Finance

How To Get A 401K Statement

Modified: December 29, 2023

Learn how to easily obtain your 401K statement and keep track of your finances with our step-by-step guide. Take control of your financial future today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a 401K Statement?

- Why Do You Need a 401K Statement?

- How to Obtain Your 401K Statement

- Method 1: Logging into Your Account Online

- Method 2: Contacting Your 401K Provider

- Method 3: Requesting a 401K Statement by Mail

- Tips for Reviewing Your 401K Statement

- Understanding the Information on Your 401K Statement

- How Often Should You Check Your 401K Statement?

- Conclusion

Introduction

Welcome to the world of finance and retirement planning! If you have a 401K retirement account, you are taking an important step towards securing your financial future. However, it is not enough to simply contribute to your 401K. It’s also essential to regularly review your account and understand its performance. This is where the 401K statement comes into play.

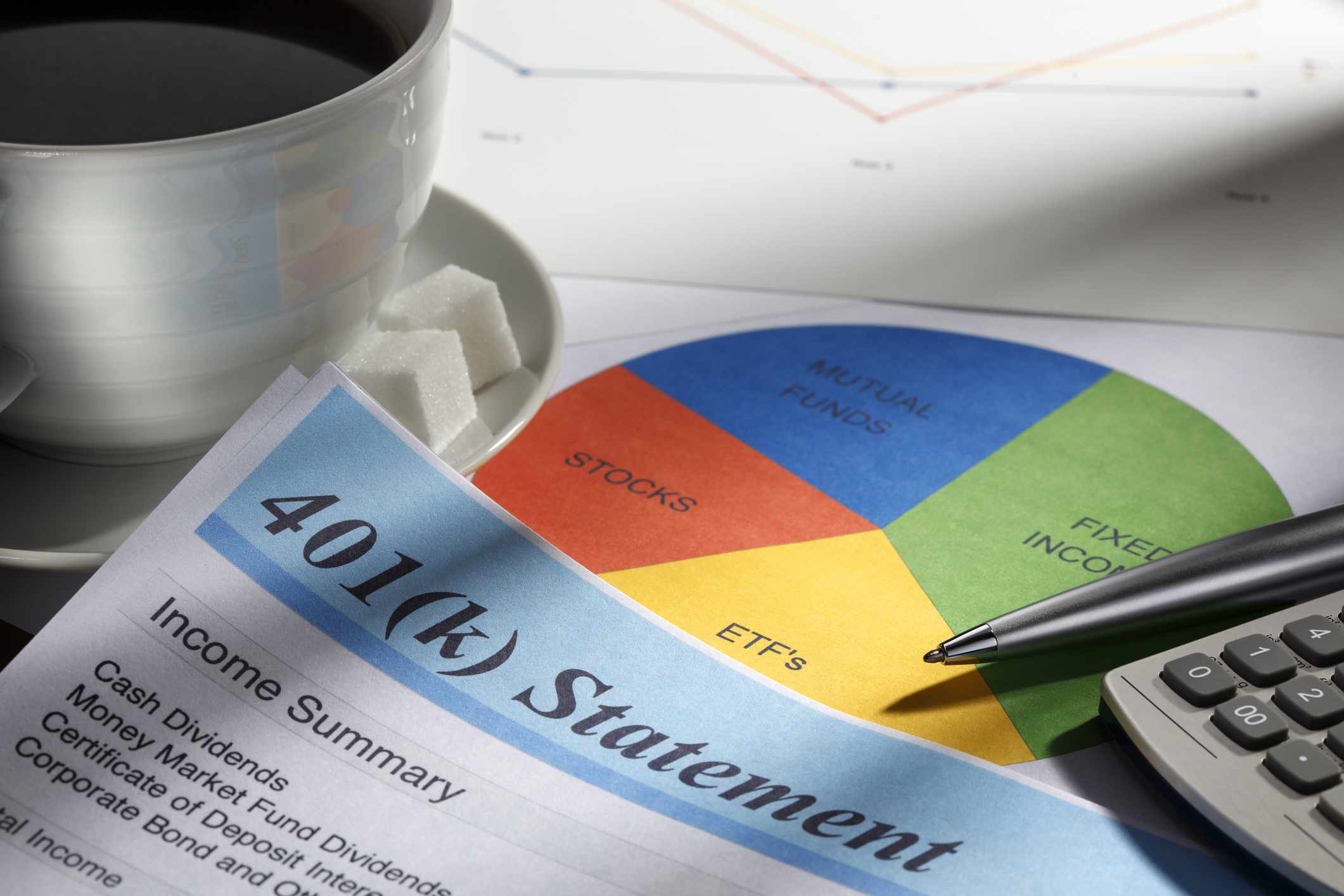

A 401K statement is a document that provides a comprehensive summary of your retirement account. It includes details about your contributions, investment performance, fees, and transactions. This statement is crucial for monitoring the growth of your retirement savings and assessing the effectiveness of your investment strategy.

