(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Introduction

Buying on credit has become a common practice in today’s consumer-driven world. It refers to the ability to purchase goods or services now and pay for them later, often in installments or through a credit card. This financial arrangement has transformed the way people shop and has had significant impacts on both consumers and businesses.

In this article, we will explore the benefits that buying on credit offers to both consumers and businesses. For consumers, buying on credit provides increased purchasing power, convenient payment options, the ability to afford high-cost items, the opportunity to establish or improve credit history, protection against faulty products, and access to rewards and loyalty programs. On the other hand, businesses benefit from offering credit to consumers through increased sales and revenue, expanding their customer base, gaining a competitive advantage, building customer loyalty, and the potential for repeat business and referrals.

However, it is important for both consumers and businesses to consider the potential risks and make informed decisions regarding buying on credit. This article aims to shed light on the advantages of this financial arrangement while also highlighting the importance of responsible credit management.

Definition of Buying on Credit

Buying on credit refers to the practice of purchasing goods or services with the agreement to pay for them at a later date. This arrangement allows consumers to acquire the desired products upfront and then repay the amount owed over time, typically with added interest and fees.

Credit can be obtained through various means, such as credit cards, installment plans, store credit, or personal loans. The terms and conditions of the credit agreement, including the repayment period, interest rates, and any associated fees, vary depending on the lender and the specific credit arrangement.

When buying on credit, consumers essentially borrow money to make their purchases. This gives them the immediate ability to acquire products or services without having to pay the full cost upfront. Instead, they commit to making regular payments over a specified period until the total amount owed is paid off.

It’s important to note that buying on credit is not inherently negative or problematic. In fact, it can be a beneficial financial tool when used responsibly. However, it’s essential for consumers to understand the terms and conditions of their credit agreements and to manage their credit obligations wisely in order to avoid excessive debt and financial strain.

Benefits to Consumers of Buying on Credit

Buying on credit offers several advantages to consumers, providing them with increased purchasing power and financial flexibility. Here are some of the key benefits:

-

Increased purchasing power: Buying on credit allows consumers to make purchases that they may not have been able to afford with cash or debit cards alone. It provides the opportunity to acquire goods or services immediately, even if they require a larger upfront investment.

-

Convenient and flexible payment options: Credit arrangements often offer flexible payment terms, allowing consumers to spread out the cost of their purchases over time. This makes it easier to manage financial obligations and budget effectively, especially for larger or unexpected expenses.

-

Ability to afford high-cost items: Buying on credit enables consumers to make significant purchases, such as a car or home, without needing to save up a large sum of money. This can be particularly beneficial for essential items that are crucial for daily life or career advancement.

-

Opportunity to establish or improve credit history: Regular and responsible use of credit can help consumers establish a positive credit history or improve their existing credit score. This can lead to better access to future credit options, lower interest rates, and improved financial opportunities.

-

Protection against faulty or unsatisfactory products/services: Many credit cards and consumer protection laws offer safeguards for consumers who make purchases on credit. This means that if a product is faulty, damaged, or does not meet expectations, consumers may have recourse options to resolve the issue and potentially receive a refund or replacement.

-

Access to rewards and loyalty programs: Credit cards often come with rewards programs that allow consumers to earn points, cashback, or other incentives for their purchases. These rewards can add value to buying on credit, providing additional benefits or discounts that can enhance the overall shopping experience.

While buying on credit offers numerous advantages, it’s important for consumers to exercise responsible credit management. This involves understanding the terms and conditions of their credit agreements, making payments on time, and avoiding excessive debt. By using credit wisely, consumers can fully enjoy the benefits it provides while maintaining their financial well-being.

#1. Increased Purchasing Power

One of the primary benefits that buying on credit offers to consumers is increased purchasing power. With the ability to make purchases now and pay for them later, consumers can acquire goods or services that may have been out of their immediate financial reach.

Without the need to save up a substantial amount of money, consumers can access a wider range of products or services and enjoy them in the present moment. This is particularly advantageous for individuals who require essential items or who wish to indulge in experiences that enhance their quality of life.

By leveraging credit, consumers can make significant purchases without depleting their savings or disrupting their cash flow. For example, someone may buy a car on credit instead of waiting months or years to save up for it. This allows them to enjoy the utility, convenience, and benefits of the car immediately, without delay.

