Finance

How Long Does The IRS Background Check Take?

Published: October 30, 2023

Learn how long it takes for the IRS to complete a background check. Discover the process and timeline for this important step related to finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial matters, the Internal Revenue Service (IRS) plays a crucial role in ensuring compliance with tax regulations. As part of their efforts to maintain the integrity of the tax system, the IRS conducts background checks on individuals and businesses. These background checks are designed to verify taxpayer information, detect potential fraud, and ensure that taxpayers are fulfilling their tax obligations.

Understanding the intricacies of an IRS background check is important, especially for individuals or businesses undergoing this process. This article aims to shed light on the duration and factors affecting an IRS background check, as well as address common questions related to the topic.

It is essential to note that an IRS background check should not be confused with a routine tax return review or audit. While both involve reviewing financial information, an IRS background check focuses on broader investigations related to taxpayer compliance and potential red flags.

Whether you are applying for certain government programs, seeking employment in a financial institution, or simply want to ensure your tax affairs are in order, understanding the timeframe and process of an IRS background check can provide you with valuable insights.

So, let’s dive in and explore how long an IRS background check typically takes, the factors that can affect the duration, and what you can do to expedite the process if necessary.

Understanding the IRS Background Check

An IRS background check is a comprehensive examination of an individual or business’s financial and tax records. Its purpose is to verify the accuracy of the information provided, identify any potential discrepancies, and ensure compliance with tax regulations.

