Finance

How Long Should You Keep 401K Statements

Published: October 17, 2023

Learn the recommended duration for keeping your 401K statements and manage your finances effectively. Find out how long you should retain important financial documents.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction:

- Importance of Keeping 401K Statements:

- Legal and Regulatory Requirements:

- Financial Planning and Record-Keeping:

- Factors to Consider in Determining How Long to Keep 401K Statements:

- Recommended Retention Period for 401K Statements:

- Digital vs. Physical Statements:

- Organizing and Storing 401K Statements:

- Securely Disposing of Old 401K Statements:

- Final Thoughts on Keeping 401K Statements:

Introduction:

When it comes to managing your financial future, one key aspect is properly organizing and storing important documents, such as your 401K statements. These statements provide crucial information about your retirement savings, including contributions, account balances, and investment performance. But how long should you keep these statements?

Understanding the importance of keeping 401K statements and knowing the recommended retention period can help you make informed decisions about managing your financial records. In this article, we will explore the reasons behind keeping 401K statements, legal requirements, factors to consider when determining how long to keep them, recommended retention periods, digital versus physical statements, organizing and storing them securely, and the process of disposing of old statements.

Whether you are just starting your retirement savings journey or have been actively contributing to your 401K for years, knowing how long to keep your statements is crucial for financial planning and peace of mind. So let’s dive in and explore the world of 401K statements and how to manage them effectively.

Importance of Keeping 401K Statements:

Keeping your 401K statements is essential for several reasons. Let’s explore the key reasons why retaining these documents can have a significant impact on your financial well-being:

- Evidence of Contributions: Your 401K statements serve as evidence of your contributions to your retirement savings. These statements provide a clear record of the amount of money you have invested in your account over time. By keeping these statements, you can ensure that the contributions made by you and your employer align with the records you have.

- Basis for Tax Reporting: 401K contributions are tax-deductible, and when it’s time to file your taxes, having accurate records is crucial. By keeping your 401K statements, you can easily reference the information needed for reporting your contributions, withdrawals, and any other taxable events related to your retirement account.