Additive to this, buying on credit also enables consumers to take advantage of time-sensitive opportunities or limited-time offers. The ability to make a purchase and spread out the payments over time allows consumers to seize opportunities and meet their immediate needs or desires without waiting for their financial circumstances to align.

However, it is essential for consumers to exercise caution and not exceed their financial capabilities when using credit to increase their purchasing power. They should assess their ability to repay the debt, taking into consideration their income, expenses, and other financial obligations. Responsible use of credit ensures that consumers can enjoy the benefits without falling into excessive debt or facing financial strain.

#2. Convenient and Flexible Payment Options

Another significant benefit to consumers of buying on credit is the convenience and flexibility it offers in terms of payment options. Unlike cash purchases or immediate debit card transactions, credit arrangements allow consumers to spread out their payments over time.

This flexibility in payment terms provides consumers with greater control over their finances and the ability to manage their budget effectively. Rather than paying a lump sum upfront, they can divide the cost of their purchase into manageable installments that align with their financial situation and cash flow.

Moreover, credit agreements often come with various payment options. Consumers have the flexibility to choose the payment frequency (e.g., monthly, bi-monthly) and the duration of the repayment period. This allows them to tailor their payments to fit their individual needs and preferences.

Convenient payment options also extend to online shopping. With the rise of e-commerce, consumers can easily make purchases on credit from the comfort of their own homes. They can utilize secure payment gateways and choose to pay in installments, making online shopping more accessible and affordable.

Additionally, credit cards offer the convenience of contactless payments, making transactions faster and easier. With a simple tap or wave of the card, consumers can complete their purchases swiftly and avoid the need to carry cash or enter their PIN.

It is important, however, for consumers to remain mindful of their credit limits and avoid overextending themselves financially. While flexible payment options provide convenience, it is crucial to budget appropriately and ensure that the repayments are manageable within their income and expenses.

By leveraging these convenient and flexible payment options, consumers can make necessary purchases or splurge on desired items without compromising their overall financial stability.

#3. Ability to Afford High-Cost Items

One of the significant benefits that buying on credit provides to consumers is the ability to afford high-cost items that may otherwise be out of reach. This financial arrangement allows individuals to make significant purchases without having to save up a large sum of money upfront.

Buying on credit allows consumers to spread out the cost of expensive items over time, making them more manageable within their monthly budgets. For example, someone who dreams of owning a home can take advantage of a mortgage loan, which enables them to purchase a property by paying it off gradually over several years.

In addition to real estate, credit can also be utilized for other high-cost items such as vehicles, appliances, electronics, or furniture. By breaking down the payment into affordable installments, consumers can enjoy the use and benefits of these items immediately rather than having to wait until they save up enough money to make a cash purchase.

This ability to afford high-cost items through credit is particularly valuable when there is an urgent need or a time-sensitive opportunity. Consider a scenario where an individual requires immediate medical treatment or a necessary car repair. Utilizing credit allows them to address these critical needs promptly without having to delay while they accumulate the necessary funds.

However, consumers should exercise caution when using credit to afford high-cost items. It is essential to carefully consider the repayment terms and ensure that the monthly payments are manageable within their financial capacity. Making informed decisions and budgeting responsibly will help consumers avoid excessive debt and maintain their financial well-being.

Overall, the ability to afford high-cost items through credit provides consumers with greater flexibility and accessibility in acquiring essential items or indulging in desired purchases.

#4. Opportunity to Establish or Improve Credit History

Buying on credit presents consumers with the opportunity to establish or improve their credit history, which can have long-lasting benefits for their financial well-being. A positive credit history is crucial when applying for future credit options, such as loans or mortgages, and can result in better interest rates and more favorable terms.

For individuals who are new to credit, making purchases on credit and repaying them responsibly is a vital step in building a positive credit record. Regular and timely payments demonstrate to lenders that the consumer is trustworthy and capable of managing their financial obligations.

Moreover, buying on credit also allows individuals with less-than-perfect credit to work towards improving their credit score. By making consistent payments and maintaining a low credit utilization ratio (the amount of credit used compared to the total credit available), consumers can gradually rebuild their creditworthiness.

Responsible credit management, such as paying bills on time and keeping credit card balances low, contributes to a healthier credit history. This can lead to improved access to credit in the future, better loan terms, and increased financial opportunities.

It’s important to note that establishing or improving credit history requires discipline and responsible decision-making. Consumers should avoid excessive debt and aim to use credit for necessary purchases that can be comfortably repaid.

