Finance

How To Pay Your Capital One Credit Card

Modified: March 2, 2024

Learn how to effectively manage your finances and pay your Capital One credit card on time. Discover tips and strategies to stay on top of your financial obligations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Setting up an online account

- Step 2: Making payments through the Capital One website

- Step 3: Paying your Capital One credit card bill via the mobile app

- Step 4: Paying your Capital One credit card bill over the phone

- Step 5: Paying your Capital One credit card bill by mail

- Step 6: Setting up automatic payments

- Conclusion

Introduction

Managing credit card payments is an essential part of personal finance, and for Capital One credit card holders, it’s crucial to understand how to pay your bill on time and efficiently. Capital One offers convenient methods to pay your credit card bill, whether online, through their mobile app, over the phone, or by mail. In this guide, we will walk you through the different steps to make your Capital One credit card payment, providing you with the information you need to stay on top of your finances.

Before we dive into the various payment methods, it’s important to highlight the benefits of paying your Capital One credit card bill promptly. First and foremost, making timely payments ensures that you avoid any late fees or penalties, which can have a negative impact on your credit score. Additionally, paying off your balance in full each month can help you avoid accruing interest charges. By understanding and utilizing the available payment options, you can effectively manage your Capital One credit card and maintain a healthy financial standing.

Now that we understand the importance of paying your Capital One credit card bill on time, let’s explore the different methods available to you. Whether you prefer the convenience of online banking, the accessibility of a mobile app, the ease of phone payments, or the traditional approach of mailing a check, Capital One offers a range of options to suit your needs. Let’s delve into each method in detail, so you can find the one that works best for you.

Step 1: Setting up an online account

Before you can make payments online for your Capital One credit card, you’ll need to set up an online account. This will allow you to securely access your account information, view your statements, and make payments conveniently from the comfort of your own home. Here are the steps to set up your online account:

- Visit the Capital One website and click on the “Sign In” or “Enroll” button.

- Select “Credit Cards” from the drop-down menu and click on “Set Up Online Access.”

- Provide your personal information, including your Capital One credit card number, Social Security number, and date of birth.

- Choose a username and password for your online account. Make sure it is something secure and memorable.

- Set up any additional security features, such as two-factor authentication, to enhance the security of your account.

- Review the terms and conditions, and if you agree, click on “Accept” to complete the registration process.

Once you’ve completed these steps, you will have successfully set up your online account with Capital One. You can now log in to your account using your username and password to manage your credit card payments and access other account features.

Setting up an online account offers several benefits. It provides a convenient and secure way to manage your Capital One credit card, giving you access to your account information anytime, anywhere. Additionally, by opting for paperless statements, you can help reduce paper waste and contribute to a greener environment.

With your online account set up, you’re now ready to explore the various methods available to pay your Capital One credit card bill. In the next steps, we will guide you through making payments through the Capital One website, using the mobile app, paying over the phone, and by mail.

Step 2: Making payments through the Capital One website

Once you have set up your online account with Capital One, you can easily make payments for your credit card bill through their website. This method provides a convenient and secure way to manage your payments. Here’s how you can make a payment through the Capital One website:

- Log in to your Capital One online account using your username and password.

- Once logged in, navigate to the “Accounts” tab to view your credit card account.

- Click on the “Pay Bill” option. This will redirect you to the payment page.

- Enter the amount you wish to pay and select the account you want to make the payment from.

- Select the payment date. You can choose to make an immediate payment or schedule it for a future date.

- Review the payment details to ensure accuracy.

- Click on “Submit” to authorize the payment.

It’s important to note that you have the option to make a minimum payment, pay the statement balance in full, or choose a custom payment amount. If you choose the minimum payment, keep in mind that you may incur interest charges on the remaining balance.

Capital One allows you to save your bank account information for future payments, making subsequent transactions faster and more convenient. Additionally, you have the flexibility to set up recurring payments or establish a payment reminder to ensure you never miss a due date.

After successfully completing your payment, remember to check your account balance to ensure the transaction has been processed correctly. The payment should reflect in your account within a few business days.