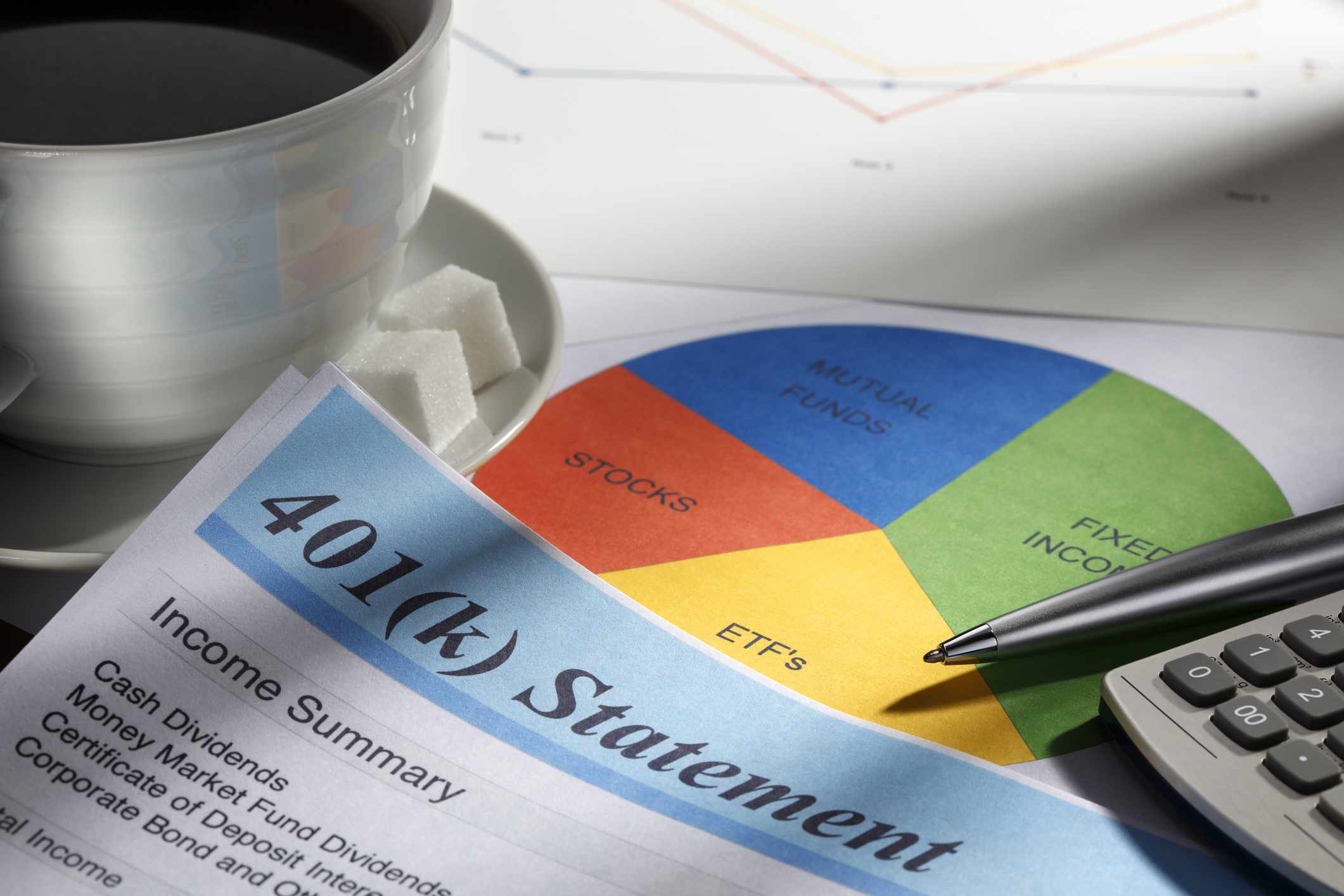

- Monitoring Investment Performance: Your 401K statements provide detailed information about the performance of your investments. By reviewing your statements regularly, you can track how your funds are performing and make informed decisions about adjusting your investment strategy if needed. These statements also provide insights into any fees associated with your investments, allowing you to evaluate the overall cost of managing your 401K.

- Retirement Planning and Goal Tracking: Your 401K statements play a crucial role in your retirement planning. By analyzing your account balances and projections, you can assess if you are on track to meet your retirement goals. Continuously tracking your progress through your statements can help you make adjustments to your savings rate or investment strategy to ensure you have a secure financial future.

- Beneficiary Designation and Estate Planning: Your 401K statements often contain information about your designated beneficiaries. By keeping these statements up-to-date and easily accessible, you can ensure that your intended beneficiaries inherit your retirement savings as per your wishes. Additionally, your statements can serve as valuable documents for estate planning, providing a comprehensive overview of your financial assets.

Overall, keeping your 401K statements is crucial for maintaining accurate records, complying with tax regulations, monitoring investment performance, planning for retirement, and ensuring smooth estate transitions. Now that we understand the importance of these statements, let’s explore the legal requirements surrounding their retention.

Legal and Regulatory Requirements:

When it comes to keeping your 401K statements, it’s important to understand the legal and regulatory requirements that govern their retention. While there is no specific federal law that dictates how long you must keep these documents, there are certain guidelines and considerations to keep in mind:

- ERISA Regulations: The Employee Retirement Income Security Act (ERISA) sets the standards for the administration of employer-sponsored retirement plans like 401Ks. While ERISA does not prescribe a specific retention period for 401K statements, it does require employers to provide participants with certain information, such as summary plan descriptions and annual reports. Therefore, it is advisable to retain at least your most recent summary plan description and annual reports, as these documents offer insights into your plan’s features and performance.

- Tax Audit Considerations: The Internal Revenue Service (IRS) has the authority to audit tax returns for up to three years after the filing date. However, this period can be extended to six years if the IRS suspects a substantial underreporting of income. It’s important to note that if your 401K statements contain information relevant to your tax returns, such as contributions or distributions, you may want to retain them for at least the duration of the IRS audit window to substantiate your tax claims.

- Other Legal Matters: In addition to tax considerations, there may be other legal matters that require you to retain your 401K statements for an extended period. For example, if you are involved in a divorce or legal dispute, these statements may be necessary to calculate the division of assets or determine your financial situation. It’s always best to consult with legal professionals to understand the specific requirements in your situation.

While there are no specific laws governing the retention of 401K statements, it is wise to err on the side of caution and retain these documents for a reasonable period. This ensures that you have the necessary information and records to address any potential legal or regulatory matters that may arise in the future.

Now that we have covered the legal requirements, let’s explore how keeping well-organized 401K statements can benefit your financial planning and record-keeping.