While the concept of a 401K statement may seem intimidating at first, fear not! In this article, we will guide you through the process of obtaining and understanding your 401K statement. Whether you’re a finance novice or a seasoned investor, we’ll help you navigate through the numbers and ensure that you are making informed decisions about your retirement savings.

So, if you’ve ever wondered how to get a 401K statement and what to look for when reviewing it, you’ve come to the right place. Let’s dive in and unravel the mystery behind these important financial documents.

What is a 401K Statement?

A 401K statement is a detailed report that provides a snapshot of your retirement savings account, specifically your 401K. This document is typically generated by your 401K provider and serves as a summary of your account activity over a specified period of time, usually quarterly or annually.

The statement contains various sections that provide key information about your 401K, including:

- Account Summary: This section provides an overview of your account balance, including the total value of your investments, contributions made, and any withdrawals or distributions.

- Investment Performance: Here, you’ll find details about how your investments within the 401K account have performed. This includes the returns generated by different funds or investment options in your portfolio.

- Contributions: This section outlines the amount of money you and your employer have contributed to your 401K during the specified period. It may also indicate any catch-up contributions made, which are additional contributions allowed for individuals aged 50 and above.

- Transactions: The transaction section lists any activity that has taken place within your 401K account. This includes purchases or sales of investments, rollovers, and any fees or expenses deducted from your account.

- Fee Breakdown: Many 401K statements provide a breakdown of the fees associated with your account, including administrative fees, investment management fees, and other charges. Understanding these fees is essential to accurately evaluate the performance and cost-effectiveness of your 401K.

- Beneficiary Designations: This part of the statement details the individuals you have designated as beneficiaries in the event of your passing. It’s important to regularly review and update these designations to ensure your wishes are accurately reflected.

A 401K statement allows you to track the growth of your retirement savings and assess whether you are on track to meet your goals. By understanding the information presented on your statement, you can make more informed decisions about your retirement investment strategy.

Now that you know what a 401K statement is and what it typically includes, let’s explore why reviewing this document is essential for managing your retirement funds effectively.

Why Do You Need a 401K Statement?

Reviewing your 401K statement is crucial for several reasons. Let’s explore why you need to pay attention to this document:

- Monitor Your Retirement Savings: A 401K statement provides a clear picture of your retirement savings progress. It allows you to track the growth of your investments and assess whether you are on track to meet your retirement goals. Regularly reviewing your statement helps you stay informed and make any necessary adjustments to your investment strategy.

- Evaluate Investment Performance: The investment performance section in your 401K statement shows how well your investments have performed over a specific period of time. By analyzing this information, you can determine which funds or investment options are generating the best returns and make informed decisions about where to allocate your future contributions.

- Assess Contribution Levels: Your 401K statement provides a breakdown of the contributions made to your account. By examining this information, you can ensure that you are contributing enough to your retirement savings. If you find that your contributions are falling short, you may consider increasing the amount you contribute or taking advantage of employer matching programs.

- Track Fees and Expenses: Understanding the fees associated with your 401K is crucial for assessing the overall performance and cost-effectiveness of your account. Your statement will provide a detailed breakdown of any fees or expenses deducted from your account. By reviewing this information, you can ensure that you are not paying excessive fees and evaluate the impact of fees on your investment returns.

- Plan for Retirement: Your 401K statement gives you a realistic snapshot of your retirement savings and helps you gauge whether you are on track to achieve your retirement goals. By understanding your current account balance, projected growth, and retirement age, you can make informed decisions about when you can comfortably retire and what lifestyle you can afford during your golden years.

