Finance

How Much Does An Accounting Specialist Make

Modified: February 21, 2024

Discover the average salary of an Accounting Specialist in the finance industry and find out how much you can earn in this rewarding field.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Job Duties of an Accounting Specialist

- Education and Certification Requirements

- Skills and Qualifications

- Average Salary of an Accounting Specialist

- Factors Affecting Salary

- Industries with the Highest Paying Accounting Specialist Jobs

- Geographic Location and Salary

- Career Outlook for Accounting Specialists

- Conclusion

Introduction

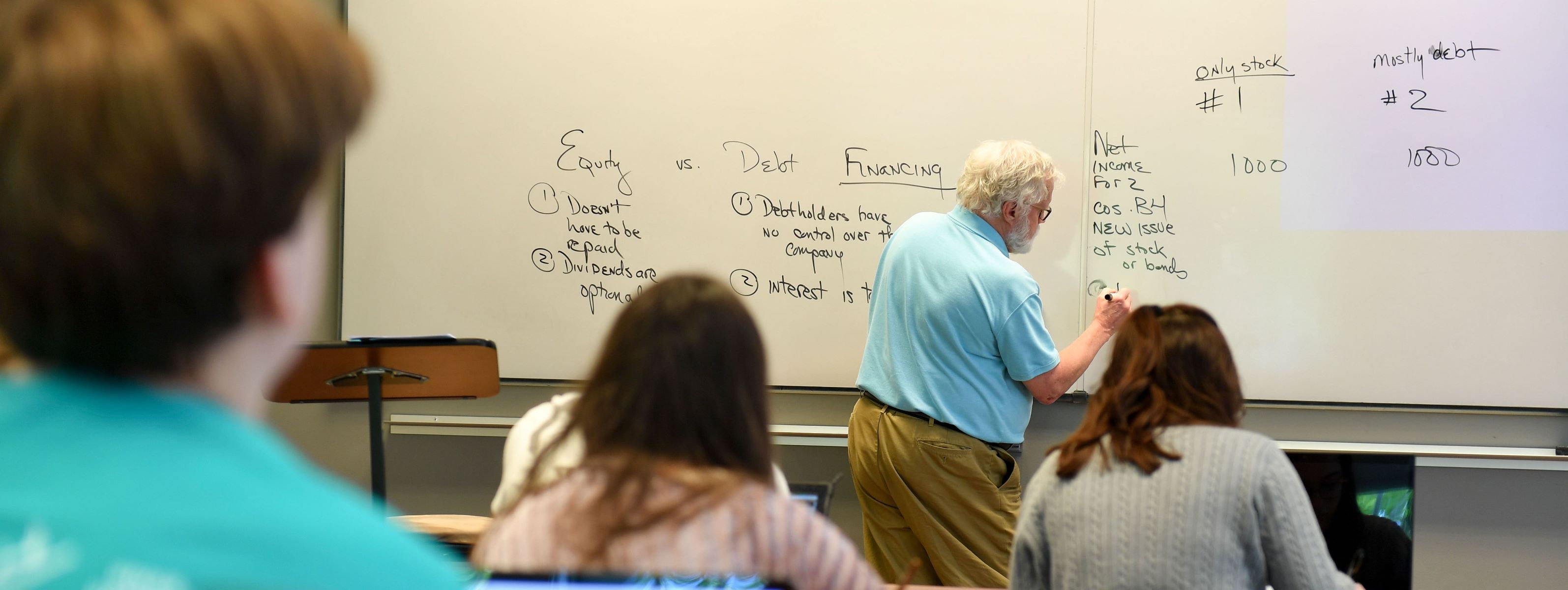

Accounting specialists play a crucial role in the financial management of businesses and organizations. They are responsible for ensuring the accuracy and integrity of financial records, analyzing financial data, and providing valuable insights to aid in decision-making processes. With their specialized knowledge in accounting principles and practices, they help maintain financial stability and compliance.

Accounting specialists perform a variety of tasks, including bookkeeping, preparing financial statements, reconciling accounts, analyzing financial data, and assisting in the budgeting process. They work closely with other departments and stakeholders to provide financial information and ensure regulatory compliance.