Financial Planning and Record-Keeping:

Keeping organized and up-to-date 401K statements plays a crucial role in your overall financial planning and record-keeping. Here’s how it can benefit you:

- Track Retirement Savings Progress: By regularly reviewing your 401K statements, you can track the growth of your retirement savings over time. This information helps you assess whether you are on track to meet your financial goals or if adjustments need to be made to your savings or investment strategy. Having a clear picture of your retirement savings progress allows you to make informed decisions about your financial future.

- Budgeting and Financial Management: Your 401K statements provide valuable insights into your financial situation. By analyzing these statements, you can determine the portion of your income that is allocated towards retirement savings. This information allows you to create a realistic budget and manage your finances effectively. Additionally, by keeping track of any employer matching contributions, you can make the most of this benefit and optimize your retirement savings.

- Evaluate Investment Performance: Monitoring your 401K statements helps you evaluate the performance of your investments. By reviewing the returns and growth of your funds, you can assess whether your investment choices are generating satisfactory results. If necessary, you can make adjustments to your investment allocations or seek professional advice to optimize your portfolio and maximize your long-term returns.

- Tax Planning and Reporting: Your 401K statements contain essential information for tax planning and reporting purposes. By keeping these statements, you can accurately report your contributions, withdrawals, and other taxable events related to your retirement account. This ensures compliance with tax regulations and helps you optimize your tax situation. Having complete and accurate records can also simplify the process of preparing your annual tax returns.

- Estate Planning and Legacy: 401K statements are essential documents for estate planning. They provide a comprehensive overview of your retirement savings, which can be an important part of your overall financial legacy. By keeping these statements organized and up-to-date, you can ensure that your beneficiaries receive the appropriate assets and financial support according to your wishes, making the transition of wealth smoother and more efficient.

In summary, effective financial planning and record-keeping rely on maintaining well-organized 401K statements. These statements not only help you track your retirement savings progress but also assist in budgeting, evaluating investment performance, tax planning and reporting, and estate planning. Now that we understand the importance of keeping 401K statements for financial planning, let’s explore the factors to consider in determining how long to retain them.

Factors to Consider in Determining How Long to Keep 401K Statements:

Deciding how long to keep your 401K statements involves considering several factors that vary depending on individual circumstances. Here are some key factors to consider when determining the retention period for your 401K statements:

- Tax and Financial Reporting Requirements: As mentioned earlier, your 401K statements contain information relevant to tax reporting. In general, it’s advisable to keep these statements for at least the duration of the IRS audit window, which is typically three years. However, you may want to extend this period to six years if you suspect a substantial underreporting of income or if you anticipate other tax-related complications.

- Employment Status: Your employment status can impact the length of time you should retain your 401K statements. If you change jobs or retire, you may want to keep the statements from each employer for as long as necessary to address any future questions or concerns related to your retirement savings. This is particularly important if your new employer does not offer a rollover option.

- Retirement Planning: Consider your retirement goals and the stage of your retirement planning journey. If you are still actively contributing to your 401K and have a long-term investment strategy, it may be beneficial to retain the statements on an ongoing basis. Keeping a record of your contributions, investment performance, and projections can help you assess your progress and make informed decisions along the way.

- Legal Considerations: Consider any potential legal matters that may impact the retention period for your 401K statements. If you anticipate legal disputes, such as divorce, or if you have ongoing estate planning needs, it may be prudent to retain these documents for longer periods. Consult with legal professionals to determine the specific requirements in your situation.

- Technology and Accessibility: Digital statements have become increasingly common in today’s digital age. Consider the ease of accessing and storing digital statements versus physical copies. Digital statements can be stored securely in password-protected files or cloud services, reducing the need for physical storage space. However, ensure you have regular backups and robust security measures in place for digital storage.

- Personal Preference: Ultimately, the decision of how long to keep your 401K statements may come down to personal preference. Some individuals may prefer to retain them indefinitely for peace of mind and comprehensive record-keeping, while others may adhere strictly to regulatory requirements. Assess your comfort level and risk tolerance when determining the retention period that aligns with your financial goals and organizational needs.

Remember, it’s essential to strike a balance between maintaining sufficient records and avoiding unnecessary clutter. Now that we have explored factors to consider when determining how long to retain your 401K statements, let’s delve into the recommended retention period.

Recommended Retention Period for 401K Statements:

While there is no one-size-fits-all answer to how long you should keep your 401K statements, there are some recommended guidelines to consider. These guidelines balance the need to retain important financial records with practical considerations:

- Current Year + 3 Years: It is generally recommended to keep your most recent 401K statements, along with supporting documents such as contribution records and annual reports, for at least the current year plus three additional years. This timeframe aligns with the IRS audit window and ensures you have the necessary records to substantiate your tax claims if audited.