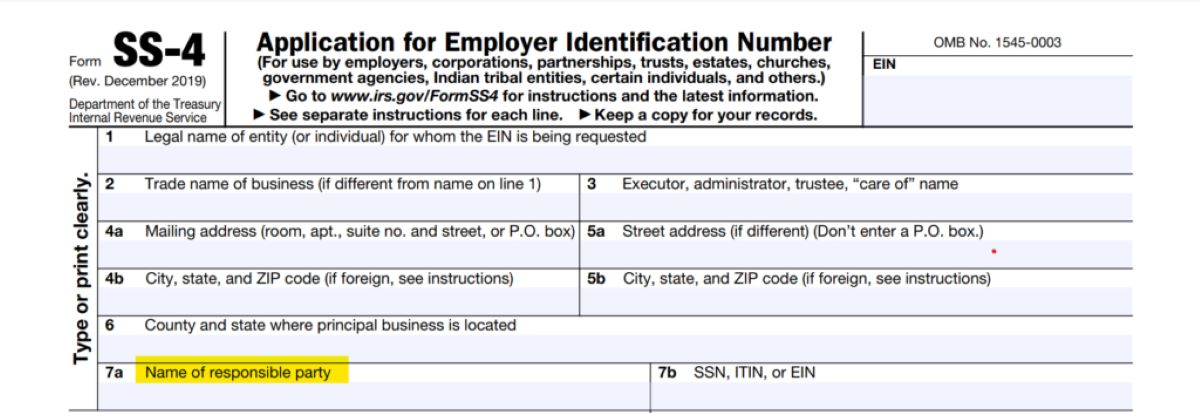

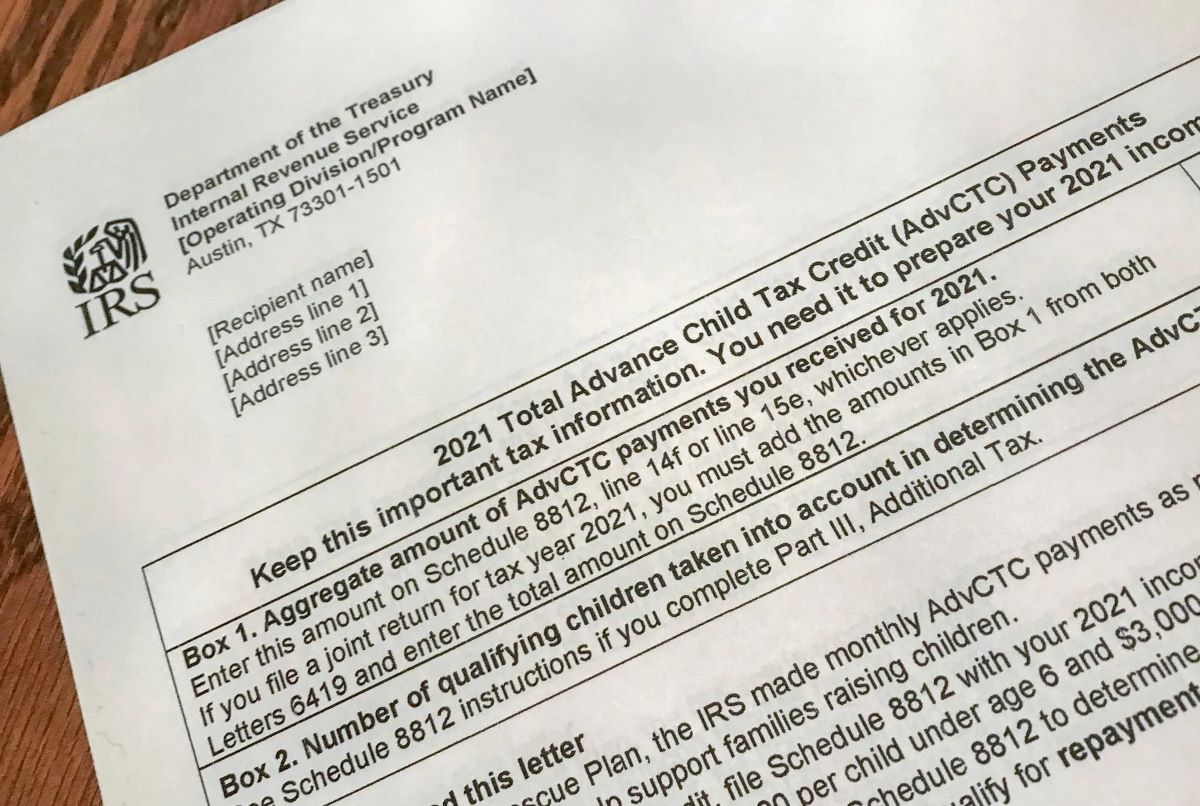

The background check process typically involves reviewing various tax forms, including but not limited to tax returns, W-2 forms, 1099 forms, and Schedule C filings. Additionally, the IRS may gather information from external sources, such as financial institutions, to cross-reference the reported income and deductions.

During the background check, the IRS will assess the taxpayer’s history of filing returns, payment records, and compliance with tax laws. They will also examine any significant changes in income or deductions, as well as identify any potential signs of fraud or underreporting.

It is important to note that an IRS background check can be initiated for various reasons, including random selection, suspicion of non-compliance, participation in government programs, or association with high-risk industries. It is not necessarily an indication of any wrongdoing or illegal activity.

The information gathered during the background check is used to ensure the taxpayer’s accuracy in reporting income, eligibility for tax benefits or deductions, and adherence to tax laws. By conducting these checks, the IRS aims to maintain the fairness and integrity of the tax system for all taxpayers.

Now that we have a general understanding of what an IRS background check entails, let’s explore the factors that can influence the duration of this process.

Factors Affecting the Duration of an IRS Background Check

Several factors can impact the length of time it takes for the IRS to complete a background check. While the specific duration can vary from case to case, understanding these key factors can provide valuable insights into why the process may take longer in some instances:

- Complexity of the case: The complexity of the taxpayer’s financial situation can significantly impact the duration of an IRS background check. If the individual or business has multiple sources of income, various sources of deductions, or complex financial transactions, the IRS may require more time to thoroughly review and verify the information.

- Volume of documentation: The amount of documentation involved in the background check can also affect its duration. If the taxpayer has extensive records or has been involved in numerous financial transactions, it may take the IRS longer to review and assess all the relevant documents.