By taking advantage of the opportunity to establish or improve their credit history through responsible use of credit, consumers can enhance their financial standing and pave the way for a brighter future.

#5. Protection against Faulty or Unsatisfactory Products/Services

One of the benefits that buying on credit provides to consumers is protection against faulty or unsatisfactory products or services. Many credit cards and consumer protection laws offer safeguards to ensure that consumers are not left empty-handed if they encounter issues with their purchases.

When consumers make a purchase on credit and encounter problems with the product or service, they may have options for seeking a resolution. In some cases, credit card companies offer chargeback protection, which allows consumers to dispute a transaction and potentially receive a refund if the product is faulty, damaged, or doesn’t meet the stated expectations.

In addition to chargeback protection, consumer protection laws often provide recourse for consumers who encounter problems with their purchases. These laws vary by jurisdiction but generally offer guidelines and remedies for consumers to seek reimbursement, repairs, or replacements in case of faulty or unsatisfactory products or services.

Buying on credit can provide consumers with an added layer of assurance when making significant purchases. Knowing that they have the option to dispute a transaction or seek a resolution can give consumers peace of mind when investing in expensive or important items.

It’s important for consumers to familiarize themselves with the terms and conditions of their credit agreements and understand the protection and dispute resolution options available to them. This knowledge empowers consumers to assert their rights and protect themselves against faulty or unsatisfactory purchases.

While buying on credit offers this level of protection, it’s still advisable for consumers to exercise caution and conduct thorough research before making a purchase. Reading reviews, comparing products, and choosing reputable sellers can reduce the risk of encountering issues and enhance the overall shopping experience.

By utilizing credit for purchases, consumers can enjoy the peace of mind that comes with added protection against faulty or unsatisfactory products or services.

#6. Access to Rewards and Loyalty Programs

One of the enticing benefits that buying on credit offers to consumers is the opportunity to access rewards and loyalty programs. Many credit cards come with built-in rewards programs that allow consumers to earn points, cashback, or other incentives for their purchases.

These rewards programs provide an additional advantage to buying on credit, as consumers can earn valuable benefits simply by using their credit cards for everyday expenses or larger purchases. The accumulated rewards can then be redeemed for a variety of perks, such as airline miles, hotel stays, gift cards, merchandise, or even statement credits.

By taking advantage of rewards programs, consumers can effectively maximize the value of their purchases. For example, frequent travelers can earn airline miles for flights or hotel stays, ultimately reducing the cost of future travel experiences. Similarly, individuals who regularly dine out or shop at specific retailers can earn cashback or loyalty points that can be redeemed for discounts or free products.

Loyalty programs tied to credit cards may also offer additional benefits, such as exclusive discounts, early access to sales, or special events. These incentives enhance the overall shopping experience and provide consumers with added value for their loyalty to a particular brand or retailer.

It is important for consumers to choose a credit card that aligns with their spending habits and preferences to maximize the benefits of rewards and loyalty programs. By selecting a card that offers rewards in categories that are relevant to their needs, consumers can optimize their savings and enhance their shopping experiences.

It’s worth noting that rewards and loyalty programs may come with certain terms and conditions, such as expiration dates or minimum spending requirements. Consumers should familiarize themselves with these details to ensure they can fully enjoy the benefits and avoid any unnecessary restrictions.

By leveraging rewards and loyalty programs, buying on credit becomes even more appealing as consumers can enjoy additional perks and savings, making their purchases even more worthwhile.

Benefits to Businesses of Offering Credit to Consumers

Offering credit to consumers can be advantageous for businesses in several ways. It not only increases sales and revenue but also expands their customer base and provides a competitive advantage in the market.

-

Increased sales and revenue: By offering credit, businesses remove the barrier of upfront payment, enabling consumers to make larger purchases or buy more frequently. This can significantly boost sales and revenue as customers have the financial flexibility to afford products or services that may otherwise be out of reach.

-

Expansion of customer base: Offering credit attracts a broader range of customers who may not have the financial means to make immediate cash purchases. By catering to these consumers, businesses tap into new market segments and gain access to a wider customer base, ultimately increasing their reach and potential for growth.

-

Competitive advantage in the market: In a competitive marketplace, businesses that offer credit stand out from their competitors. The availability of credit options can be a deciding factor for consumers when choosing where to make their purchases, giving businesses a distinct advantage over those that only accept immediate cash payments.