- Employment Period + 3 Years: If you change jobs or retire, consider keeping your 401K statements from each employer for at least the duration of your employment plus three additional years. This allows you to address any questions or concerns related to your retirement savings during that period.

- Long-Term Retirement Planning + Indefinitely: If you are in the early stages of your retirement planning or actively contributing to your 401K, it may be beneficial to retain your statements on an ongoing basis. Maintaining a comprehensive record of your contributions, investment performance, and projections can help you track your progress and inform your retirement decisions.

- Legal and Estate Planning Considerations: If you anticipate legal disputes, such as divorce or ongoing estate planning needs, consult with legal professionals to determine the appropriate retention period for your 401K statements. In some cases, it may be necessary to retain these documents for an extended period.

It’s important to adapt these recommendations to your specific situation and consider your personal preference for record-keeping. As digital statements become more prevalent, securely storing electronic copies may alleviate physical storage concerns while ensuring easy accessibility.

Remember that financial institutions and employers are required to retain electronic copies of your 401K statements for a certain period, so you can generally obtain previous statements if needed in the future. However, having your own copies provides an extra layer of security and convenience.

Now that we have discussed the recommended retention period for 401K statements, let’s explore the differences between digital and physical statements and the best way to organize and store them.

Digital vs. Physical Statements:

With the advent of technology, the availability of digital 401K statements has become increasingly common. Both digital and physical statements have their advantages and considerations. Let’s explore the differences between the two:

Digital Statements:

- Convenience: Digital statements are easily accessible at any time and from anywhere with an internet connection. You can view and download them from the comfort of your own home or on the go.

- Reduced Clutter: Storing digital statements eliminates the need for physical storage space, reducing paper clutter in your home or office.

- Searchability: Digital statements can be easily searched using keywords, making it convenient to find specific information quickly.

- Security: Storing digital statements in password-protected files or encrypted cloud services can provide an added layer of security. It is important to ensure the security of your digital files by using strong passwords and regularly updating your security measures.

- Environmental Impact: Choosing digital statements over physical copies helps reduce paper waste and supports environmental sustainability.

Physical Statements:

- Tangible Records: Physical statements provide a tangible record that some individuals prefer for their own peace of mind.

- Easier to Review: For some people, reviewing paper statements can be more comfortable and facilitate a more thorough review and analysis of account information.

- Backup Options: Physical statements can be scanned and saved as digital copies to provide an additional backup in case of loss or damage.

- Accessibility Concerns: Physical statements may be more susceptible to loss, theft, or damage, requiring extra precautions for their safekeeping.

Ultimately, the decision to opt for digital or physical statements depends on your personal preferences, storage capabilities, and ease of access. Many people find a combination of both methods to be the most practical solution. For example, you may choose to receive digital statements while also printing and retaining physical copies for your records.

Now that we understand the differences between digital and physical statements, let’s explore effective ways to organize and store your 401K statements.

Organizing and Storing 401K Statements:

Properly organizing and storing your 401K statements is crucial for easy access, efficient record-keeping, and maintaining the security of your financial information. Here are some tips to help you effectively organize and store your 401K statements:

- Create Separate Folders: Set up a dedicated folder in your email inbox or on your computer to store digital 401K statements. Create subfolders or label emails for each year or employer to keep them well-organized and easy to locate.

- Use File Naming Conventions: If you download digital statements, use consistent and descriptive file names that include the date, employer, and any other relevant information. This will make it easier to search for specific statements in the future.

- Consider Cloud Storage: Utilize secure cloud storage services to store digital copies of your 401K statements. This provides easy accessibility from multiple devices and protects against data loss due to device malfunction or theft. Ensure the cloud service you choose has strong encryption and security measures in place.

- Back Up Regularly: Whether you opt for digital or physical storage, create regular backups. For digital statements, back up your files to an external hard drive or another secure cloud storage provider. For physical statements, consider scanning and saving them as digital copies and store the physical copies in a secure location.

- Keep Supporting Documents Together: Maintain a separate folder or file for supporting documents, such as contribution records, annual reports, or beneficiary designations. This ensures that all relevant information is easily accessible when needed.

- Organize Physical Copies: If you receive physical 401K statements, keep them in a dedicated file folder or binder. Sort them chronologically or categorize them by employer to simplify retrieval and reference.

- Secure Physical Storage: Store physical statements in a safe and secure location, such as a locked filing cabinet or a fireproof safe. Ensure that unauthorized individuals cannot access these documents, protecting your sensitive financial information.