- IRS workload: The IRS processes a vast number of tax returns and conducts background checks on a regular basis. The workload of IRS agents can impact the speed at which background checks are completed. During busier periods, such as tax season, the turnaround time for background checks may be longer.

- Need for additional information: In some cases, the IRS may require additional information or clarification from the taxpayer to proceed with the background check. This could be due to missing documents, discrepancies in reported information, or the need for further explanation of financial transactions. The time it takes to gather and provide this additional information can prolong the duration of the background check.

- Correcting errors or discrepancies: If the IRS identifies errors or discrepancies in the taxpayer’s records during the background check, the process may be delayed as the taxpayer is given an opportunity to rectify these issues. This could involve providing amended tax returns, supporting documentation, or explanations for any inconsistencies in the reported information.

It’s important to note that these factors are not exhaustive, and there may be other individual circumstances unique to a particular case that can impact the duration of an IRS background check. While some background checks can be completed relatively quickly, others may take several weeks or even months to finalize.

Next, let’s explore the typical timeframe for an IRS background check to ensure you have a realistic expectation of the process.

Typical Timeframe for an IRS Background Check

The duration of an IRS background check can vary depending on the factors discussed earlier. However, it’s helpful to have a general understanding of the typical timeframe involved in this process.

In most cases, an IRS background check can take anywhere from a few weeks to several months to complete. The exact duration depends on the complexity of the case, the volume of documentation, and the availability of IRS resources.

For individuals with straightforward tax situations and relatively simple financial records, the background check process tends to be quicker. In such cases, the IRS may be able to complete the review and verification within a few weeks.

However, for individuals or businesses with more complex financial situations, multiple sources of income, or extensive documentation, the background check process may take significantly longer. It’s not uncommon for these cases to be under review for several months as the IRS carefully examines and validates the information provided.

It’s important to note that the IRS aims to complete background checks as efficiently as possible. However, due to the volume of cases and the intricate nature of some reviews, it’s essential to be patient and prepared for the potential duration of the process.

If you’re wondering why your background check is taking longer than expected, it’s always a good idea to reach out to the IRS for clarification. They can provide updates on the status of your case and any additional information or documentation they may require.

Now, let’s explore the possibility of expediting an IRS background check in certain situations.

Expedited IRS Background Checks

While the duration of an IRS background check is generally dictated by the complexity of the case and the workload of the IRS, there are certain situations where individuals or businesses may seek to expedite the process.

One such scenario is when an individual or business needs to meet specific deadlines or time-sensitive requirements. For example, if you are applying for a government program that requires a clean background check, it may be necessary to expedite the process to meet the program’s application deadline.

To request an expedited IRS background check, it is recommended to contact the IRS directly and explain the situation. While not all requests can be accommodated, the IRS may consider expediting the process if there is a valid reason and proper documentation to support the request.

It’s important to note that expediting an IRS background check is not guaranteed and is evaluated on a case-by-case basis. In some instances, the IRS may require additional information or documentation to substantiate the need for an expedited review.

Furthermore, it’s crucial to communicate with the IRS in a timely and professional manner. Provide all requested information promptly and ensure that you maintain open lines of communication with the assigned IRS agent or contact person.

However, it is important to note that not all requests for an expedited background check will be granted, as the IRS needs to prioritize its workload and maintain fairness for all taxpayers.

While expediting an IRS background check is an option in some cases, it’s essential to plan ahead and allow ample time for the normal processing of background checks to avoid unnecessary stress or delays.

Now, let’s explore some possible delays that can occur during the IRS background check process and how to navigate them.

Possible Delays in the IRS Background Check Process

While the IRS strives to complete background checks in a timely manner, there are various circumstances that can cause delays in the process. Understanding these potential delays can help you navigate the situation more effectively:

- Incomplete or missing documentation: If the taxpayer fails to provide all the necessary documentation or if there are discrepancies in the information provided, the background check process may be delayed. It’s important to ensure that all required forms and supporting documents are submitted accurately and in a timely manner to avoid unnecessary delays.

