Finance

How Much For An Insurance License

Published: December 2, 2023

Looking to obtain an insurance license? Discover the cost and requirements involved in securing your license in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Obtaining an insurance license is an important step for individuals seeking a career in the insurance industry. Whether you’re interested in selling insurance policies, providing risk management services, or offering financial advice, having the appropriate license is a requirement to operate legally and ethically in this field.

Insurance licenses come in various types, each allowing the license holder to engage in specific insurance-related activities. The process of obtaining and maintaining an insurance license involves meeting certain requirements and paying associated costs. By understanding the steps involved and the factors that affect insurance license costs, individuals can navigate the licensing process more effectively.

Additionally, having an insurance license offers a range of benefits. It provides credibility, professional growth opportunities, and the ability to help individuals and businesses navigate the complexities of insurance coverage. This article will delve into the different types of insurance licenses, the requirements for obtaining one, the associated costs, and the steps involved. We’ll also explore the benefits of holding an insurance license and why it’s an important credential for those interested in the insurance industry.

Types of Insurance Licenses

In the insurance industry, there are several types of licenses that individuals can obtain depending on the specific area of expertise they wish to pursue. Here are some common types of insurance licenses:

- Property and Casualty Insurance License: This license allows professionals to sell insurance policies that protect against property damage, as well as liability for injuries or damages caused by the insured.

- Life and Health Insurance License: This license enables individuals to sell life insurance policies, annuities, and health insurance coverage.

- Insurance Adjuster License: Adjusters investigate insurance claims to determine the extent of coverage and negotiate settlements with policyholders.

- Insurance Producer License: Also known as an insurance agent or broker license, this allows individuals to sell insurance policies on behalf of insurance companies.

- Surplus Lines License: This license permits individuals to sell insurance coverage from non-admitted insurers for risks that cannot be insured by admitted insurers.

These are just a few examples of the many types of insurance licenses available. Each license has specific requirements and regulations pertaining to the type of insurance being offered. It’s important to carefully review the regulations for the desired license type to ensure compliance with the specific licensing authority in your area.

Requirements for Obtaining an Insurance License

Obtaining an insurance license requires individuals to meet certain requirements set by the licensing authority. While the specific requirements may vary depending on the jurisdiction and the type of license being pursued, here are some common requirements:

- Age Requirement: Most jurisdictions require individuals to be at least 18 or 21 years old to obtain an insurance license.

- Education: Many states have educational requirements that must be fulfilled before applying for an insurance license. This may include completing pre-licensing courses or earning a degree in a related field.

- Examination: Individuals are typically required to pass a licensing examination to demonstrate their knowledge and understanding of insurance laws, regulations, and practices. The examination may cover topics specific to the type of insurance license being sought.

- Background Check: Licensing authorities often conduct background checks to ensure applicants have a good reputation and are of good character.

- Licensing Fee: Applicants are required to pay a licensing fee, which varies depending on the jurisdiction and the type of license being sought.

- Continuing Education: After obtaining an insurance license, individuals are typically required to fulfill continuing education requirements to maintain their license and stay up-to-date with industry changes and regulations.

It’s important to note that these requirements can vary from state to state and country to country. Therefore, it is crucial to research and understand the specific requirements set by the licensing authority in your jurisdiction.

Additionally, some jurisdictions may have additional prerequisites such as fingerprinting, proof of residency, or sponsorship by an insurance company. It’s crucial to review the specific requirements outlined by the licensing authority to ensure compliance before applying for an insurance license.