- Monitor Beneficiary Designations: It’s important to regularly review the beneficiary designations section of your 401K statement. This ensures that your desired beneficiaries are appropriately listed and that any life changes, such as marriage, divorce, or the birth of a child, are reflected in your account. Keeping this information up to date ensures that your retirement savings will be distributed according to your wishes in the event of your passing.

As you can see, a 401K statement provides invaluable insights into the status of your retirement savings. By reviewing it regularly and understanding the information presented, you can make informed decisions to optimize your investment strategy and work towards a secure financial future.

Now that you understand the importance of a 401K statement, let’s explore how you can obtain your statement to stay informed about your retirement savings.

How to Obtain Your 401K Statement

Obtaining your 401K statement may seem like a daunting task, but it is actually quite straightforward. There are several methods you can use to access your statement:

Method 1: Logging into Your Account Online

The easiest and most convenient way to obtain your 401K statement is by logging into your account online. Most 401K providers offer online portals where you can securely access and manage your retirement account. Once you log in, navigate to the section that provides statements or documents. You should be able to select the desired timeframe for your statement, such as quarterly or annually, and generate a downloadable or printable version.

Method 2: Contacting Your 401K Provider

If you’re unable to access your statement online or prefer to receive a physical copy, you can reach out to your 401K provider directly. Contact their customer service or member services department and request a copy of your latest 401K statement. They will guide you through the necessary steps to obtain it, which may include verifying your identity and providing specific account information.

Method 3: Requesting a 401K Statement by Mail

If you prefer to receive your 401K statement by mail, you can request a physical copy from your 401K provider. Reach out to their customer service or member services department and inform them of your preference. They will update your account settings accordingly and ensure that future statements are sent to your mailing address.

Regardless of the method you choose, it’s important to regularly obtain and review your 401K statement. This will help you stay informed about your retirement savings and make any necessary adjustments to your investment strategy.

Now that you’ve learned how to obtain your 401K statement, let’s move on to the next section and explore some tips for reviewing and understanding the information presented on your statement.

Method 1: Logging into Your Account Online

Logging into your 401K account online is the most convenient and accessible way to obtain your 401K statement. Most 401K providers offer user-friendly online portals that allow you to securely access and manage your retirement account. Here’s how to do it:

- Visit the Provider’s Website: Start by visiting the website of your 401K provider. Look for a login or sign-in section on the homepage.

- Enter Your Credentials: Once you’ve found the login section, enter your username or account number and password. If you haven’t created an online account yet, you may need to register and create a username and password.

- Navigate to Statements or Documents: Once logged in, explore the different sections of the online portal to find the section that provides statements or documents. This section may have labels such as “My Account,” “Statements,” “Documents,” or something similar.

- Select the Timeframe: Within the statements or documents section, you should be able to select the timeframe for your 401K statement, such as quarterly or annually. Choose the desired timeframe for your statement.

- Download or Print the Statement: After selecting the timeframe, you will have the option to download or print your 401K statement. Choose the format that suits your preference and save or print the document for your records.

By logging into your account online, you can conveniently access your 401K statement whenever you need it. This method allows you to review your statement at your own pace and easily compare it to previous statements to track the progress of your retirement savings.

Remember to keep your login credentials secure and avoid accessing your account from unsecured or public networks. Regularly updating your password and enabling two-factor authentication, if available, adds an extra layer of security to protect your retirement account.

Now that you know how to obtain your 401K statement by logging into your account online, let’s explore another method: contacting your 401K provider directly.

Method 2: Contacting Your 401K Provider

If you’re unable to access your 401K statement online or prefer a different method, contacting your 401K provider directly is a reliable way to obtain your statement. Here’s how to go about it:

- Find the Contact Information: Look for the contact information of your 401K provider. This information is usually available on their website, in your account documents, or on any correspondence you’ve received from them.

- Reach Out to Customer Service: Contact the customer service or member services department of your 401K provider. They are trained to assist account holders with various inquiries, including requests for statements.

- Verify Your Identity: To ensure the security of your account information, the customer service representative may ask you to verify your identity. Be prepared to provide personal details such as your account number, social security number, or other identifying information.

- Request Your 401K Statement: Inform the customer service representative that you would like to request a copy of your latest 401K statement. They will guide you through the necessary steps and let you know the expected timeframe for receiving the statement.

- Provide a Preferred Delivery Method: If you have a preference for receiving your statement, such as by email or mail, let the representative know. They will update your account settings accordingly to ensure that future statements are delivered to your preferred method.

