emotional well-being.

Conclusion

The release of funds for child support by the IRS involves several factors that can influence the process. Understanding these factors, such as court orders, tax refund offsets, and processing times, can help parents navigate the system more effectively.

It’s important to select the most suitable payment option for child support, whether it’s through direct payments, income withholding, or utilizing state disbursement units or electronic payment services. Clear communication and compliance with court orders are essential for consistent and timely support for the child.

Tax refund offsets can have a significant impact on child support payments, providing financial support to custodial parents while potentially creating financial challenges for non-custodial parents. It’s crucial for both parties to understand their obligations and comply with their child support responsibilities to avoid tax refund offsets and other enforcement actions.

In cases where disputes or disagreements arise, there are avenues for appeals and resolving disputes. Seeking legal advice, engaging in mediation, and utilizing the family court system can help reach fair resolutions that prioritize the child’s best interests.

Overall, ensuring the smooth release of funds for child support requires cooperation, understanding, and compliance from both parents. By actively participating in the process, maintaining open communication, and seeking legal guidance when necessary, parents can navigate the complexities of child support and ensure the well-being of the child.