- Additional information or clarification: The IRS may require additional information or clarification regarding certain aspects of the taxpayer’s financial records. This can prolong the background check process as the taxpayer is given an opportunity to provide the requested information. It’s essential to respond promptly and provide any requested details to expedite the process.

- Backlog of cases: During periods of high demand or increased workload, such as tax season, the IRS may experience a backlog of cases, which can lead to delays in background checks. It’s important to be aware of these peak periods and plan accordingly to avoid potential delays.

- Complexity of the case: As discussed earlier, the complexity of a taxpayer’s financial situation can contribute to longer processing times. If the IRS encounters complex transactions or complicated financial records during the background check, more time may be required to review and verify the information.

- Internal IRS procedures: Internal procedures within the IRS can also cause delays in the background check process. These delays may include administrative processes, coordination between different departments, or other internal factors that are beyond the taxpayer’s control.

While it’s frustrating to experience delays in the background check process, it’s important to remain patient and proactive. Maintaining open lines of communication with the IRS and promptly addressing any requests for additional information can help minimize delays and ensure a smoother process.

Now, let’s address some common questions related to IRS background checks to provide further clarity on the topic.

Common Questions About IRS Background Checks

IRS background checks can be complex and somewhat confusing. To provide further clarity, let’s address some common questions that individuals and businesses have about this process:

- Do all taxpayers undergo an IRS background check? No, not all taxpayers undergo an IRS background check. Background checks are typically conducted for specific reasons, such as participation in government programs, high-risk industries, or suspicion of non-compliance with tax regulations.

- Can an IRS background check result in an audit? While an IRS background check is separate from a routine audit, the information gathered during the background check can potentially lead to an audit if significant discrepancies or red flags are found. It’s important to ensure the accuracy and integrity of your tax records to minimize the risk of further scrutiny.

- Can an IRS background check be challenged? Yes, taxpayers have the right to challenge the findings of an IRS background check. If you believe there is an error or misunderstanding regarding the information provided, you can work with the IRS to resolve any discrepancies and address the concerns raised during the background check.

- Can an IRS background check affect credit scores or employment opportunities? An IRS background check itself does not directly impact credit scores or employment opportunities. However, if the background check reveals significant tax discrepancies or non-compliance, it could indirectly affect your financial reputation and potentially impact employment prospects, particularly in industries that require a high level of financial integrity.

- Can I check the status of my IRS background check? Yes, you can check the status of your background check by contacting the IRS directly. They will be able to provide you with updates on the progress of your case and any additional information or documentation they may require.

Remember, each IRS background check is unique, and the process can vary depending on individual circumstances. It is important to consult with a tax professional or seek guidance from the IRS if you have any specific questions or concerns regarding your background check.

Now, let’s conclude and recap the key points discussed in this article.

Conclusion

Understanding the IRS background check process is essential for individuals and businesses navigating their financial and tax obligations. While the duration of an IRS background check can vary depending on factors such as case complexity, documentation volume, and IRS workload, it typically takes a few weeks to several months to complete.

Factors such as the complexity of the case, incomplete or missing documentation, and the need for additional information or clarification can potentially cause delays in the background check process. It’s important to be patient, proactive, and responsive in providing any requested information to minimize delays.

While certain situations may warrant an expedited background check, such requests are evaluated on a case-by-case basis and are not guaranteed. Planning ahead and allowing ample time for the normal processing of background checks is crucial to avoid unnecessary stress and delays.

Common questions regarding IRS background checks include their impact on credit scores or employment opportunities, the potential for audits, and the right to challenge the findings. Remember, an IRS background check is not the same as an audit, and individuals have the right to address any discrepancies or concerns raised during the process.

If you have questions or concerns about your IRS background check, it’s always recommended to seek guidance from a tax professional or contact the IRS directly for clarification and updates on the status of your case.

By having a clear understanding of the IRS background check process and being proactive in addressing any issues or discrepancies, you can ensure compliance with tax regulations and maintain the integrity of the tax system.