In addition to their technical skills, accounting specialists also possess strong analytical and problem-solving abilities. They can spot inconsistencies, identify financial trends, and recommend improvements to financial processes. With their attention to detail and ability to handle large amounts of data, they ensure accuracy in financial reporting and help organizations make informed financial decisions.

Furthermore, the role of an accounting specialist requires a high level of ethics and integrity. They handle sensitive financial information and must adhere to strict regulations and ethical standards. Trustworthiness and confidentiality are crucial traits in this profession.

To become an accounting specialist, individuals typically need a bachelor’s degree in accounting or a related field. Additionally, many employers prefer candidates who have obtained relevant certifications, such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designations. These certifications demonstrate a commitment to professional excellence and can enhance career opportunities and earning potential.

Accounting specialists can find employment in various industries, including corporate organizations, government agencies, non-profit organizations, and accounting firms. The demand for accounting specialists is expected to remain strong, driven by factors such as globalization, increased regulatory requirements, and the need for financial transparency.

In this article, we will delve into the job duties of an accounting specialist, education and certification requirements, skills and qualifications, average salary, factors affecting salary, industries with the highest paying accounting specialist jobs, geographic location and salary differences, and the career outlook for accounting specialists. By understanding the intricacies of this profession, individuals can make informed decisions about pursuing a career as an accounting specialist and chart a successful path in the financial industry.

Job Duties of an Accounting Specialist

An accounting specialist is responsible for a range of financial tasks within an organization. They perform various duties to ensure accurate and efficient financial record-keeping and reporting. Here are some key job duties of an accounting specialist:

- Bookkeeping: One of the primary responsibilities of an accounting specialist is to maintain accurate financial records. They update and maintain general ledgers, record financial transactions, and reconcile accounts.

- Preparing Financial Statements: Accounting specialists prepare financial statements, such as balance sheets, income statements, and cash flow statements. They compile and analyze financial data to ensure its accuracy and compliance with accounting standards.

- Reconciling Accounts: They reconcile accounts and resolve any discrepancies or issues found. This involves comparing financial records and bank statements to identify and rectify discrepancies.

- Financial Analysis: Accounting specialists analyze financial data to provide valuable insights to management. They assess financial performance, identify trends, and prepare reports that help in decision-making processes.

- Assisting in Budgeting: They assist in the budgeting process by preparing financial forecasts and participating in budget meetings. Their expertise helps in setting realistic financial goals and tracking expenses against the budget.

- Regulatory Compliance: Accounting specialists ensure compliance with financial regulations and reporting requirements. They stay updated with changes in accounting standards and maintain proper documentation to meet regulatory obligations.

- Payroll Processing: Some accounting specialists may be responsible for processing employee payroll. They calculate wages, deductions, and taxes, ensuring accuracy and timeliness in payroll disbursement.

- Financial System Management: They are proficient in using accounting software and tools to manage financial systems and streamline processes. They ensure data integrity and troubleshoot any issues that may arise.

- Auditing: Accounting specialists assist auditors during financial audits, providing necessary documentation and explaining financial processes. They help ensure compliance with auditing standards and regulations.

These are just a few examples of the job duties performed by accounting specialists. They play a vital role in maintaining financial accuracy and transparency, providing valuable insights, and contributing to the overall financial health of an organization.

Education and Certification Requirements

To pursue a career as an accounting specialist, certain education and certification requirements are typically expected. Here is an overview of the necessary qualifications:

Education: Most employers require accounting specialists to have at least a bachelor’s degree in accounting, finance, or a related field. A bachelor’s degree provides a solid foundation in accounting principles, financial reporting, taxation, and auditing. Some universities also offer specialized programs or concentrations in accounting that provide more in-depth knowledge in this field.

While a bachelor’s degree is the standard requirement, some employers may consider candidates with an associate degree or relevant work experience. However, individuals with higher education qualifications often have better career prospects and more opportunities for advancement.

Certifications: While not always mandatory, obtaining professional certifications can significantly enhance an accounting specialist’s career prospects and earning potential. The most common certifications for accounting professionals include:

- Certified Public Accountant (CPA): The CPA designation is highly regarded in the accounting field. It requires passing a rigorous exam and meeting specific education and experience requirements. CPAs have a deep understanding of accounting principles, taxation, and financial reporting. They often work in public accounting firms or hold senior-level positions in organizations.