-

Building customer loyalty and long-term relationships: Offering credit can foster customer loyalty as it establishes a long-term relationship between the business and the customer. As consumers continue to make purchases and repay their credit accounts responsibly, a sense of trust and loyalty is developed, leading to repeat business and potentially lifelong customers.

-

Opportunity for upselling and cross-selling: When consumers have access to credit, they may be more inclined to upgrade their purchases or explore related products and services. This presents businesses with the opportunity to upsell or cross-sell, increasing the overall transaction value and maximizing their revenue potential.

-

Potential for repeat business and referrals: By providing credit options and delivering positive customer experiences, businesses can increase the likelihood of repeat business. Satisfied customers who have received quality products or services and a smooth credit process are more likely to refer friends, family, and colleagues, further expanding the business’s customer base through word-of-mouth.

It is important for businesses to implement responsible credit practices, including thorough credit risk assessments and efficient payment processing systems, to mitigate potential risks and ensure a positive experience for both the business and the consumer.

By offering credit, businesses can not only increase their sales and customer base but also build long-term relationships, establish a competitive edge, and enhance their overall profitability and success in the marketplace.

#1. Increased Sales and Revenue

One of the primary benefits that offering credit to consumers provides to businesses is the potential for increased sales and revenue. By allowing customers to make purchases on credit, businesses remove the barrier of immediate payment, making it easier for consumers to afford their products or services.

Offering credit expands the purchasing power of consumers as they can acquire higher-cost items or make multiple purchases without the need for immediate cash. This increased affordability can lead to larger transaction sizes and more frequent purchases, ultimately resulting in a boost in sales and revenue for businesses.

Moreover, the availability of credit options allows businesses to reach customers who may not have the financial means for upfront payments. By catering to these consumers, businesses tap into new market segments and expand their customer base. This expansion can lead to a broader reach, increased brand exposure, and the potential for long-term growth.

Additionally, offering credit can encourage customers to make purchases they might otherwise postpone or forgo. Instead of needing to save up for a large purchase, customers can take advantage of credit options to acquire the desired products or services immediately. This can be particularly impactful for businesses selling higher-priced items, as it reduces the time customers need to wait before making a purchase.

It’s worth noting that while offering credit can increase sales and revenue, businesses need to carefully manage credit risk and implement responsible lending practices. This includes conducting thorough credit assessments and establishing appropriate credit limits to mitigate potential default risks and ensure a healthy balance between credit exposure and financial stability.

By offering credit to consumers, businesses create an opportunity for increased sales and revenue, as well as the potential for customer loyalty and long-term relationships. However, it is crucial to strike a balance between providing credit options and managing potential risks to optimize the advantages of this approach.

#2. Expansion of Customer Base

Offering credit to consumers can significantly contribute to the expansion of a business’s customer base. By providing credit options, businesses can attract customers who may not have the immediate financial means to make cash purchases. This opens up new market segments and allows businesses to tap into previously untapped customer demographics.

Some consumers may be hesitant to make purchases if they are unable to afford them outright. However, offering credit empowers these customers to make the desired purchases by spreading out the cost over time. This accessibility to credit can attract a broader range of customers, including those on a tight budget or those looking to make more substantial investments.

Moreover, offering credit can be particularly appealing to first-time buyers or young adults who may not have established a strong credit history yet. By extending credit, businesses provide these customers with an opportunity to demonstrate their creditworthiness and build a positive financial record. This initial experience with credit can establish a long-term relationship between the customer and the business, potentially leading to repeat business and customer loyalty.

Expanding the customer base through credit offerings is also beneficial in terms of market reach. By attracting new customers who were previously unable to make purchases, businesses can increase their brand exposure and gain visibility in new markets. This can lead to a domino effect, with satisfied customers referring friends, family, and colleagues to the business, further expanding the customer base through word-of-mouth recommendations.

To effectively expand the customer base, businesses must communicate their credit options clearly and make the credit application process as streamlined as possible. Providing transparent information about interest rates, repayment terms, and any associated fees will enhance customer confidence in the credit offerings. Additionally, leveraging various marketing channels, such as social media, online advertisements, or collaborations with influencers, can help businesses reach their target audience and raise awareness about their credit offerings.

By offering credit to consumers, businesses can tap into new customer segments, expand their market reach, and ultimately foster business growth and success.