Using the Capital One website to make payments is an efficient and straightforward method. It offers convenience, flexibility, and peace of mind knowing that your transactions are protected and easily accessible. In the next step, we will explore making payments through the Capital One mobile app.

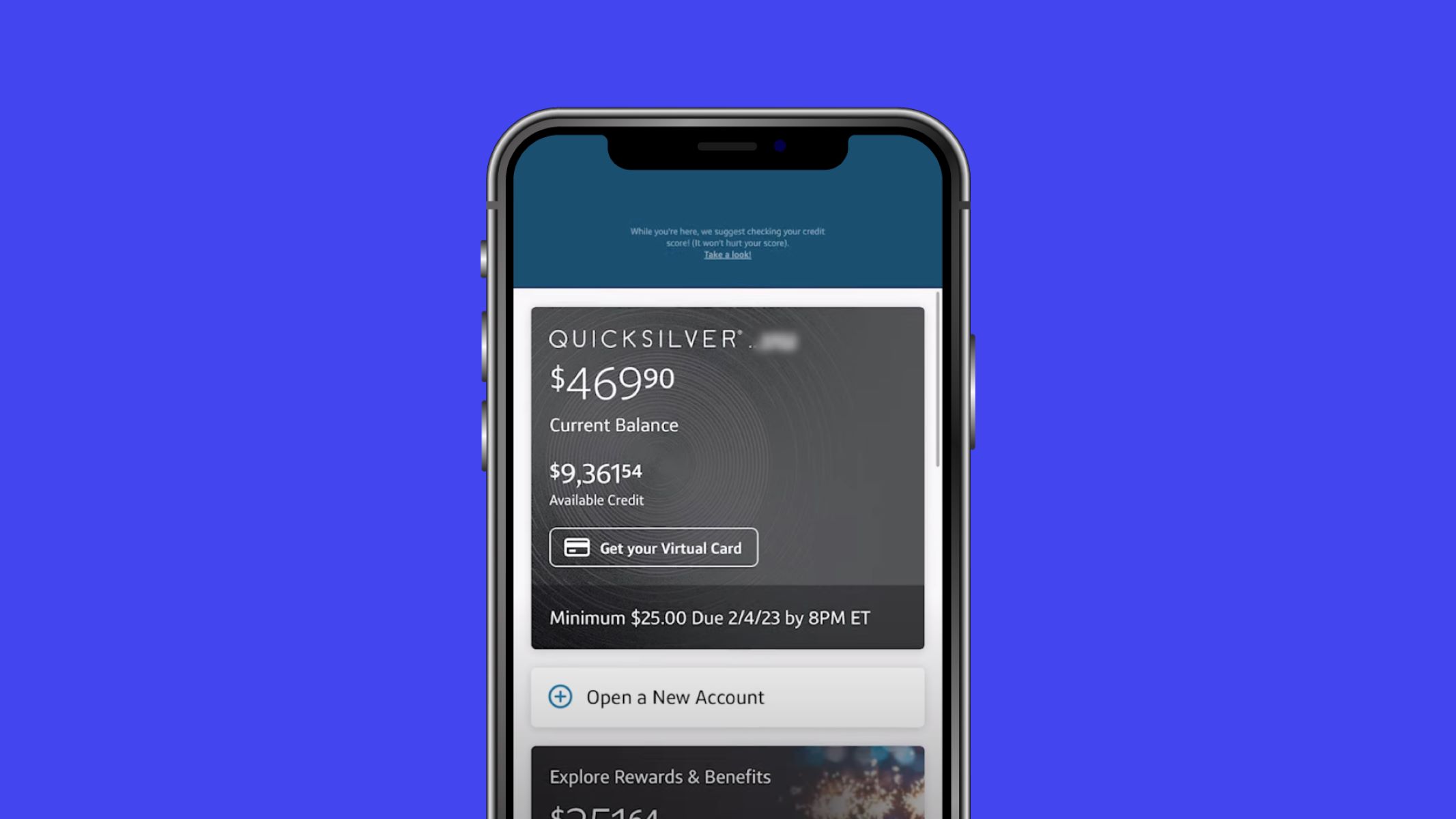

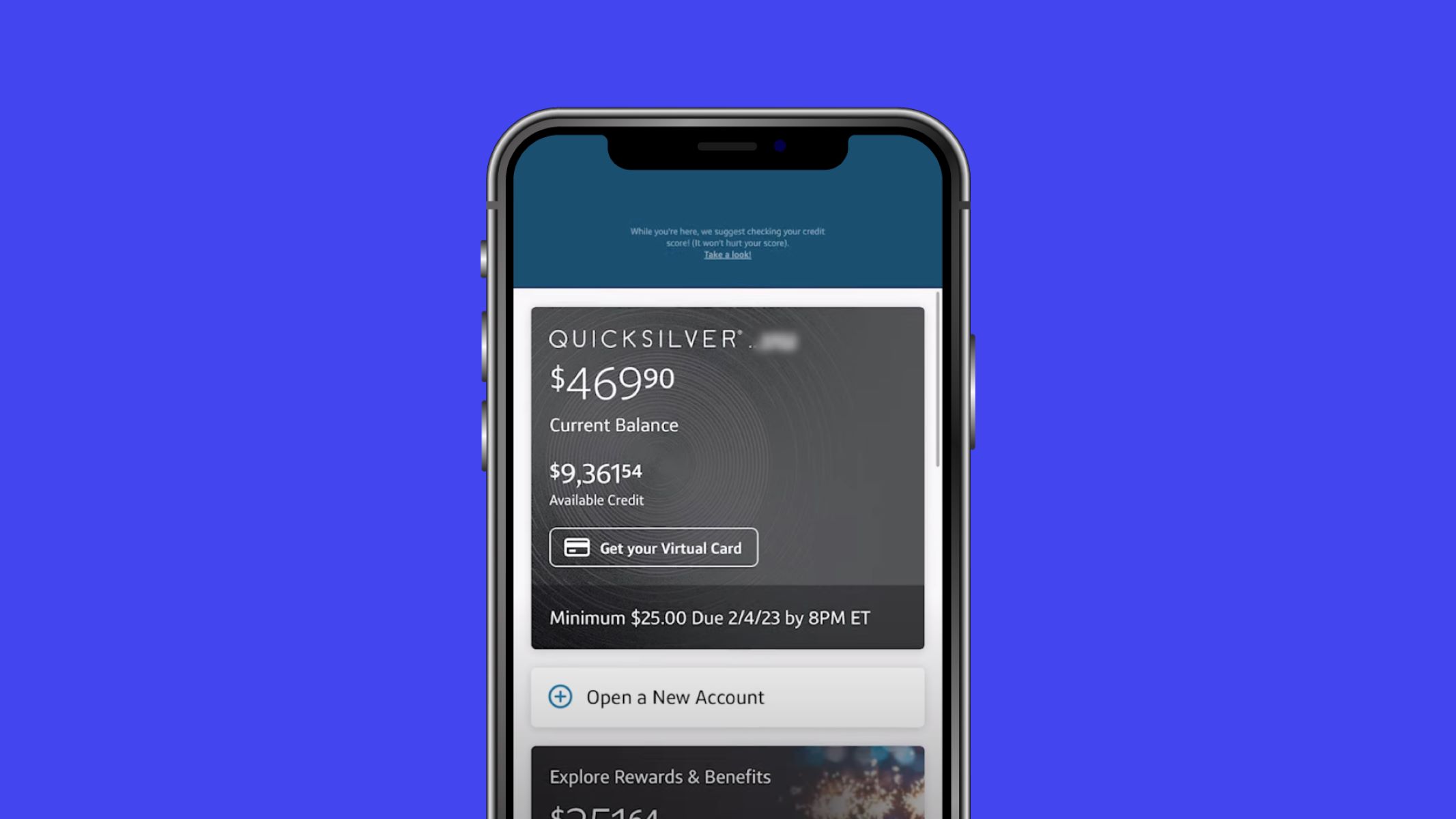

Step 3: Paying your Capital One credit card bill via the mobile app

In today’s digital age, mobile apps have become a popular way to manage various aspects of our lives, including finances. Capital One offers a user-friendly mobile app that allows you to conveniently make payments for your credit card bill on the go. Here’s how you can pay your Capital One credit card bill using the mobile app:

- Download the Capital One mobile app from your device’s app store and install it.