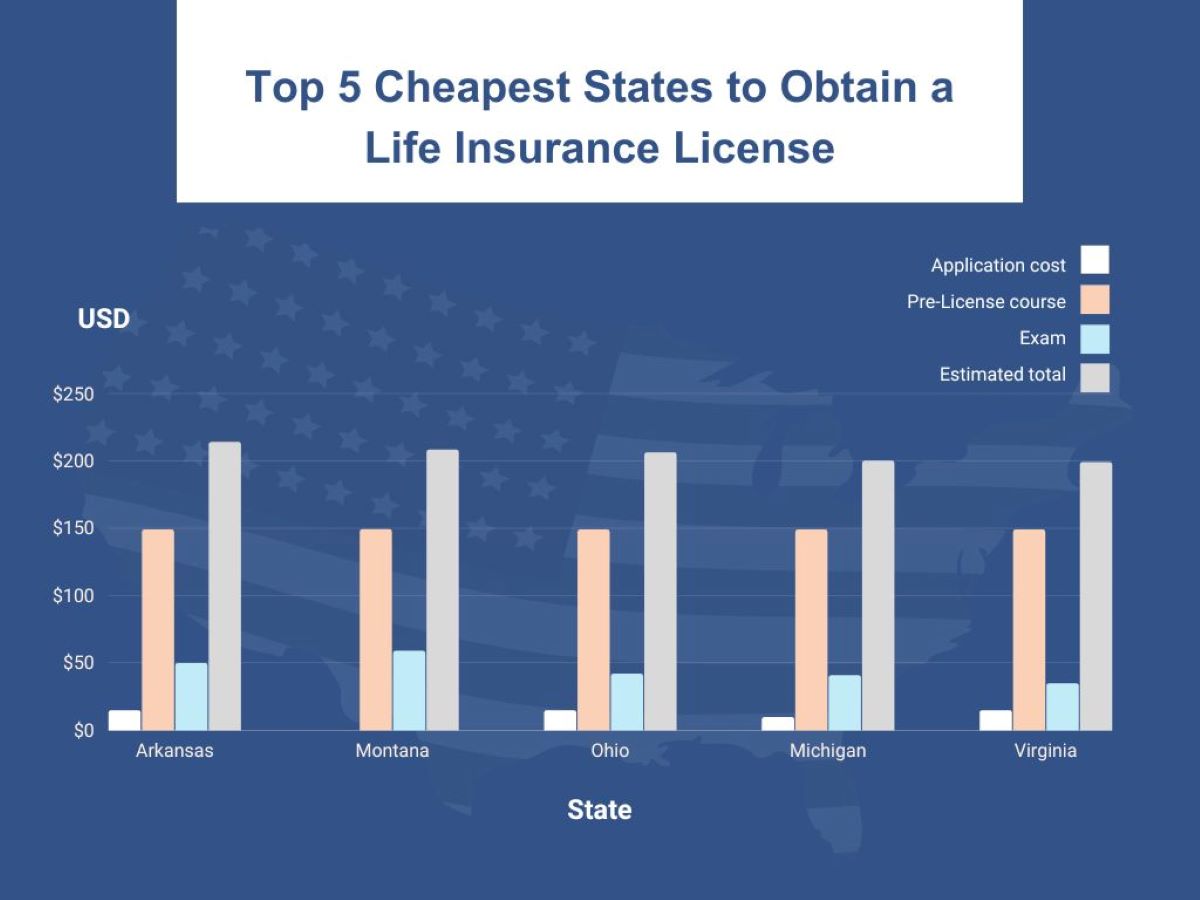

Insurance License Costs

Obtaining an insurance license comes with various costs that individuals need to consider. These costs can vary depending on the type of license, jurisdiction, and additional requirements. Here are the main factors that contribute to the insurance license costs:

- Application Fees: When applying for an insurance license, there is typically an application fee that must be paid. This fee covers the administrative costs associated with processing the application.

- Licensing Exam Fees: Many licensing authorities require individuals to pass an examination to obtain their insurance license. These exams often come with associated fees, covering the cost of administering and grading the exam.

- Pre-licensing Education Costs: Depending on the jurisdiction, individuals may be required to complete pre-licensing courses to qualify for an insurance license. These courses typically come with a fee, covering the cost of the study materials and instruction.

- Licensing Renewal Fees: Insurance licenses usually need to be renewed periodically, which involves paying a renewal fee. This fee ensures that the license remains active and up to date.

- Continuing Education Expenses: To maintain their insurance license, professionals are often required to complete continuing education courses. These courses come with associated costs for enrollment and materials.

- Background Check and Fingerprinting Fees: Some jurisdictions require applicants to undergo a background check and provide fingerprints as part of the licensing process. The fees for these services are usually borne by the applicant.

- Additional Requirements: Depending on the jurisdiction and type of insurance license, there may be additional requirements such as surety bonds, sponsorship, or proof of residency. These requirements can result in additional costs.

It’s important for individuals to consider the various costs involved in obtaining and maintaining an insurance license. These costs can range from a few hundred to several thousand dollars, depending on the jurisdiction and the specific requirements. Researching and budgeting for these expenses is essential to ensure a smooth and successful licensing process.

Factors Affecting Insurance License Costs

The costs associated with obtaining an insurance license can vary based on several factors. Understanding these factors can help individuals better estimate and plan for the expenses involved. Here are some key factors that can impact insurance license costs:

- Type of License: Different types of insurance licenses may have different associated costs. For example, a property and casualty insurance license may have different fees compared to a life and health insurance license.