- Certified Management Accountant (CMA): The CMA certification is focused on management accounting and is offered by the Institute of Management Accountants (IMA). CMAs demonstrate expertise in financial planning, analysis, control, and decision-making. This certification is valuable for accounting specialists in strategic planning and management roles.

- Chartered Global Management Accountant (CGMA): The CGMA designation is jointly offered by the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA). This certification emphasizes management accounting skills, global business acumen, and ethics.

In addition to these certifications, accounting specialists can also explore other industry-specific certifications or designations based on their niche or area of interest.

Continuing education is crucial for accounting specialists to stay updated with the evolving accounting principles, regulations, and technological advancements. Many professional organizations offer specialized courses, seminars, and webinars to help accounting professionals enhance their knowledge and skills.

Obtaining an advanced degree, such as a Master’s in Accounting or a Master of Business Administration (MBA), can also open up additional opportunities for career advancement.

By fulfilling the educational requirements and obtaining relevant certifications, aspiring accounting specialists can demonstrate their expertise and commitment to professional excellence, enhancing their chances of securing rewarding job opportunities in the field.

Skills and Qualifications

Being an accounting specialist requires a specific set of skills and qualifications to excel in the role. Here are some essential skills and qualifications for accounting specialists:

1. Strong Analytical Skills: Accounting specialists need to analyze financial data, identify patterns, and detect any discrepancies. They must have excellent analytical skills to interpret complex financial information and provide accurate insights.

2. Attention to Detail: Precision and attention to detail are critical in accounting. Accounting specialists must be meticulous in their work to ensure accuracy in financial statements, record-keeping, and compliance with regulations.

3. Proficiency in Accounting Software: Accounting specialists should be well-versed in using accounting software and tools, such as QuickBooks, SAP, or Oracle. They need to accurately record transactions, generate financial reports, and manage financial information effectively.

4. Knowledge of Accounting Principles: A solid understanding of accounting principles, such as GAAP (Generally Accepted Accounting Principles), is essential. Accounting specialists should be familiar with financial statements, reconciliation processes, and tax regulations.

5. Ethics and Integrity: Accounting specialists handle sensitive financial information and must maintain the highest ethical standards. They must adhere to confidentiality requirements, demonstrate honesty, and follow ethical guidelines in financial reporting.

6. Organizational and Time Management Skills: With multiple tasks and deadlines, accounting specialists need strong organizational and time management skills. They should prioritize tasks, manage their workload efficiently, and meet reporting deadlines.

7. Communication Skills: Accounting specialists often work with cross-functional teams and stakeholders. They should possess excellent verbal and written communication skills to effectively convey financial information and collaborate with others.

8. Problem-Solving Abilities: Accounting specialists encounter financial discrepancies and complex situations. They need strong problem-solving skills to identify issues, investigate root causes, and implement solutions to ensure accurate financial records.

9. Continuous Learning: The field of accounting is ever-evolving, with new regulations and technological advancements. Accounting specialists should have a thirst for knowledge and be open to continuous learning to stay updated with industry trends and advancements.

10. Teamwork: Collaboration is key in the accounting field. Accounting specialists should be able to work effectively as part of a team, communicate with colleagues, and contribute to the overall success of the organization.

While possessing these skills and qualifications is important, employers may also look for relevant work experience, industry knowledge, and the ability to handle high-pressure situations. Having a customer-centric mindset and being able to adapt to changing circumstances are also valuable traits in the accounting field.

By honing these skills and acquiring the necessary qualifications, aspiring accounting specialists can position themselves as competent professionals in the industry, opening doors to a promising and fulfilling career.

Average Salary of an Accounting Specialist

The average salary of an accounting specialist can vary based on factors such as experience, qualifications, location, industry, and the size of the organization. However, accounting specialists are generally well-compensated for their expertise and responsibilities.

In the United States, the average annual salary for an accounting specialist is around $55,000 to $65,000. Entry-level accounting specialists with limited experience may earn a starting salary closer to $40,000, while those with several years of experience and additional certifications can earn upwards of $80,000 annually.

Salaries can also vary by location. Major metropolitan areas or regions with a high cost of living may offer higher salaries to accounting specialists to offset living expenses. It’s not uncommon for accounting specialists in cities like New York, Los Angeles, or San Francisco to earn significantly more than the national average.