- Open the app and log in to your Capital One account using your username and password.

- Once logged in, navigate to the credit card account you wish to make a payment for.

- Tap on the “Make a Payment” option.

- Enter the payment amount and select the bank account you want to make the payment from.

- Choose the payment date – immediate or schedule it for a future date.

- Review the payment details to ensure accuracy.

- Confirm the payment by tapping on the “Submit” button.

The mobile app also provides the option to set up recurring payments, allowing you to automate your credit card bill payments. This can be particularly useful if you prefer the convenience of not having to manually make a payment each month.

The Capital One mobile app offers additional features such as transaction history, balance inquiries, and customized account alerts. It provides a seamless and secure experience, giving you the flexibility to manage your credit card payments from anywhere at any time.

After making your payment via the mobile app, it’s always advisable to check your account balance to ensure the transaction has been processed successfully. The payment should reflect in your account within a few business days.

The Capital One mobile app is a convenient and efficient method for paying your credit card bill. It puts the power of managing your finances right at your fingertips. However, if you prefer the traditional approach, you can still make payments over the phone. We will discuss this method in the next step.

Step 4: Paying your Capital One credit card bill over the phone

If you prefer a more personal touch or need assistance with your Capital One credit card payment, you have the option to pay your bill over the phone. Capital One provides a dedicated customer service line where you can make your payment securely and conveniently. Follow these steps to pay your Capital One credit card bill over the phone:

- Locate the customer service phone number on the back of your Capital One credit card or visit the Capital One website to find the appropriate contact number.

- Call the customer service number and listen for the prompts.

- When prompted, select the option to make a payment.

- Follow the automated voice prompts to enter your credit card information, such as the card number and expiration date.

- Provide the necessary details, including the payment amount and the bank account from which the payment should be withdrawn.

- Confirm the payment details with the customer service representative or automated system.

- Complete the payment by authorizing the transaction.

While making a payment over the phone can be a convenient option, it’s important to ensure that you are calling the official Capital One customer service number to maintain the security of your personal and financial information.

After making your payment, it’s advisable to check your account balance to ensure the transaction has been processed successfully. The payment should reflect in your account within a few business days.

Paying your Capital One credit card bill over the phone provides a direct and personal method of making your payment. It allows you the opportunity to speak to a customer service representative if you have any questions or concerns. However, if you prefer a more traditional approach, you can still choose to mail your payment. Let’s explore this method in the next step.

Step 5: Paying your Capital One credit card bill by mail

If you prefer a more traditional method or are unable to make a payment online or over the phone, you can still pay your Capital One credit card bill by mail. Follow these steps to mail your payment:

- Write a check or obtain a money order for the amount you wish to pay. Make sure it is payable to Capital One and includes your Capital One credit card account number in the memo section.

- Place the check or money order in an envelope along with the payment stub from your monthly credit card statement. If you do not have the payment stub, write your Capital One credit card account number on a separate piece of paper and include it in the envelope.

- Seal the envelope securely.

- Address the envelope to the payment processing center. The address can be found on the back of your credit card statement or on the Capital One website.

- Affix sufficient postage to the envelope.

- Drop the envelope off at a post office or mailbox.

It’s important to send your payment well in advance of the due date to ensure it arrives on time. Capital One typically recommends allowing at least seven to ten days for processing, so plan accordingly.

When paying by mail, it’s highly recommended to keep a copy of your check or money order, as well as the payment stub or proof of mailing, for your records. This can be useful in the event of any discrepancies or payment inquiries.

Once your payment is received and processed by Capital One, it should reflect in your account within a reasonable timeframe. If you have any concerns or questions about your mailed payment, you can contact Capital One’s customer service for assistance.