- Jurisdiction: The licensing authority in each jurisdiction sets its own fees and requirements. As a result, the costs of obtaining and maintaining an insurance license can vary from one jurisdiction to another.

- Pre-licensing Education: Some jurisdictions require individuals to complete pre-licensing education courses before obtaining an insurance license. The cost of these courses can vary depending on the provider and the specific requirements in each jurisdiction.

- Licensing Exam: The examination fee for the licensing exam can vary based on the jurisdiction and the type of license. Additionally, some jurisdictions may charge additional fees for retaking the exam if an individual does not pass on the first attempt.

- Renewal Period: The frequency of license renewal varies by jurisdiction and can impact the renewal fees. Some jurisdictions require annual renewals, while others may have longer renewal periods.

- Continuing Education Requirements: The cost of fulfilling continuing education requirements can vary based on the number of courses and the cost per course. Additionally, individuals may need to factor in the cost of travel, accommodation, or online course fees.

- Additional Requirements: Some licensing authorities may have additional requirements, such as background checks or fingerprinting. These services may come with their own associated costs.

- Discounts and Waivers: It’s worth investigating if there are any discounts or waivers available for certain categories of individuals, such as veterans or those in financial hardship. These can help reduce the costs associated with obtaining an insurance license.

Considering these factors when budgeting for an insurance license can help individuals plan accordingly and avoid any surprises. It’s essential to research and understand the specific requirements and costs in the desired jurisdiction to ensure a smooth and affordable licensing process.

Steps to Obtain an Insurance License

Obtaining an insurance license involves several steps that individuals must follow. Although the specific process may vary depending on the jurisdiction and type of license being sought, here are the general steps to obtain an insurance license:

- Research License Requirements: Begin by researching the specific requirements set by the licensing authority in your jurisdiction. Understand the education, age, examination, and background check requirements for the type of insurance license you wish to obtain.

- Complete Pre-Licensing Education: If pre-licensing education is required, enroll in courses that are approved by the licensing authority. Complete the mandatory hours of instruction and study the relevant materials to prepare for the licensing exam.

- Apply for the License: Submit your completed application and pay the associated application fee. Ensure that you include all necessary supporting documents, such as proof of education and identification, as required by the licensing authority.

- Take and Pass the Licensing Exam: Prepare for the licensing exam by studying the relevant material and resources provided by the licensing authority or approved course providers. Schedule and take the exam, ensuring you meet the passing criteria set by the licensing authority.

- Undergo Background Check and Fingerprinting: If required, complete the background check and fingerprinting process as mandated by the licensing authority. This step ensures that you meet the character and integrity standards required to hold an insurance license.

- Pay License and Renewal Fees: Once you have met all the requirements and passed the licensing exam, pay the license fee to the licensing authority. Renew your license periodically by paying the renewal fee as required.

- Complete Continuing Education: Maintain your license by fulfilling the continuing education requirements set by the licensing authority. This involves completing the specified number of hours of approved courses within the renewal period.

- Stay Updated and Compliant: It is essential to stay updated on any changes to insurance laws, regulations, and practices in your jurisdiction. Adhere to ethical standards and comply with any additional requirements stipulated by the licensing authority to maintain your license.

It’s crucial to consult the licensing authority’s website or contact them directly for detailed information on the specific steps and requirements for obtaining an insurance license in your jurisdiction. Following these steps diligently and staying organized throughout the licensing process will help you successfully obtain and maintain your insurance license.

Renewing and Maintaining an Insurance License

Once you have obtained your insurance license, it is important to understand the process of renewing and maintaining your license. Licensing authorities require license holders to renew their licenses periodically and fulfill certain obligations to remain compliant. Here are the key aspects of renewing and maintaining an insurance license:

- Renewal Period: Familiarize yourself with the renewal period specified by the licensing authority in your jurisdiction. This is typically a specific number of years, after which you must renew your license to keep it active.

- Renewal Application: Submit a renewal application to the licensing authority before the expiration of your license. Pay the designated renewal fee and provide any required supporting documentation, such as proof of continuing education completion.

- Continuing Education Requirements: Most jurisdictions require license holders to complete a certain number of continuing education (CE) hours during each renewal period. Take approved CE courses to fulfill this requirement and maintain your license’s active status.

- Record-Keeping: Keep track of your CE course completion certificates and any other required documentation. These records may be requested during the renewal process or in the event of an audit by the licensing authority.