The industry in which an accounting specialist works can also impact their salary. Accounting specialists in industries such as finance, insurance, and professional services tend to command higher salaries due to the complexity and sensitivity of the financial transactions involved. Government agencies and non-profit organizations may offer slightly lower salaries but often provide additional benefits and job stability.

Experience and qualifications play a significant role in determining salary levels. Accounting specialists with more years of experience and specialized knowledge, such as being a Certified Public Accountant (CPA) or Certified Management Accountant (CMA), are likely to receive higher compensation. Ongoing professional development and staying up-to-date with industry trends can also contribute to salary growth.

It’s important to note that salary is not the only factor to consider when evaluating the compensation for an accounting specialist. Other benefits such as health insurance, retirement plans, paid time off, and opportunities for growth and advancement should also be taken into account.

As the demand for financial expertise continues to grow, accounting specialists can expect favorable job prospects and competitive salaries. With the right qualifications, skills, and experience, accounting specialists can build a rewarding and financially rewarding career in the field of finance and accounting.

Factors Affecting Salary

The salary of an accounting specialist is influenced by various factors that can impact earning potential. Understanding these factors is essential for individuals looking to negotiate their salary or evaluate job opportunities within the field. Here are some key factors that affect the salary of an accounting specialist:

1. Education and Credentials: The level of education and professional certifications can significantly impact an accounting specialist’s salary. holding a bachelor’s degree in accounting, for example, may be considered the minimum educational requirement, but individuals with advanced degrees or relevant certifications like the Certified Public Accountant (CPA) designation have a competitive edge and may be eligible for higher salaries.

2. Experience: Experience is a crucial factor in salary determination. Accounting specialists with more years of experience typically earn higher salaries. As they acquire knowledge, skills, and expertise through years of practice, their value to organizations increases, leading to better compensation packages.

3. Industry and Company Size: The industry in which an accounting specialist works plays a significant role in salary fluctuations. High-demand industries like finance, insurance, and professional services often offer higher salaries to attract top talent due to the complexity and volume of financial transactions. Furthermore, large organizations and corporations tend to have larger budgets for employee compensation, which can translate into higher salaries for accounting specialists compared to smaller companies or non-profit organizations.

4. Geographic Location: The geographic location of the job can have a significant impact on salary levels. Cost of living and regional market dynamics influence salary ranges. Major metropolitan areas with a higher cost of living typically offer higher salaries to accounting specialists compared to smaller towns or rural areas.

5. Supply and Demand: The supply and demand of accounting specialists also play a role in salary levels. If there is a shortage of qualified accounting specialists in a particular area or industry, salaries tend to be higher as organizations compete for talent. Conversely, if the market is saturated with candidates, salaries may be lower due to the abundance of available professionals.

6. Skills and Specializations: Accounting specialists with specialized skills or knowledge in areas such as tax accounting, forensic accounting, or financial analysis may command higher salaries. These individuals bring unique expertise that enhances the value they provide to employers, making them more sought after and eligible for higher compensation.

7. Performance and Contributions: An accounting specialist’s salary can also be influenced by their performance and contributions to the organization. Those who consistently exceed expectations, take on additional responsibilities, or contribute significantly to improving financial processes may be rewarded with higher salaries, bonuses, or promotions.

It’s important to note that these factors are interconnected and can vary depending on individual circumstances. Assessing these factors and considering their impact on salary negotiation or career choices can help accounting specialists make informed decisions about maximizing their earning potential.

Industries with the Highest Paying Accounting Specialist Jobs

While accounting specialists can find employment in various industries, certain sectors are known for offering higher salaries due to the complexity and financial significance of their operations. Here are some industries that typically offer the highest paying accounting specialist jobs:

1. Finance and Investment: The finance and investment industry is renowned for offering some of the highest salaries for accounting specialists. This industry includes investment banks, hedge funds, private equity firms, and asset management companies. The complexity of financial transactions and the need for accurate record-keeping and regulatory compliance contribute to the higher earning potential in this sector.