By contacting your 401K provider directly, you can ensure that your request for a 401K statement is fulfilled promptly and accurately. The customer service team is there to assist you and provide you with the necessary information you need to manage your retirement account effectively.

Keep in mind that response times may vary depending on the provider, so be patient if you don’t receive your statement immediately. If you have any further questions or concerns, don’t hesitate to reach out to the customer service team for clarification.

Now that you know how to obtain your 401K statement by contacting your 401K provider, let’s explore one more method: requesting a statement by mail.

Method 3: Requesting a 401K Statement by Mail

If you prefer to receive a physical copy of your 401K statement, you can request it by mail from your 401K provider. Here’s how to go about it:

- Locate the Contact Information: Find the contact information for your 401K provider. This can usually be found on their website, account documents, or any correspondence you’ve received from them.

- Contact Customer Service: Get in touch with the customer service or member services department of your 401K provider. They will assist you with your request for a paper statement.

- Verify Your Identity: To ensure the security of your account information, the customer service representative may ask you to verify your identity. Be prepared to provide personal details such as your account number, social security number, or other identifying information.

- Request a Paper Statement: Inform the representative that you would like to receive a physical copy of your 401K statement by mail. They will update your account settings to ensure that future statements are mailed to your preferred address.

- Confirm Delivery Details: Provide the representative with your current mailing address or confirm that the address on file is correct. Double-check the spelling and accuracy of your address to ensure that the statement is delivered to the right location.

By requesting a 401K statement by mail, you can have a tangible document in hand that you can review at your own pace. It’s important to keep your statement in a safe and secure place, such as a locked file cabinet or a secure digital storage device.

Be aware that mail delivery may take some time, especially if you’re requesting statements from previous years. It is advisable to follow up with your 401K provider if you haven’t received your requested statement within the expected timeframe.

Now that you know how to obtain your 401K statement by mail, let’s move on to the next section and explore some tips for reviewing and understanding the information presented in your 401K statement.

Tips for Reviewing Your 401K Statement

Reviewing your 401K statement is essential for understanding the status of your retirement savings and making informed decisions about your investment strategy. Here are some helpful tips for effectively reviewing and analyzing your 401K statement:

- Check for Accuracy: Start by carefully reviewing the personal information on your statement, such as your name, address, and beneficiary designations. Ensure that everything is accurate and up to date.

- Review Account Summary: Pay attention to the account summary section, which provides an overview of your current account balance, contributions made, and any withdrawals or distributions. It’s important to ensure that these numbers align with your records and expectations.

- Analyze Investment Performance: Take a close look at the investment performance section of your statement. Review how each investment option or fund in your portfolio has performed over the specified period. Consider whether any adjustments need to be made to your investment allocations based on the performance results.

- Assess Contributions: Examine the contribution section to ensure that the amounts shown match what you and your employer have contributed to your 401K. Ensure that any catch-up contributions, if applicable, have been correctly accounted for.

- Evaluate Fees and Expenses: Scrutinize the fee breakdown section to understand the fees associated with your 401K account. Pay attention to administrative fees, investment management fees, and any other charges. Evaluate whether the fees are reasonable and in line with industry standards.

- Track Changes and Transactions: Review the transaction section to identify any changes or transactions that have taken place within your 401K account. This includes purchases or sales of investments, rollovers, and any fees incurred. Ensure that all transactions are accurately recorded.

- Compare to Previous Statements: If you have access to previous 401K statements, compare them to your latest statement. Look for any significant changes in contribution amounts, investments, or account balances. Analyzing trends over time can give you valuable insights into the growth of your retirement savings.

- Seek Professional Guidance: If you are unsure about any aspect of your 401K statement or need assistance in interpreting the information, consider consulting a financial advisor or retirement planning professional. They can provide guidance tailored to your specific financial goals and help you make informed decisions.

By following these tips, you can effectively review your 401K statement, gain a clearer understanding of your retirement savings, and make any necessary adjustments to your investment strategy.

Now that you know how to review and interpret your 401K statement, let’s delve deeper into understanding the information presented on your statement.

Understanding the Information on Your 401K Statement

Understanding the information presented on your 401K statement is essential for effectively managing your retirement savings. Here’s a breakdown of the key sections and information you’ll find on your statement:

- Account Summary: This section provides an overview of your 401K account, including your current balance, contributions made, and any withdrawals or distributions. It gives you a snapshot of how your account is growing over time.