#3. Competitive Advantage in the Market

Offering credit to consumers provides businesses with a distinct competitive advantage in the market. By providing credit options, businesses differentiate themselves from competitors who may only accept immediate cash payments. This advantage can attract customers who prioritize affordability and flexibility when making purchasing decisions.

With the availability of credit options, businesses position themselves as more accessible and accommodating to customers, giving them an edge over competitors who lack such offerings. This can be particularly influential in industries where consumers make significant purchases or have a high demand for flexible payment options.

Customers often compare similar products or services based on various factors, including price, quality, and convenience. Offering credit can be a key factor in the decision-making process, as it removes the immediate financial burden and provides customers with the option to spread out their payments. This added convenience and flexibility can sway customers to choose a business that offers credit over competitors who do not.

Moreover, having credit offerings can attract customers who are loyal to their credit cards or financial institutions. By partnering with credit providers or offering in-house financing options, businesses can tap into existing customer bases and benefit from the loyalty and spending habits of these customers. This advantage can be especially relevant for businesses that sell big-ticket items or have higher average transaction values.

While offering credit provides a competitive advantage, it is important for businesses to regularly assess their credit terms and stay updated on market trends. This ensures that their offerings remain competitive and appeal to the evolving preferences and needs of their target customers.

By providing credit options, businesses can differentiate themselves in the market, attract customers who prioritize convenience and flexibility, and gain a competitive edge over competitors who do not offer similar payment solutions.

#4. Building Customer Loyalty and Long-Term Relationships

Offering credit to consumers provides businesses with a powerful tool for building customer loyalty and fostering long-term relationships. By extending credit, businesses establish a financial partnership with their customers, creating an opportunity to cultivate trust and loyalty.

When consumers have access to credit, they are more likely to choose a business that aligns with their financial needs and provides an easy and convenient credit application process. This initial positive experience can lay the foundation for a long-term relationship, as customers appreciate the financial flexibility offered by the business.

As customers make purchases and consistently repay their credit accounts, businesses have the chance to deepen the relationship by offering exceptional customer service and personalized experiences. This can include proactive communication, special discounts or offers, and tailored recommendations based on the customer’s buying habits.

By nurturing these long-term relationships, businesses can benefit from repeat business and increased customer loyalty. Satisfied customers are more likely to continue their patronage, refer friends and family, and become brand advocates. This not only leads to increased sales but also enhances the brand’s reputation and credibility.

Additive to this, customers who have a positive credit experience with a business become more ingrained in the brand ecosystem. They may choose to consolidate their purchases with that particular business, increasing their lifetime value and the overall profitability for the business.

Building customer loyalty and long-term relationships through credit offerings requires maintaining open lines of communication and providing exceptional customer support. Timely and transparent communication about credit limits, payment terms, and any changes or updates to the credit offerings are crucial for establishing trust and maintaining a positive customer experience.

By offering credit and nurturing customer relationships, businesses can create a loyal customer base that not only drives revenue but also becomes a valuable asset in terms of brand advocacy and referrals.

#5. Opportunity for Upselling and Cross-Selling

Offering credit to consumers presents businesses with a valuable opportunity for upselling and cross-selling. When customers have the option to make purchases on credit, they may be more inclined to consider additional or upgraded products and services, maximizing the value of each transaction.

Upselling involves convincing a customer to purchase a higher-priced item or opt for additional features or upgrades. For example, a customer seeking a basic laptop may be tempted to upgrade to a higher-end model with better specifications if credit options are available. By highlighting the benefits and enticing features of the upgraded product, businesses can increase the transaction value and generate more revenue.

Cross-selling, on the other hand, involves promoting related or complementary products or services to the customer. For instance, a customer purchasing a smartphone on credit may be interested in purchasing a protective case, screen protector, or additional accessories alongside the device. By recommending the value-added products and showcasing their benefits, businesses can enhance the customer’s overall experience and generate incremental sales.

Offering credit enables businesses to present these upselling and cross-selling opportunities without putting undue financial strain on the customer. Customers can opt for enhanced options or additional products, knowing that they can spread the cost over time through credit payments.

Effective upselling and cross-selling require businesses to have a deep understanding of their customers’ needs, preferences, and purchasing patterns. By segmenting their customer base and implementing personalized marketing strategies, businesses can identify relevant upselling and cross-selling opportunities and tailor their offers accordingly.