2. Professional Services: Professional services firms, such as accounting and consulting firms, provide a range of financial services to clients. These firms often work with large corporations, performing financial audits, providing advisory services, and offering specialized accounting expertise. Accounting specialists working in professional services firms have the opportunity to work on high-profile projects, leading to higher salaries.

3. Technology and Software Development: With the increasing reliance on technology in the business world, the technology and software development industry has a need for accounting specialists who understand the intricacies of financial management in this sector. These professionals often work with software companies, ensuring proper revenue recognition, handling financial planning and analysis, and managing complex financial systems. The demand for accounting specialists in this industry is growing, leading to competitive compensation packages.

4. Corporate Accounting and Finance: Accounting specialists employed in large corporations or multinational companies can earn high salaries due to the size and complexity of these organizations. They may be involved in financial reporting, budgeting, forecasting, and analyzing financial data to support strategic decision-making. The responsibility for managing a company’s financial operations often entails attractive compensation packages.

5. Healthcare and Pharmaceuticals: The healthcare and pharmaceutical industries deal with intricate financial structures, regulatory compliance, and revenue management. Accounting specialists in this sector handle medical reimbursements, manage financial statements, and ensure compliance with healthcare regulations. Due to the critical nature of the industry and the demand for accuracy and financial transparency, accounting specialists in healthcare tend to receive higher salaries.

6. Manufacturing and Engineering: Manufacturing and engineering companies have complex financial processes, including cost analysis, inventory management, and project accounting. Accounting specialists in this industry play a vital role in ensuring the financial health of the organization. Their expertise in managing budgets, controlling costs, and analyzing production costs contributes to the higher salaries in this sector.

It’s important to note that the highest-paying industries for accounting specialists may also vary depending on factors such as geographic location, size of the organization, and specific job roles. Additionally, advancements in technology, changes in regulations, and market dynamics can influence salary trends in different industries over time. Keeping up with industry trends and exploring opportunities in high-paying sectors can lead to a rewarding and well-compensated career as an accounting specialist.

Geographic Location and Salary

Geographic location plays a significant role in determining the salary of an accounting specialist. Different regions and cities have varying costs of living, job markets, and industry dynamics that can impact compensation levels. Here is an overview of how geographic location can affect an accounting specialist’s salary:

1. High-Cost Metropolitan Areas: Major metropolitan areas with a high cost of living, such as New York City, Los Angeles, San Francisco, London, and Tokyo, often offer higher salaries to accounting specialists. This is due to the higher expenses associated with rent, transportation, and other necessities. Employers in these regions recognize the need to provide higher compensation to attract and retain talent.

2. Rural or Smaller Towns: Accounting specialists working in rural or smaller towns may experience lower salary ranges compared to their counterparts in larger cities. The cost of living in these areas is typically lower, which can lead to lower salary expectations. However, the lower cost of living may also result in a higher standard of living and better overall financial well-being.

3. Regional Economic Factors: The overall economic health and industry presence in a specific region can impact salary levels. Regions with a strong presence of high-paying industries, such as finance, technology, or professional services, may offer higher salaries to accounting specialists. This is because companies in these industries often compete for top talent, leading to increased compensation packages.

4. Global Disparities: Accounting specialists working in different countries may experience significant differences in salary levels due to economic fluctuations, currency exchange rates, and local market dynamics. Developed countries with robust financial sectors tend to offer higher salaries, while developing economies may provide lower compensation. It’s important for professionals to research and consider these factors when seeking employment in different regions.

5. Local Labor Market: The demand and supply of accounting talent in a specific region or city can impact salary levels. In areas with a scarcity of qualified accounting specialists, employers may offer higher salaries to attract and retain talent. Conversely, areas with a surplus of professionals may see lower salary ranges due to increased competition for available positions.

6. Cost-of-Living Adjustments: Some organizations take into account the cost of living when determining salary levels. They may adjust salaries based on location to ensure that employees can maintain a comparable standard of living. These cost-of-living adjustments can result in higher or lower salaries depending on the specific location.

When considering salary expectations, it’s crucial for accounting specialists to research the local market, industry trends, and the cost of living in the desired geographic area. While higher salaries can be tempting, it’s important to weigh the salary against other factors such as career growth opportunities, work-life balance, and overall job satisfaction.