Paying your Capital One credit card bill by mail offers a traditional and reliable method of making your payment. While it may take a bit longer for the payment to be processed compared to other methods, it can be a suitable option for those who prefer the offline approach.

Now that we have discussed various payment methods, let’s explore setting up automatic payments for your Capital One credit card bill in the next step.

Step 6: Setting up automatic payments

To simplify your credit card bill payment process and ensure that you never miss a payment, Capital One offers the convenience of setting up automatic payments. By setting up automatic payments, you can have your monthly credit card bill paid automatically from your designated bank account. Here’s how you can set up automatic payments for your Capital One credit card:

- Log in to your Capital One online account using your username and password.

- Go to the “Accounts” tab and select the credit card account you want to set up for automatic payments.

- Under the “Payments” section, select the “Set Up AutoPay” option.

- Provide the necessary information, such as the bank account details from which the payment should be withdrawn and the payment amount preference (minimum payment, statement balance, or a custom amount).

- Choose the payment date that works best for you.

- Review the automatic payment details to ensure accuracy.

- Confirm and authorize the automatic payment setup.

Once you have set up automatic payments, your Capital One credit card bill will be paid automatically on the scheduled date from your designated bank account. This eliminates the need for manual payments each month and reduces the risk of forgetting or missing a payment.

It’s important to ensure that you have sufficient funds in your bank account on the scheduled payment date to avoid any potential issues or penalties. You should also regularly check your bank account and credit card statements to ensure the automatic payments are being processed correctly.

If you wish to make any changes to your automatic payments, such as updating the payment amount or changing the bank account details, you can easily do so by accessing your online account or contacting Capital One’s customer service.

Setting up automatic payments provides the convenience and peace of mind of knowing that your credit card bill will be paid on time each month. It helps you stay in control of your finances and avoids any late fees or penalties.

With the six steps discussed in this guide, you now have a comprehensive understanding of the various methods available to pay your Capital One credit card bill. Whether you prefer the convenience of online payments, the mobility of the mobile app, the personal touch of phone payments, the traditional approach of mailing a check, or the simplicity of automatic payments, Capital One offers options to suit your preferences and needs.

Remember, staying on top of your credit card payments is crucial for maintaining a healthy financial standing. By making timely and consistent payments, you can build a positive credit history and take control of your personal finances.

Now, go ahead and choose the payment method that works best for you, and enjoy the peace of mind that comes with managing your Capital One credit card bill efficiently.

Conclusion

Paying your Capital One credit card bill on time is a vital part of managing your personal finances. In this guide, we have explored six different methods that Capital One offers to make your credit card payments convenient and hassle-free.

First, setting up an online account allows you to access your account information and make payments securely from the comfort of your own home. The Capital One website provides a user-friendly interface for making payments.

Furthermore, the Capital One mobile app offers the convenience of making payments on the go. With just a few taps, you can easily manage your credit card payments from anywhere at any time.

If you prefer a more personal approach, paying your Capital One credit card bill over the phone is an option. By calling the customer service number, you can provide your payment details and complete the transaction with the assistance of a representative.

For those who prefer a traditional method, mailing your payment is still an option. By sending a check or money order along with the payment stub, you can ensure your payment reaches Capital One on time.

Lastly, for a hassle-free payment experience, setting up automatic payments allows your credit card bill to be paid automatically from your designated bank account on the scheduled date.

By following these steps and choosing the payment method that suits your preferences, you can effectively manage your Capital One credit card bill, avoid late fees, and maintain a positive credit history.

Remember, it’s crucial to keep track of your payments, monitor your account activity, and regularly review your bank and credit card statements to ensure accuracy and detect any discrepancies.

With the range of payment options and the convenience they offer, paying your Capital One credit card bill has never been easier. Take advantage of the tools and methods available, and stay in control of your financial journey.

Start today by exploring the different payment methods and find the one that best fits your lifestyle and preferences. Take the first step towards financial success by paying your Capital One credit card bill on time, every time.