- Investment Performance: The investment performance section shows you how well your individual investments or funds within your 401K have performed. It typically includes information such as the rate of return, gains or losses, and the performance compared to relevant benchmarks. This section helps you assess the effectiveness of your investment strategy.

- Contributions: The contributions section outlines the amount of money you and your employer have contributed to your 401K during the specified period. It may also include information about catch-up contributions, which are additional contributions allowed for individuals aged 50 and above.

- Transactions: This section lists any activity that has taken place within your 401K account, such as purchases or sales of investments, rollovers, and any fees or expenses incurred. It provides a detailed record of the changes occurring in your account.

- Fee Breakdown: Many 401K statements include a breakdown of the fees associated with your account, such as administrative fees and investment management fees. It’s important to understand these fees and evaluate their impact on your investment returns.

- Beneficiary Designations: The beneficiary designations section details the individuals you have designated to receive your retirement savings in the event of your passing. It’s crucial to review and update these designations regularly, especially after major life events, to ensure that your wishes are accurately reflected.

To make the most of your 401K statement, take the time to analyze each section and understand the implications it holds for your retirement savings. Regularly reviewing your statement allows you to identify any discrepancies, track your progress towards your retirement goals, and make informed decisions about your investment strategy.

If you come across any unfamiliar terms or concepts on your statement, don’t hesitate to research or seek guidance from a financial advisor or 401K provider. They can help clarify any questions or concerns you may have and provide further insights into the information presented on your statement.

Now that you have a better understanding of the information on your 401K statement, let’s move on to discuss how often you should review and check your statement.

How Often Should You Check Your 401K Statement?

Checking your 401K statement regularly is an important part of effectively managing your retirement savings. The frequency with which you should review your statement depends on various factors, including your financial goals, investment strategy, and personal preference. Here are some guidelines to help you determine how often you should check your 401K statement:

Quarterly:

Many 401K providers issue statements on a quarterly basis. Reviewing your statement every three months allows you to monitor the growth of your retirement savings, assess the performance of your investments, and make any necessary adjustments. This timeframe provides a balance between staying informed about your account and avoiding excessive monitoring that may lead to unnecessary stress.

Annually:

In addition to reviewing your quarterly statements, it is recommended to conduct a thorough annual review of your 401K account. This allows you to take a step back and evaluate the progress of your retirement savings over a longer period. Use this opportunity to reassess your financial goals, rebalance your portfolio if necessary, and make any necessary adjustments to your investment strategy.

Life Events:

It’s important to check your 401K statement whenever significant life events occur. Examples of such events include getting married, having a child, changing jobs, or reaching retirement age. These milestones often require adjustments to your retirement savings plan, so reviewing your statement during these times ensures that your account aligns with your evolving financial circumstances.

Ongoing Monitoring:

Besides checking your statement during the designated intervals, it’s beneficial to keep an eye on your account on an ongoing basis. Utilize the online portal provided by your 401K provider to monitor your account balance, track contributions and investment performance, and assess any recent transactions. Regular monitoring can help you identify any potential issues or discrepancies promptly.

Remember, the key is to strike a balance between staying actively engaged in managing your retirement savings and avoiding becoming overly obsessed with short-term fluctuations. Find a frequency that works for you and complements your financial goals and priorities.

Now that you understand how often you should check your 401K statement, let’s wrap up our discussion.