Ultimately, accounting specialists should consider factors beyond salary alone when evaluating job opportunities. The combination of a competitive salary, a suitable cost of living, and a fulfilling work environment contributes to a well-rounded and satisfying career as an accounting specialist.

Career Outlook for Accounting Specialists

The career outlook for accounting specialists is promising, with a positive job growth trajectory and a range of opportunities in various industries. Here is an overview of the career outlook for accounting specialists:

1. Job Growth: The demand for accounting specialists is expected to grow steadily in the coming years. As organizations continue to place an emphasis on financial transparency, regulatory compliance, and effective financial management, the need for skilled accounting professionals remains high. According to the U.S. Bureau of Labor Statistics, the employment of accountants and auditors is projected to grow 6% from 2018 to 2028.

2. Globalization: With the increasing globalization of business operations, there is a growing need for accounting specialists who understand international accounting standards, tax regulations, and cross-border transactions. Accounting specialists with a global mindset and knowledge of international accounting practices can take advantage of opportunities in multinational companies, consulting firms, and international tax firms.

3. Technological Advancements: Rapid advancements in technology and automation are reshaping the accounting profession. While technology can automate routine tasks, accounting specialists are still needed to analyze financial data, interpret results, provide insights, and make strategic decisions. Accounting specialists who embrace technology, stay updated with emerging tools and software, and adapt to new ways of working will be well-positioned for career success.

4. Evolving Roles and Specializations: The role of an accounting specialist is evolving beyond traditional bookkeeping and financial reporting. There is an increasing demand for professionals with specialized skills in areas such as forensic accounting, data analytics, sustainability reporting, and risk management. By acquiring additional certifications and developing expertise in these niche areas, accounting specialists can differentiate themselves and explore exciting career paths.

5. Regulatory Compliance: The accounting and financial industries are subject to ever-evolving regulations and compliance requirements. Accounting specialists who stay updated with changes in accounting standards and develop expertise in compliance can find lucrative opportunities in assisting organizations in meeting regulatory obligations. These professionals play a critical role in maintaining financial transparency and ensuring adherence to industry-specific regulations.

6. Career Advancement: Accounting specialists who display exceptional skills, knowledge, and expertise can advance in their careers to positions of greater responsibility. They may progress to roles such as financial managers, controllers, or chief financial officers (CFOs). Career advancement may also involve taking on managerial responsibilities, leading teams, and contributing to strategic financial decision-making within organizations.

7. Entrepreneurship: Accounting specialists with an entrepreneurial mindset have the option to start their own accounting firms or offer consulting services to clients. This can provide more flexibility, the opportunity to work with diverse clients, and the potential for higher earnings as business owners.

As the financial landscape continues to evolve, accounting specialists who stay adaptable, continue their professional development, and showcase their expertise will have a wealth of opportunities. By embracing new technologies, specializing in emerging fields, and demonstrating a commitment to delivering value, accounting specialists can thrive in their careers and make a meaningful impact in the financial world.

Conclusion

Being an accounting specialist offers a rewarding and lucrative career in the financial industry. From maintaining accurate financial records to providing valuable insights and ensuring regulatory compliance, accounting specialists play a crucial role in the financial management of organizations.

To pursue a career as an accounting specialist, individuals typically need a bachelor’s degree in accounting or a related field. Obtaining professional certifications, such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designations, can enhance career opportunities and earning potential.

Accounting specialists possess a unique set of skills, including strong analytical abilities, attention to detail, proficiency in accounting software, and knowledge of accounting principles. They also demonstrate ethics, integrity, and the ability to work collaboratively with others.

The average salary of an accounting specialist can vary based on factors such as experience, qualifications, location, industry, and the size of the organization. Industries such as finance, professional services, and technology typically offer higher salaries to accounting specialists.

Geographic location also plays a significant role in salary levels, with high-cost metropolitan areas often providing higher salaries to offset the higher cost of living. Additionally, the career outlook for accounting specialists is positive, driven by factors such as globalization, technological advancements, evolving roles, and regulatory compliance requirements.

In conclusion, a career as an accounting specialist offers financial stability, growth opportunities, and the chance to contribute to the financial success of organizations. With the right qualifications, skills, and dedication to professional excellence, individuals can excel in this field and forge a successful and fulfilling career in the world of finance and accounting.