Additionally, businesses should ensure that their sales staff is well-trained and equipped with product knowledge to effectively communicate the value proposition of the upsell or cross-sell. A well-executed sales pitch, backed by a clear understanding of the customer’s needs, can significantly increase the chances of a successful upsell or cross-sell.

By leveraging credit offerings, businesses can capitalize on the opportunity to upsell and cross-sell, increasing the average transaction value and ultimately driving greater revenue and profitability.

#6. Potential for Repeat Business and Referrals

One of the significant benefits that offering credit to consumers provides to businesses is the potential for repeat business and referrals. Creating a positive credit experience for customers can encourage them to continue their patronage in the long term while also becoming advocates for the business.

When customers have a positive credit experience with a business, they are more likely to return for future purchases. By providing seamless credit application processes, fair terms, and excellent customer service, businesses can establish trust and loyalty with their customers. This can lead to repeat business as customers find it convenient and beneficial to make purchases on credit from the same business.

Additive to this, customers who have a positive credit experience are more likely to refer friends, family, and colleagues to the business. Satisfied customers become brand advocates and share their positive experiences with others, leading to word-of-mouth referrals. These referrals can bring in new customers who may also take advantage of the credit options offered by the business.

Furthermore, satisfied customers are more likely to leave positive reviews and ratings, which can enhance the business’s online reputation. Positive online presence, in turn, can attract more customers, increasing the potential for both repeat business and referrals.

To capitalize on the potential for repeat business and referrals through credit offerings, businesses should prioritize customer satisfaction and provide ongoing support. Prompt and friendly customer service, clear communication about credit terms, and proactive engagement with customers can foster a positive relationship that encourages customers to return and recommend the business to others.

Implementing loyalty programs or exclusive benefits for customers who use credit options can also incentivize repeat purchases and referrals. Rewards for repeat customers can further deepen their loyalty and give them additional reasons to choose the business over competitors.

By focusing on building long-term relationships and exceeding customer expectations in credit transactions, businesses can unlock the potential for repeat business and tap into the valuable network of referrals, thereby driving continuous growth and success.

Potential Risks and Considerations for Consumers and Businesses

While buying on credit offers numerous benefits, it is essential for both consumers and businesses to be aware of the potential risks and considerations associated with this financial arrangement.

For consumers, some of the potential risks include:

- Accumulating excessive debt: Buying on credit can lead to overspending and accumulating debt beyond one’s financial means. It is crucial for consumers to carefully assess their ability to repay the credit and avoid taking on more debt than they can manage.

- High-interest rates and fees: Credit agreements often involve interest charges and fees that can increase the total cost of the purchase. Consumers should review and compare the terms of different credit options to ensure they are obtaining the most favorable rates and fees.

- Negative impact on credit score: Failure to make timely repayments or defaulting on credit obligations can negatively impact a consumer’s credit score. This can make it more difficult to obtain credit in the future and may result in higher interest rates on future loans.

- Impulse purchases and overspending: The availability of credit can tempt consumers to make impulsive purchases or spend beyond their means. It is important to exercise discipline and only use credit for necessary purchases that fit within one’s budget.

- Dependency on credit: Relying heavily on credit for day-to-day expenses or living beyond one’s means can lead to a cycle of debt and financial instability. Developing effective budgeting and financial management skills is crucial to avoid becoming dependent on credit for basic needs.

For businesses offering credit to consumers, some considerations include:

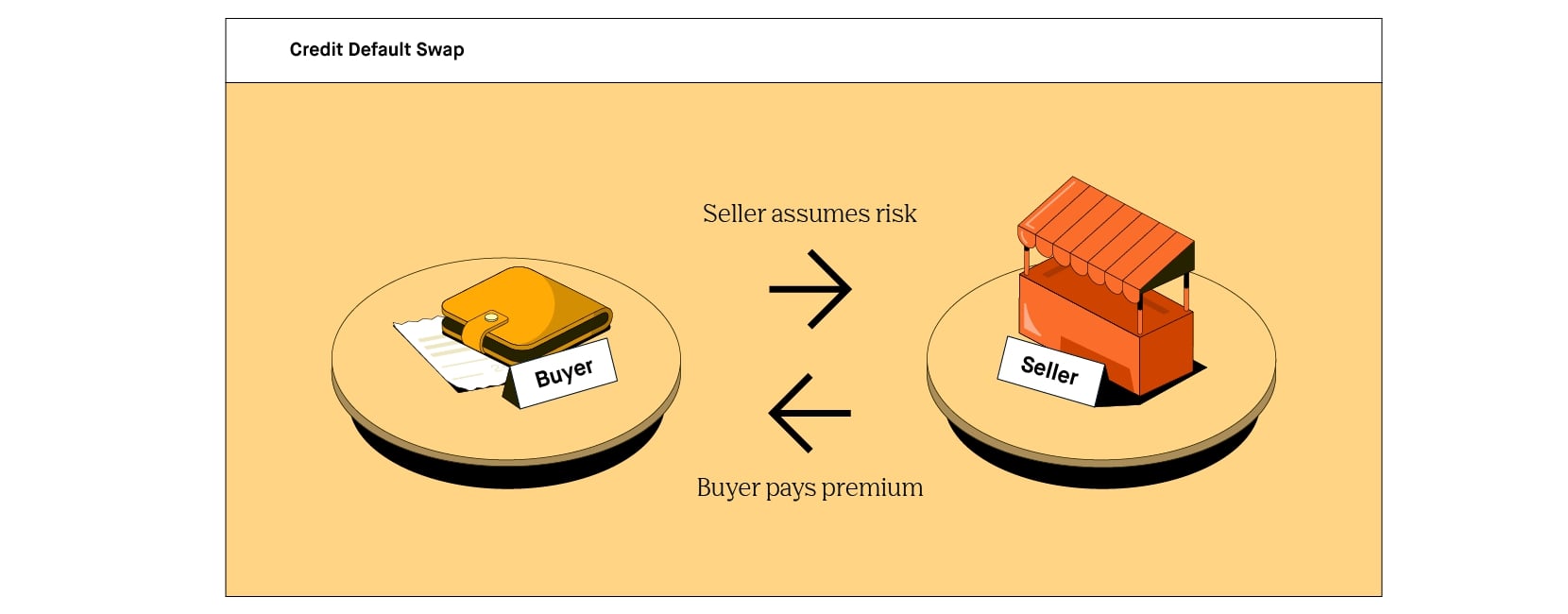

- Credit risk management: Extending credit to consumers involves assessing and managing credit risk. Businesses should implement proper credit risk management practices, including conducting credit checks and setting appropriate credit limits, to minimize the risk of default and financial loss.

- Cash flow management: Offering credit can impact a business’s cash flow, as it may delay the receipt of payments. Businesses must carefully manage their cash flow to ensure they have sufficient funds to cover their operational expenses while waiting for credit payments to be made.

- Compliance with regulations: Businesses offering credit must comply with relevant regulations and consumer protection laws. This includes providing clear and transparent information about credit terms, adhering to fair lending practices, and ensuring compliance with privacy and data security regulations.

- Managing customer relationships: Providing credit can create long-term relationships with customers. It is important for businesses to maintain open lines of communication, provide excellent customer service, and handle any credit-related issues promptly and professionally.

- Risk of defaults and bad debts: Despite credit risk management efforts, businesses may still face instances of defaults or bad debts. It is crucial to have contingency plans in place to handle such situations and mitigate the financial impact on the business.

Both consumers and businesses should carefully assess the risks and benefits of buying and offering credit, respectively. Understanding the potential risks and taking proactive measures to mitigate those risks can help ensure a positive credit experience for all parties involved.

Conclusion

Buying on credit offers a range of benefits to both consumers and businesses. For consumers, it provides increased purchasing power, convenient payment options, and the ability to afford high-cost items. It also offers the opportunity to establish or improve credit history, protection against faulty products or services, and access to rewards and loyalty programs.

Businesses, on the other hand, benefit from offering credit by experiencing increased sales and revenue, expanding their customer base, gaining a competitive advantage, building customer loyalty, and having the opportunity for upselling and cross-selling.

However, it is essential for both consumers and businesses to consider the potential risks. Consumers must be cautious about accumulating excessive debt, high-interest rates, and possible negative impacts on their credit score. Businesses, on the other hand, need to manage credit risk and cash flow effectively, comply with regulations, and handle customer relationships and potential defaults.

By being aware of these potential risks and considerations, consumers can make informed decisions about buying on credit, while businesses can mitigate risks and maximize the benefits of offering credit.

In conclusion, buying on credit can provide opportunities and advantages for consumers and businesses alike. It offers increased financial flexibility, access to essential products and services, and the potential for long-term relationships and growth. However, responsible credit management and a thorough understanding of the associated risks are crucial for a successful and mutually beneficial credit experience.