Conclusion

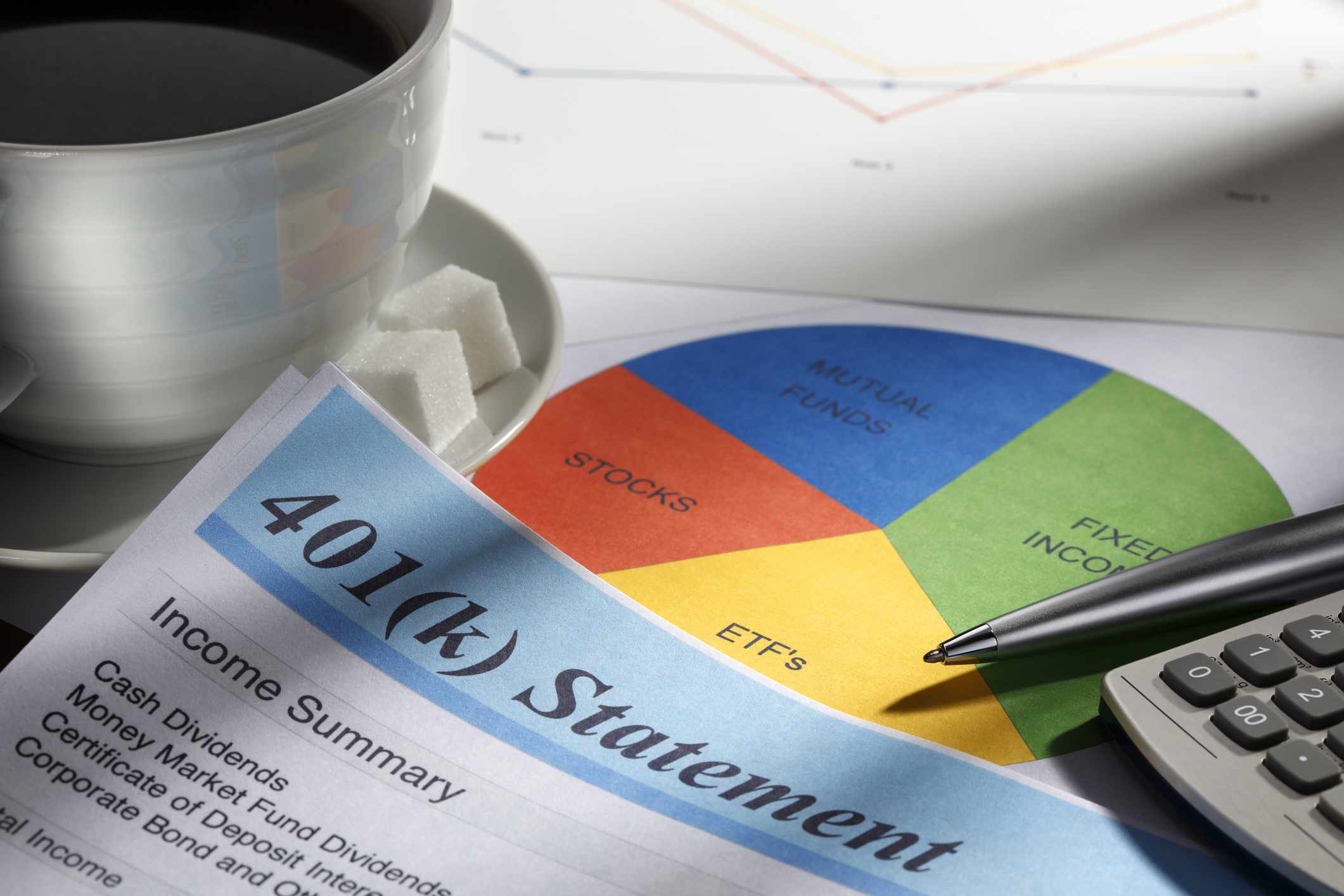

Managing your 401K and staying informed about your retirement savings is crucial for securing a comfortable financial future. By obtaining and reviewing your 401K statement regularly, you gain valuable insights into the performance of your investments, contribution levels, fees, and overall account balance. Armed with this knowledge, you can make informed decisions to optimize your retirement savings and ensure you stay on track towards your financial goals.

Whether you choose to access your statement online, contact your 401K provider, or request a physical copy by mail, the process of obtaining your 401K statement is straightforward. Once you have your statement in hand, take the time to review it carefully and understand the information presented. Look for accuracy, assess investment performance, and evaluate contribution levels. Pay attention to any fees or expenses deducted from your account and regularly review and update your beneficiary designations. Seeking professional guidance if needed can offer valuable insights and ensure you’re making the most of your retirement savings.

Remember to establish a regular rhythm for reviewing your statements. Quarterly or annual reviews, in addition to monitoring during significant life events, strike a balance between staying informed and avoiding excessive monitoring. However, ongoing monitoring is also essential to stay on top of your retirement savings and react to any changes or discrepancies promptly.

By following these guidelines and actively engaging in managing your 401K, you can take control of your financial future and enjoy a more secure retirement. So, embrace the power of your 401K statement and use it as a tool to navigate your way towards a prosperous retirement.