- Stay Updated: Stay informed about changes in insurance laws, regulations, and industry best practices. Continuously educate yourself on new developments and ensure that your business practices remain compliant with current standards.

- Professional Associations: Consider joining professional insurance associations that offer resources, networking opportunities, and continuing education courses. These associations can help you stay updated and connected within the industry.

- Compliance with Ethical Standards: Adhere to the ethical standards outlined by your licensing authority and professional code of conduct. Engage in ethical business practices and maintain the highest level of integrity while serving clients.

- License Suspension and Reinstatement: Failure to renew your license on time or adhere to licensing requirements may result in license suspension or revocation. If your license becomes suspended, take the necessary steps to rectify the issue and follow the reinstatement process outlined by the licensing authority.

By understanding the renewal process and actively maintaining your license, you can ensure ongoing compliance and professional growth in the insurance industry. Remaining diligent with continuing education, record-keeping, and ethical practices will help you maintain a strong and active insurance license.

Benefits of Having an Insurance License

Obtaining an insurance license offers individuals numerous benefits, both professionally and personally. Holding an insurance license provides credibility, opens up career opportunities, and allows individuals to assist clients in navigating the complexities of insurance coverage. Here are some of the key benefits of having an insurance license:

- Credibility and Trust: An insurance license demonstrates your knowledge and expertise in the insurance industry, which can enhance your credibility with clients and colleagues. It reassures them that you have met the licensing requirements and are committed to following ethical practices.

- Career Opportunities: Having an insurance license can open doors to various career opportunities within the insurance industry. Whether you choose to be an insurance agent, broker, adjuster, or work in underwriting or risk management, an insurance license is often a prerequisite for employment.

- Income Potential: The insurance industry offers competitive compensation and commission-based earning potential. With an insurance license, you can sell insurance policies, work on commission, and build a successful career in an industry that is always in demand.

- Client Assistance: As a licensed insurance professional, you have the knowledge and expertise to assist clients in understanding their insurance needs and finding appropriate coverage. You can provide guidance, advice, and support to individuals and businesses looking to protect their assets and manage risks.

- Professional Growth: Holding an insurance license requires continuing education to maintain competency and stay updated with industry changes. This commitment to ongoing learning fosters professional growth, enabling you to expand your skills, knowledge, and expertise in specialized areas of the insurance industry.

- Networking Opportunities: The insurance industry is built on relationships and connections. With an insurance license, you can become a part of professional insurance associations, attend industry conferences, and network with peers, opening doors to new opportunities and collaborations.

- Independence and Entrepreneurship: Many insurance professionals have the option to work independently or start their own insurance agencies. Owning an insurance license allows you to build your own business, set your own schedule, and have control over your career path.

- Community Impact: By helping clients protect their assets and manage risks, you can make a positive impact on individuals, families, and businesses in your community. Assisting them in securing appropriate insurance coverage provides financial security and peace of mind.

Overall, an insurance license offers numerous benefits, both professionally and personally. It provides credibility, career opportunities, income potential, and the ability to assist clients in navigating the complex world of insurance. It’s an important credential for those interested in the insurance industry and can lead to a rewarding and fulfilling career.

Conclusion

Obtaining an insurance license is a crucial step for individuals looking to pursue a career in the insurance industry. It opens up a world of opportunities and allows license holders to operate legally and ethically in the field. From property and casualty insurance to life and health insurance, there are various types of insurance licenses that individuals can obtain based on their areas of expertise.

While the journey to obtaining an insurance license requires meeting specific requirements, the benefits are well worth the effort. Having an insurance license provides credibility, professional growth opportunities, and the ability to assist clients in navigating insurance coverage options. It enhances career prospects, income potential, and opens doors to various roles within the insurance industry.

Renewing and maintaining an insurance license is just as important as obtaining one. It involves staying updated on industry changes, fulfilling continuing education requirements, and adhering to ethical standards. By actively maintaining your license, you can ensure ongoing compliance, professional growth, and credibility in the industry.

Having an insurance license is not only beneficial professionally but also personally. It allows license holders to make a positive impact on their clients’ lives, protecting their assets and providing peace of mind. The insurance industry is ever-evolving and offers diverse opportunities for those with an insurance license, be it working as an independent agent, starting an agency, or providing specialized insurance services.

In conclusion, obtaining an insurance license is a crucial step for individuals looking to establish a successful career in the insurance industry. It provides credibility, opens doors to career opportunities, and allows individuals to assist clients in navigating insurance coverage. By renewing and maintaining the license, professionals can continue to thrive and make a positive impact in the ever-changing insurance landscape.