- Update Regularly: Keep your organization system up to date. Remove outdated statements, update folder labels or digital file names, and ensure that all new statements are properly filed. Regular maintenance helps prevent clutter and keeps your record-keeping system efficient.

Remember, the organization and storage method you choose should align with your personal preferences, accessibility needs, and the level of security you desire. No matter which method you choose, the most important aspect is to create a consistent and reliable system that allows you to locate and retrieve 401K statements quickly and easily.

Now that we have covered effective methods for organizing and storing your 401K statements, let’s explore the importance of securely disposing of old statements.

Securely Disposing of Old 401K Statements:

When it comes to the disposal of old 401K statements, it’s crucial to prioritize the security and confidentiality of your financial information. Here are some steps to ensure the secure disposal of your old 401K statements:

- Shred Physical Copies: If you have physical copies of old 401K statements that are no longer needed, it is recommended to shred them using a cross-cut shredder. This ensures that sensitive information cannot be pieced together or retrieved from discarded documents.

- Securely Delete Digital Copies: If you have digital copies of old 401K statements stored on your computer or other devices, use a secure deletion method to ensure they cannot be recovered. Simply deleting the files is not sufficient, as they can still be recovered by skilled individuals. Consider using specialized software that securely wipes the data from your devices or seek professional assistance if needed.

- Dispose of Old Devices: If you stored digital statements on old computers, laptops, or other electronic devices, ensure that you wipe the data thoroughly before disposing of the devices. If you plan to sell or donate them, consider using data erasure tools or consulting a professional to guarantee all personal and financial information has been removed.

- Consider Document Destruction Services: If you have a large volume of physical statements to dispose of, consider engaging professional document destruction services. These services ensure secure and confidential destruction of your old 401K statements, giving you peace of mind that the information cannot be recovered.

- Review Privacy Policies: Before disposing of physical or digital statements, be aware of any relevant privacy policies or guidelines provided by your financial institution or employer. They may have specific recommendations or requirements for the proper disposal of financial records related to your 401K.

- Keep Documentation of Disposal: Maintain a record or document detailing the dates and methods used to dispose of your old 401K statements. This serves as an additional documentation trail and provides assurance that you have taken appropriate measures to protect your personal information.

By following these steps, you can significantly reduce the risk of unauthorized access to your old 401K statements and protect your sensitive financial information from falling into the wrong hands.

Now that we have discussed the secure disposal of old 401K statements, let’s conclude with some final thoughts on the importance of keeping these documents.

Final Thoughts on Keeping 401K Statements:

Properly managing and retaining your 401K statements is essential for your financial well-being and future planning. Here are some key takeaways to keep in mind:

- Documentation and Compliance: Keeping your 401K statements ensures you have accurate records of your contributions, investment performance, and tax-related information. This documentation helps you comply with legal and regulatory requirements, substantiate tax claims, and address any potential legal matters.

- Financial Planning: Regularly reviewing your 401K statements allows you to track your retirement savings progress, evaluate investment performance, and make informed decisions about your financial future. These statements play a vital role in budgeting, retirement planning, and estate planning, helping you achieve your financial goals.

- Security and Privacy: It’s crucial to prioritize the security and privacy of your 401K statements. Whether you choose digital or physical storage, employ proper organizational practices, securely dispose of old statements, and maintain an up-to-date backup system to protect your sensitive financial information.

- Individual Considerations: While there are recommended guidelines regarding the retention period of 401K statements, every individual’s situation and preference may vary. Consider factors such as tax reporting requirements, employment status changes, retirement planning goals, and legal considerations when determining how long to keep your statements.

- Combination of Digital and Physical: Many individuals find it beneficial to maintain both digital and physical copies of their 401K statements. Digital copies offer convenience, accessibility, and searchability, while physical copies provide a tangible record and ease of review. Adapt your storage method to best suit your needs.

By keeping your 401K statements organized, up-to-date, and secure, you can have greater control over your financial future, make informed decisions, and have peace of mind. Regularly review and assess the retention period for your statements based on changing circumstances and consult with professionals whenever necessary.

Remember, your 401K statements represent your hard-earned savings and serve as a roadmap to your financial goals. Treat them with the importance they deserve and ensure you have the necessary documentation to navigate your financial journey effectively.

If you have any questions or concerns regarding your 401K statements, it’s always advisable to consult with a financial advisor or tax professional who can provide personalized guidance based on your specific circumstances.

Now, take the next step towards organizing your 401K statements and protecting your financial future!